'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label socialism. Show all posts

Showing posts with label socialism. Show all posts

Monday, 25 September 2023

Friday, 18 August 2023

A level Economics: The 1973 coup against democratic socialism in Chile still matters

It happened 50 years ago, changed the course of world history – and revealed just how authoritarian conservatives are. Andy Beckett in The Guardian

Fifty years on, the 1973 coup in Chile still haunts politics there and far beyond. As we approach its anniversary, on 11 September, the violent overthrow of the elected socialist government of Salvador Allende and its replacement by the brutal dictatorship of General Augusto Pinochet are already being marked in Britain, through a period of remembrance scheduled to include dozens of separate exhibitions and events. Among these will be a march in Sheffield, archival displays in Edinburgh, a concert in Swansea, and a conference and picket of the Chilean embassy in London.

Few past events in faraway countries receive this level of attention. Military takeovers were not unusual in South America during the cold war. And Chile has been a relatively stable democracy since the Pinochet dictatorship ended, 33 years ago. So why does the 1973 coup still resonate?

In the UK, one answer is that roughly 2,500 Chilean refugees fled here after the coup, despite an unwelcoming Conservative government. “It is intended to keep the number of refugees to a very small number and, if our criteria are not fully met, we may accept none of them,” said a Foreign Office memo not released until three decades afterwards.

The Chileans came regardless, partly because leftwing activists, trade unionists and politicians including Tony Benn and Jeremy Corbyn created a solidarity movement – of a scale and duration harder to imagine in our more politically impatient times – which helped the refugees build new lives, and campaigned with them for years against the Pinochet regime. Some of these exiles settled in Britain permanently; veterans of the solidarity movement are involved in this year’s remembrance events, as they have been in earlier anniversaries. The left’s reverence for old struggles can sometimes distract it or weigh it down, but it is also a source of emotional and cultural strength, and an acknowledgment that the past and present are often more linked than we realise.

Two weeks ago, it was revealed that an old army helicopter that stands in a wood in Sussex as part of a paintball course had previously been used by the Pinochet government, to transport dissidents and then throw them into the sea. The dictatorship was a pioneer of this and other methods of “disappearing” its enemies and perceived enemies, believing that lethal abductions would frighten the population into obedience more effectively than conventional state murders.

Not unconnectedly, the regime also pioneered the harsh free-market policies which transformed much of the world – and which are still supported by most Tories, many rightwing politicians in other countries, and many business interests. In Chile, the idea that a deregulated economy required a highly disciplined citizenry, to avoid the economic semi-anarchy spilling over into society, was exhaustively tested and refined, to the great interest of foreign politicians such as Margaret Thatcher.

Fifty years on, the 1973 coup in Chile still haunts politics there and far beyond. As we approach its anniversary, on 11 September, the violent overthrow of the elected socialist government of Salvador Allende and its replacement by the brutal dictatorship of General Augusto Pinochet are already being marked in Britain, through a period of remembrance scheduled to include dozens of separate exhibitions and events. Among these will be a march in Sheffield, archival displays in Edinburgh, a concert in Swansea, and a conference and picket of the Chilean embassy in London.

Few past events in faraway countries receive this level of attention. Military takeovers were not unusual in South America during the cold war. And Chile has been a relatively stable democracy since the Pinochet dictatorship ended, 33 years ago. So why does the 1973 coup still resonate?

In the UK, one answer is that roughly 2,500 Chilean refugees fled here after the coup, despite an unwelcoming Conservative government. “It is intended to keep the number of refugees to a very small number and, if our criteria are not fully met, we may accept none of them,” said a Foreign Office memo not released until three decades afterwards.

The Chileans came regardless, partly because leftwing activists, trade unionists and politicians including Tony Benn and Jeremy Corbyn created a solidarity movement – of a scale and duration harder to imagine in our more politically impatient times – which helped the refugees build new lives, and campaigned with them for years against the Pinochet regime. Some of these exiles settled in Britain permanently; veterans of the solidarity movement are involved in this year’s remembrance events, as they have been in earlier anniversaries. The left’s reverence for old struggles can sometimes distract it or weigh it down, but it is also a source of emotional and cultural strength, and an acknowledgment that the past and present are often more linked than we realise.

Two weeks ago, it was revealed that an old army helicopter that stands in a wood in Sussex as part of a paintball course had previously been used by the Pinochet government, to transport dissidents and then throw them into the sea. The dictatorship was a pioneer of this and other methods of “disappearing” its enemies and perceived enemies, believing that lethal abductions would frighten the population into obedience more effectively than conventional state murders.

Not unconnectedly, the regime also pioneered the harsh free-market policies which transformed much of the world – and which are still supported by most Tories, many rightwing politicians in other countries, and many business interests. In Chile, the idea that a deregulated economy required a highly disciplined citizenry, to avoid the economic semi-anarchy spilling over into society, was exhaustively tested and refined, to the great interest of foreign politicians such as Margaret Thatcher.

Augusto Pinochet, left, and President Salvador Allende attend a ceremony naming Pinochet as commander in chief of the army, 23 August, 1973. Photograph: Enrique Aracena/AP

Another reason that the 1973 coup remains a powerful event is that it left unfinished business at the other end of the political spectrum. The Allende government was an argumentative and ambitious coalition which, almost uniquely, attempted to create a socialist country with plentiful consumer pleasures and modern technology, including a kind of early internet called Project Cybersyn, without Soviet-style repression. For a while, even the Daily Mail was impressed: “An astonishing experiment is taking place,” it reported on the first anniversary of his election. “If it survives, the implications will be immense for other countries.”

The coup happened partly because the government’s popularity, though never overwhelming, rose while it was in office. This rise convinced conservative interests that it would be reelected, and would then take the patchy reforms of its first term much further. For the same reasons, the Allende presidency remains tantalising for some on the left. An updated version of his combination of social liberalism, egalitarianism and mass political participation may still have the potential to transform the left’s prospects, as Corbyn’s successful campaigns in 2015, 2016 and 2017 suggested.

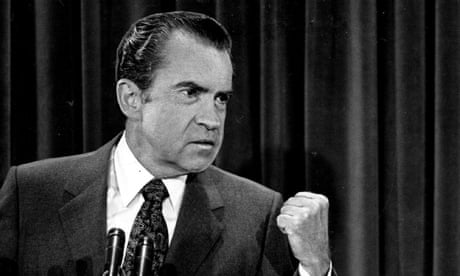

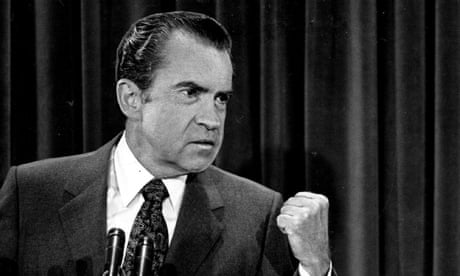

Files reveal Nixon role in plot to block Allende from Chilean presidency

There is one more, bleaker reason to reflect on the coup: for what it revealed about conservatism. When I wrote a book on Chile two decades ago, it was unsettling to learn about how the US Republicans undermined Allende, by covert CIA funding of his enemies, for instance, and how the Conservatives helped Pinochet, through arms sales and diplomatic support. But these moves seemed to be explained largely by cold-war strategies and free-market zealotry, which was fading in the early 21st century.

Yet from today’s perspective, with another Trump presidency threatening, far-right parties in power across Europe, and a Tory government with few, if any, inhibitions about criminalising dissent, the Chile coup looks prophetic. Nowadays the line between conservatism and authoritarianism is not so much blurred occasionally, in national emergencies, as nonexistent in many countries.

Some critics of conservatism would say that it’s naive to think such a line ever existed. In 1930s Europe, for instance, supposedly moderate and pro-democratic rightwing parties often facilitated the rise of fascism. Yet the postwar world, after fascism had been militarily defeated, was meant to be one where such toxic alliances against the left never happened again.

The 1973 coup ended that comfortable assumption. “It is not for us to pass judgment on Chile’s internal affairs,” said the Tory Foreign Office minister Julian Amery in the Commons, two months later, despite the coup having initiated killings and torture on a mass scale. When the coup is remembered, its victims should come first. But the response of conservatives around the world to the crushing of Chile’s democracy and civil liberties should never be forgotten.

