The national debt was the bogeyman in 2008/9 not anymore writes Ethan Ilzetzki in The Guardian

The chancellor, Rishi Sunak (right), visits a London market on 1 June. Photograph: Simon Walker/PA

The coronavirus pandemic has taken a calamitous toll on the economy, with unemployment in April 2020 rising faster than in any month on record. The Treasury has responded with unprecedented measures to support workers, businesses and the self-employed, leading to a public deficit of £300bn this year.

How concerned should we be about the public debt, forecast to exceed the size of the UK economy? Public debt results when the government spends more than it raises in tax revenues – runs a public deficit – and borrows money to cover the gap. The government then pays interest on this debt, which is eventually repaid or rolled over by new borrowing. As long as interest rates are low – they are currently nearly zero – this poses few costs. The economy may also grow, generating more tax revenues and making it easier to repay the debt. But if interest rates rise faster than the economy grows, the public debt may increase to unsustainable levels. These may eventually require budget cuts or tax increases, often referred to as austerity.

These views are a far cry from the calls for budgetary cuts during the global financial crisis

The Centre for Macroeconomics (CfM) – a research centre bringing together experts from institutions such as the London School of Economics, University of Oxford, University of Cambridge and the Bank of England – posed this question to a panel of some of the UK’s leading economists. Economists are a conservative lot: we like budgetary numbers to add up. So the responses might come as a surprise. With one exception, not a single panel member expressed concern about the deficit. What’s more, the majority thought that public debt should be ultimately addressed with tax increases, particularly on the wealthy; and the panel unanimously opposed public spending cuts. Several even advocated monetary financing of the deficit, in other words selling government bonds directly to the Bank of England. These days, not even economists support austerity.

These views are a far cry from the calls for budgetary cuts during the global financial crisis and reflect a substantial shift in economic thought that has been unfolding over the past few decades. The change isn’t solely a British phenomenon. German economists were particularly uncompromising on limiting deficits during the Eurozone crisis. But a new generation of German economists has been the vanguard in promoting “coronabonds”, which would mutualise debts of EU members. The International Monetary Fund (IMF) was well-known for its conservative views on public deficits. The global financial crisis brought change to the institution, with its then chief economist, Olivier Blanchard, openly advocating stimulus over austerity.

Economic stabilisation through public spending was the brainchild of John Maynard Keynes during the Great Depression. But the Keynesian moment in economic thought was relatively short-lived. The global inflation of the 1970s brought a new generation of economists, sceptical about governments’ ability to use their budgetary power to support economic recovery. Keynesian views had been pushed so far to the sidelines that the Nobel laureate economist Robert Lucas Jr pronounced “the audience starts to whisper and giggle to one another” whenever Keyensian views were espoused in economics research seminars.

These views seeped into the political consciousness to the extent that by 1976, the prime minister, James Callaghan, told the Labour party conference that the option of “spend[ing] your way out of a recession and increas[ing] employment by cutting taxes and boosting government spending” no longer existed and would only lead to inflation. These views were enshrined in the Washington Consensus, whose first principle, according to John Williamson, was: “Washington believes in fiscal discipline.”

The debate on the public debt re-emerged during the recession of 2008-9. A substantial faction in the economics profession continued to warn that fiscal stimulus was no way to recovery. At the same time, increasing numbers of mainstream economists, including the leadership of the IMF and Ben Bernanke, then head of the US Federal Reserve Board, supported the public spending expansions that the US government undertook and warned that the UK’s austerity programme would exacerbate the economic pain. The attitude shift was partly pragmatic. At the turn of the century, many economists had come to believe that central banks had the ability to resolve all macroeconomic woes. This position became less tenable when central banks around the world were running out of ammunition, having reduced interest rates to zero.

