'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label housing. Show all posts

Showing posts with label housing. Show all posts

Thursday, 16 June 2022

Saturday, 25 September 2021

Monday, 20 September 2021

Eat the rich! Why millennials and generation Z have turned their backs on capitalism

Owen Jones in The Guardian

The young are hungry and the rich are on the menu. This delicacy first appeared in the 18th century, when the philosopher Jean-Jacques Rousseau supposedly declared: “When the people shall have no more to eat, they will eat the rich!” But today this phrase is all over Twitter and other social media. On TikTok, viral videos feature fresh-faced youngsters menacingly raising their forks at anyone with cars that have start buttons or fridges that have water and ice dispensers.

So should the world’s billionaires – and fridge-owners – start sleeping with one eye open? Hardly. It’s clear that millennials (those born between the early 80s and the mid-90s) and zoomers (the following generation) are not really advocating violence. But it is also clear that this is more than just another viral meme.

The world’s most famous leftwing millennial, New York’s rebellious Democrat Alexandria Ocasio-Cortez, neatly sums up the generation’s zeitgeist. If leftism often seems to be the preserve of socially awkward nerds – hi! – and shouty older white men, she is the totem of the cool kids who like their redistribution of wealth and power with a hefty side order of mainstream popular culture.

It doesn’t sit easily with some: when the congresswoman accepted a free invitation to the uber-exclusive Met Ball in a dress emblazoned with “Tax the rich”, even some leftists joined the right in puffed-up outrage. Whether you thought it was an audacious demand for the sickeningly rich to cough up at their own exclusive party – or a stunt compromised by taking place in a real-life version of The Hunger Games’s Capitol – it showed that elites can’t escape the young flexing their political muscles.

According to a report published in July by the rightwing thinktank the Institute for Economic Affairs (IEA), younger Britons have taken a decidedly leftwing turn. Nearly 80% blame capitalism for the housing crisis, while 75% believe the climate emergency is “specifically a capitalist problem” and 72% back sweeping nationalisation. All in all, 67% want to live under a socialist economic system.

With a seemingly hegemonic Tory party on a high after routing Corbynism, the IEA warned that the polling is a “wake-up call” for supporters of market capitalism. “The rejection of capitalism may be an abstract aspiration,” it says. “But so too was Brexit.” It’s a striking phenomenon on the other side of the Atlantic, too: a Harvard University study in 2016 found that more than 50% of young people in the heartland of laissez-faire economics reject capitalism, while a 2018 Gallup poll found that 45% of young Americans saw capitalism favourably, down from 68% in 2010.

Jack Foster, a 33-year-old bank worker from Salford, shows how lived experience has fed this disillusionment with capitalism. After he dropped out of university and worked in a call centre – a “horrible job” – the financial crash shaped his political attitudes, as they did for much of his generation. But housing loomed particularly large. “I was renting, thinking: ‘How will I ever be able to afford a house?’” he says. “My mum was a cleaner, my dad was disabled, and the people I knew who could afford a house got help off their parents. It wasn’t a case of having a job and saving up; you had to inherit money.”

Dating apps are another, less formal way of seeing where the wind blows. The apps have increasingly become no-go zones for Tory supporters. Given Labour had a 43-point lead among the under-25s in the last election – unlike in 1983, when the Tories had a nine-point lead among our youngest voters – the dating pools of the youthful true blue have shrunk. “No Tories – it’s a deal breaker”, “Absolutely no Tories (the left are sexier anyway, facts)”, “Swipe right if you vote left” and “Just looking for someone to hold hands with at the revolution” adorn profiles on Tinder, Hinge and Bumble.

Many of the young have concluded that an economic strategy that penalises them, coupled with a “culture war” that denigrates many of their deeply held values, amounts to a Tory declaration of war on their generation. Anyone who buys into that is, therefore, deemed profoundly unsexy.

For the IEA’s Kristian Niemietz, this is partly down to a “reputational change” for socialism. Once associated with “fringe groups”, he thinks it is now more “a fashion statement, definitely on social media, where people construct a socialist persona which they use for image purposes”. Where he agrees with the left is that an epic housing crisis should receive much of the blame for its renewed attractiveness.

“Whether you ask free marketeers, conservatives, centrists, the centre-left or socialists, all believe the UK has a housing crisis, that it’s a massive problem, but all have different answers about where it comes from and what to do about it,” he says. “If people are getting ripped off and think the market is rigged against them, the one way people can react to that is to generalise: ‘This is what capitalism is like – what the market is like’, making them more sympathetic to socialist ideas.”

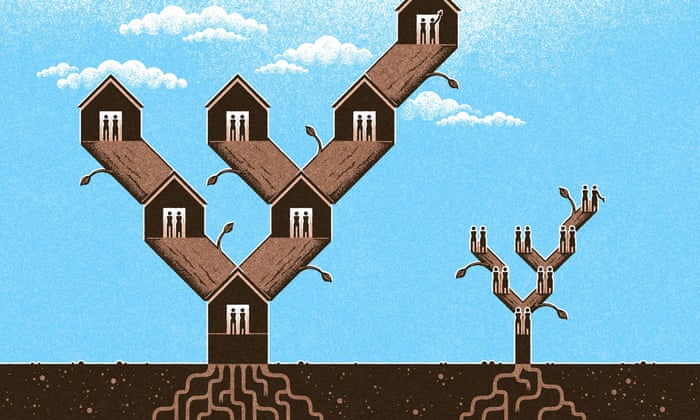

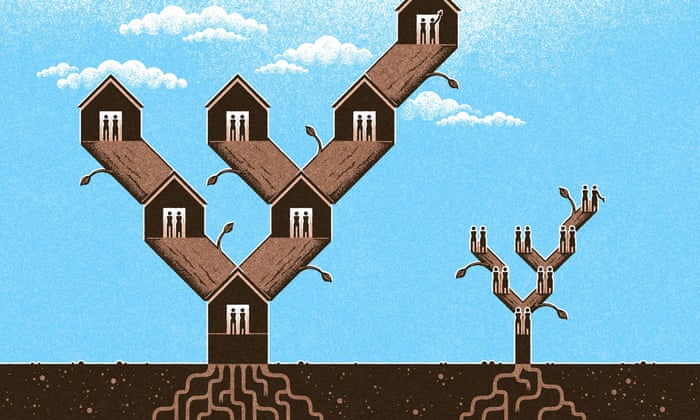

Rather than a ‘property-owning democracy’, Britain looks more like a landlord’s paradise. Illustration: Jacky Sheridan/The Guardian

Rather than a ‘property-owning democracy’, Britain looks more like a landlord’s paradise. Illustration: Jacky Sheridan/The Guardian

In the 80s, Margaret Thatcher’s ideological mentor Keith Joseph described the push for homeownership as resuming “the forward march of embourgeoisement which went so far in Victorian times”. The great hope, for many Thatcherites, was that the “right to buy” would transform Labour-voting council tenants into Tory-supporting homeowners, a view later echoed by either David Cameron or George Osborne, one of whom Nick Clegg recalled objecting to building more social housing on the grounds that “it just creates Labour voters”.

But rather than the “property-owning democracy” promised by Thatcherism, Britain looks more like a landlords’ paradise. By 2017, 40% of the homes flogged off under right to buy were owned by private landlords charging twice the rent of council properties. Indeed, in the space of two decades, the odds of a young adult on a middle income owning a home more than halved. These young people have been called generation rent, with about half of the under-35s in England renting in a private sector often defined by extortionate rents and insecurity.

Rents in England take up approaching half of a tenants’ take-home pay, and an astonishing 74.8% in London, up one-third since the century began. And if millennials bet the house, so to speak, on a parental lifeboat, disappointment beckons: the typical inheritance age is between 55 and 64, and the median amount handed down is about £11,000, meaning half receive less.

