'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Saturday, 10 August 2024

Sunday, 23 April 2023

The Confidence Game......2

There’s a likely apocryphal story about the French poet Jacques Prevert. One day he was walking past a blind man who held up a sign “Blind man without a pension”. He stopped to chat. How was it going? Were people helpful? “Not great”, the man replied.

Could I borrow your sign?” Prevert asked. The blind man nodded.

The poet took the sign, flipped it over and wrote a message.

The next day, he again walked past the blind man, “How is it going now?” he asked. “Incredible,” the man replied. “I’ve never received so much money in my life.”

On the sign, Prevert had written: “Spring is coming, but I won’t see it.”

Give us a compelling story, and we open up. Scepticism gives way to belief. The same approach that makes a blind man’s cup overflow with donations can make us more receptive to almost any persuasive message, for good or for ill.

When we step into a magic show, we come in actively wanting to be fooled. We want deception to cover our eyes and make our world a tiny bit more fantastical, more awesome than it was before. And the magician, in many ways, uses the exact same approaches as the confidence man - only without the destruction of the con’s end game. “Magic is a kind of a conscious, willing con,” says Michael Shermer, a science historian and writer. “You’re not being foolish to fall for it. If you don’t fall for it, the magician is doing something wrong.”

At their root, magic tricks and confidence games share the same fundamental principle: a manipulation of our beliefs. Magic operates at the most basic level of visual perception, manipulating how we see and experience reality. It changes for an instant what we think possible, quite literally taking advantage of our eyes’ and brains’ foibles to create an alternative version of the world. A con does the same thing, but can go much deeper. Long cons, the kind that take weeks, months or even years to unfold, manipulate reality at a higher level, playing with our most basic beliefs about humanity and the world.

The real confidence game feeds on the desire for magic, exploiting our endless taste for an existence that is more extraordinary and somehow more meaningful.

When we fall for a con, we aren’t actively seeking deception - or at least we don’t think we are. As long as the desire for magic, for a reality that is somehow greater than our everyday existence remains, the confidence game will thrive.

Extracted from The Confidence Game by Maria Konnikova

Monday, 7 June 2021

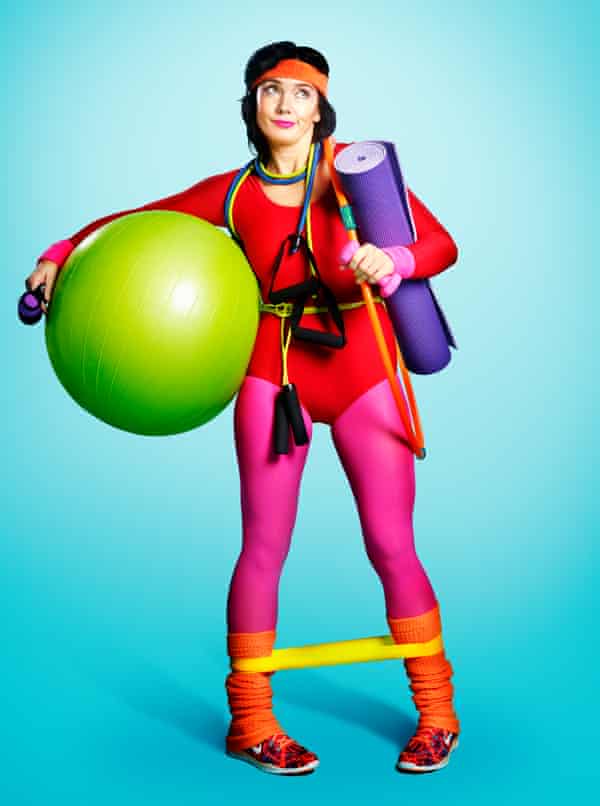

Just don’t do it: 10 exercise myths

Yesterday at an outdoor coffee shop, I met my old friend James in person for the first time since the pandemic began. Over the past year on Zoom, he looked just fine, but in 3D there was no hiding how much weight he’d gained. As we sat down with our cappuccinos, I didn’t say a thing, but the first words out of his mouth were: “Yes, yes, I’m now 20lb too heavy and in pathetic shape. I need to diet and exercise, but I don’t want to talk about it!”

If you feel like James, you are in good company. With the end of the Covid-19 pandemic now plausibly in sight, 70% of Britons say they hope to eat a healthier diet, lose weight and exercise more. But how? Every year, millions of people vow to be more physically active, but the vast majority of these resolutions fail. We all know what happens. After a week or two of sticking to a new exercise regime we gradually slip back into old habits and then feel bad about ourselves.

Clearly, we need a new approach because the most common ways we promote exercise – medicalising and commercialising it – aren’t widely effective. The proof is in the pudding: most adults in high-income countries, such as the UK and US, don’t get the minimum of 150 minutes per week of physical activity recommended by most health professionals. Everyone knows exercise is healthy, but prescribing and selling it rarely works.

I think we can do better by looking beyond the weird world in which we live to consider how our ancestors as well as people in other cultures manage to be physically active. This kind of evolutionary anthropological perspective reveals 10 unhelpful myths about exercise. Rejecting them won’t transform you suddenly into an Olympic athlete, but they might help you turn over a new leaf without feeling bad about yourself.