Another reason that the 1973 coup remains a powerful event is that it left unfinished business at the other end of the political spectrum. The Allende government was an argumentative and ambitious coalition which, almost uniquely, attempted to create a socialist country with plentiful consumer pleasures and modern technology, including a kind of early internet called Project Cybersyn, without Soviet-style repression. For a while, even the Daily Mail was impressed: “An astonishing experiment is taking place,” it reported on the first anniversary of his election. “If it survives, the implications will be immense for other countries.”

The coup happened partly because the government’s popularity, though never overwhelming, rose while it was in office. This rise convinced conservative interests that it would be reelected, and would then take the patchy reforms of its first term much further. For the same reasons, the Allende presidency remains tantalising for some on the left. An updated version of his combination of social liberalism, egalitarianism and mass political participation may still have the potential to transform the left’s prospects, as Corbyn’s successful campaigns in 2015, 2016 and 2017 suggested.

Files reveal Nixon role in plot to block Allende from Chilean presidency

There is one more, bleaker reason to reflect on the coup: for what it revealed about conservatism. When I wrote a book on Chile two decades ago, it was unsettling to learn about how the US Republicans undermined Allende, by covert CIA funding of his enemies, for instance, and how the Conservatives helped Pinochet, through arms sales and diplomatic support. But these moves seemed to be explained largely by cold-war strategies and free-market zealotry, which was fading in the early 21st century.

Yet from today’s perspective, with another Trump presidency threatening, far-right parties in power across Europe, and a Tory government with few, if any, inhibitions about criminalising dissent, the Chile coup looks prophetic. Nowadays the line between conservatism and authoritarianism is not so much blurred occasionally, in national emergencies, as nonexistent in many countries.

Some critics of conservatism would say that it’s naive to think such a line ever existed. In 1930s Europe, for instance, supposedly moderate and pro-democratic rightwing parties often facilitated the rise of fascism. Yet the postwar world, after fascism had been militarily defeated, was meant to be one where such toxic alliances against the left never happened again.

The 1973 coup ended that comfortable assumption. “It is not for us to pass judgment on Chile’s internal affairs,” said the Tory Foreign Office minister Julian Amery in the Commons, two months later, despite the coup having initiated killings and torture on a mass scale. When the coup is remembered, its victims should come first. But the response of conservatives around the world to the crushing of Chile’s democracy and civil liberties should never be forgotten.

Saturday, 18 March 2023

Friday, 9 September 2022

Friday, 4 February 2022

Wednesday, 27 October 2021

Don’t blame Nehru’s Socialism for Air India fate. Read the 1944 Bombay Plan first

Vibhav Mariwala in The Print

Air India’s privatisation is finally underway, albeit, belatedly. Consequently, this has led to conversations around the planned economy, and in turn blamed the Socialist economy for India’s woes. These debates presume that India was forced into planning; this assumption undermines the country’s economic history, and disregards the role that Indian businesses played in shaping economic policy leading up to Independence.

In 1944, during the height of the Bengal famine, and with the seeming inevitability of Independence, J.R.D. Tata and seven other industrialists and executives — G.D. Birla, Purushottam Das Thakurdas, Ardeshir Shroff, Kasturbhai Lalbhai, Ardeshir Dalal, John Matthai, and Lal Shri Ram — came together to write a manifesto on the future of the Indian economy post-Independence. This was known as the Bombay Plan, or more formally called A Plan of Economic Development for India. The authors of the plan helped set up the Reserve Bank of India (RBI), Federation of Indian Chambers of Commerce and Industry (FICCI), supported the Indian National Congress (INC) during the Freedom struggle and even sat on the viceroy’s executive council during WWII.

View on economy

The Bombay Plan aimed to express the authors’ views on the post-Independence economy. It had the following components: a transition from agricultural domination to industrialisation; the allocation of resources through centralised planning, and the division of industries into ‘basic industries’, dominated by the State, and ‘consumer industries’, left to the private sector. From its outset, the plan acknowledged the primacy of the State in organising the economy and providing basic necessities to citizens. Historians such as Medha Kudaisya call the plan “a revolutionary idea” in State planning since it adopted a middle way for the private sector to coexist in a planned economy. On the other hand, Vivek Chibber in Locked in Place, argues that the plan was a way for businesses to entrench their own vested interests. (Vivek Chibber, Locked in Place: State-Building and Late Industrialization in India (Princeton, N.J. ; Princeton University Press, 2006), 86.)

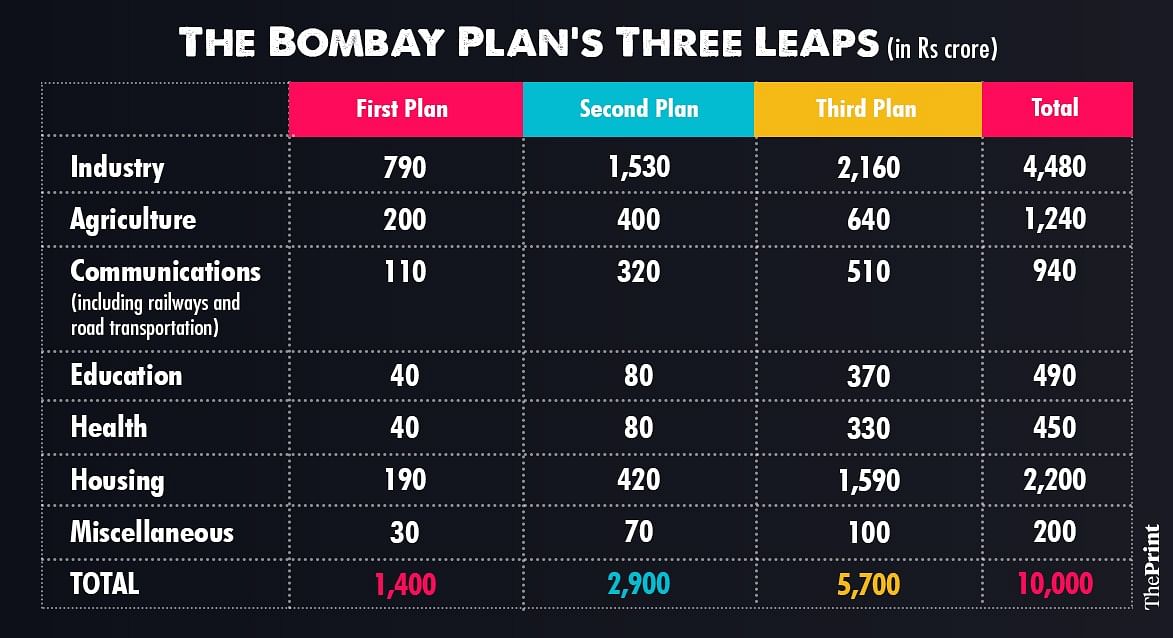

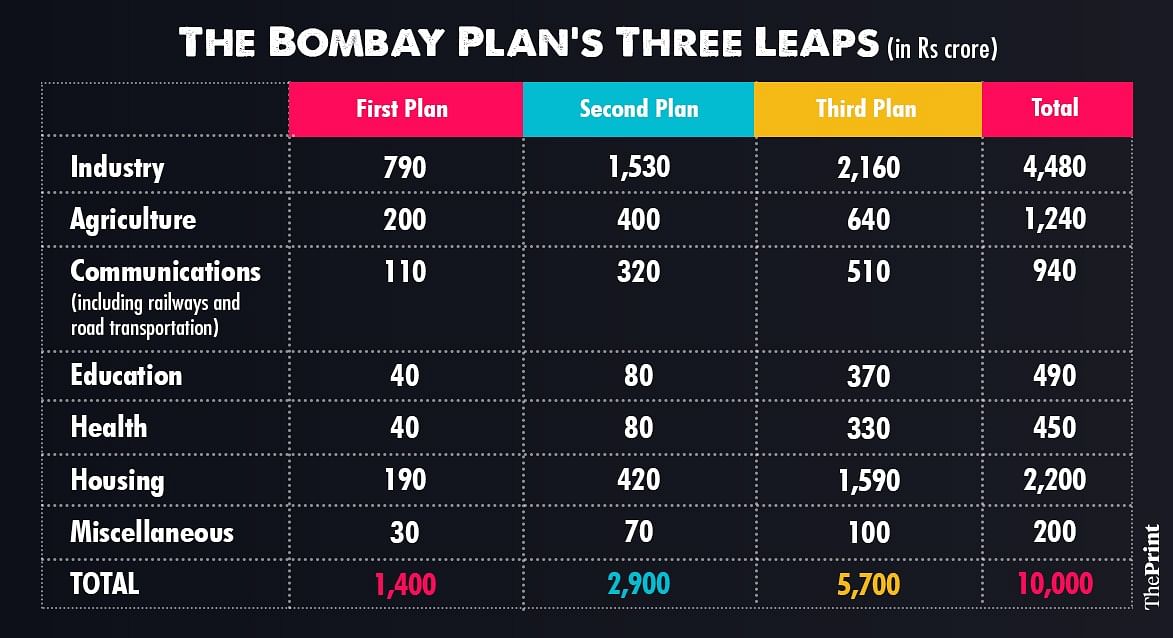

The principle objective of the plan was “to bring about a doubling of the present per capita income within a period of fifteen years from the time the plan comes into operation,” and increase production of power and capital goods. It then went on to define a reasonable living standard, cost of housing, clothing and food to individuals, housing requirements, and the provision of essential infrastructure like sewage treatment, water and electricity. It planned to achieve these aims in three ‘leaps’ spread over five years, analogous to the Five-Year Plans. The table below reflects these priorities.