There is no rational reason, of course, for the young to defend this economic system. According to a 2019 poll by the charity Barnardo’s, two-thirds of under-25s believe their generation will be worse off than their parents. Keir Milburn, an academic and the author of Generation Left – which argues widespread leftist sympathies among the young are a modern phenomenon bred by economic conditions – says this pessimism is new. “For someone born in the 60s who came into adulthood, there was a sense of optimism, that things will be better,” he says. “It’s the Enlightenment, modernist attitude that things will get better, society will always generally progress. Now it’s just [the author] Steven Pinker who thinks this.”

David Horner, 30, a charity worker in London, began feeling disenchanted with the prevailing system when he was at university. Now he has a child on the way, he worries about the world he’s bringing them into. From working with younger people from poorer communities to listening to the experiences of friends working in crisis-ridden health and education services, he’s in no doubt about the problem. “But we’re told this is the apex, the best we can get as a political economic system, and any alternative – even if it’s seemingly not that radical – just gets pushed away, that this is the way things have to be,” he says. “As I’ve got older, there’s that unfortunate feeling that you don’t want to accept the way things are, but there’s so much power, and corporations and people with vested interests in capitalism and the way the economy works at the moment.”

A generation was told that it was important to go to university to have a salary you could live on. But the earnings gap between graduates and non-graduates has fallen substantially and, despite England’s graduates accruing a student debt of £40,280 in 2020, more than one-third of employed Britons with a degree work in non-graduate jobs. In the years that followed the financial crash, and austerity in particular, it was the wages of young workers that fell the most in a protracted living-standards squeeze without precedent since the Victorian era.

Formal education plus economic insecurity is a heady mix, but it’s not the only phenomenon at play. Non-academic routes to a secure standard of living have been stripped away, such as the skilled apprenticeships available to so many 16-year-old school leavers in the past. Young working-class voters were considerably more likely to vote Labour in 2017 than their middle-class counterparts.

But a profound existential question has led many young people to question the entire economic system. “I saw a post on Instagram the other day asking if you’d rather travel a hundred years backwards or forwards in time, and all the comments asked: ‘Are we even going to be around in a hundred years?’” says Haroon Faqir, a 22-year-old graduate. “Those comments sum up people my age and our attitudes towards the problems we face in a capitalist system.”

Emily Harris, 20, a student in London, says her biggest worry is that “there’s not even going to be a planet: we’ve got Jeff Bezos launching himself into space while Las Vegas runs out of water and half the world’s on fire. If these billionaires stopped making money they could solve all of these problems and still have billions in the bank.”

While much of the mainstream media offers little sympathy for the insecurities and aspirations of younger Britons, the internet has offered a political education. The journalist Chanté Joseph is 25, placing her in the borderlands between millennial and zoomer. “[The microblogging site] Tumblr radicalised me,” she says. “Reading about race, identity and class made me think: ‘This is all crazy,’ and opened my eyes.”

Many of her generation then migrated to Twitter and TikTok, she says, “where young people create a lot of political content that’s really personable and relatable. That’s why a lot of younger people feel more radical – it seems more normal when these ideas are explained in a way where you think: ‘How can you possibly disagree?’”

More than one-third of workers on zero-hours contracts – often not knowing how much they will be paid week to week – are under 25, while many others are in “bogus self-employment”, where they are registered as self-employed but are actually working on contract for one employer while deprived of rights such as a minimum wage or holiday pay. The free market would bring them freedom, they were told; instead it gifted them insecurity.

The sacrifices made by young people during the pandemic have further crystallised a sense of injustice. Hannah Baird, a 22-year-old student, grew up in Rotherham and has always felt dissatisfied by the status quo. Her fears about the climate emergency, and exposure to dissenting opinions on social media, strengthened her discontent. “During the pandemic it feels like a lot of blame has been put on young people for the cases,” she says. “I still have to pay the full tuition fees when exclusively doing online lessons for a year and a half, which feels like a slap in the face, and it always seems universities were the last to be mentioned in plans for unlocking. It just feels, in general, that the government don’t really care about our generation, like we’re left behind.”

That doesn’t mean the young have been transformed into committed revolutionary socialists, but of those millennials familiar with Karl Marx, half have a positive view of him, compared with 40% of generation X and just 20% of baby boomers.

In Beautiful World, Where Are You – the latest novel by the millennial author Sally Rooney – it’s not just the sex that is sexy. One of her characters mulls over how everyone is talking about communism. “When I first started talking about Marxism, people laughed at me,” they say. “Now it’s everyone’s thing.” While it’s probably not the backbone of the patter at newly bustling nightclubs in Newcastle or Cardiff, there’s no question that a post-cold war youth is far more open to this once roundly condemned 19th-century philosophy.

Many placed their faith in Jeremy Corbyn’s leadership to offer solutions to their economic grievances; recent polling suggests that younger Labour voters are nearly twice as likely to believe he would be a better leader than Keir Starmer.

Most young people are not immersed in radical literature, yet politicised zoomers and millennials leave an ideological footprint in their friendship groups. But this doesn’t mean the left should simply bank the two rising generations, waiting for demographics to eventually grant the political victory that has so far eluded them. As the economist James Meadway warned in a recent article, entitled Generation Left Might Not Be That Left After All, populist rightwing answers to their disenchantment might cut through. In France, many young people have swung to the far right; in the UK, few are members of trade unions, which historically help craft anti-capitalist attitudes; while some classically rightwing sentiments coexist with leftish attitudes among many young people.

The rich – whose wealth surged during the pandemic – remain uneaten. But it is clear that young people see no rational incentive to back a system that seems to offer little other than insecurity and crisis.

The young are hungry and the rich are on the menu. This delicacy first appeared in the 18th century, when the philosopher Jean-Jacques Rousseau supposedly declared: “When the people shall have no more to eat, they will eat the rich!” But today this phrase is all over Twitter and other social media. On TikTok, viral videos feature fresh-faced youngsters menacingly raising their forks at anyone with cars that have start buttons or fridges that have water and ice dispensers.

So should the world’s billionaires – and fridge-owners – start sleeping with one eye open? Hardly. It’s clear that millennials (those born between the early 80s and the mid-90s) and zoomers (the following generation) are not really advocating violence. But it is also clear that this is more than just another viral meme.

The world’s most famous leftwing millennial, New York’s rebellious Democrat Alexandria Ocasio-Cortez, neatly sums up the generation’s zeitgeist. If leftism often seems to be the preserve of socially awkward nerds – hi! – and shouty older white men, she is the totem of the cool kids who like their redistribution of wealth and power with a hefty side order of mainstream popular culture.

It doesn’t sit easily with some: when the congresswoman accepted a free invitation to the uber-exclusive Met Ball in a dress emblazoned with “Tax the rich”, even some leftists joined the right in puffed-up outrage. Whether you thought it was an audacious demand for the sickeningly rich to cough up at their own exclusive party – or a stunt compromised by taking place in a real-life version of The Hunger Games’s Capitol – it showed that elites can’t escape the young flexing their political muscles.

According to a report published in July by the rightwing thinktank the Institute for Economic Affairs (IEA), younger Britons have taken a decidedly leftwing turn. Nearly 80% blame capitalism for the housing crisis, while 75% believe the climate emergency is “specifically a capitalist problem” and 72% back sweeping nationalisation. All in all, 67% want to live under a socialist economic system.

With a seemingly hegemonic Tory party on a high after routing Corbynism, the IEA warned that the polling is a “wake-up call” for supporters of market capitalism. “The rejection of capitalism may be an abstract aspiration,” it says. “But so too was Brexit.” It’s a striking phenomenon on the other side of the Atlantic, too: a Harvard University study in 2016 found that more than 50% of young people in the heartland of laissez-faire economics reject capitalism, while a 2018 Gallup poll found that 45% of young Americans saw capitalism favourably, down from 68% in 2010.