Myth 1: It’s normal to exercise

Whenever you move to do anything, you’re engaging in physical activity. In contrast, exercise is voluntary physical activity undertaken for the sake of fitness. You may think exercise is normal, but it’s a very modern behaviour. Instead, for millions of years, humans were physically active for only two reasons: when it was necessary or rewarding. Necessary physical activities included getting food and doing other things to survive. Rewarding activities included playing, dancing or training to have fun or to develop skills. But no one in the stone age ever went for a five-mile jog to stave off decrepitude, or lifted weights whose sole purpose was to be lifted.

Myth 2: Avoiding exertion means you are lazy

Whenever I see an escalator next to a stairway, a little voice in my brain says, “Take the escalator.” Am I lazy? Although escalators didn’t exist in bygone days, that instinct is totally normal because physical activity costs calories that until recently were always in short supply (and still are for many people). When food is limited, every calorie spent on physical activity is a calorie not spent on other critical functions, such as maintaining our bodies, storing energy and reproducing. Because natural selection ultimately cares only about how many offspring we have, our hunter-gatherer ancestors evolved to avoid needless exertion – exercise – unless it was rewarding. So don’t feel bad about the natural instincts that are still with us. Instead, accept that they are normal and hard to overcome.

Myth 3: Sitting is the new smoking

You’ve probably heard scary statistics that we sit too much and it’s killing us. Yes, too much physical inactivity is unhealthy, but let’s not demonise a behaviour as normal as sitting. People in every culture sit a lot. Even hunter-gatherers who lack furniture sit about 10 hours a day, as much as most westerners. But there are more and less healthy ways to sit. Studies show that people who sit actively by getting up every 10 or 15 minutes wake up their metabolisms and enjoy better long-term health than those who sit inertly for hours on end. In addition, leisure-time sitting is more strongly associated with negative health outcomes than work-time sitting. So if you work all day in a chair, get up regularly, fidget and try not to spend the rest of the day in a chair, too.

Myth 4: Our ancestors were hard-working, strong and fast

A common myth is that people uncontaminated by civilisation are incredible natural-born athletes who are super-strong, super-fast and able to run marathons easily. Not true. Most hunter-gatherers are reasonably fit, but they are only moderately strong and not especially fast. Their lives aren’t easy, but on average they spend only about two to three hours a day doing moderate-to-vigorous physical activity. It is neither normal nor necessary to be ultra-fit and ultra-strong.

Myth 5: You can’t lose weight walking

Until recently just about every weight-loss programme involved exercise. Recently, however, we keep hearing that we can’t lose weight from exercise because most workouts don’t burn that many calories and just make us hungry so we eat more. The truth is that you can lose more weight much faster through diet rather than exercise, especially moderate exercise such as 150 minutes a week of brisk walking. However, longer durations and higher intensities of exercise have been shown to promote gradual weight loss. Regular exercise also helps prevent weight gain or regain after diet. Every diet benefits from including exercise.

Myth 6: Running will wear out your knees

Many people are scared of running because they’re afraid it will ruin their knees. These worries aren’t totally unfounded since knees are indeed the most common location of runners’ injuries. But knees and other joints aren’t like a car’s shock absorbers that wear out with overuse. Instead, running, walking and other activities have been shown to keep knees healthy, and numerous high-quality studies show that runners are, if anything, less likely to develop knee osteoarthritis. The strategy to avoiding knee pain is to learn to run properly and train sensibly (which means not increasing your mileage by too much too quickly).

Myth 7: It’s normal to be less active as we age

After many decades of hard work, don’t you deserve to kick up your heels and take it easy in your golden years? Not so. Despite rumours that our ancestors’ life was nasty, brutish and short, hunter-gatherers who survive childhood typically live about seven decades, and they continue to work moderately as they age. The truth is we evolved to be grandparents in order to be active in order to provide food for our children and grandchildren. In turn, staying physically active as we age stimulates myriad repair and maintenance processes that keep our bodies humming. Numerous studies find that exercise is healthier the older we get.

Myth 8: There is an optimal dose/type of exercise

One consequence of medicalising exercise is that we prescribe it. But how much and what type? Many medical professionals follow the World Health Organisation’s recommendation of at least 150 minutes a week of moderate or 75 minutes a week of vigorous exercise for adults. In truth, this is an arbitrary prescription because how much to exercise depends on dozens of factors, such as your fitness, age, injury history and health concerns. Remember this: no matter how unfit you are, even a little exercise is better than none. Just an hour a week (eight minutes a day) can yield substantial dividends. If you can do more, that’s great, but very high doses yield no additional benefits. It’s also healthy to vary the kinds of exercise you do, and do regular strength training as you age.

Myth 9: ‘Just do it’ works

Let’s face it, most people don’t like exercise and have to overcome natural tendencies to avoid it. For most of us, telling us to “just do it” doesn’t work any better than telling a smoker or a substance abuser to “just say no!” To promote exercise, we typically prescribe it and sell it, but let’s remember that we evolved to be physically active for only two reasons: it was necessary or rewarding. So let’s find ways to do both: make it necessary and rewarding. Of the many ways to accomplish this, I think the best is to make exercise social. If you agree to meet friends to exercise regularly you’ll be obliged to show up, you’ll have fun and you’ll keep each other going.

