A register of journalists' interests would help readers to spot astroturfing

No one will be shocked to discover hypocrisy among hacks, but there's also a more substantial issue here. A good deal of reporting looks almost indistinguishable from corporate press releases. Often that's because it is corporate press releases, mindlessly recycled by overstretched staff: a process Nick Davies has christened churnalism. Or it could be because the reporters work for people who see themselves, as Max Hastings said of his employer Conrad Black, as "members of the rich men's trade union", whose mission is to defend the proprietorial class to which they belong.

But there are sometimes other influences at play, which are even less visible to the public. From time to time a payola scandal surfaces, in which journalists are shown to have received money from people whose interests they write or talk about. For example, two columnists in the US, Doug Bandow and Peter Ferrara, were exposed for taking undisclosed payments from the disgraced corporate lobbyist Jack Abramoff. On top of the payments he received from the newspapers he worked for, Bandow was given $2,000 for every column he wrote which favoured Abramoff's clients.

Armstrong Williams, a TV host, secretly signed a $240,000 contract with George W Bush's Department of Education to promote Bush's education bill and ensure that the education secretary was offered slots on his programme. In the UK, a leaked email revealed that Professor Roger Scruton, a columnist for the Financial Times and a contributor to other newspapers, was being paid £4,500 a month by Japan Tobacco International to write on "major topics of current concern" to the industry.

These revelations were accidental. For all we know, such deals could be commonplace. While journalists are not subject to the accountability they demand of others, their powerful position – helping to shape public opinion – is wide open to abuse.

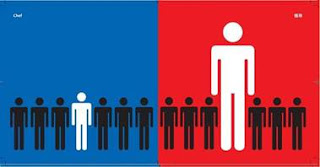

The question of who pays for public advocacy has become an obsession of mine. I've seen how groups purporting to be spontaneous gatherings of grassroots activists, fighting the regulation of tobacco or demanding that governments should take no action on climate change, have in fact been created and paid for by corporations: a practice known as astroturfing. I've asked the bodies which call themselves free-market thinktanks, yet spend much of their time promoting corporate talking-points, to tell me who funds them. All but one have refused.

But if I'm to subject other people to this scrutiny, I should also be prepared to expose myself to it. So I have done something which might be foolhardy, but which I feel is necessary: I've opened a registry of my interests on my website, in which I will detail all the payments, gifts and hospitality (except from family and friends) I receive, as well as the investments I've made. I hope it will encourage other journalists to do the same. In fact I urge you, their readers, to demand it of them.

Like many British people, I feel embarrassed talking about money, and publishing the amounts I receive from the Guardian and other employers makes me feel naked. I fear I will be attacked by some people for earning so much and mocked by others for earning so little. Even so, the more I think about it, the more I wonder why it didn't occur to me to do this before.

A voluntary register is a small step towards transparency. What I would really like to see is a mandatory list of journalists' financial interests, similar to the House of Commons registry. I believe that everyone who steps into public life should be obliged to show who is paying them, and how much. Publishing this register could be one of the duties of whatever replaces the discredited Press Complaints Commission.

Journalists would still wield influence without responsibility. That's written into the job description. But at least we would then have some idea of whether it's the organ-grinder talking or his monkey.