Jack Foster, a 33-year-old bank worker from Salford, shows how lived experience has fed this disillusionment with capitalism. After he dropped out of university and worked in a call centre – a “horrible job” – the financial crash shaped his political attitudes, as they did for much of his generation. But housing loomed particularly large. “I was renting, thinking: ‘How will I ever be able to afford a house?’” he says. “My mum was a cleaner, my dad was disabled, and the people I knew who could afford a house got help off their parents. It wasn’t a case of having a job and saving up; you had to inherit money.”

Dating apps are another, less formal way of seeing where the wind blows. The apps have increasingly become no-go zones for Tory supporters. Given Labour had a 43-point lead among the under-25s in the last election – unlike in 1983, when the Tories had a nine-point lead among our youngest voters – the dating pools of the youthful true blue have shrunk. “No Tories – it’s a deal breaker”, “Absolutely no Tories (the left are sexier anyway, facts)”, “Swipe right if you vote left” and “Just looking for someone to hold hands with at the revolution” adorn profiles on Tinder, Hinge and Bumble.

Many of the young have concluded that an economic strategy that penalises them, coupled with a “culture war” that denigrates many of their deeply held values, amounts to a Tory declaration of war on their generation. Anyone who buys into that is, therefore, deemed profoundly unsexy.

For the IEA’s Kristian Niemietz, this is partly down to a “reputational change” for socialism. Once associated with “fringe groups”, he thinks it is now more “a fashion statement, definitely on social media, where people construct a socialist persona which they use for image purposes”. Where he agrees with the left is that an epic housing crisis should receive much of the blame for its renewed attractiveness.

“Whether you ask free marketeers, conservatives, centrists, the centre-left or socialists, all believe the UK has a housing crisis, that it’s a massive problem, but all have different answers about where it comes from and what to do about it,” he says. “If people are getting ripped off and think the market is rigged against them, the one way people can react to that is to generalise: ‘This is what capitalism is like – what the market is like’, making them more sympathetic to socialist ideas.”

Rather than a ‘property-owning democracy’, Britain looks more like a landlord’s paradise. Illustration: Jacky Sheridan/The Guardian

Rather than a ‘property-owning democracy’, Britain looks more like a landlord’s paradise. Illustration: Jacky Sheridan/The GuardianIn the 80s, Margaret Thatcher’s ideological mentor Keith Joseph described the push for homeownership as resuming “the forward march of embourgeoisement which went so far in Victorian times”. The great hope, for many Thatcherites, was that the “right to buy” would transform Labour-voting council tenants into Tory-supporting homeowners, a view later echoed by either David Cameron or George Osborne, one of whom Nick Clegg recalled objecting to building more social housing on the grounds that “it just creates Labour voters”.

But rather than the “property-owning democracy” promised by Thatcherism, Britain looks more like a landlords’ paradise. By 2017, 40% of the homes flogged off under right to buy were owned by private landlords charging twice the rent of council properties. Indeed, in the space of two decades, the odds of a young adult on a middle income owning a home more than halved. These young people have been called generation rent, with about half of the under-35s in England renting in a private sector often defined by extortionate rents and insecurity.

Rents in England take up approaching half of a tenants’ take-home pay, and an astonishing 74.8% in London, up one-third since the century began. And if millennials bet the house, so to speak, on a parental lifeboat, disappointment beckons: the typical inheritance age is between 55 and 64, and the median amount handed down is about £11,000, meaning half receive less.

There is no rational reason, of course, for the young to defend this economic system. According to a 2019 poll by the charity Barnardo’s, two-thirds of under-25s believe their generation will be worse off than their parents. Keir Milburn, an academic and the author of Generation Left – which argues widespread leftist sympathies among the young are a modern phenomenon bred by economic conditions – says this pessimism is new. “For someone born in the 60s who came into adulthood, there was a sense of optimism, that things will be better,” he says. “It’s the Enlightenment, modernist attitude that things will get better, society will always generally progress. Now it’s just [the author] Steven Pinker who thinks this.”

David Horner, 30, a charity worker in London, began feeling disenchanted with the prevailing system when he was at university. Now he has a child on the way, he worries about the world he’s bringing them into. From working with younger people from poorer communities to listening to the experiences of friends working in crisis-ridden health and education services, he’s in no doubt about the problem. “But we’re told this is the apex, the best we can get as a political economic system, and any alternative – even if it’s seemingly not that radical – just gets pushed away, that this is the way things have to be,” he says. “As I’ve got older, there’s that unfortunate feeling that you don’t want to accept the way things are, but there’s so much power, and corporations and people with vested interests in capitalism and the way the economy works at the moment.”

A generation was told that it was important to go to university to have a salary you could live on. But the earnings gap between graduates and non-graduates has fallen substantially and, despite England’s graduates accruing a student debt of £40,280 in 2020, more than one-third of employed Britons with a degree work in non-graduate jobs. In the years that followed the financial crash, and austerity in particular, it was the wages of young workers that fell the most in a protracted living-standards squeeze without precedent since the Victorian era.

Formal education plus economic insecurity is a heady mix, but it’s not the only phenomenon at play. Non-academic routes to a secure standard of living have been stripped away, such as the skilled apprenticeships available to so many 16-year-old school leavers in the past. Young working-class voters were considerably more likely to vote Labour in 2017 than their middle-class counterparts.

But a profound existential question has led many young people to question the entire economic system. “I saw a post on Instagram the other day asking if you’d rather travel a hundred years backwards or forwards in time, and all the comments asked: ‘Are we even going to be around in a hundred years?’” says Haroon Faqir, a 22-year-old graduate. “Those comments sum up people my age and our attitudes towards the problems we face in a capitalist system.”

Emily Harris, 20, a student in London, says her biggest worry is that “there’s not even going to be a planet: we’ve got Jeff Bezos launching himself into space while Las Vegas runs out of water and half the world’s on fire. If these billionaires stopped making money they could solve all of these problems and still have billions in the bank.”

While much of the mainstream media offers little sympathy for the insecurities and aspirations of younger Britons, the internet has offered a political education. The journalist Chanté Joseph is 25, placing her in the borderlands between millennial and zoomer. “[The microblogging site] Tumblr radicalised me,” she says. “Reading about race, identity and class made me think: ‘This is all crazy,’ and opened my eyes.”

Many of her generation then migrated to Twitter and TikTok, she says, “where young people create a lot of political content that’s really personable and relatable. That’s why a lot of younger people feel more radical – it seems more normal when these ideas are explained in a way where you think: ‘How can you possibly disagree?’”

More than one-third of workers on zero-hours contracts – often not knowing how much they will be paid week to week – are under 25, while many others are in “bogus self-employment”, where they are registered as self-employed but are actually working on contract for one employer while deprived of rights such as a minimum wage or holiday pay. The free market would bring them freedom, they were told; instead it gifted them insecurity.

The sacrifices made by young people during the pandemic have further crystallised a sense of injustice. Hannah Baird, a 22-year-old student, grew up in Rotherham and has always felt dissatisfied by the status quo. Her fears about the climate emergency, and exposure to dissenting opinions on social media, strengthened her discontent. “During the pandemic it feels like a lot of blame has been put on young people for the cases,” she says. “I still have to pay the full tuition fees when exclusively doing online lessons for a year and a half, which feels like a slap in the face, and it always seems universities were the last to be mentioned in plans for unlocking. It just feels, in general, that the government don’t really care about our generation, like we’re left behind.”

That doesn’t mean the young have been transformed into committed revolutionary socialists, but of those millennials familiar with Karl Marx, half have a positive view of him, compared with 40% of generation X and just 20% of baby boomers.

In Beautiful World, Where Are You – the latest novel by the millennial author Sally Rooney – it’s not just the sex that is sexy. One of her characters mulls over how everyone is talking about communism. “When I first started talking about Marxism, people laughed at me,” they say. “Now it’s everyone’s thing.” While it’s probably not the backbone of the patter at newly bustling nightclubs in Newcastle or Cardiff, there’s no question that a post-cold war youth is far more open to this once roundly condemned 19th-century philosophy.