Myth 10: Exercise is a magic bullet

Finally, let’s not oversell exercise as medicine. Although we never evolved to exercise, we did evolve to be physically active just as we evolved to drink water, breathe air and have friends. Thus, it’s the absence of physical activity that makes us more vulnerable to many illnesses, both physical and mental. In the modern, western world we no longer have to be physically active, so we invented exercise, but it is not a magic bullet that guarantees good health. Fortunately, just a little exercise can slow the rate at which you age and substantially reduce your chances of getting a wide range of diseases, especially as you age. It can also be fun – something we’ve all been missing during this dreadful pandemic.

Tuesday, 16 April 2019

Sunday, 20 May 2018

To Save Western Capitalism - Look East

Once upon a time, not so long ago, there was a place where peace and prosperity reigned. Let’s call this place the West. These lands had once been ravaged by bloody wars but its rulers had, since, solved the puzzle of perpetual progress and discovered a kind of political and economic elixir of life. Big Problems were relegated to either Somewhere Else (the East) or Another Time (History). The Westerners dutifully sent emissaries far and wide to spread the word that the secret of eternal bliss had been found –and were, themselves, to live happily ever after.

So ran, until very recently, the story of how the West was won.

The formula that had been discovered was simple: the recipe for a bright, shiny new brand of global capitalism based on liberal democracy and something called neoclassical economics. But it was different from previous eras – cleansed of Dickensian grime. The period after the two world wars was in many a Golden Age: the moment of Bretton Woods (that established the international monetary and financial order) and the Beveridge report (the blueprint for the welfare state), feminism and free love.

It was post-colonial, post-racial, post-gendered. It felt like you could have it all, material abundance and the moral revolutions; a world infinitely vulnerable to invention – but all without picking sides, all based on institutional equality of access. That’s how clever the scheme was – truly a brave new world. Fascism and class, slavery and genocide – no one doubted that, in the main, it had been left behind (or at least that we could all agree on its evils); that the wheels of history had permanently been set in motion to propel us towards a better future. The end of history, Francis Fukuyama called it – the zenith of human civilisation.

Austerity in Athens: the eurozone crisis hit Greece not once but twice (Getty)

While liberal democracy was the part of the programme that got slapped on to the brochure, it was a streamlined paradigm of neoclassical economics that provided the brains behind the enterprise. Neoclassical economics, scarred by war-era ideological acrimony, scrubbed the subject of all the messy stuff: politics, values – all the fluff. To do so it used a new secret weapon: quantitative precision unprecedented in the social sciences.

It didn’t rest on whimsical things like enlightened leadership or invested citizenship or compassionate communities. No, siree. It was pure science: a reliable, universally-applicable maximising equation for society (largely stripped of any contextual or, until recently, even cognitive considerations). Its particular magic trick was to be able to do good without requiring anyone to be good.

And, it was limitless in its capacity to turn boundless individual rationality into endless material wellbeing, to cull out of infinite resources (on a global scale) indefinite global growth. It presumed to definitively replace faltering human touch with the infallible “invisible hand” and, so, discourses of exploitation with those of merit.

When I started as a graduate student in the early 2000s, this model was at the peak of its powers: organised into an intellectual and policy assembly line that more or less ran the world. At the heart of this enterprise, in the unipolar post-Cold War order, was what was known as the Chicago school of law and economics. The Chicago school boiled the message of neoclassical economics down to a simpler formula still: the American Dream available for export – just add private property and enforceable contracts. Anointed with a record number of Nobel prizes, its message went straight to the heart of Washington DC, and from there – via its apostles, the International Monetary Fund and the World Bank radiated out to the rest of the globe.

It was like the social equivalent of the Genome project. Sure the model required the odd tweak, the ironing out of the occasional glitch but, for the most part, the code had been cracked. So, like the ladies who lunch, scholarly attention in the West turned increasingly to good works and the fates of “the other” – spatially and temporally.

One strain led to a thriving industry in development: these were the glory days of tough love, and loan conditionalities. The message was clear: if you want Western-style growth, get with the programme. The polite term for it was structural adjustment and good governance: a strict regime of purging what Max Weber had called mysticism and magic, and swapping it for muscular modernisation. Titles like Daron Acemoglu and James Robinson’s Why Nations Fail: The Origins of Power, Prosperity and Poverty and Hernando de Soto’s The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else jostled for space on shelves of bookstores and best-seller lists.

Another led to esoteric islands of scholarship devoted to atonement for past sins. On the US side of the Atlantic, post-colonial scholarship gained a foothold, even if somewhat limp. In America, slavery has been, for a while now, the issue a la mode. A group of Harvard scholars has been taking a keen interest in the “history of capitalism”.

Playing intellectual archaeologists, they’ve excavated the road that led to today’s age of plenty – leaving in its tracks a blood-drenched path of genocide, conquest, and slavery. The interest that this has garnered, for instance Sven Beckert’s Empire of Cotton, is heartening, but it has been limited to history (or worse still, “area studies”) departments rather than economics, and focused on the past not the present.

As far back as the fifties ... the economy was driving the society, when it should have been the other way around (Getty)

Indeed, from the perspective of Western scholarship, the epistemic approach to the amalgam of these instances has been singularly inspired by Indiana Jones – dismissed either as curious empirical aberrations or distanced by the buffer of history. By no means the stuff of mainstream economic theory.