Graphic by Ramandeep Kaur | ThePrint

Graphic by Ramandeep Kaur | ThePrint

The planners argued for a ‘mixed-economy’ model, where the government would take control of ‘basic industries,’ and the private sector would take charge of ‘consumer industries’. Basic industries included transportation, chemicals, power generation, and steel production. More significantly, they argued that nationalisation of basic industries could reduce income disparities and that the government had to prioritise basic industries over consumption to reduce poverty. The planners conclude this section by saying, “for the success of our economic plan that the basic industries, on which ultimately the whole economic development of the country depends, should be developed as rapidly as possible,” emphasising that the government needed to take a leading role in the economy to ensure their provision. This shows that the the business community conceded the centrality of the State in building India’s economy.

The plan was well received, with endorsements from FICCI, RBI Governor C.D. Deshmukh, and the viceroy, who in response to the plan document had established a Department of Planning and Development in 1944 (Tryst with Prosperity). Newspaper editorials in India and abroad supported the plan. The Glasgow Herald commended the planners for thinking about issues such as “public health, population control and education” that “Indian political leaders [could not] be induced to think about, however urgent.” The New York Times reported that “the main political factions in India do not seem to be coming forward with any such practical approaches,” reiterating the view that India’s political elite had not considered policy solutions to India’s problems. However, the plan document was criticised as well for being inaccurate and a vehicle for the elite to entrench their interests over the interests of the poor by K.T. Shah, general secretary of the 1937-38 NPC and Gulzarilal Nanda, future Planning Minister (1951-63)and other economists. Its calculations relied on statistics from 1932, making its assumptions highly outdated and it underestimated the costs of implementing its aims.

Influence on economic planning

The document was significant since it reframed debates on State planning — from arguing if the State should dominate the economy, to analysing the extent to which the State should be involved in the economy. Its influence on Indian economic planning is clearly seen in the immediate aftermath of WWII, and in the First and Second Five-Year Plans that prioritised agricultural development and industrial growth, respectively. It also paved the way for India to adopt a third way in structuring its political economy by providing an opportunity to the country to combine aspects of Western capitalism, Soviet planning, and Western Socialism, allowing India to chart its own independent course. To many, the plan was a way for businesses to signal to the INC leadership that it was willing to accept the supremacy of the State in the economy, while acknowledging the role of the private sector in supporting consumption activity.

Insisting that Nehruvian Socialism was the cause for India’s economic ills without acknowledging the political and economic contexts of post-Independence India reflects an incomplete understanding of India’s formative years after independence. The Bombay Plan is an essential document to understanding the events that led to the creation of India’s planned economy, and reiterates the view that planning was not imposed on the country, but was widely debated across the private and public sphere in the years leading up to Independence.

Air India’s privatisation is finally underway, albeit, belatedly. Consequently, this has led to conversations around the planned economy, and in turn blamed the Socialist economy for India’s woes. These debates presume that India was forced into planning; this assumption undermines the country’s economic history, and disregards the role that Indian businesses played in shaping economic policy leading up to Independence.

In 1944, during the height of the Bengal famine, and with the seeming inevitability of Independence, J.R.D. Tata and seven other industrialists and executives — G.D. Birla, Purushottam Das Thakurdas, Ardeshir Shroff, Kasturbhai Lalbhai, Ardeshir Dalal, John Matthai, and Lal Shri Ram — came together to write a manifesto on the future of the Indian economy post-Independence. This was known as the Bombay Plan, or more formally called A Plan of Economic Development for India. The authors of the plan helped set up the Reserve Bank of India (RBI), Federation of Indian Chambers of Commerce and Industry (FICCI), supported the Indian National Congress (INC) during the Freedom struggle and even sat on the viceroy’s executive council during WWII.

View on economy

The Bombay Plan aimed to express the authors’ views on the post-Independence economy. It had the following components: a transition from agricultural domination to industrialisation; the allocation of resources through centralised planning, and the division of industries into ‘basic industries’, dominated by the State, and ‘consumer industries’, left to the private sector. From its outset, the plan acknowledged the primacy of the State in organising the economy and providing basic necessities to citizens. Historians such as Medha Kudaisya call the plan “a revolutionary idea” in State planning since it adopted a middle way for the private sector to coexist in a planned economy. On the other hand, Vivek Chibber in Locked in Place, argues that the plan was a way for businesses to entrench their own vested interests. (Vivek Chibber, Locked in Place: State-Building and Late Industrialization in India (Princeton, N.J. ; Princeton University Press, 2006), 86.)

The principle objective of the plan was “to bring about a doubling of the present per capita income within a period of fifteen years from the time the plan comes into operation,” and increase production of power and capital goods. It then went on to define a reasonable living standard, cost of housing, clothing and food to individuals, housing requirements, and the provision of essential infrastructure like sewage treatment, water and electricity. It planned to achieve these aims in three ‘leaps’ spread over five years, analogous to the Five-Year Plans. The table below reflects these priorities.

Graphic by Ramandeep Kaur | ThePrint

Graphic by Ramandeep Kaur | ThePrintThe planners argued for a ‘mixed-economy’ model, where the government would take control of ‘basic industries,’ and the private sector would take charge of ‘consumer industries’. Basic industries included transportation, chemicals, power generation, and steel production. More significantly, they argued that nationalisation of basic industries could reduce income disparities and that the government had to prioritise basic industries over consumption to reduce poverty. The planners conclude this section by saying, “for the success of our economic plan that the basic industries, on which ultimately the whole economic development of the country depends, should be developed as rapidly as possible,” emphasising that the government needed to take a leading role in the economy to ensure their provision. This shows that the the business community conceded the centrality of the State in building India’s economy.

The plan was well received, with endorsements from FICCI, RBI Governor C.D. Deshmukh, and the viceroy, who in response to the plan document had established a Department of Planning and Development in 1944 (Tryst with Prosperity). Newspaper editorials in India and abroad supported the plan. The Glasgow Herald commended the planners for thinking about issues such as “public health, population control and education” that “Indian political leaders [could not] be induced to think about, however urgent.” The New York Times reported that “the main political factions in India do not seem to be coming forward with any such practical approaches,” reiterating the view that India’s political elite had not considered policy solutions to India’s problems. However, the plan document was criticised as well for being inaccurate and a vehicle for the elite to entrench their interests over the interests of the poor by K.T. Shah, general secretary of the 1937-38 NPC and Gulzarilal Nanda, future Planning Minister (1951-63)and other economists. Its calculations relied on statistics from 1932, making its assumptions highly outdated and it underestimated the costs of implementing its aims.

Influence on economic planning

The document was significant since it reframed debates on State planning — from arguing if the State should dominate the economy, to analysing the extent to which the State should be involved in the economy. Its influence on Indian economic planning is clearly seen in the immediate aftermath of WWII, and in the First and Second Five-Year Plans that prioritised agricultural development and industrial growth, respectively. It also paved the way for India to adopt a third way in structuring its political economy by providing an opportunity to the country to combine aspects of Western capitalism, Soviet planning, and Western Socialism, allowing India to chart its own independent course. To many, the plan was a way for businesses to signal to the INC leadership that it was willing to accept the supremacy of the State in the economy, while acknowledging the role of the private sector in supporting consumption activity.

Insisting that Nehruvian Socialism was the cause for India’s economic ills without acknowledging the political and economic contexts of post-Independence India reflects an incomplete understanding of India’s formative years after independence. The Bombay Plan is an essential document to understanding the events that led to the creation of India’s planned economy, and reiterates the view that planning was not imposed on the country, but was widely debated across the private and public sphere in the years leading up to Independence.