The slow recovery in the UK and the economic carnage in southern Europe – both following austerity policies – compared with the faster recovery in the US, appeared to lend further credence to the notion that active fiscal policy could be used to support economic recovery. This new view perhaps reached its apogee in Blanchard’s 2019 presidential address to the American Economic Association, where he argued that public debt is no longer of concern when interest rates are well below the economy’s growth rate. Our confidence that high-income countries, which are still able to borrow at low interest rates, will be spared may be premature. Public debt is indeed no concern when interest rates are at zero. But history shows us that governments’ borrowing rates may change dramatically when market sentiment shifts.

Benign deficit neglect is a ultimately a rich-country luxury. The developing world is now in the midst of the greatest public debt crisis in a generation. Governments from Argentina to Zambia are financing their deficits with great difficulty. As investors repatriated their funds to the relative safety of the US, these countries have seen rising borrowing rates and tumbling currencies, and will require (or already in the process of) debt restructuring.

Governments’ top priorities should remain the public health emergency and supporting the economy through these difficult times. But it would be wise to keep half an eye on the public debt clock.

As 26 million Americans lose their jobs, the billionaire class has added $308bn to its wealth writes Dominic Rushe and Mona Chalabi in The Guardian

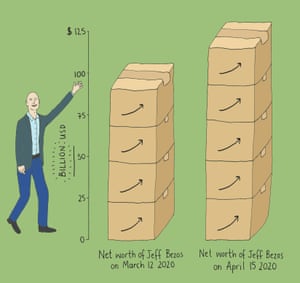

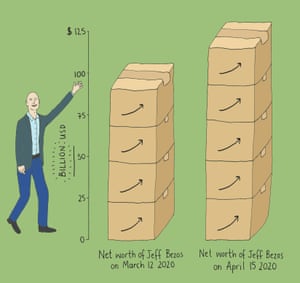

Jeff Bezos has seen his wealth increase from $105bn to $130bn. Photograph: Mona Chalabi

Never let a good crisis go to waste: as the coronavirus pandemic sweeps the world, America’s 1% have taken profitable advantage of the old saying.

Some of the richest people in the US have been at the front of the queue as the government has handed out trillions of dollars to prop up an economy it shuttered amid the coronavirus pandemic. At the same time, the billionaire class has added $308bn to its wealth in four weeks - even as a record 26 million people lost their jobs.

According to a new report from the Institute for Policy Studies, a progressive thinktank, between 18 March and 22 April the wealth of America’s plutocrats grew 10.5%. After the last recession, it took over two years for total billionaire wealth to get back to the levels they enjoyed in 2007.

Eight of those billionaires have seen their net worth surge by over $1bn each, including the Amazon boss, Jeff Bezos, and his ex-wife MacKenzie Bezos; Eric Yuan, founder of Zoom; the former Microsoft chief Steve Ballmer; and Elon Musk, the Tesla and SpaceX technocrat.

The billionaire bonanza comes as a flotilla of big businesses, millionaires and billionaires sail through loopholes in a $349bn bailout meant to save hard-hit small businesses. About 150 public companies managed to bag more than $600m in forgivable loans before the funds ran out. Among them was Shake Shack, a company with 6,000 employees valued at $2bn. It has since given the cash back but others have not.

Fisher Island, a members-only location off the coast of Miami where the average income of residents is $2.2m and the beaches are made from imported Bahamian sand, has received $2m in aid.

Its residents seemed to be doing fine even before the bailout. This month, the island purchased thousands of rapid Covid-19 blood test kits for all residents and workers. The rest of Florida is struggling. About 1% of Florida’s population has been tested for the coronavirus, behind the national figure of 4%. The state is also in the midst of an unemployment claims crisis, with its underfunded benefits system unable to cope with the volume of people filing.

The banks that were the largest recipients of bailout cash in the last recession have also done well, raking in $10bn in fees from the government loans, according to an analysis by National Public Radio.

“Heads we win, tails you lose,” said Chuck Collins, director of the program on inequality and the common good at the Institute for Policy Studies and co-author of the new report.

Collins said the pandemic had further exposed fault lines in the US body politic that have been widening the gap between the really rich and the rest over decades.