Some of us weakly cleared our throats and tried to politely intercede that there were, all around us, petri dishes of living, breathing data on not just development – but capitalism itself. Maybe, just maybe – could it be? – that if the template failed to work in a large majority of cases around the globe that there may be a slight design error.

My longtime co-author, Nobel Prize winner in Economics and outspoken critic, Joseph Stiglitz, in his 1990 classic Globalisation and Its Discontents chronicled any number of cases of leaching-like brutality of structural adjustment. The best-selling author and my colleague at Cambridge, Ha-Joon Chang, in Kicking Away the Ladder, pointed out that it was a possibility that the West was misremembering the trajectory of its own ascent to power – that perhaps it was just a smidgen more fraught than it remembered, that maybe the State had had a somewhat more active part to play before it retired from the stage.

But a bright red line separated the “us” from the “them” enforcing a system of strict epistemic apartheid. Indeed, as economics retreated further and further into its silo of smugness, economics departments largely stopped teaching economic history or sociology and development economics clung on by operating firmly within the discipline-approved methodology.

So far, so good – a bit like the last night of merriment on the Titanic. Then the iceberg hit.

Suddenly the narratives that were comfortably to do with the there and then became for the Western world a matter of the here and now.

In the last 10 years, what economic historian Robert Skidelsky recently referred to as the “lost decade” for the advanced industrial West, problems that were considered the exclusive preserve of development theory – declining growth, rampant inequality, failing institutions, a fractured political consensus, corruption, mass protests and poverty – started to be experienced on home turf.

The Great Recession starting 2008 should really have been the first hint: foreclosures and evictions, bankruptcies and bailouts, crashed stock markets. Then came the eurozone crisis starting in 2009 (first Greece; then Ireland; then Portugal; then Spain; then Cyprus; oh, and then Greece, again). But after an initial scare, it was largely business as usual – written off as an inevitable blip in the boom-bust logic of capitalist cycles. It was 2016, the year the world went mad, that made the writing on the wall impossible to turn away from – starting with the shock Brexit vote, and then the Trump election. Not everyone understands what a CDO (collateralised debt obligation) is, but the vulgarity of a leader of the free world who governs by tweet and “grabs pussy” is hard to miss.

So how did it happen, this unexpected epilogue to the end of history?

I hate to say I told you so, but some of us had seen this coming – the twist in the tale, foreshadowed by an eerie background score lurking behind the clinking of champagne glasses. Even at the height of the glory days. In the summer before the fall of Lehman Brothers, a group of us “heterodox economists” had gathered at a summer school in the North of England. We felt like the audience at a horror movie – knowing that the gory climax was moments away while the victim remained blissfully impervious.

The plot wasn’t just predictable, it was in the script for anyone to see. You just had to look closely at the fine print.

In particular, you needed to have read your Karl Polanyi, the economic sociologist, who predicted this crisis over 50 years ago. As far back as 1954, The Great Transformation diagnosed the central perversion of the capitalist system, the inversion that makes the person less important than the thing – the economy driving society, rather than the other way around.

Polanyi’s point was simple: if you turned all the things that people hold sacred into grist to the mill of a large impersonal economic machinery (he called this disembedding) there would be a backlash. That the fate of a world where monopoly money reigns supreme and human players are reduced to chessmen at its mercy is doomed. The sociologist Fred Block compares this to the stretching of a giant elastic band – either it reverts to a more rooted position, or it snaps.

It is this tail-wagging-the-dog quality that is driving the current crisis of capitalism. It’s a matter of existential alienation. This problem of artificial abstraction runs through the majority of upheavals of our age – from the financial crisis to Facebook. So cold were the nights in this era of enforced neutrality that the torrid affair between liberal democracy and neoclassical economics resulted in the most surprising love child – populism.

The simple fact is that after decades on promises not delivered on, the system had written just one too many cheques that couldn’t be cashed. And people had had just about enough.

The Brexit vote in 2016 followed by the election of Trump ... and the world had finally gone mad (Getty)

The old fault lines of global capitalism, the East versus West dynamics of the World Trade Organisation’s Doha Round, turned out to be red herrings. The axis that counts is the system versus the little people. Indeed, the anatomies of annihilation look remarkably similar across the globe – whether it’s the loss of character of a Vanishing New York or Disappearing London, or threatened communities of farmers in India and fishermen in Greece.

Trump voters in the US, Brexiteers in Britain and Modi supporters in India seek identity – any identity, even a made-up call to arms to “return” to mythical past greatness in the face of the hollowing out of meaning of the past 70 years. The rise of populism is, in many ways, the death cry of populations on the verge of extinction – yearning for something to believe in when their gods have died young. It’s a problem of the 1 per cent – poised to control two-thirds of the world economy by 2030 – versus the 99 per cent. But far more pernicious is the Frankenstein’s monster that is the idea of an economic system that is an end in itself.

Not to be too much of a conspiracy theorist about it, but the current system doesn’t work because it wasn’t meant to – it was rigged from the start. Wealth was never actually going to “trickle down”. Thomas Piketty did the maths.

Suddenly, the alarmist calls of the developmentalists objecting to the systemic skews in the process of globalisation don’t seem quite so paranoid.