Saturday, 4 September 2021

Monday, 16 August 2021

Monday, 11 January 2021

Wednesday, 22 July 2020

Sunday, 12 July 2020

Monday, 8 June 2020

Sunday, 26 April 2020

'Heads we win, tails you lose': how America's rich have turned pandemic into profit

As 26 million Americans lose their jobs, the billionaire class has added $308bn to its wealth writes Dominic Rushe and Mona Chalabi in The Guardian

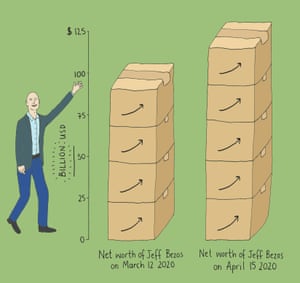

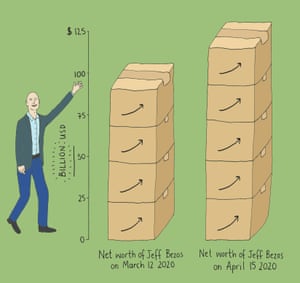

Jeff Bezos has seen his wealth increase from $105bn to $130bn. Photograph: Mona Chalabi

Never let a good crisis go to waste: as the coronavirus pandemic sweeps the world, America’s 1% have taken profitable advantage of the old saying.

Some of the richest people in the US have been at the front of the queue as the government has handed out trillions of dollars to prop up an economy it shuttered amid the coronavirus pandemic. At the same time, the billionaire class has added $308bn to its wealth in four weeks - even as a record 26 million people lost their jobs.

According to a new report from the Institute for Policy Studies, a progressive thinktank, between 18 March and 22 April the wealth of America’s plutocrats grew 10.5%. After the last recession, it took over two years for total billionaire wealth to get back to the levels they enjoyed in 2007.

Eight of those billionaires have seen their net worth surge by over $1bn each, including the Amazon boss, Jeff Bezos, and his ex-wife MacKenzie Bezos; Eric Yuan, founder of Zoom; the former Microsoft chief Steve Ballmer; and Elon Musk, the Tesla and SpaceX technocrat.

The billionaire bonanza comes as a flotilla of big businesses, millionaires and billionaires sail through loopholes in a $349bn bailout meant to save hard-hit small businesses. About 150 public companies managed to bag more than $600m in forgivable loans before the funds ran out. Among them was Shake Shack, a company with 6,000 employees valued at $2bn. It has since given the cash back but others have not.

Fisher Island, a members-only location off the coast of Miami where the average income of residents is $2.2m and the beaches are made from imported Bahamian sand, has received $2m in aid.

Its residents seemed to be doing fine even before the bailout. This month, the island purchased thousands of rapid Covid-19 blood test kits for all residents and workers. The rest of Florida is struggling. About 1% of Florida’s population has been tested for the coronavirus, behind the national figure of 4%. The state is also in the midst of an unemployment claims crisis, with its underfunded benefits system unable to cope with the volume of people filing.

The banks that were the largest recipients of bailout cash in the last recession have also done well, raking in $10bn in fees from the government loans, according to an analysis by National Public Radio.

“Heads we win, tails you lose,” said Chuck Collins, director of the program on inequality and the common good at the Institute for Policy Studies and co-author of the new report.

Collins said the pandemic had further exposed fault lines in the US body politic that have been widening the gap between the really rich and the rest over decades.

“The rules of the economy have been tipped in favor of asset owners against everyone else,” said Collins.

By 2016 – seven years after the end of the last recession – the bottom 90% of households in the US had still not recovered from the last downturn while the top 10% had more wealth than they had in 2007.

Throughout the recovery, stock market gains disproportionately favored the wealthy. The top 1% of households own nearly 38% of all stock, according to research by the New York University economist Edward Wolff. Even before the coronavirus hit, homeownership in the US – a traditional source of wealth growth – was well below its 2004 peak.

Nor did Americans earn more. Wage growth remained sluggish during the decade-long record-breaking growth in the jobs market that came after the last recession.

For black and Latin Americans, the situation is worse. The black-white wage gaps are larger today than they were in 1979.

Meanwhile, billionaires have been unable to put a well-heeled foot wrong. Billionaire wealth soared 1,130% in 2020 dollars between 1990 and 2020, according to the Institute for Policy Studies. That increase is more than 200 times greater than the 5.37% growth of median wealth in the US over this same period. And the tax obligations of America’s billionaires, measured as a percentage of their wealth, decreased 79% between 1980 and 2018.

So when the pandemic struck, those at the apex of the wealth pyramid were better positioned than ever to take advantage of the chaos. The rest, not so much.

Collins has been studying income inequality for 25 years and has seen the really rich win victory after victory. But even he was surprised by how quickly America’s billionaires have turned pandemic into profit. “I still get shocked,” he said.

Never let a good crisis go to waste: as the coronavirus pandemic sweeps the world, America’s 1% have taken profitable advantage of the old saying.

Some of the richest people in the US have been at the front of the queue as the government has handed out trillions of dollars to prop up an economy it shuttered amid the coronavirus pandemic. At the same time, the billionaire class has added $308bn to its wealth in four weeks - even as a record 26 million people lost their jobs.

According to a new report from the Institute for Policy Studies, a progressive thinktank, between 18 March and 22 April the wealth of America’s plutocrats grew 10.5%. After the last recession, it took over two years for total billionaire wealth to get back to the levels they enjoyed in 2007.

Eight of those billionaires have seen their net worth surge by over $1bn each, including the Amazon boss, Jeff Bezos, and his ex-wife MacKenzie Bezos; Eric Yuan, founder of Zoom; the former Microsoft chief Steve Ballmer; and Elon Musk, the Tesla and SpaceX technocrat.

The billionaire bonanza comes as a flotilla of big businesses, millionaires and billionaires sail through loopholes in a $349bn bailout meant to save hard-hit small businesses. About 150 public companies managed to bag more than $600m in forgivable loans before the funds ran out. Among them was Shake Shack, a company with 6,000 employees valued at $2bn. It has since given the cash back but others have not.

Fisher Island, a members-only location off the coast of Miami where the average income of residents is $2.2m and the beaches are made from imported Bahamian sand, has received $2m in aid.

Its residents seemed to be doing fine even before the bailout. This month, the island purchased thousands of rapid Covid-19 blood test kits for all residents and workers. The rest of Florida is struggling. About 1% of Florida’s population has been tested for the coronavirus, behind the national figure of 4%. The state is also in the midst of an unemployment claims crisis, with its underfunded benefits system unable to cope with the volume of people filing.

The banks that were the largest recipients of bailout cash in the last recession have also done well, raking in $10bn in fees from the government loans, according to an analysis by National Public Radio.

“Heads we win, tails you lose,” said Chuck Collins, director of the program on inequality and the common good at the Institute for Policy Studies and co-author of the new report.

Collins said the pandemic had further exposed fault lines in the US body politic that have been widening the gap between the really rich and the rest over decades.

“The rules of the economy have been tipped in favor of asset owners against everyone else,” said Collins.

By 2016 – seven years after the end of the last recession – the bottom 90% of households in the US had still not recovered from the last downturn while the top 10% had more wealth than they had in 2007.

Throughout the recovery, stock market gains disproportionately favored the wealthy. The top 1% of households own nearly 38% of all stock, according to research by the New York University economist Edward Wolff. Even before the coronavirus hit, homeownership in the US – a traditional source of wealth growth – was well below its 2004 peak.

Nor did Americans earn more. Wage growth remained sluggish during the decade-long record-breaking growth in the jobs market that came after the last recession.

For black and Latin Americans, the situation is worse. The black-white wage gaps are larger today than they were in 1979.

Meanwhile, billionaires have been unable to put a well-heeled foot wrong. Billionaire wealth soared 1,130% in 2020 dollars between 1990 and 2020, according to the Institute for Policy Studies. That increase is more than 200 times greater than the 5.37% growth of median wealth in the US over this same period. And the tax obligations of America’s billionaires, measured as a percentage of their wealth, decreased 79% between 1980 and 2018.

So when the pandemic struck, those at the apex of the wealth pyramid were better positioned than ever to take advantage of the chaos. The rest, not so much.

Collins has been studying income inequality for 25 years and has seen the really rich win victory after victory. But even he was surprised by how quickly America’s billionaires have turned pandemic into profit. “I still get shocked,” he said.

Monday, 25 November 2019

Is Labour the answer to Capitalism's decline?