Many placed their faith in Jeremy Corbyn’s leadership to offer solutions to their economic grievances; recent polling suggests that younger Labour voters are nearly twice as likely to believe he would be a better leader than Keir Starmer.

Most young people are not immersed in radical literature, yet politicised zoomers and millennials leave an ideological footprint in their friendship groups. But this doesn’t mean the left should simply bank the two rising generations, waiting for demographics to eventually grant the political victory that has so far eluded them. As the economist James Meadway warned in a recent article, entitled Generation Left Might Not Be That Left After All, populist rightwing answers to their disenchantment might cut through. In France, many young people have swung to the far right; in the UK, few are members of trade unions, which historically help craft anti-capitalist attitudes; while some classically rightwing sentiments coexist with leftish attitudes among many young people.

The rich – whose wealth surged during the pandemic – remain uneaten. But it is clear that young people see no rational incentive to back a system that seems to offer little other than insecurity and crisis.

Sunday, 24 May 2020

Most ingredients are in place for a property crash later this year

Rising unemployment is toxic for the property market and low interest rates may not be enough writes Larry Elliott in The Guardian

Spring is usually the time when the property market comes out of hibernation. Photograph: lucemac/GuardianWitness

This weekend marks the start of a truncated summer house buying season, the moment the residential property market comes out of hibernation.

Normally this happens at Easter but, for obvious reasons, that has not been possible in 2020. Estate agents have been shuttered along with almost every other business, waiting impatiently for the lifting of the lockdown. This bank holiday weekend, with fine weather forecast, provides a chance to make up for lost time.

Well, perhaps. Britain’s love affair with rising house prices borders on the pathological so a mini boom can’t entirely be ruled out. The government did its best last week to give the market a boost by extending its mortgage holiday for the financially distressed for a further three months. That means those having trouble keeping up with their home loans won’t have to make a repayment until at least September.

That said, the notion that this is going to be a year of high turnover and rising house prices is wide of the mark. All the ingredients, bar one, is in place for a crash later in the year.

Let’s start with the obvious: the economy has been poleaxed by the Covid-19 pandemic. The official jobless figures – showing a rise to 2.1 million in claimant count unemployment – provide only a hint of the damage that has been caused to the labour market by the lockdown. A truer picture comes from the number of jobs furloughed under the Treasury’s wage subsidy scheme, which stands at 8m and counting.

Not every one of those furloughed workers is going to end up jobless, but some of them will. The number will depend, crucially, on how long it takes for the economy to return to something like normal. The slower the process the more businesses will close permanently.

Rishi Sunak announced earlier this month that the furloughing scheme will be kept going until the end of October, but from the start of August employers will be asked to foot part of the wage bill themselves. At present, the government is paying 80% of wages up to a monthly maximum of £2,500, an expensive commitment that helps explain why the state borrowed almost as much in April (£62bn) as in the whole of the last financial year.

The chancellor will announce in the next few days how big a contribution employers will need to make, but at a minimum they can expect to pay 20% of an employee’s wages. This will be the moment of truth for many businesses.

Rising unemployment is toxic for the property market. If people struggle to find another job quickly after losing their job they fall into mortgage arrears and eventually have their homes repossessed. That happened in the early 1990s and is one reason why a mortgage holiday has been introduced this time.

Hansen Lu, property economist at Capital Economics, has shown how a moratorium on home loan payments saves someone paying 2.5% on a £200,000 mortgage £5,400 over a six-month period. That’s quite a financial cushion because although the lender eventually has to be paid back, it means subsequent mortgage payments go up by about £30 a month.

Again, everything depends on the state of the labour market this autumn. The mortgage holiday will end at the same time as the furlough scheme, and already there will be many households who will be wondering how they will manage at that point.

Buying a house is the single biggest financial commitment most of us ever make. When people are deciding whether to buy or not, they think hard about whether they are going to be able to keep up the monthly payments. It is not just being unemployed that matters; it is the threat of unemployment. Surveys suggest, hardly surprisingly, that consumers are extremely wary of committing to big-ticket items.

Only one thing is missing from a perfect storm: sharply rising interest rates. A doubling of official interest rates was the trigger for recession and record home repossessions in the early 1990s, but there is not the slightest prospect of that happening this time. The Bank of England has cut interest rates to 0.1% and is debating whether to take them negative.

There are economists – the monetarist Tim Congdon, for example – who believe that the vast quantities of money the Bank is chucking at the economy will eventually lead to much higher inflation. In those circumstances Threadneedle Street would have a choice: raise interest rates aggressively to hit the government’s 2% inflation target and guarantee deep recession in the process; or go easy. If it chooses the first option the housing market will collapse because many owner occupiers can only service the debts they have had to to incur to afford expensive real estate if interest rates remain at historically low levels.

So here’s how things stack up. On the one hand, the economy has collapsed and is recovering only falteringly; unemployment, whether real or hidden by the furlough, is rocketing; incomes are being squeezed; consumer confidence is at a low ebb; and the ratio of house prices to earnings is high. On the other hand, interest rates are low and will stay low for some time. In the jargon of the economics profession, there are more downside than upside risks.

But let me personalise things a bit. A relative for whom I hold power of attorney is about to have his house put on the market to fund his care home fees. My intention is to take the first halfway decent offer that’s received, because my sense is that prices are heading lower. In the past I haven’t heeded my own advice and lived to regret it. Not this time, though.

This weekend marks the start of a truncated summer house buying season, the moment the residential property market comes out of hibernation.

Normally this happens at Easter but, for obvious reasons, that has not been possible in 2020. Estate agents have been shuttered along with almost every other business, waiting impatiently for the lifting of the lockdown. This bank holiday weekend, with fine weather forecast, provides a chance to make up for lost time.

Well, perhaps. Britain’s love affair with rising house prices borders on the pathological so a mini boom can’t entirely be ruled out. The government did its best last week to give the market a boost by extending its mortgage holiday for the financially distressed for a further three months. That means those having trouble keeping up with their home loans won’t have to make a repayment until at least September.

That said, the notion that this is going to be a year of high turnover and rising house prices is wide of the mark. All the ingredients, bar one, is in place for a crash later in the year.

Let’s start with the obvious: the economy has been poleaxed by the Covid-19 pandemic. The official jobless figures – showing a rise to 2.1 million in claimant count unemployment – provide only a hint of the damage that has been caused to the labour market by the lockdown. A truer picture comes from the number of jobs furloughed under the Treasury’s wage subsidy scheme, which stands at 8m and counting.

Not every one of those furloughed workers is going to end up jobless, but some of them will. The number will depend, crucially, on how long it takes for the economy to return to something like normal. The slower the process the more businesses will close permanently.

Rishi Sunak announced earlier this month that the furloughing scheme will be kept going until the end of October, but from the start of August employers will be asked to foot part of the wage bill themselves. At present, the government is paying 80% of wages up to a monthly maximum of £2,500, an expensive commitment that helps explain why the state borrowed almost as much in April (£62bn) as in the whole of the last financial year.

The chancellor will announce in the next few days how big a contribution employers will need to make, but at a minimum they can expect to pay 20% of an employee’s wages. This will be the moment of truth for many businesses.

Rising unemployment is toxic for the property market. If people struggle to find another job quickly after losing their job they fall into mortgage arrears and eventually have their homes repossessed. That happened in the early 1990s and is one reason why a mortgage holiday has been introduced this time.

Hansen Lu, property economist at Capital Economics, has shown how a moratorium on home loan payments saves someone paying 2.5% on a £200,000 mortgage £5,400 over a six-month period. That’s quite a financial cushion because although the lender eventually has to be paid back, it means subsequent mortgage payments go up by about £30 a month.