“The rules of the economy have been tipped in favor of asset owners against everyone else,” said Collins.

By 2016 – seven years after the end of the last recession – the bottom 90% of households in the US had still not recovered from the last downturn while the top 10% had more wealth than they had in 2007.

Throughout the recovery, stock market gains disproportionately favored the wealthy. The top 1% of households own nearly 38% of all stock, according to research by the New York University economist Edward Wolff. Even before the coronavirus hit, homeownership in the US – a traditional source of wealth growth – was well below its 2004 peak.

Nor did Americans earn more. Wage growth remained sluggish during the decade-long record-breaking growth in the jobs market that came after the last recession.

For black and Latin Americans, the situation is worse. The black-white wage gaps are larger today than they were in 1979.

Meanwhile, billionaires have been unable to put a well-heeled foot wrong. Billionaire wealth soared 1,130% in 2020 dollars between 1990 and 2020, according to the Institute for Policy Studies. That increase is more than 200 times greater than the 5.37% growth of median wealth in the US over this same period. And the tax obligations of America’s billionaires, measured as a percentage of their wealth, decreased 79% between 1980 and 2018.

So when the pandemic struck, those at the apex of the wealth pyramid were better positioned than ever to take advantage of the chaos. The rest, not so much.

Collins has been studying income inequality for 25 years and has seen the really rich win victory after victory. But even he was surprised by how quickly America’s billionaires have turned pandemic into profit. “I still get shocked,” he said.

‘The virus does not discriminate,” suggested Michael Gove after both Boris Johnson and the health secretary, Matt Hancock, were struck down by Covid-19. But societies do. And in so doing, they ensure that the devastation wreaked by the virus is not equally shared writes Kenan Malik in The Guardian

We can see this in the way that the low paid both disproportionately have to continue to work and are more likely to be laid off; in the sacking of an Amazon worker for leading a protest against unsafe conditions; in the rich having access to coronavirus tests denied to even most NHS workers.

But to see most clearly how societies allow the virus to discriminate, look not at London or Rome or New York but at Delhi and Johannesburg and Lagos. Here, “social distancing” means something very different than it does to Europeans or Americans. It is less about the physical space between people than the social space between the rich and poor that means only the privileged can maintain any kind of social isolation.

In the Johannesburg township of Alexandra, somewhere between 180,000 and 750,000 people live in an estimated 20,000 shacks. Through it runs South Africa’s most polluted river, the Jukskei, whose water has tested positive for cholera and has run black from sewage. Makoko is often called Lagos’s “floating slum” because a third of the shacks are built on stilts over a fetid lagoon. No one is sure how many people live there, but it could be up to 300,000. Dharavi, in Mumbai, is the word’s largest slum. Like Makoko and Alexandra, it nestles next to fabulously rich areas, but the million people estimated to live there are squashed into less than a square mile of land that was once a rubbish tip.

In such neighbourhoods, what can social distancing mean? Extended families often live in one- or two-room shacks. The houses may be scrubbed and well kept but many don’t have lavatories, electricity or running water. Communal latrines and water points are often shared by thousands. Diseases from diarrhoea to typhoid stalked such neighbourhoods well before coronavirus.

FacebookTwitterPinterest People in their shanties at Dharavi during the coronavirus lockdown in Mumbai. Photograph: Rajanish Kakade/AP

South Africa, Nigeria and India have all imposed lockdowns. Alexandra and Dharavi have both reported their first cases of coronavirus. But in these neighbourhoods, the idea of protecting oneself from coronavirus must seem as miraculous as clean water.

Last week, tens of thousands of Indian workers, suddenly deprived of the possibility of pay, and with most public transport having been shut down, decided to walk back to their home villages, often hundreds of miles away, in the greatest mass exodus since partition. Four out of five Indians work in the informal sector. Almost 140 million, more than a quarter of India’s working population, are migrants from elsewhere in the country. Yet their needs had barely figured in the thinking of policymakers, who seemed shocked by the actions of the workers.