But this is more than “poco” (what the cool kids call postcolonialism) schadenfreude. My point is a serious one; although I would scarcely have dared articulate it before now. Could Kipling have been wrong, and might the East have something to offer the mighty West? Could the experiences of exotic lands point the way back to the future? Could it be, could it just, that it may even be a source of epistemic wisdom?

Behind the scaffolding of Xi Jinping’s China or Narendra Modi’s India, sites of capitalism under construction, we are offered a glimpse into the system’s true nature. It is not God-given, but the product of highly political choices. Just like Jane Jacobs protesting to save Washington Square Park or Beatrix Potter devoting the bulk of her royalty earnings to conserving the Lake District were choices. But these cases also show that trust and community are important. The incredible resilience of India’s jugaad economy, or the critical role of quanxi in the creation of the structures in what has been for the past decade the world’s fastest-growing nation, China. A little mysticism and magic may be just the thing.

The narrative that we need is less that of Frankenstein’s man-loses-control of monster, and more that of Pinocchio’s toy-becomes-real-boy-by-acquiring-conscience; less technology, and more teleology. The real limit may be our imaginations. Perhaps the challenge is to do for scholarship, what Black Panther has done for Hollywood. You never know. Might be a blockbuster.

Saturday, 11 November 2017

The magic money tree does exist, according to modern monetary theory

After seven years of austerity, we are accustomed to thinking of the economy as a household with the nation’s credit card maxed out, to paraphrase David Cameron. The fetishisation of debt translated into massive cuts to UK spending on public services. At the same time, there remains widespread public anger that the big banks continued to make record profits and bonuses in spite of George Osborne’s assurances that we would all be in it together.

That was then though. Both Cameron and Osborne have since departed. This year, the political climate turned on its axis. The Conservative majority of 2015 gave way to a hung parliament with 40 per cent of voters opting for Corbyn’s Labour. The electorate’s acceptance of austerity mantras had evidently reached its limit.

Against this backdrop, the publication of Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal Worldcould not be more timely. It is written by 65-year-old Australian heterodox economist William Mitchell and the journalist and author Thomas Fazi. The book’s introduction is topically titled “Make the Left Great Again”; a sentiment that will no doubt chime with many progressives.

It diagnoses that neoliberalism was not just a right-wing Thatcherite-Reaganite prospectus. The centre-left, as embodied by Mitterrand’s socialists in France, Blair’s New Labour and the Democratic Party in the US, was complicit in its imposition. This consensus culminated in the decimation of manufacturing, decline of union membership, the expansion of financial services, wage flattening, falling living standards and the privatisation of public services. At the heart of neoliberalism was the assertion that the free market is the supreme arbiter with the economy managed by technocratic expertise. The flip side of this depoliticisation resulted in ordinary people becoming alienated and disillusioned with the social democratic parties that formerly represented them. Instead they turned to anti-establishment (usually hard right) parties.

Margaret Thatcher and Tony Blair both knelt at the altar of neoliberalism (AFP/Getty)

Furthermore, Mitchell and Fazi point out that the notion that neoliberalism is anti-state is a misconception. In fact, the state has been essential to the neoliberal project as became evident in the aftermath of the 2008 financial crisis. The state is not only required to bail out corporations and banks but to create new markets and in an authoritarian mould to police its citizens. However, Mitchell and Fazi intend to reclaim national sovereignty as part of a 21st century progressive vision. This is where modern monetary theory (MMT) comes in.

Bill Mitchell is one of its key proponents. MMT is one of those Alice in Wonderland, down the wormhole kind of concepts that neutralises every received wisdom – from that childhood conversation when your father sat you down to explain banks using saving deposits to invest in other businesses right up to politicians telling us that the UK is broke. In other words, prepare to be blown away and forget what you think you knew about money.

MMT essentially proposes that money is created ex nihilo or out of nothing. Whether it is private banks, central banks or governments, money is an abstract concept of ones and zeros. Thus, when your bank lends you a mortgage, it essentially creates money by typing it up on a computer. Similarly, the government has the power to create “fiat money” – that is money established by government regulation or law as opposed to currencies with intrinsic value, such as gold.

In effect, the usual dictum of “tax and spend” is inverted to “spend and tax” with spending stimulating jobs and growth, which can later be taxed. Taxation is not therefore a way of raising revenue but a tool for either controlling the money supply or shaping policy through incentives. Of course, it is much more complicated than that as certain conditions must be met. Public spending cannot be unlimited and must be commensurate to the capacity of the economy amongst other things in order to avoid hyper-inflation.

Ecomomist William Mitchell argues that the notion that neoliberalism is anti-state is a misconception

Both authors have been on a global book tour taking in the US and Europe. In London, Mitchell and Fazi gave their talk at the Newington Green Unitarian Church – one of Britain’s oldest nonconformist churches. Mary Wollstonecraft was the most famous member of its congregation and was inspired by the sermons of the radical minister Dr Richard Price in her thinking on the new French republic and the rights of women.

The setting is certainly suitable for the preaching of a heretical doctrine. In fact, I am reminded that it is the 500th anniversary of Martin Luther pinning his 95 theses to the door of a Wittgenstein church. The parallels are hard to overlook; then as now Europe was in crisis with Britain exiting the established order.