On Milton Friedman and the Chicago boys

Milton Friedman's pencil

On Milton Friedman's pencil story

Soviet Union

China

China

Soviet Union

Thursday, 6 June 2019

‘Socialism for the rich’: the evils of bad economics

The economic arguments adopted by Britain and the US in the 1980s led to vastly increased inequality – and gave the false impression that this outcome was not only inevitable, but good writes Jonathan Aldred in The Guardian

In most rich countries, inequality is rising, and has been rising for some time. Many people believe this is a problem, but, equally, many think there’s not much we can do about it. After all, the argument goes, globalisation and new technology have created an economy in which those with highly valued skills or talents can earn huge rewards. Inequality inevitably rises. Attempting to reduce inequality via redistributive taxation is likely to fail because the global elite can easily hide their money in tax havens. Insofar as increased taxation does hit the rich, it will deter wealth creation, so we all end up poorer.

One strange thing about these arguments, whatever their merits, is how they stand in stark contrast to the economic orthodoxy that existed from roughly 1945 until 1980, which held that rising inequality was not inevitable, and that various government policies could reduce it. What’s more, these policies appear to have been successful. Inequality fell in most countries from the 1940s to the 1970s. The inequality we see today is largely due to changes since 1980.

In both the US and the UK, from 1980 to 2016, the share of total income going to the top 1% has more than doubled. After allowing for inflation, the earnings of the bottom 90% in the US and UK have barely risen at all over the past 25 years. More generally, 50 years ago, a US CEO earned on average about 20 times as much as the typical worker. Today, the CEO earns 354 times as much.

Any argument that rising inequality is largely inevitable in our globalised economy faces a crucial objection. Since 1980 some countries have experienced a big increase in inequality (the US and the UK); some have seen a much smaller increase (Canada, Japan, Italy), while inequality has been stable or falling in others (France, Belgium and Hungary). So rising inequality cannot be inevitable. And the extent of inequality within a country cannot be solely determined by long-run global economic forces, because, although most richer countries have been subject to broadly similar forces, the experiences of inequality have differed.

The familiar political explanation for this rising inequality is the huge shift in mainstream economic and political thinking, in favour of free markets, triggered by the elections of Ronald Reagan and Margaret Thatcher. Its fit with the facts is undeniable. Across developed economies, the biggest rise in inequality since 1945 occurred in the US and UK from 1980 onwards.

The power of a grand political transformation seems persuasive. But it cannot be the whole explanation. It is too top-down: it is all about what politicians and other elites do to us. The idea that rising inequality is inevitable begins to look like a convenient myth, one that allows us to avoid thinking about another possibility: that through our electoral choices and decisions in daily life we have supported rising inequality, or at least acquiesced in it. Admittedly, that assumes we know about it. Surveys in the UK and US consistently suggest that we underestimate both the level of current inequality and how much it has recently increased. But ignorance cannot be a complete excuse, because surveys also reveal a change in attitudes: rising inequality has become more acceptable – or at least, less unacceptable – especially if you are not on the wrong end of it.

Inequality is unlikely to fall much in the future unless our attitudes turn unequivocally against it. Among other things, we will need to accept that how much people earn in the market is often not what they deserve, and that the tax they pay is not taking from what is rightfully theirs.

One crucial reason why we have done so little to reduce inequality in recent years is that we downplay the role of luck in achieving success. Parents teach their children that almost all goals are attainable if you try hard enough. This is a lie, but there is a good excuse for it: unless you try your best, many goals will definitely remain unreachable.

Ignoring the good luck behind my success helps me feel good about myself, and makes it much easier to feel I deserve the rewards associated with success. High earners may truly believe that they deserve their income because they are vividly aware of how hard they have worked and the obstacles they have had to overcome to be successful.

But this is not true everywhere. Support for the idea that you deserve what you get varies from country to country. And in fact, support for such beliefs is stronger in countries where there seems to be stronger evidence that contradicts them. What explains this?

Attitude surveys have consistently shown that, compared to US residents, Europeans are roughly twice as likely to believe that luck is the main determinant of income and that the poor are trapped in poverty. Similarly, people in the US are about twice as likely as Europeans to believe that the poor are lazy and that hard work leads to higher quality of life in the long run.

FacebookTwitterPinterest ‘There’s been class warfare going on for the last 20 years, and my class has won’ … US billionaire Warren Buffett. Photograph: Kevin Lamarque/Reuters

However, if the only function of the state is to support private ownership rights (maintaining a legal system, police, and so on), it seems that taxation could be very low – and any further taxation on top could still be seen as a form of theft. Implicit in this view is the idea of incomes earned, and so ownership rights created, in an entirely private market economy, with the state entering only later, to ensure these rights are maintained. Many economics textbooks picture the state in this way, as an add-on to the market. Yet this, too, is a fantasy.

In the modern world, all economic activity reflects the influence of government. Markets are inevitably defined and shaped by government. There is no such thing as income earned before government comes along. My earnings partly reflect my education. Earlier still, the circumstances of my birth and my subsequent health reflects the healthcare available. Even if that healthcare is entirely “private”, it depends on the education of doctors and nurses, and the drugs and other technologies available. Like all other goods and services, these in turn depend on the economic and social infrastructure, including transport networks, communications systems, energy supplies and extensive legal arrangements covering complex matters such as intellectual property, formal markets such as stock exchanges, and jurisdiction across national borders. Lord Lloyd-Webber’s wealth depends on government decisions about the length of copyright on the music he wrote. In sum, it is impossible to isolate what is “yours” from what is made possible, or influenced, by the role of government.

Talk of taxation as theft turns out to be a variation on the egotistical tendency to see one’s success in splendid isolation, ignoring the contribution of past generations, current colleagues and government. Undervaluing the role of government leads to the belief that if you are smart and hard-working, the high taxes you endure, paying for often wasteful government, are not a good deal. You would be better off in a minimal-state, low-tax society.

One reply to this challenge points to the evidence on the rich leaving their home country to move to a lower tax jurisdiction: in fact, very few of them do. But here is a more ambitious reply from Warren Buffett: “Imagine there are two identical twins in the womb … And the genie says to them: ‘One of you is going to be born in the United States, and one of you is going to be born in Bangladesh. And if you wind up in Bangladesh, you will pay no taxes. What percentage of your income would you bid to be born in the United States?’ … The people who say: ‘I did it all myself’ … believe me, they’d bid more to be in the United States than in Bangladesh.”

Much of the inequality we see today in richer countries is more down to decisions made by governments than to irreversible market forces. These decisions can be changed. However, we have to want to control inequality: we must make inequality reduction a central aim of government policy and wider society. The most entrenched, self-deluding and self-perpetuating justifications for inequality are about morality, not economy. The great economist John Kenneth Galbraith nicely summarised the problem: “One of man’s oldest exercises in moral philosophy … is the search for a superior moral justification for selfishness. It is an exercise which always involves a certain number of internal contradictions and even a few absurdities. The conspicuously wealthy turn up urging the character-building value of privation for the poor.”

In most rich countries, inequality is rising, and has been rising for some time. Many people believe this is a problem, but, equally, many think there’s not much we can do about it. After all, the argument goes, globalisation and new technology have created an economy in which those with highly valued skills or talents can earn huge rewards. Inequality inevitably rises. Attempting to reduce inequality via redistributive taxation is likely to fail because the global elite can easily hide their money in tax havens. Insofar as increased taxation does hit the rich, it will deter wealth creation, so we all end up poorer.

One strange thing about these arguments, whatever their merits, is how they stand in stark contrast to the economic orthodoxy that existed from roughly 1945 until 1980, which held that rising inequality was not inevitable, and that various government policies could reduce it. What’s more, these policies appear to have been successful. Inequality fell in most countries from the 1940s to the 1970s. The inequality we see today is largely due to changes since 1980.

In both the US and the UK, from 1980 to 2016, the share of total income going to the top 1% has more than doubled. After allowing for inflation, the earnings of the bottom 90% in the US and UK have barely risen at all over the past 25 years. More generally, 50 years ago, a US CEO earned on average about 20 times as much as the typical worker. Today, the CEO earns 354 times as much.

Any argument that rising inequality is largely inevitable in our globalised economy faces a crucial objection. Since 1980 some countries have experienced a big increase in inequality (the US and the UK); some have seen a much smaller increase (Canada, Japan, Italy), while inequality has been stable or falling in others (France, Belgium and Hungary). So rising inequality cannot be inevitable. And the extent of inequality within a country cannot be solely determined by long-run global economic forces, because, although most richer countries have been subject to broadly similar forces, the experiences of inequality have differed.