India’s great exodus shows that “migration” is not, as we imagine in the west, merely external migration, but internal migration, too. Internal migrants, whether in India, Nigeria or South Africa, are often treated as poorly as external ones and often for the same reason – they are not seen as “one of us” and so denied basic rights and dignities. In one particularly shocking incident, hundreds of migrants returning to the town of Bareilly, in the northern Indian state of Uttar Pradesh, were sprayed by officials with chemicals usually used to sanitise buses. They might as well have been vermin, not just metaphorically but physically, too.

All this should make us think harder about what we mean by “community”. In Britain, the pandemic has led to a flowering of social-mindedness and community solidarity. Where I live in south London, a mutual aid group has sprung up to help self-isolating older people. The food bank has gained a new throng of volunteers. Such welcome developments have been replicated in hundreds of places around the country.

FacebookTwitterPinterest South African National Defence Force soldiers enforce lockdown in Johannesburg’s Alexandra township on 28 March 2020. Photograph: Luca Sola/AFP via Getty Images

But the idea of a community is neither as straightforward nor as straightforwardly good as we might imagine. When Donald Trump reportedly offers billions of dollars to a German company to create a vaccine to be used exclusively for Americans, when Germany blocks the export of medical equipment to Italy, when Britain, unlike Portugal, refuses to extend to asylum seekers the right to access benefits and healthcare during the coronavirus crisis, each does so in the name of protecting a particular community or nation.

The rhetoric of community and nation can become a means not just to discount those deemed not to belong but also to obscure divisions within. In India, Narendra Modi’s BJP government constantly plays to nationalist themes, eulogising Mother India, or Bhārat Mata. But it’s a nationalism that excludes many groups, from Muslims to the poor. In Dharavi and Alexandra and Makoko, and many similar places, it will not simply be coronavirus but also the willingness of the rich, both in poor countries and in wealthier nations, to ignore gross inequalities that will kill.

In Britain in recent weeks, there has been a welcome, belated recognition of the importance of low-paid workers. Yet in the decade before that, their needs were sacrificed to the demands of austerity, under the mantra of “we’re all in it together”. We need to beware of the same happening after the pandemic, too, of the rhetoric of community and nation being deployed to protect the interests of privileged groups. We need to beware, too, that in a world that many insist will be more nationalist, and less global, we don’t simply ignore what exists in places such as Alexandra and Makoko and Dharavi.

“We’re all at risk from the virus,” observed Gove. That’s true. It is also true that societies, both nationally and globally, are structured in ways that ensure that some face far more risk than others – and not just from coronavirus.

Horror over the west’s failure to contain Covid-19 will pale by comparison if it sweeps the developing world asks Nesrine Malik in The Guardian

‘The ebola epidemic of 2014 is still fresh in the mind in sub-Saharan African countries.’ A man wears a mask while shopping in Johannesburg. Photograph: Luca Sola/AFP via Getty Images

Though Africa has fewer coronavirus cases and a slower rate of infection than the UK, many countries in the continent have passed dramatically more extreme measures to prevent its spread than Britain has. In my birth country of Sudan, after only one case and one death was registered, all schools and universities were shut down. Several other nations, such as Egypt, have taken the ultimate precaution and closed their airports.

There is no denial here, no mixed messaging, and no unfounded promise of how soon we will send the virus packing.

The tough and timely action is borne less out of political maturity than it is bitter experience, and an awareness that already overburdened public healthcare systems cannot sustain an onslaught. The ebola epidemic of 2014 is still fresh in the mind in sub-Saharan African countries; it was an experience that showed prevention and containment are the only hope of fending off thousands of deaths.

If we are concerned about the failure to contain the virus in western Europe and the US, multiples of that horror await in the developing world. With few means of medical intervention, and several other risk factors such as malnutrition, high population densities, communal living and lack of access to water and washing facilities, the rates of mortality could dwarf what has been seen so far in the west. And economically, the virus risks ushering in an ice age. There are no war chests, no stimulus packages, no insurance payouts.