Huddled on a church pew for the interview, I ask Mitchell what exactly is MMT? He answers that it is “a lens through which we can understand the monetary system”. Remarkably, the elemental question – where does money come from? – does not have a settled answer amongst economists, experts and policy makers. Organisations such as Positive Money have already embarked on the process of demystifying money creation. I am reminded of the chapter “The Great Money Trick” in Robert Tressell’s The Ragged-Trousered Philanthropists in which loaves of bread are used to illustrate how the concept of money and surplus value (profit) guarantees perpetual penury for the working class and concentration of wealth for the ruling class.

So how might all of this play out post-Brexit? Mitchell and Fazi seem to be making the progressive argument for Brexit (nicknamed Lexit). This is in keeping with the old-left position that the EU does not represent genuine international solidarity. They acknowledge that it is difficult to make progressive arguments for sovereignty as nationalism has been condemned to a default reactionary position.

John McDonnell and Jeremy Corbyn have pledged to take private finance initiative contracts back into public hands, but how would financing of infrastructure work under a Corbyn government? (Getty)

Yet polling demonstrates that sovereignty was the most common reason for people voting Brexit. Mitchell and Fazi reformulate a progressive definition of sovereignty as having democratic control over the economy rather than simply within ethno-nationalist parameters. According to Mitchell, sovereignty is absolutely fundamental in order for countries to exercise power over their money creation. As long as a country has its own central bank and currency then it is free to spend. While Greece, bound by the constraints of the European Central Bank and the euro, does not have this freedom. After the talk, Mitchell tells me that sovereignty entails having a currency issuing monopoly: “The reality is that national governments are the monopoly issuers of their own currency.”

Mitchell also debunks the idea that governments borrow money from international markets and with it the notion that they are hostage to the market. He has recently written a blog on how Corbyn should not be afraid of global markets. Mitchell cites the 2001 Argentinian debt default as demonstrating that a country can get away with it and recover. Similarly, Iceland imposed capital controls (measures to regulate capital flows in and out of a country) in order to steer the economy through rough waters after its banking system crashed.

In the same vein, Mitchell proposes that governments do not use bonds and gilts to raise revenue. He cites a previous Australian Conservative administration issuing debt when they were running surpluses as an example of the use of bonds as corporate welfare thus “exposing the game”.

At the recent Labour conference, Shadow Chancellor John McDonnell stated that Labour would take private finance initiative (PFI) contracts back into public hands. So how would financing of infrastructure work under a Corbyn government? At the start of the year, this question might have appeared absurd yet only this month The New York Times published an op-ed piece titled “Get ready for Prime Minister Corbyn”.

Milton Friedman said money supply must be controlled in order to limit inflation, so government debt must be prioritised

Here is where quantitative easing (QE) comes in. QE was intended to stimulate bank lending in the aftermath of the financial crisis. However, growth levels have remained stagnant in Britain and Europe. In reality, the banks simply said thank you for the free lunch and used QE to restore their balance sheets. Studies have shown that much of QE ended up contributing to stock market and property bubbles.

Economist Richard Murphy – whose work has focused on tax avoidance and the offshore world – proposed what came to be termed “people’s QE”. For a while, this was a central tenet of the Corbynomics programme. Murphy’s basic idea was that if QE could be used for the banking system, then why not use it to build new homes or create climate jobs? As long as sufficient value was created then the nemesis of hyper-inflation could be avoided.

It therefore appears that Theresa May’s oft-repeated refrain attacking Corbyn on the grounds that there is no such thing as a magic money tree is not exactly true. So if money can basically be created with the press of a button, then suddenly our world appears to be (pacePanglossian disciples) the craziest of all possible worlds.

At this point, you might understandably be asking why on earth we do not just spend our way out of the current mess. And while we are it – give the NHS more money, shelter the homeless and feed the poor of the world. This is where we come up against the ideological edifice of neoliberalism.

Monetarist doctrine states – as per the Chicago School’s Milton Friedman – that the money supply must be controlled in order to limit inflation. Thus, government debt must be prioritised. The Maastricht treaty, which founded the EU, stipulated limits on public spending. Greece is the textbook example of austerity in which debt repayments are prioritised in order to appease creditors (mainly banking institutions).

Banks used quantitative easing to restore their balance sheets (Getty)

While a landmark 2014 study demonstrated that the UK coalition government’s welfare changes enabled tax cuts for the wealthiest thus cancelling out any impact on the deficit. Former Greek finance minister Yanis Varoufakis has also argued that the austerity strategy applied to Greek debt has been extremely counterproductive. The combination of bailouts with cuts has depressed the economy resulting in an increase of the debt (as a percentage of GDP).

The ascendancy of neoliberalism was such that its ideology became an all-pervasive atmosphere. During the event, Mitchell asks how many in the audience have heard of the Powell memorandum. Only a couple of hands go up. Lewis Powell was an American lawyer – later appointed as a Supreme Court justice by Richard Nixon – now indelibly associated with his eponymous 1971 memorandum. This outlined a blueprint for the American conservative movement and the network of think tanks funded by business interests. It recommended that the business class should close ranks in order to present a united front. It also stipulated that lobbyists would be needed to influence policy makers and legislators. And it suggested that infiltration of the media and academia would be necessary in order to achieve the goals of unshackling free enterprise from government interference.