The familiar political explanation for this rising inequality is the huge shift in mainstream economic and political thinking, in favour of free markets, triggered by the elections of Ronald Reagan and Margaret Thatcher. Its fit with the facts is undeniable. Across developed economies, the biggest rise in inequality since 1945 occurred in the US and UK from 1980 onwards.

The power of a grand political transformation seems persuasive. But it cannot be the whole explanation. It is too top-down: it is all about what politicians and other elites do to us. The idea that rising inequality is inevitable begins to look like a convenient myth, one that allows us to avoid thinking about another possibility: that through our electoral choices and decisions in daily life we have supported rising inequality, or at least acquiesced in it. Admittedly, that assumes we know about it. Surveys in the UK and US consistently suggest that we underestimate both the level of current inequality and how much it has recently increased. But ignorance cannot be a complete excuse, because surveys also reveal a change in attitudes: rising inequality has become more acceptable – or at least, less unacceptable – especially if you are not on the wrong end of it.

Inequality is unlikely to fall much in the future unless our attitudes turn unequivocally against it. Among other things, we will need to accept that how much people earn in the market is often not what they deserve, and that the tax they pay is not taking from what is rightfully theirs.

One crucial reason why we have done so little to reduce inequality in recent years is that we downplay the role of luck in achieving success. Parents teach their children that almost all goals are attainable if you try hard enough. This is a lie, but there is a good excuse for it: unless you try your best, many goals will definitely remain unreachable.

Ignoring the good luck behind my success helps me feel good about myself, and makes it much easier to feel I deserve the rewards associated with success. High earners may truly believe that they deserve their income because they are vividly aware of how hard they have worked and the obstacles they have had to overcome to be successful.

But this is not true everywhere. Support for the idea that you deserve what you get varies from country to country. And in fact, support for such beliefs is stronger in countries where there seems to be stronger evidence that contradicts them. What explains this?

Attitude surveys have consistently shown that, compared to US residents, Europeans are roughly twice as likely to believe that luck is the main determinant of income and that the poor are trapped in poverty. Similarly, people in the US are about twice as likely as Europeans to believe that the poor are lazy and that hard work leads to higher quality of life in the long run.

Ronald Reagan and Margaret Thatcher in 1988. Photograph: Reuters

Yet in fact, the poor (the bottom 20%) work roughly the same total annual hours in the US and Europe. And economic opportunity and intergenerational mobility is more limited in the US than in Europe. The US intergenerational mobility statistics bear a striking resemblance to those for height: US children born to poor parents are as likely to be poor as those born to tall parents are likely to be tall. And research has repeatedly shown that many people in the US don’t know this: perceptions of social mobility are consistently over-optimistic.

European countries have, on average, more redistributive tax systems and more welfare benefits for the poor than the US, and therefore less inequality, after taxes and benefits. Many people see this outcome as a reflection of the different values that shape US and European societies. But cause-and-effect may run the other way: you-deserve-what-you-get beliefs are strengthened by inequality.

Psychologists have shown that people have motivated beliefs: beliefs that they have chosen to hold because those beliefs meet a psychological need. Now, being poor in the US is extremely tough, given the meagre welfare benefits and high levels of post-tax inequality. So Americans have a greater need than Europeans to believe that you deserve what you get and you get what you deserve. These beliefs play a powerful role in motivating yourself and your children to work as hard as possible to avoid poverty. And these beliefs can help alleviate the guilt involved in ignoring a homeless person begging on your street.

This is not just a US issue. Britain is an outlier within Europe, with relatively high inequality and low economic and social mobility. Its recent history fits the cause-and-effect relationship here. Following the election of Margaret Thatcher in 1979, inequality rose significantly. After inequality rose, British attitudes changed. More people became convinced that generous welfare benefits make poor people lazy and that high salaries are essential to motivate talented people. However, intergenerational mobility fell: your income in Britain today is closely correlated with your parents’ income.

If the American Dream and other narratives about everyone having a chance to be rich were true, we would expect the opposite relationship: high inequality (is fair because of) high intergenerational mobility. Instead, we see a very different narrative: people cope with high inequality by convincing themselves it is fair after all. We adopt narratives to justify inequality because society is highly unequal, not the other way round. So inequality may be self-perpetuating in a surprising way. Rather than resist and revolt, we just cope with it. Less Communist Manifesto, more self-help manual.

Inequality begets further inequality. As the top 1% grow richer, they have more incentive and more ability to enrich themselves further. They exert more and more influence on politics, from election-campaign funding to lobbying over particular rules and regulations. The result is a stream of policies that help them but are inefficient and wasteful. Leftwing critics have called it “socialism for the rich”. Even the billionaire investor Warren Buffett seems to agree: “There’s been class warfare going on for the last 20 years and my class has won,” he once said.

This process has been most devastating when it comes to tax. High earners have most to gain from income tax cuts, and more spare cash to lobby politicians for these cuts. Once tax cuts are secured, high earners have an even stronger incentive to seek pay rises, because they keep a greater proportion of after-tax pay. And so on.

Although there have been cuts in the top rate of income tax across almost all developed economies since 1979, it was the UK and the US that were first, and that went furthest. In 1979, Thatcher cut the UK’s top rate from 83% to 60%, with a further reduction to 40% in 1988. Reagan cut the top US rate from 70% in 1981 to 28% in 1986. Although top rates today are slightly higher – 37% in the US and 45% in the UK – the numbers are worth mentioning because they are strikingly lower than in the post-second-world-war period, when top tax rates averaged 75% in the US and were even higher in the UK.

Some elements of the Reagan-Thatcher revolution in economic policy, such as Milton Friedman’s monetarist macroeconomics, have subsequently been abandoned. But the key policy idea to come out of microeconomics has become so widely accepted today that it has acquired the status of common sense: that tax discourages economic activity and, in particular, income tax discourages work.

This doctrine seemingly transformed public debate about taxation from an endless argument over who gets what, to the promise of a bright and prosperous future for all. The “for all” bit was crucial: no more winners and losers. Just winners. And the basic ideas were simple enough to fit on the back of a napkin.

One evening in December 1974, a group of ambitious young conservatives met for dinner at the Two Continents restaurant in Washington DC. The group included the Chicago University economist Arthur Laffer, Donald Rumsfeld (then chief of staff to President Gerald Ford), and Dick Cheney (then Rumsfeld’s deputy, and a former Yale classmate of Laffer’s).

While discussing Ford’s recent tax increases, Laffer pointed out that, like a 0% income tax rate, a 100% rate would raise no revenue because no one would bother working. Logically, there must be some tax rate between these two extremes that would maximise tax revenue. Although Laffer does not remember doing so, he apparently grabbed a napkin and drew a curve on it, representing the relationship between tax rates and revenues. The Laffer curve was born and, with it, the idea of trickle-down economics.

The key implication that impressed Rumsfeld and Cheney was that, just as tax rates lower than 100% must raise more revenue, cuts in income tax rates more generally could raise revenue. In other words, there could be winners, and no losers, from tax cuts. But could does not mean will. No empirical evidence was produced in support of the mere logical possibility that tax cuts could raise revenue, and even the economists employed by the incoming Reagan administration six years later struggled to find any evidence in support of the idea.

Yet in fact, the poor (the bottom 20%) work roughly the same total annual hours in the US and Europe. And economic opportunity and intergenerational mobility is more limited in the US than in Europe. The US intergenerational mobility statistics bear a striking resemblance to those for height: US children born to poor parents are as likely to be poor as those born to tall parents are likely to be tall. And research has repeatedly shown that many people in the US don’t know this: perceptions of social mobility are consistently over-optimistic.

European countries have, on average, more redistributive tax systems and more welfare benefits for the poor than the US, and therefore less inequality, after taxes and benefits. Many people see this outcome as a reflection of the different values that shape US and European societies. But cause-and-effect may run the other way: you-deserve-what-you-get beliefs are strengthened by inequality.

Psychologists have shown that people have motivated beliefs: beliefs that they have chosen to hold because those beliefs meet a psychological need. Now, being poor in the US is extremely tough, given the meagre welfare benefits and high levels of post-tax inequality. So Americans have a greater need than Europeans to believe that you deserve what you get and you get what you deserve. These beliefs play a powerful role in motivating yourself and your children to work as hard as possible to avoid poverty. And these beliefs can help alleviate the guilt involved in ignoring a homeless person begging on your street.