There is little data about the impact in Africa of previous pandemics such as the 1918-19 Spanish flu (except from South Africa where, because of troop movements, 6% of the population perished). But we do have the experience of economically similar south Asian countries to go by. It is estimated that up to 30% of the entire fatal toll of the Spanish flu came from a single country, India. And in Africa it appears that the countries that suffered the highest casualties were those most exposed to global flows of people and capital – the ports or thoroughfares for troops on the move, and for sea and land labour.

There is something painfully predictable about how coronavirus was introduced to the continent. Well-off travellers to the rest of the world returned from holidays and business trips carrying the virus, as did infected tourists. In Egypt, the first cases of Covid-19 appear to be linked to one cruise ship, where locals who served the tourists contracted the disease.

The spread of the virus on the continent sits in the crosscurrents of travel and financial flows that expose African countries to the sharp end of globalisation – one where the flow of people is encouraged into the continent for business and tourism, and severely restricted out of the continent even for the wealthy and well connected.

It is the recurring theme of how the pandemic has played out so far. The poor, the uninsured, the disenfranchised, the information-poor and the less mobile are sitting ducks. Many western economies, including the US and the UK, have slowly pushed these people to the margins, while restricting employment benefits such as holiday pay, sick leave, and private insurance to an increasingly exclusive class. One of the reasons the British and US governments have been so slow to provide free testing, medical care and bailouts for those who’ve lost work is that these inequalities are now hardwired into the system. They cannot be undone overnight even when lives depend on it.

The global economy is set up in much the same way, with winners who hoard the spoils, and losers who scratch around for the leftovers. If wealthy single countries cannot scramble to save their own people, there is no hope for any effort to extend help to countries with a fraction of the resources.

But here is the tragic catch for those who think that this structural imbalance is not our problem. In this instance, national and international inequalities cannot persist without everyone losing. The realisation is just beginning to dawn upon lawmakers that the rich cannot be barricaded against the poor, no matter how high the barriers to the fortress are. Limiting the spread of the virus entails ensuring that everyone in the pool, be it local or global, is given the ability to test, self-isolate if need be, and receive treatment.

Yes, to some extent this is a utopian aspiration. But it is also essentially pragmatic. We cannot extol the virtues of small government and global societies without grasping that the risk to the majority cannot be halted from spreading: viruses do not distinguish between classes and nationalities.

Just as work and public life cannot be shuttered for ever, borders cannot be closed indefinitely. African countries are moving fast against coronavirus, well aware that they are on their own. But barring a miracle, or a pandemic Marshall plan by wealthier countries, if the virus explodes in poorer countries, the cataclysm will engulf everyone.

A report I helped publish has led to attacks and flat-out falsehoods in the rightwing media. It’s clear whose interests they serve writes George Monbiot in The Guardian

‘As their crucial role in promoting Nigel Farage, Brexit and Boris Johnson suggests, the newspapers are as powerful as ever.’ Photograph: Christopher Pledger

All billionaires want the same thing – a world that works for them. For many, this means a world in which they are scarcely taxed and scarcely regulated; where labour is cheap and the planet can be used as a dustbin; where they can flit between tax havens and secrecy regimes, using the Earth’s surface as a speculative gaming board, extracting profits and dumping costs. The world that works for them works against us.

So how, in nominal democracies, do they get what they want? They fund political parties and lobby groups, set up fake grassroots (Astroturf) campaigns and finance social media ads. But above all, they buy newspapers and television stations. The widespread hope and expectation a few years ago was that, in the internet age, news controlled by billionaires would be replaced by news controlled by the people: social media would break their grip. But social media is instead dominated by stories the billionaire press generates. As their crucial role in promoting Nigel Farage, Brexit and Boris Johnson suggests, the newspapers are as powerful as ever.