So what would happen if governments followed through on the logic of MMT? Well for a start the Goldman Sachs, JPMorgans and HSBCs of this world would not be as rich or powerful and in the worst-case scenario they might even cease to have any purpose. A recent comprehensive survey from the pro-market Legatum Institute confirms that significant majorities of the British public are in favour of renationalisation of utilities and railways. The public is equally split on nationalisation of the banks with 50 per cent in favour. Corbyn and McDonnell have proposed a national investment bank with a network of regional banks in order to help rebalance the economy and encourage lending.

Whether or not one accepts MMT, it is increasingly apparent that public and democratic oversight of finance and money is becoming a central pillar of progressive postcapitalism alongside public control of public services, a green economy, full automation and the four-day week.

Friday, 30 June 2017

There is a magic money tree. But only for the Queen and the DUP

There is no magic money tree, say the Tories: unless it’s to bribe extremists to keep them in power, or to renovate the palaces of multimillionaire monarchs. Today nurses take to the streets to demand an end to a pay freeze that has slashed the living standards of these life-saving, care-giving national heroes. One such nurse confronted Theresa May – whose lack of emotional intelligence is only matched by her lack of authority – on national television before the election. There was no magic money tree, was May’s robotic response. If the nurse had been met with a middle finger, it would scarcely have been less insulting.

Let’s be absolutely clear. The Tories’ programme of cuts – austerity, whatever you want to call it – is a con, a lie, an ideologically driven act of sadism that has caused immeasurable and unnecessary hurt and pain. The Tories are keen to portray Labour as shambolic and wasteful spendthrifts. In this they are aided and abetted by the party’s post-crash failure to defend its own spending record. Then the Tories lost their majority, and lo! They did conjure up the magic money tree to shower gifts on their homophobic, anti-choice, climate change-denying, sectarian friends.

While nurses are driven to food banks in one of the richest societies that has ever existed, the Tories have almost doubled the Queen’s income. We live in a country that cannot provide affordable, comfortable and safe homes for millions of its own citizens, but the Tories can suddenly find tens of millions more each year to help renovate Buckingham Palace. There is a magic money tree for palaces, but not people.

The money soon to be showered on Northern Ireland will undoubtedly help the Six Counties

The cost of the Tories’ calamitous failure will be significantly more than £1bn, of course. As Nick Macpherson – a former Treasury official, puts it – this is just a “downpayment. DUP will back for more ... again and again.” And neither can they be trusted with taxpayers’ dosh, having wasted nearly half a billion on a failed energy scheme.

But do you know what? The money soon to be showered on Northern Ireland will undoubtedly help the six counties. It will improve public services, education, the health services and infrastructure. It will undoubtedly lift living standards and fuel economic growth. That is what public investment – so mercilessly slashed by the Tories – achieves.

And if it’s good enough for Northern Ireland, it’s good enough for the rest of us. We can ask the most well off, for whom the crash was only ever something they read about in newspapers, to pay a bit more money; the same with booming big business. The billions are there: for housing, education, infrastructure, police – and, yes, to pay our nurses a decent wage.

The Tories are nothing more than a racket for their wealthy backers, a crude political instrument to defend the interests of Britain’s shameless vested interests. They will happily locate a magic money tree if it’s their own political survival that’s at risk. But what is good for the partisan interests of the Conservative party is not good for the nation.

The Tories’ Ulster spending spree should embolden all of us who always believed austerity was an ideologically driven con. On Saturday, thousands will march with the People’s Assembly to demand the end of the failed Tory experiment. The Tories have legitimised their arguments. Austerity is over for Northern Ireland, it’s over for the Queen, and now it must end for everybody else too.

Wednesday, 24 August 2016

How tricksters make you see what they want you to see

By David Robson in the BBC

Could you be fooled into “seeing” something that doesn’t exist?

Matthew Tompkins, a magician-turned-psychologist at the University of Oxford, has been investigating the ways that tricksters implant thoughts in people’s minds. With a masterful sleight of hand, he can make a poker chip disappear right in front of your eyes, or conjure a crayon out of thin air.

Although interesting in themselves, the first three videos are really a warm-up for this more ambitious illusion, in which Tompkins tries to plant an image in the participant’s minds using the power of suggestion alone.

Around a third of his participants believed they had seen Tompkins take an object from the pot and tuck it into his hand – only to make it disappear later on. In fact, his fingers were always empty, but his clever pantomiming created an illusion of a real, visible object.

How is that possible? Psychologists have long known that the brain acts like an expert art restorer, touching up the rough images hitting our retina according to context and expectation. This “top-down processing” allows us to build a clear picture from the barest of details (such as this famous picture of the “Dalmatian in the snow”). It’s the reason we can make out a face in the dark, for instance. But occasionally, the brain may fill in too many of the gaps, allowing expectation to warp a picture so that it no longer reflects reality. In some ways, we really do see what we want to see.

This “top-down processing” is reflected in measures of brain activity, and it could easily explain the phantom vanish trick. The warm-up videos, the direction of his gaze, and his deft hand gestures all primed the participants’ brains to see the object between his fingers, and for some participants, this expectation overrode the reality in front of their eyes.