This is not just a US issue. Britain is an outlier within Europe, with relatively high inequality and low economic and social mobility. Its recent history fits the cause-and-effect relationship here. Following the election of Margaret Thatcher in 1979, inequality rose significantly. After inequality rose, British attitudes changed. More people became convinced that generous welfare benefits make poor people lazy and that high salaries are essential to motivate talented people. However, intergenerational mobility fell: your income in Britain today is closely correlated with your parents’ income.

If the American Dream and other narratives about everyone having a chance to be rich were true, we would expect the opposite relationship: high inequality (is fair because of) high intergenerational mobility. Instead, we see a very different narrative: people cope with high inequality by convincing themselves it is fair after all. We adopt narratives to justify inequality because society is highly unequal, not the other way round. So inequality may be self-perpetuating in a surprising way. Rather than resist and revolt, we just cope with it. Less Communist Manifesto, more self-help manual.

Inequality begets further inequality. As the top 1% grow richer, they have more incentive and more ability to enrich themselves further. They exert more and more influence on politics, from election-campaign funding to lobbying over particular rules and regulations. The result is a stream of policies that help them but are inefficient and wasteful. Leftwing critics have called it “socialism for the rich”. Even the billionaire investor Warren Buffett seems to agree: “There’s been class warfare going on for the last 20 years and my class has won,” he once said.

This process has been most devastating when it comes to tax. High earners have most to gain from income tax cuts, and more spare cash to lobby politicians for these cuts. Once tax cuts are secured, high earners have an even stronger incentive to seek pay rises, because they keep a greater proportion of after-tax pay. And so on.

Although there have been cuts in the top rate of income tax across almost all developed economies since 1979, it was the UK and the US that were first, and that went furthest. In 1979, Thatcher cut the UK’s top rate from 83% to 60%, with a further reduction to 40% in 1988. Reagan cut the top US rate from 70% in 1981 to 28% in 1986. Although top rates today are slightly higher – 37% in the US and 45% in the UK – the numbers are worth mentioning because they are strikingly lower than in the post-second-world-war period, when top tax rates averaged 75% in the US and were even higher in the UK.

Some elements of the Reagan-Thatcher revolution in economic policy, such as Milton Friedman’s monetarist macroeconomics, have subsequently been abandoned. But the key policy idea to come out of microeconomics has become so widely accepted today that it has acquired the status of common sense: that tax discourages economic activity and, in particular, income tax discourages work.

This doctrine seemingly transformed public debate about taxation from an endless argument over who gets what, to the promise of a bright and prosperous future for all. The “for all” bit was crucial: no more winners and losers. Just winners. And the basic ideas were simple enough to fit on the back of a napkin.

One evening in December 1974, a group of ambitious young conservatives met for dinner at the Two Continents restaurant in Washington DC. The group included the Chicago University economist Arthur Laffer, Donald Rumsfeld (then chief of staff to President Gerald Ford), and Dick Cheney (then Rumsfeld’s deputy, and a former Yale classmate of Laffer’s).

While discussing Ford’s recent tax increases, Laffer pointed out that, like a 0% income tax rate, a 100% rate would raise no revenue because no one would bother working. Logically, there must be some tax rate between these two extremes that would maximise tax revenue. Although Laffer does not remember doing so, he apparently grabbed a napkin and drew a curve on it, representing the relationship between tax rates and revenues. The Laffer curve was born and, with it, the idea of trickle-down economics.

The key implication that impressed Rumsfeld and Cheney was that, just as tax rates lower than 100% must raise more revenue, cuts in income tax rates more generally could raise revenue. In other words, there could be winners, and no losers, from tax cuts. But could does not mean will. No empirical evidence was produced in support of the mere logical possibility that tax cuts could raise revenue, and even the economists employed by the incoming Reagan administration six years later struggled to find any evidence in support of the idea.

George Osborne, who lowered the UK’s top rate of tax from 50% to 45% in 2013. Photograph: Matt Cardy/PA

Yet it proved irresistible to Reagan, the perennial optimist, who essentially overruled his expert advisers, convinced that the “entrepreneurial spirit unleashed by the new tax cuts would surely bring in more revenue than his experts imagined”, as the historian Daniel T Rodgers put it. (If this potent brew of populist optimism and impatience with economic experts seems familiar today, that might be explained in part by the fact that Laffer was also a campaign adviser to Donald Trump.)

For income tax cuts to raise tax revenue, the prospect of higher after-tax pay must motivate people to work more. The resulting increase in GDP and income may be enough to generate higher tax revenues, even though the tax rate itself has fallen. Although the effects of the big Reagan tax cuts are still disputed (mainly because of disagreement over how the US economy would have performed without the cuts), even those sympathetic to trickle-down economics conceded that the cuts had negligible impact on GDP – and certainly not enough to outweigh the negative effect of the cuts on tax revenues.

But the Laffer curve did remind economists that a revenue-maximising top tax rate somewhere between 0% and 100% must exist. Finding the magic number is another matter: the search continues today. It is worth a brief dig into this research, not least because it is regularly used to veto attempts to reduce inequality by raising tax on the rich. In 2013, for example, the UK chancellor of the exchequer George Osborne reduced the top rate of income tax from 50% to 45%, arguing Laffer-style that the tax cut would lead to little, if any, loss of revenue. Osborne’s argument relied on economic analysis suggesting that the revenue-maximising top tax rate for the UK is about 40%.

Yet the assumptions behind this number are shaky, as most economists involved in producing such figures acknowledge. Let’s begin with the underlying idea: if lower tax rates raise your after-tax pay, you are motivated to work more. It seems plausible enough but, in practice, the effects are likely to be minimal. If income tax falls, many of us cannot work more, even if we wanted to. There is little opportunity to get paid overtime, or otherwise increase our paid working hours, and working harder during current working hours does not lead to higher pay. Even for those who have these opportunities, it is far from clear that they will work more or harder. They may even decide to work less: since after-tax pay has risen, they can choose to work fewer hours and still maintain their previous income level. So the popular presumption that income tax cuts must lead to more work and productive economic activity turns out to have little basis in either common sense or economic theory.

There are deeper difficulties with Osborne’s argument, difficulties not widely known even among economists. It is often assumed that if the top 1% is incentivised by income tax cuts to earn more, those higher earnings reflect an increase in productive economic activity. In other words, the pie gets bigger. But some economists, including the influential Thomas Piketty, have shown this was not true for CEOs and other top corporate managers following the tax cuts in the 1980s. Instead, they essentially funded their own pay rises by paying shareholders less, which led in turn to lower dividend tax revenue for the government. In fact, Piketty and colleagues have argued that the revenue-maximising top income tax rate may be as high as 83%.

The income tax cuts for the rich of the past 40 years were originally justified by economic arguments: Laffer’s rhetoric was seized upon by politicians. But to economists, his ideas were both familiar and trivial. Modern economics provides neither theory nor evidence proving the merit of these tax cuts. Both are ambiguous. Although politicians can ignore this truth for a while, it suggests that widespread opposition to higher taxes on the rich is ultimately based on reasons beyond economics.

When the top UK income tax rate was raised to 50% in 2009 (until Osborne cut it to 45% four years later) the composer Andrew Lloyd Webber, one of Britain’s wealthiest people, responded bluntly: “The last thing we need is a Somali pirate-style raid on the few wealth creators who still dare to navigate Britain’s gale-force waters.” In the US, Stephen Schwarzman, CEO of private equity firm Blackstone, likened proposals to remove a specialised tax exemption to the German invasion of Poland.

While we may scoff at these moans from the super-rich, most people unthinkingly accept the fundamental idea behind them: that income tax is a kind of theft, taking income which is rightfully owned by the person who earned it. It follows that tax is, at best, a necessary evil, and so should be minimised as far as possible. On these grounds, the 83% top tax rate discussed by Piketty is seen as unacceptable.

There is an entire cultural ecosystem that has evolved around the idea of tax-as-theft, recognisable today in politicians’ talk about “spending taxpayers’ money”, or campaigners celebrating “tax freedom day”. This language exists outside the world of politics, too. Tax economists, accountants and lawyers refer to the so-called “tax burden”.

But the idea that you somehow own your pre-tax income, while obvious, is false. To begin with, you could never have ownership rights prior to, or independent from, taxation. Ownership is a legal right. Laws require various institutions, including police and a legal system, to function. These institutions are financed through taxation. The tax and the ownership rights are effectively created simultaneously. We cannot have one without the other.