Again, everything depends on the state of the labour market this autumn. The mortgage holiday will end at the same time as the furlough scheme, and already there will be many households who will be wondering how they will manage at that point.

Buying a house is the single biggest financial commitment most of us ever make. When people are deciding whether to buy or not, they think hard about whether they are going to be able to keep up the monthly payments. It is not just being unemployed that matters; it is the threat of unemployment. Surveys suggest, hardly surprisingly, that consumers are extremely wary of committing to big-ticket items.

Only one thing is missing from a perfect storm: sharply rising interest rates. A doubling of official interest rates was the trigger for recession and record home repossessions in the early 1990s, but there is not the slightest prospect of that happening this time. The Bank of England has cut interest rates to 0.1% and is debating whether to take them negative.

There are economists – the monetarist Tim Congdon, for example – who believe that the vast quantities of money the Bank is chucking at the economy will eventually lead to much higher inflation. In those circumstances Threadneedle Street would have a choice: raise interest rates aggressively to hit the government’s 2% inflation target and guarantee deep recession in the process; or go easy. If it chooses the first option the housing market will collapse because many owner occupiers can only service the debts they have had to to incur to afford expensive real estate if interest rates remain at historically low levels.

So here’s how things stack up. On the one hand, the economy has collapsed and is recovering only falteringly; unemployment, whether real or hidden by the furlough, is rocketing; incomes are being squeezed; consumer confidence is at a low ebb; and the ratio of house prices to earnings is high. On the other hand, interest rates are low and will stay low for some time. In the jargon of the economics profession, there are more downside than upside risks.

But let me personalise things a bit. A relative for whom I hold power of attorney is about to have his house put on the market to fund his care home fees. My intention is to take the first halfway decent offer that’s received, because my sense is that prices are heading lower. In the past I haven’t heeded my own advice and lived to regret it. Not this time, though.

Friday, 7 June 2019

Friday, 25 May 2018

The trouble with charitable billionaires

More and more wealthy CEOs are pledging to give away parts of their fortunes – often to help fix problems their companies caused. Some call this ‘philanthrocapitalism’, but is it just corporate hypocrisy? By Carl Rhodes and Peter Bloom in The Guardian

In February 2017, Facebook’s founder and CEO Mark Zuckerberg was in the headlines for his charitable activities. The Chan Zuckerberg Initiative, founded by the tech billionaire and his wife, Priscilla Chan, handed out over $3m in grants to aid the housing crisis in the Silicon Valley area. David Plouffe, the Initiative’s president of policy and advocacy, stated that the grants were intended to “support those working to help families in immediate crisis while supporting research into new ideas to find a long-term solution – a two-step strategy that will guide much of our policy and advocacy work moving forward”.

This is but one small part of Zuckerberg’s charity empire. The Initiative has committed billions of dollars to philanthropic projects designed to address social problems, with a special focus on solutions driven by science, medical research and education. This all took off in December 2015, when Zuckerberg and Chan wrote and published a letter to their new baby Max. The letter made a commitment that over the course of their lives they would donate 99% of their shares in Facebook (at the time valued at $45bn) to the “mission” of “advancing human potential and promoting equality”.

The housing intervention is of course much closer to home, dealing with issues literally at the door of Facebook’s Menlo Park head office. This is an area where median house prices almost doubled to around $2m in the five years between 2012 and 2017.

More generally, San Francisco is a city with massive income inequality, and the reputation of having the most expensive housing in the US. Chan Zuckerberg’s intervention was clearly designed to offset social and economic problems caused by rents and house prices having skyrocketed to such a level that even tech workers on six-figure salaries find it hard to get by. For those on more modest incomes, supporting themselves, let alone a family, is nigh-on impossible.

Ironically, the boom in the tech industry in this region – a boom Facebook has been at the forefront of – has been a major contributor to the crisis. As Peter Cohen from the Council of Community Housing Organizations explained it: “When you’re dealing with this total concentration of wealth and this absurd slosh of real-estate money, you’re not dealing with housing that’s serving a growing population. You’re dealing with housing as a real-estate commodity for speculation.”

Zuckerberg’s apparent generosity, it would seem, is a small contribution to a large problem that was created by the success of the industry he is involved in. In one sense, the housing grants (equivalent to the price of just one-and-a-half average Menlo Park homes) are trying to put a sticking plaster on a problem that Facebook and other Bay Area corporations aided and abetted. It would appear that Zuckerberg was redirecting a fraction of the spoils of neoliberal tech capitalism, in the name of generosity, to try to address the problems of wealth inequality created by a social and economic system that allowed those spoils to accrue in the first place.

It is easy to think of Zuckerberg as some kind of CEO hero – a once regular kid whose genius made him one of the richest men in the world, and who decided to use that wealth for the benefit of others. The image he projects is of altruism untainted by self-interest. A quick scratch of the surface reveals that the structure of Zuckerberg’s charity enterprise is informed by much more than good-hearted altruism. Even while many have applauded Zuckerberg for his generosity, the nature of this apparent charity was openly questioned from the outset.

The wording of Zuckerberg’s 2015 letter could easily have been interpreted as meaning that he was intending to donate $45bn to charity. As investigative reporter Jesse Eisinger reported at the time, the Chan Zuckerberg Initiative through which this giving was to be funnelled is not a not-for-profit charitable foundation, but a limited liability company. This legal status has significant practical implications, especially when it comes to tax. As a company, the Initiative can do much more than charitable activity: its legal status gives it rights to invest in other companies, and to make political donations. Effectively the company does not restrict Zuckerberg’s decision-making as to what he wants to do with his money; he is very much the boss. Moreover, as Eisinger described it, Zuckerberg’s bold move yielded a huge return on investment in terms of public relations for Facebook, even though it appeared that he simply “moved money from one pocket to the other” while being “likely never to pay any taxes on it”.

The creation of the Chan Zuckerberg Initiative – decidedly not a charity organisation – means that Zuckerberg can control the company’s investments as he sees fit, while accruing significant commercial, tax and political benefits. All of this is not to say that Zuckerberg’s motives do not include some expression of his own generosity or some genuine desire for humanity’s wellbeing and equality.

What it does suggest, however, is that when it comes to giving, the CEO approach is one in which there is no apparent incompatibility between being generous, seeking to retain control over what is given, and the expectation of reaping benefits in return. This reformulation of generosity – in which it is no longer considered incompatible with control and self-interest – is a hallmark of the “CEO society”: a society where the values associated with corporate leadership are applied to all dimensions of human endeavour.

Mark Zuckerberg was by no means the first contemporary CEO to promise and initiate large-scale donations of wealth to self-nominated good causes. In the CEO society it is positively a badge of honour for the world’s most wealthy businesspeople to create vehicles to give away their wealth. This has been institutionalised in what is known as The Giving Pledge, a philanthropy campaign initiated by Warren Buffett and Bill Gates in 2010. The campaign targets billionaires around the world, encouraging them to give away the majority of their wealth. There is nothing in the pledge that specifies what exactly the donations will be used for, or even whether they are to be made now or willed after death; it is just a general commitment to using private wealth for ostensibly public good. It is not legally binding either, but a moral commitment.

There is a long list of people and families who have made the pledge. Mark Zuckerberg and Priscilla Chan are there, and so are some 174 others, including household names such as Richard and Joan Branson, Michael Bloomberg, Barron Hilton and David Rockefeller. It would seem that many of the world’s richest people simply want to give their money away to good causes. This all amounts to what human geographers Iain Hay and Samantha Muller sceptically refer to as a “golden age of philanthropy”, in which, since the late 1990s, bequests to charity from the super-rich have escalated to the hundreds of billions of dollars. These new philanthropists bring to charity an “entrepreneurial disposition”, Hay and Muller wrote in a 2014 paper, yet one that they suggest has been “diverting attention and resources away from the failings of contemporary manifestations of capitalism”, and may also be serving as a substitute for public spending withdrawn by the state.