Tuesday, 20 October 2015

The wild animal of batting

There are batsmen you can explain, whose magic you can unravel. Virender Sehwag was not one of them

Sehwag: an experience that grabs you © Getty Images

Sehwag: an experience that grabs you © Getty ImagesThere is a flash. It's up and over a bunch of slips, maybe a gully, and a third man. The ball just disappears up, out of sight, before dropping over the rope. The third man is puffing hard, but this wasn't for him. There is a frustrated, faceless bowler, an unspecified ground and a generic captain rubbing his forehead.

As it happens you can hear whispers of the batsman being compared to Sachin. But that is unfair. This is something different.

There are some things that shouldn't be explained. Maybe that's why we don't get Victor Trumper. We search for answers, facts, numbers and reasons. For some people that doen't work; you have to see them, feel them. They are part of a time and place you don't get. You are not meant to understand what they stood for, just know that it was something special through all the witnesses.

Yet, even when you weren't there, you had no context, no visuals, no memories, no experience; he could still move you. Sometimes it was the actual numbers alone. Just starting at a scorecard, there was an experience of him that just grabs you. The man who wore no number, could with a simple 200 out of 330, give you a sudden rush of blood, that slight, magical dizzy feel of something you can't quite explain.

There are some who say he only makes runs on Asian flat tracks. It feels like abusing a painter for preferring to use canvas instead of wanting to paint a live shark. What he created with the flat tracks was unlike what anyone else would, or could. There were times when he scored that it felt like Asia had been created just so he would have this stage.

There is a flash over the leg side. It's a drop-kick, a pick-up, a smack. The bowler is just an extra, a vessel. The ball goes over a rope, a fence, some spectators, a hill. It hits a scoreboard. Maybe it goes over it. Maybe it disappears into the distance. Maybe it explodes the scoreboard like you see in them Hollywood baseball films. The whole thing happened like it was preordained, like it was supposed to happen that way, and that time, for some secret reason.

He just stands there. Looking generally disinterested. People around the world are yelling, jumping, screaming, laughing. Mouths are wide open, jaws are on the floor. But he doesn't react that way. He almost never does.

There is a flash outside off. The bat has missed the ball. Yet the same general look of disinterest and calmness he has after a boundary follows a play and miss. Other days he uses the same smile after his best shot, or his worst.

Playing and missing is supposed to be a test of who you are as a human being. Do you believe in luck, do you believe in hard work, do you believe in faith? In his case, none of these applied. As to whether the ball went into a scoreboard, into a crowd, onto a roof, or safely nestled in the keeper's gloves, it was gone. Finished. That moment, that euphoria, that danger, doesn't matter anymore. The greatest legcutter, the sexiest doosra, or a mystery ball fired from a cannon, it doesn't matter. It could be a long hop. A full toss. It just goes past him. When you bowled to him, you weren't bowling to a batsman; you were bowling to a belief system.

There was comfort in his madness. Others have stopped, slowed, changed, restricted, just to survive, to thrive, to score all that they could score. Not him. Maybe he just couldn't slow down, couldn't hold back. He was what he was, a wild animal of batting.

There is a flash through point. It seems to exist on his bat and at the boundary at the same time. It was a cut but could have been a drive. They all went the same way, just as fast. Before the commentator has had time to react, the bowler has placed his hands on his head or the crowd is fully out of their chairs, the ball's journey has been completed.

Maybe it's Chennai. Maybe it's Melbourne. Maybe it's Lahore. Maybe it's Galle. Maybe It's Steyn. Maybe it's Ahktar. Maybe it's McGrath. Maybe it's Murali. It's all too quick. He's already moved on.

There are people who say he is just a slogger. That's a misunderstanding of slogging. Sloggers throw the bat recklessly without a method or a base. They always run out of luck, out of time, are found out. This was Zen slogging. He has a slogger's energy, a batsman's eye, and a tranquil mind. It's an odd combination. It shouldn't work. It didn't always.

But when it did, the innings was something that changed things. He could, when applied correctly, change the future. At other times, it was as if he could predict it. And if he didn't change the future of batting, he, at the very least, foretold it.

There are batsmen you can explain. You can unravel their magic; paint it for others to see. But he was above explanation. You couldn't unravel what he did, you simply had to reclassify it. His batting wasn't from the manual. It wasn't like the others.

If anything, it was a self-help manual, a religious text, wrapped up in cover drives. A road map for better living was right there in the middle of the ground. Play your shots, forget your mistakes, forget your success, keep playing your shots. Believe. Sehwagology.

There is a flash back past the bowler. There is someone, somewhere, stating that it is impossible to play that shot, from that ball. Someone else, somewhere else, is comparing him to another batsman. There is another someone, somewhere online, typing out their theory on his flaws. But at the ground their words get drowned out in applause - not applause, a cacophony of screaming.

There is a flash. A sudden burst of bright light. A brief display of joy. A moment. An instant. Virender Sehwag.

Tuesday, 19 May 2015

Abracadabra! Britain’s political elite has fooled us all again

Monday, 10 February 2014

How internet dating became everyone's route to a perfect love match

The algorithm method: how internet dating became everyone's route to a perfect love match

The Kiss, 1901-4, by sculptor Auguste Rodin. Photograph: Sarah Lee for the Guardian

The Kiss, 1901-4, by sculptor Auguste Rodin. Photograph: Sarah Lee for the Guardian Tinder is a new dating app on smartphones.

Tinder is a new dating app on smartphones.