They use this power not only to promote the billionaires’ favoured people and ideas, but also to shut down change before it happens. They deploy their attack dogs to take down anyone who challenges the programme. It is one thing to know this. It is another to experience it. A month ago I and six others published a report commissioned by the Labour party called Land for the Many. It proposed a set of policies that would be of immense benefit to the great majority of Britain’s people: ensuring that everyone has a good, affordable home; improving public amenities; shifting tax from ordinary people towards the immensely rich; protecting the living world; and enhancing public control over the decisions that affect our lives. We showed how the billionaires and other oligarchs could be put back in their boxes.

The result has been four extraordinary weeks of attacks in the Mail, Express, Sun, Times and Telegraph. Our contention that oligarchic power is rooted in the ownership and control of land has been amply vindicated by the response of oligarchic power.

Some of these reports peddle flat-out falsehoods. A week ago the Mail on Sunday claimed that our report recommends a capital gains tax on people’s main homes. This “spiteful raid that will horrify millions” ensures “we will soon be joining the likes of China, Cuba, Laos and Vietnam in becoming one of the world’s few Marxist-Leninist states”. This claim was picked up, and often embellished, by all the other rightwing papers. The policy proved, the Telegraph said, that “keeping a hard-left Labour party out of office is not an academic ideological ambition but a deadly serious matter for millions of voters”. Boris Johnson, Philip Hammond and several other senior Tories weighed in, attacking our “mad” proposal.

But we made no such recommendation. We considered the idea, listed its possible advantages and drawbacks, then specifically rejected it. As they say in these papers, you couldn’t make it up. But they have.

There were dozens of other falsehoods: apparently we have proposed a “garden tax”; we intend to add “an extra £374 a year on top of what the typical household pays in council tax” (no such figure is mentioned in our report); and inspectors will be sent to people’s homes to investigate their bedrooms.

Dozens of reports claim that our proposals are “plans” hatched by Jeremy Corbyn: “Jeremy Corbyn’s garden tax bombshell”; “Jeremy Corbyn is planning a huge tax raid”; “Corbyn’s war on homeowners”. Though Corbyn is aware of our report, he has played no role in it. What it contains are not his plans but our independent policy suggestions, none of which has yet been adopted by Labour. The press response gives me an inkling of what it must be like to walk in his shoes, as I see my name (and his) attached to lurid schemes I’ve never heard of, and associated with Robert Mugabe, Nicolás Maduro and the Soviet Union. Not one of the many journalists who wrote these articles has contacted any of the authors of the report. Yet they harvested lengthy quotes denouncing us from senior Conservatives.

The common factor in all these articles is their conflation of the interests of the ultra-rich with the interests of the middle classes. While our proposals take aim at the oligarchs, and would improve the prospects of the great majority, they are presented as an attack on ordinary people. Progressive taxation, the protection of public space and good homes for all should strike terror into your heart.

We’ve lodged a complaint to the press regulator, Ipso, about one of the worst examples, and we might make others. But to pursue them all would be a full-time job (we wrote the report unpaid, in our own time). The simple truth is that we are being outgunned by the brute power of billionaires. And the same can be said for democracy.

It is easy to see why political parties have become so cautious and why, as a result, the UK is stuck with outmoded institutions and policies, and succumbs to ever more extreme and regressive forms of taxation and control. Labour has so far held its nerve – and this makes its current leadership remarkable. It has not allowed itself to be bullied by the billionaire press.

The old threat has not abated – it has intensified. If a newspaper is owned by a billionaire, be suspicious of every word you read in it. Check its sources, question its claims. And withhold your support from any party that allows itself to be bullied or – worse – guided by their agenda. Stand in solidarity with those who resist it.

The economic arguments adopted by Britain and the US in the 1980s led to vastly increased inequality – and gave the false impression that this outcome was not only inevitable, but good writes Jonathan Aldred in The Guardian

In most rich countries, inequality is rising, and has been rising for some time. Many people believe this is a problem, but, equally, many think there’s not much we can do about it. After all, the argument goes, globalisation and new technology have created an economy in which those with highly valued skills or talents can earn huge rewards. Inequality inevitably rises. Attempting to reduce inequality via redistributive taxation is likely to fail because the global elite can easily hide their money in tax havens. Insofar as increased taxation does hit the rich, it will deter wealth creation, so we all end up poorer.