A protester outside the Nasdaq headquarters in New York marks Facebook’s IPO, 2012. Photograph: Alamy Stock Photo

The recent development of philanthrocapitalism also marks the increasing encroachment of business into the provision of public goods and services. This encroachment is not limited to the activities of individual billionaires; it is also becoming a part of the activities of large corporations under the rubric of CSR. This is especially the case for large multinational corporations whose global reach, wealth and power give them significant political clout. This relationship has been referred to as “political CSR”. Business ethics professors Andreas Scherer and Guido Palazzo note that, for large corporations, “CSR is increasingly displayed in corporate involvement in the political process of solving societal problems, often on a global scale”. Such political CSR initiatives see organisations cooperating and collaborating with governments, civic bodies and international institutions, so that historical separations between the purposes of the state and the corporations are increasingly eroded.

Global corporations have long been involved in quasi-governmental activities such as the setting of standards and codes, and today are increasingly engaging in other activities that have traditionally been the domain of government, such as public health provision, education, the protection of human rights, addressing social problems such as Aids and malnutrition, protection of the natural environment and the promotion of peace and social stability.

Today, large organisations can amass significant economic and political power, on a global scale. This means that their actions – and the way those actions are regulated – have far-reaching social consequences. The balanced tipped in 2000, when the Institute for Policy Studies in the US reported, after comparing corporate revenues with gross domestic product (GDP), that 51 of the largest economies in the world were corporations, and 49 were national economies. The biggest corporations were General Motors, Walmart and Ford, each of which was larger economically than Poland, Norway and South Africa. As the heads of these corporations, CEOs are now quasi-politicians. One only has to think of the increasing power of the World Economic Forum, whose annual meeting in Davos in Switzerland sees corporate CEOs and senior politicians getting together with the ostensible goal of “improving the world”, a now time-honoured ritual that symbolises the global power and agency of CEOs.

The development of CSR is not the result of self-directed corporate initiatives for doing good deeds, but a response to widespread CSR activism from NGOs, pressure groups and trade unions. Often this has been in response to the failure of governments to regulate large corporations. High-profile industrial accidents and scandals have also put pressure on organisations for heightened self-regulation.

An explosion at a Union Carbide chemical plant in Bhopal, India in 1984 led to the deaths of an estimated 25,000 people. James Post, a professor of management at Boston University, explains that, after the disaster, “the global chemical industry recognised that it was nearly impossible to secure a licence to operate without public confidence in industry safety standards. The Chemical Manufacturers Association (CMA) adopted a code of conduct, including new standards of product stewardship, disclosure and community engagement.”

The impetus for this was corporate self-interest, rather than generosity, as industries and corporations globally “began to recognise the increasing importance of reputation and image”. Similar moves were enacted after other major industrial accidents, such as the Exxon Valdez oil tanker spilling hundreds of thousands of barrels of oil in Alaska in 1989, and BP’s Deepwater Horizon oil rig exploding in the Gulf of Mexico in 2010.

In the CEO society, corporate logic such as this rules supreme, and ensures that any activities thought of as generous and socially responsible ultimately have a payoff in terms of self-interest. If there was ever a debate between the ethics of genuine hospitality, reciprocity and self-interest, it is not to be found here. It is in accordance with this CEO logic that the mechanisms for redressing the inequality created through wealth generation are placed in the hands of the wealthy, and in a way that ultimately benefits them. The worst excesses of neoliberal capitalism are morally justified by the actions of the very people who benefit from those excesses. Wealth redistribution is placed in the hands of the wealthy, and social responsibility in the hands of those who have exploited society for personal gain.

Meanwhile, inequality is growing, and both corporations and the wealthy find ways to avoid the taxes that the rest of us pay. In the name of generosity, we find a new form of corporate rule, refashioning another dimension of human endeavour in its own interests. Such is a society where CEOs are no longer content to do business; they must control public goods as well. In the end, while the Giving Pledge’s website may feature more and more smiling faces of smug-looking CEOs, the real story is of a world characterised by gross inequality that is getting worse year by year.

In February 2017, Facebook’s founder and CEO Mark Zuckerberg was in the headlines for his charitable activities. The Chan Zuckerberg Initiative, founded by the tech billionaire and his wife, Priscilla Chan, handed out over $3m in grants to aid the housing crisis in the Silicon Valley area. David Plouffe, the Initiative’s president of policy and advocacy, stated that the grants were intended to “support those working to help families in immediate crisis while supporting research into new ideas to find a long-term solution – a two-step strategy that will guide much of our policy and advocacy work moving forward”.

This is but one small part of Zuckerberg’s charity empire. The Initiative has committed billions of dollars to philanthropic projects designed to address social problems, with a special focus on solutions driven by science, medical research and education. This all took off in December 2015, when Zuckerberg and Chan wrote and published a letter to their new baby Max. The letter made a commitment that over the course of their lives they would donate 99% of their shares in Facebook (at the time valued at $45bn) to the “mission” of “advancing human potential and promoting equality”.

The housing intervention is of course much closer to home, dealing with issues literally at the door of Facebook’s Menlo Park head office. This is an area where median house prices almost doubled to around $2m in the five years between 2012 and 2017.

More generally, San Francisco is a city with massive income inequality, and the reputation of having the most expensive housing in the US. Chan Zuckerberg’s intervention was clearly designed to offset social and economic problems caused by rents and house prices having skyrocketed to such a level that even tech workers on six-figure salaries find it hard to get by. For those on more modest incomes, supporting themselves, let alone a family, is nigh-on impossible.

Ironically, the boom in the tech industry in this region – a boom Facebook has been at the forefront of – has been a major contributor to the crisis. As Peter Cohen from the Council of Community Housing Organizations explained it: “When you’re dealing with this total concentration of wealth and this absurd slosh of real-estate money, you’re not dealing with housing that’s serving a growing population. You’re dealing with housing as a real-estate commodity for speculation.”

Zuckerberg’s apparent generosity, it would seem, is a small contribution to a large problem that was created by the success of the industry he is involved in. In one sense, the housing grants (equivalent to the price of just one-and-a-half average Menlo Park homes) are trying to put a sticking plaster on a problem that Facebook and other Bay Area corporations aided and abetted. It would appear that Zuckerberg was redirecting a fraction of the spoils of neoliberal tech capitalism, in the name of generosity, to try to address the problems of wealth inequality created by a social and economic system that allowed those spoils to accrue in the first place.

It is easy to think of Zuckerberg as some kind of CEO hero – a once regular kid whose genius made him one of the richest men in the world, and who decided to use that wealth for the benefit of others. The image he projects is of altruism untainted by self-interest. A quick scratch of the surface reveals that the structure of Zuckerberg’s charity enterprise is informed by much more than good-hearted altruism. Even while many have applauded Zuckerberg for his generosity, the nature of this apparent charity was openly questioned from the outset.

The wording of Zuckerberg’s 2015 letter could easily have been interpreted as meaning that he was intending to donate $45bn to charity. As investigative reporter Jesse Eisinger reported at the time, the Chan Zuckerberg Initiative through which this giving was to be funnelled is not a not-for-profit charitable foundation, but a limited liability company. This legal status has significant practical implications, especially when it comes to tax. As a company, the Initiative can do much more than charitable activity: its legal status gives it rights to invest in other companies, and to make political donations. Effectively the company does not restrict Zuckerberg’s decision-making as to what he wants to do with his money; he is very much the boss. Moreover, as Eisinger described it, Zuckerberg’s bold move yielded a huge return on investment in terms of public relations for Facebook, even though it appeared that he simply “moved money from one pocket to the other” while being “likely never to pay any taxes on it”.

The creation of the Chan Zuckerberg Initiative – decidedly not a charity organisation – means that Zuckerberg can control the company’s investments as he sees fit, while accruing significant commercial, tax and political benefits. All of this is not to say that Zuckerberg’s motives do not include some expression of his own generosity or some genuine desire for humanity’s wellbeing and equality.