Yet it proved irresistible to Reagan, the perennial optimist, who essentially overruled his expert advisers, convinced that the “entrepreneurial spirit unleashed by the new tax cuts would surely bring in more revenue than his experts imagined”, as the historian Daniel T Rodgers put it. (If this potent brew of populist optimism and impatience with economic experts seems familiar today, that might be explained in part by the fact that Laffer was also a campaign adviser to Donald Trump.)

For income tax cuts to raise tax revenue, the prospect of higher after-tax pay must motivate people to work more. The resulting increase in GDP and income may be enough to generate higher tax revenues, even though the tax rate itself has fallen. Although the effects of the big Reagan tax cuts are still disputed (mainly because of disagreement over how the US economy would have performed without the cuts), even those sympathetic to trickle-down economics conceded that the cuts had negligible impact on GDP – and certainly not enough to outweigh the negative effect of the cuts on tax revenues.

But the Laffer curve did remind economists that a revenue-maximising top tax rate somewhere between 0% and 100% must exist. Finding the magic number is another matter: the search continues today. It is worth a brief dig into this research, not least because it is regularly used to veto attempts to reduce inequality by raising tax on the rich. In 2013, for example, the UK chancellor of the exchequer George Osborne reduced the top rate of income tax from 50% to 45%, arguing Laffer-style that the tax cut would lead to little, if any, loss of revenue. Osborne’s argument relied on economic analysis suggesting that the revenue-maximising top tax rate for the UK is about 40%.

Yet the assumptions behind this number are shaky, as most economists involved in producing such figures acknowledge. Let’s begin with the underlying idea: if lower tax rates raise your after-tax pay, you are motivated to work more. It seems plausible enough but, in practice, the effects are likely to be minimal. If income tax falls, many of us cannot work more, even if we wanted to. There is little opportunity to get paid overtime, or otherwise increase our paid working hours, and working harder during current working hours does not lead to higher pay. Even for those who have these opportunities, it is far from clear that they will work more or harder. They may even decide to work less: since after-tax pay has risen, they can choose to work fewer hours and still maintain their previous income level. So the popular presumption that income tax cuts must lead to more work and productive economic activity turns out to have little basis in either common sense or economic theory.

There are deeper difficulties with Osborne’s argument, difficulties not widely known even among economists. It is often assumed that if the top 1% is incentivised by income tax cuts to earn more, those higher earnings reflect an increase in productive economic activity. In other words, the pie gets bigger. But some economists, including the influential Thomas Piketty, have shown this was not true for CEOs and other top corporate managers following the tax cuts in the 1980s. Instead, they essentially funded their own pay rises by paying shareholders less, which led in turn to lower dividend tax revenue for the government. In fact, Piketty and colleagues have argued that the revenue-maximising top income tax rate may be as high as 83%.

The income tax cuts for the rich of the past 40 years were originally justified by economic arguments: Laffer’s rhetoric was seized upon by politicians. But to economists, his ideas were both familiar and trivial. Modern economics provides neither theory nor evidence proving the merit of these tax cuts. Both are ambiguous. Although politicians can ignore this truth for a while, it suggests that widespread opposition to higher taxes on the rich is ultimately based on reasons beyond economics.

When the top UK income tax rate was raised to 50% in 2009 (until Osborne cut it to 45% four years later) the composer Andrew Lloyd Webber, one of Britain’s wealthiest people, responded bluntly: “The last thing we need is a Somali pirate-style raid on the few wealth creators who still dare to navigate Britain’s gale-force waters.” In the US, Stephen Schwarzman, CEO of private equity firm Blackstone, likened proposals to remove a specialised tax exemption to the German invasion of Poland.

While we may scoff at these moans from the super-rich, most people unthinkingly accept the fundamental idea behind them: that income tax is a kind of theft, taking income which is rightfully owned by the person who earned it. It follows that tax is, at best, a necessary evil, and so should be minimised as far as possible. On these grounds, the 83% top tax rate discussed by Piketty is seen as unacceptable.

There is an entire cultural ecosystem that has evolved around the idea of tax-as-theft, recognisable today in politicians’ talk about “spending taxpayers’ money”, or campaigners celebrating “tax freedom day”. This language exists outside the world of politics, too. Tax economists, accountants and lawyers refer to the so-called “tax burden”.

But the idea that you somehow own your pre-tax income, while obvious, is false. To begin with, you could never have ownership rights prior to, or independent from, taxation. Ownership is a legal right. Laws require various institutions, including police and a legal system, to function. These institutions are financed through taxation. The tax and the ownership rights are effectively created simultaneously. We cannot have one without the other.

FacebookTwitterPinterest ‘There’s been class warfare going on for the last 20 years, and my class has won’ … US billionaire Warren Buffett. Photograph: Kevin Lamarque/Reuters

However, if the only function of the state is to support private ownership rights (maintaining a legal system, police, and so on), it seems that taxation could be very low – and any further taxation on top could still be seen as a form of theft. Implicit in this view is the idea of incomes earned, and so ownership rights created, in an entirely private market economy, with the state entering only later, to ensure these rights are maintained. Many economics textbooks picture the state in this way, as an add-on to the market. Yet this, too, is a fantasy.

In the modern world, all economic activity reflects the influence of government. Markets are inevitably defined and shaped by government. There is no such thing as income earned before government comes along. My earnings partly reflect my education. Earlier still, the circumstances of my birth and my subsequent health reflects the healthcare available. Even if that healthcare is entirely “private”, it depends on the education of doctors and nurses, and the drugs and other technologies available. Like all other goods and services, these in turn depend on the economic and social infrastructure, including transport networks, communications systems, energy supplies and extensive legal arrangements covering complex matters such as intellectual property, formal markets such as stock exchanges, and jurisdiction across national borders. Lord Lloyd-Webber’s wealth depends on government decisions about the length of copyright on the music he wrote. In sum, it is impossible to isolate what is “yours” from what is made possible, or influenced, by the role of government.

Talk of taxation as theft turns out to be a variation on the egotistical tendency to see one’s success in splendid isolation, ignoring the contribution of past generations, current colleagues and government. Undervaluing the role of government leads to the belief that if you are smart and hard-working, the high taxes you endure, paying for often wasteful government, are not a good deal. You would be better off in a minimal-state, low-tax society.

One reply to this challenge points to the evidence on the rich leaving their home country to move to a lower tax jurisdiction: in fact, very few of them do. But here is a more ambitious reply from Warren Buffett: “Imagine there are two identical twins in the womb … And the genie says to them: ‘One of you is going to be born in the United States, and one of you is going to be born in Bangladesh. And if you wind up in Bangladesh, you will pay no taxes. What percentage of your income would you bid to be born in the United States?’ … The people who say: ‘I did it all myself’ … believe me, they’d bid more to be in the United States than in Bangladesh.”

Much of the inequality we see today in richer countries is more down to decisions made by governments than to irreversible market forces. These decisions can be changed. However, we have to want to control inequality: we must make inequality reduction a central aim of government policy and wider society. The most entrenched, self-deluding and self-perpetuating justifications for inequality are about morality, not economy. The great economist John Kenneth Galbraith nicely summarised the problem: “One of man’s oldest exercises in moral philosophy … is the search for a superior moral justification for selfishness. It is an exercise which always involves a certain number of internal contradictions and even a few absurdities. The conspicuously wealthy turn up urging the character-building value of privation for the poor.”

Thursday, 14 February 2019

America’s unexpected socialist dawn

Edward Luce in The FT

Anyone who thinks America’s populist moment has passed should think again. Donald Trump promised to make America great again. Half of the Democratic party now vows to make their country socialist for the first time. Much that is solid is melting into air. A few years ago, most Democrats were scared to call themselves liberal. Now they embrace socialism with abandon.

It may end in tears. A defeat to Mr Trump in 2020 would deliver an early grave to America’s socialist dawn. Until then, however, US voters are catching a glimpse of something rare — a genuine ideological debate. It would be rash to predict the outcome.

The chief exhibit is Alexandria Ocasio-Cortez’s Green New Deal. By any measure, her bill is preposterously extravagant. On one estimate Ms Ocasio-Cortez’s proposed new entitlements and public works would cost $6.6tn a year, which is two-thirds larger again than America’s $4tn federal budget.

The fact that a 29-year-old former bartender has gone from zero to the ubiquitous abbreviation of AOC in a few months tells us something about America’s appetite for change

Nothing like it has been seen. Moreover, Ms Ocasio-Cortez seems to have little idea how she would pay for it. Some say the bill would be self-funding because it would stimulate the economy. Others are punting on cost-free debt. According to modern monetary theory, governments can simply create new money without causing inflation.