What it does suggest, however, is that when it comes to giving, the CEO approach is one in which there is no apparent incompatibility between being generous, seeking to retain control over what is given, and the expectation of reaping benefits in return. This reformulation of generosity – in which it is no longer considered incompatible with control and self-interest – is a hallmark of the “CEO society”: a society where the values associated with corporate leadership are applied to all dimensions of human endeavour.

Mark Zuckerberg was by no means the first contemporary CEO to promise and initiate large-scale donations of wealth to self-nominated good causes. In the CEO society it is positively a badge of honour for the world’s most wealthy businesspeople to create vehicles to give away their wealth. This has been institutionalised in what is known as The Giving Pledge, a philanthropy campaign initiated by Warren Buffett and Bill Gates in 2010. The campaign targets billionaires around the world, encouraging them to give away the majority of their wealth. There is nothing in the pledge that specifies what exactly the donations will be used for, or even whether they are to be made now or willed after death; it is just a general commitment to using private wealth for ostensibly public good. It is not legally binding either, but a moral commitment.

There is a long list of people and families who have made the pledge. Mark Zuckerberg and Priscilla Chan are there, and so are some 174 others, including household names such as Richard and Joan Branson, Michael Bloomberg, Barron Hilton and David Rockefeller. It would seem that many of the world’s richest people simply want to give their money away to good causes. This all amounts to what human geographers Iain Hay and Samantha Muller sceptically refer to as a “golden age of philanthropy”, in which, since the late 1990s, bequests to charity from the super-rich have escalated to the hundreds of billions of dollars. These new philanthropists bring to charity an “entrepreneurial disposition”, Hay and Muller wrote in a 2014 paper, yet one that they suggest has been “diverting attention and resources away from the failings of contemporary manifestations of capitalism”, and may also be serving as a substitute for public spending withdrawn by the state.

Warren Buffett announces a $30bn donation to the Bill and Melinda Gates Foundation, 2006. Photograph: Justin Lane/EPA

Essentially, what we are witnessing is the transfer of responsibility for public goods and services from democratic institutions to the wealthy, to be administered by an executive class. In the CEO society, the exercise of social responsibilities is no longer debated in terms of whether corporations should or shouldn’t be responsible for more than their own business interests. Instead, it is about how philanthropy can be used to reinforce a politico-economic system that enables such a small number of people to accumulate obscene amounts of wealth. Zuckerberg’s investment in solutions to the Bay Area housing crisis is an example of this broader trend.

The reliance on billionaire businesspeople’s charity to support public projects is a part of what has been called “philanthrocapitalism”. This resolves the apparent antinomy between charity (traditionally focused on giving) and capitalism (based on the pursuit of economic self-interest). As historian Mikkel Thorup explains, philanthrocapitalism rests on the claim that “capitalist mechanisms are superior to all others (especially the state) when it comes to not only creating economic but also human progress, and that the market and market actors are or should be made the prime creators of the good society”.

The golden age of philanthropy is not just about benefits that accrue to individual givers. More broadly, philanthropy serves to legitimise capitalism, as well as to extend it further and further into all domains of social, cultural and political activity.

Philanthrocapitalism is about much more than the simple act of generosity it pretends to be, instead involving the inculcation of neoliberal values personified by the billionaire CEOs who have led its charge. Philanthropy is recast in the same terms in which a CEO would consider a business venture. Charitable giving is translated into a business model that employs market-based solutions characterised by efficiency and quantified costs and benefits.

Philanthrocapitalism takes the application of management discourses and practices from business corporations and adapts them to charitable work. The focus is on entrepreneurship, market-based approaches and performance metrics. The process is funded by super-rich businesspeople and managed by those experienced in business. The result, at a practical level, is that philanthropy is undertaken by CEOs in a manner similar to how they would run businesses.

As part of this, charitable foundations have changed in recent years. As explained in a paper by Garry Jenkins, a professor of law at the University of Minnesota, this involves becoming “increasingly directive, controlling, metric-focused and business-oriented with respect to their interactions with grantee public charities, in an attempt to demonstrate that the work of the foundation is ‘strategic’ and ‘accountable’”.

This is far from the benign shift to a different and better way of doing things that it claims to be – a CEO style to “save the world through business thinking and market methods”, as Jenkins puts it. Instead, the risk of philanthrocapitalism is a takeover of charity by business interests, such that generosity to others is appropriated into the overarching dominance of the CEO model of society and its corporate institutions.

The modern CEO is very much at the forefront of the political and media stage. While this often leads to CEOs becoming vaunted celebrities, it also leaves them open to being identified as scapegoats for economic injustice. The increasingly public role taken by CEOs is related to a renewed corporate focus on their wider social responsibility. Firms must now balance, at least rhetorically, a dual commitment to profit and social outcomes. This has been reflected in the promotion of the “triple bottom line”, which combines social, financial and environmental priorities in corporate reporting.

This turn toward social responsibility represents a distinct problem for CEOs. While firms may be willing to sacrifice some short-term profit for the sake of preserving their public reputation, this same bargain is rarely on offer to CEOs themselves, who are judged on their quarterly reports and how well they are serving the fiscal interests of their shareholders. Thus, whereas social responsibility strategies may win public kudos, in the confines of the boardroom it is often a different story, especially when the budget is being scrutinised.

There is a further economic incentive for CEOs to avoid making fundamental changes to their operations in the name of social justice, in that a large portion of CEO remuneration often consists of company stock and options. Accepting fair trade policies and closing sweatshops may be good for the world, but is potentially disastrous for a firm’s immediate financial success. What is ethically valuable to the voting and buying public is not necessarily of concrete value to corporations, nor personally beneficial to their top executives.

Many firms have sought to resolve this contradiction through high-profile philanthropy. Exploitative labour practices or corporate malpractice are swept under the carpet as companies publicise tax-efficient contributions to good causes. Such contributions may be a relatively small price to pay compared with changing fundamental operational practices. Likewise, giving to charity is a prime opportunity for CEOs to be seen to be doing good without having to sacrifice their commitment to making profit at any social cost. Charitable activity permits CEOs to be philanthropic rather than economically progressive or politically democratic.

There is an even more straightforward financial consideration at play in some cases. Charity can be an absolute boon to capital accumulation: corporate philanthropy has been shown to have a positive effect on perceptions by stock market analysts. At the personal level, CEOs can take advantage of promoting their individual charity to distract from other, less savoury activities; as an executive, they can cash in on the capital gains that can be made from introducing high-profile charity strategies.

The very notion of corporate social responsibility, or CSR, has been criticised for providing companies with a moral cover to act in quite exploitative and socially damaging ways. But in the current era, social responsibility, when portrayed as an individual character trait of chief executives, has allowed corporations to be run as irresponsibly as ever. CEOs’ very public engagement in philanthrocapitalism can be understood as a key component of this reputation management. It is part of the marketing of the firm itself, as the good deeds of its leaders come to signify the overall goodness of the corporation.

Ironically, philanthrocapitalism also grants corporations the moral right, at least within the public consciousness, to be socially irresponsible. The trumpeting of the CEOs’ personal generosity can grant an implicit right for their corporations to act ruthlessly and with little consideration for the broader social effects of their activities. This reflects a productive tension at the heart of modern CSR: the more moral a CEO, the more immoral their company can in theory seek to be.

The hypocrisy revealed by CEOs claiming to be dedicated to social responsibility and charity also exposes a deeper authoritarian morality that prevails in the CEO society. Philanthrocapitalism is commonly presented as the social justice component of an otherwise amoral global free market. At best, corporate charity is a type of voluntary tax paid by the 1% for their role in creating such an economically deprived and unequal world. Yet this “giving” culture also helps support and spread a distinctly authoritarian form of economic development that mirrors the autocratic leadership style of the executives who predominantly fund it.

The marketisation of global charity and empowerment has dangerous implications that transcend economics. It also has a troubling emerging political legacy, one in which democracy is sacrificed on that altar of executive-style empowerment. Politically, the free market is posited as a fundamental requirement for liberal democracy. However, recent analysis reveals the deeper connection between processes of marketisation and authoritarianism. In particular, a strong government is required to implement these often unpopular market changes. The image of the powerful autocrat is, to this effect, transformed into a potentially positive figure, a forward-thinking political leader who can guide their country on the correct market path in the face of “irrational” opposition. Charity becomes a conduit for CEOs to fund these “good” authoritarians.

Essentially, what we are witnessing is the transfer of responsibility for public goods and services from democratic institutions to the wealthy, to be administered by an executive class. In the CEO society, the exercise of social responsibilities is no longer debated in terms of whether corporations should or shouldn’t be responsible for more than their own business interests. Instead, it is about how philanthropy can be used to reinforce a politico-economic system that enables such a small number of people to accumulate obscene amounts of wealth. Zuckerberg’s investment in solutions to the Bay Area housing crisis is an example of this broader trend.

The reliance on billionaire businesspeople’s charity to support public projects is a part of what has been called “philanthrocapitalism”. This resolves the apparent antinomy between charity (traditionally focused on giving) and capitalism (based on the pursuit of economic self-interest). As historian Mikkel Thorup explains, philanthrocapitalism rests on the claim that “capitalist mechanisms are superior to all others (especially the state) when it comes to not only creating economic but also human progress, and that the market and market actors are or should be made the prime creators of the good society”.

The golden age of philanthropy is not just about benefits that accrue to individual givers. More broadly, philanthropy serves to legitimise capitalism, as well as to extend it further and further into all domains of social, cultural and political activity.

Philanthrocapitalism is about much more than the simple act of generosity it pretends to be, instead involving the inculcation of neoliberal values personified by the billionaire CEOs who have led its charge. Philanthropy is recast in the same terms in which a CEO would consider a business venture. Charitable giving is translated into a business model that employs market-based solutions characterised by efficiency and quantified costs and benefits.

Philanthrocapitalism takes the application of management discourses and practices from business corporations and adapts them to charitable work. The focus is on entrepreneurship, market-based approaches and performance metrics. The process is funded by super-rich businesspeople and managed by those experienced in business. The result, at a practical level, is that philanthropy is undertaken by CEOs in a manner similar to how they would run businesses.

As part of this, charitable foundations have changed in recent years. As explained in a paper by Garry Jenkins, a professor of law at the University of Minnesota, this involves becoming “increasingly directive, controlling, metric-focused and business-oriented with respect to their interactions with grantee public charities, in an attempt to demonstrate that the work of the foundation is ‘strategic’ and ‘accountable’”.

This is far from the benign shift to a different and better way of doing things that it claims to be – a CEO style to “save the world through business thinking and market methods”, as Jenkins puts it. Instead, the risk of philanthrocapitalism is a takeover of charity by business interests, such that generosity to others is appropriated into the overarching dominance of the CEO model of society and its corporate institutions.

The modern CEO is very much at the forefront of the political and media stage. While this often leads to CEOs becoming vaunted celebrities, it also leaves them open to being identified as scapegoats for economic injustice. The increasingly public role taken by CEOs is related to a renewed corporate focus on their wider social responsibility. Firms must now balance, at least rhetorically, a dual commitment to profit and social outcomes. This has been reflected in the promotion of the “triple bottom line”, which combines social, financial and environmental priorities in corporate reporting.

This turn toward social responsibility represents a distinct problem for CEOs. While firms may be willing to sacrifice some short-term profit for the sake of preserving their public reputation, this same bargain is rarely on offer to CEOs themselves, who are judged on their quarterly reports and how well they are serving the fiscal interests of their shareholders. Thus, whereas social responsibility strategies may win public kudos, in the confines of the boardroom it is often a different story, especially when the budget is being scrutinised.

There is a further economic incentive for CEOs to avoid making fundamental changes to their operations in the name of social justice, in that a large portion of CEO remuneration often consists of company stock and options. Accepting fair trade policies and closing sweatshops may be good for the world, but is potentially disastrous for a firm’s immediate financial success. What is ethically valuable to the voting and buying public is not necessarily of concrete value to corporations, nor personally beneficial to their top executives.

Many firms have sought to resolve this contradiction through high-profile philanthropy. Exploitative labour practices or corporate malpractice are swept under the carpet as companies publicise tax-efficient contributions to good causes. Such contributions may be a relatively small price to pay compared with changing fundamental operational practices. Likewise, giving to charity is a prime opportunity for CEOs to be seen to be doing good without having to sacrifice their commitment to making profit at any social cost. Charitable activity permits CEOs to be philanthropic rather than economically progressive or politically democratic.

There is an even more straightforward financial consideration at play in some cases. Charity can be an absolute boon to capital accumulation: corporate philanthropy has been shown to have a positive effect on perceptions by stock market analysts. At the personal level, CEOs can take advantage of promoting their individual charity to distract from other, less savoury activities; as an executive, they can cash in on the capital gains that can be made from introducing high-profile charity strategies.

The very notion of corporate social responsibility, or CSR, has been criticised for providing companies with a moral cover to act in quite exploitative and socially damaging ways. But in the current era, social responsibility, when portrayed as an individual character trait of chief executives, has allowed corporations to be run as irresponsibly as ever. CEOs’ very public engagement in philanthrocapitalism can be understood as a key component of this reputation management. It is part of the marketing of the firm itself, as the good deeds of its leaders come to signify the overall goodness of the corporation.

Ironically, philanthrocapitalism also grants corporations the moral right, at least within the public consciousness, to be socially irresponsible. The trumpeting of the CEOs’ personal generosity can grant an implicit right for their corporations to act ruthlessly and with little consideration for the broader social effects of their activities. This reflects a productive tension at the heart of modern CSR: the more moral a CEO, the more immoral their company can in theory seek to be.

The hypocrisy revealed by CEOs claiming to be dedicated to social responsibility and charity also exposes a deeper authoritarian morality that prevails in the CEO society. Philanthrocapitalism is commonly presented as the social justice component of an otherwise amoral global free market. At best, corporate charity is a type of voluntary tax paid by the 1% for their role in creating such an economically deprived and unequal world. Yet this “giving” culture also helps support and spread a distinctly authoritarian form of economic development that mirrors the autocratic leadership style of the executives who predominantly fund it.

The marketisation of global charity and empowerment has dangerous implications that transcend economics. It also has a troubling emerging political legacy, one in which democracy is sacrificed on that altar of executive-style empowerment. Politically, the free market is posited as a fundamental requirement for liberal democracy. However, recent analysis reveals the deeper connection between processes of marketisation and authoritarianism. In particular, a strong government is required to implement these often unpopular market changes. The image of the powerful autocrat is, to this effect, transformed into a potentially positive figure, a forward-thinking political leader who can guide their country on the correct market path in the face of “irrational” opposition. Charity becomes a conduit for CEOs to fund these “good” authoritarians.

A protester outside the Nasdaq headquarters in New York marks Facebook’s IPO, 2012. Photograph: Alamy Stock Photo

The recent development of philanthrocapitalism also marks the increasing encroachment of business into the provision of public goods and services. This encroachment is not limited to the activities of individual billionaires; it is also becoming a part of the activities of large corporations under the rubric of CSR. This is especially the case for large multinational corporations whose global reach, wealth and power give them significant political clout. This relationship has been referred to as “political CSR”. Business ethics professors Andreas Scherer and Guido Palazzo note that, for large corporations, “CSR is increasingly displayed in corporate involvement in the political process of solving societal problems, often on a global scale”. Such political CSR initiatives see organisations cooperating and collaborating with governments, civic bodies and international institutions, so that historical separations between the purposes of the state and the corporations are increasingly eroded.