One strange thing about these arguments, whatever their merits, is how they stand in stark contrast to the economic orthodoxy that existed from roughly 1945 until 1980, which held that rising inequality was not inevitable, and that various government policies could reduce it. What’s more, these policies appear to have been successful. Inequality fell in most countries from the 1940s to the 1970s. The inequality we see today is largely due to changes since 1980.

In both the US and the UK, from 1980 to 2016, the share of total income going to the top 1% has more than doubled. After allowing for inflation, the earnings of the bottom 90% in the US and UK have barely risen at all over the past 25 years. More generally, 50 years ago, a US CEO earned on average about 20 times as much as the typical worker. Today, the CEO earns 354 times as much.

Any argument that rising inequality is largely inevitable in our globalised economy faces a crucial objection. Since 1980 some countries have experienced a big increase in inequality (the US and the UK); some have seen a much smaller increase (Canada, Japan, Italy), while inequality has been stable or falling in others (France, Belgium and Hungary). So rising inequality cannot be inevitable. And the extent of inequality within a country cannot be solely determined by long-run global economic forces, because, although most richer countries have been subject to broadly similar forces, the experiences of inequality have differed.

The familiar political explanation for this rising inequality is the huge shift in mainstream economic and political thinking, in favour of free markets, triggered by the elections of Ronald Reagan and Margaret Thatcher. Its fit with the facts is undeniable. Across developed economies, the biggest rise in inequality since 1945 occurred in the US and UK from 1980 onwards.

The power of a grand political transformation seems persuasive. But it cannot be the whole explanation. It is too top-down: it is all about what politicians and other elites do to us. The idea that rising inequality is inevitable begins to look like a convenient myth, one that allows us to avoid thinking about another possibility: that through our electoral choices and decisions in daily life we have supported rising inequality, or at least acquiesced in it. Admittedly, that assumes we know about it. Surveys in the UK and US consistently suggest that we underestimate both the level of current inequality and how much it has recently increased. But ignorance cannot be a complete excuse, because surveys also reveal a change in attitudes: rising inequality has become more acceptable – or at least, less unacceptable – especially if you are not on the wrong end of it.

Inequality is unlikely to fall much in the future unless our attitudes turn unequivocally against it. Among other things, we will need to accept that how much people earn in the market is often not what they deserve, and that the tax they pay is not taking from what is rightfully theirs.

One crucial reason why we have done so little to reduce inequality in recent years is that we downplay the role of luck in achieving success. Parents teach their children that almost all goals are attainable if you try hard enough. This is a lie, but there is a good excuse for it: unless you try your best, many goals will definitely remain unreachable.

Ignoring the good luck behind my success helps me feel good about myself, and makes it much easier to feel I deserve the rewards associated with success. High earners may truly believe that they deserve their income because they are vividly aware of how hard they have worked and the obstacles they have had to overcome to be successful.

But this is not true everywhere. Support for the idea that you deserve what you get varies from country to country. And in fact, support for such beliefs is stronger in countries where there seems to be stronger evidence that contradicts them. What explains this?

Attitude surveys have consistently shown that, compared to US residents, Europeans are roughly twice as likely to believe that luck is the main determinant of income and that the poor are trapped in poverty. Similarly, people in the US are about twice as likely as Europeans to believe that the poor are lazy and that hard work leads to higher quality of life in the long run.

Ronald Reagan and Margaret Thatcher in 1988. Photograph: Reuters

Yet in fact, the poor (the bottom 20%) work roughly the same total annual hours in the US and Europe. And economic opportunity and intergenerational mobility is more limited in the US than in Europe. The US intergenerational mobility statistics bear a striking resemblance to those for height: US children born to poor parents are as likely to be poor as those born to tall parents are likely to be tall. And research has repeatedly shown that many people in the US don’t know this: perceptions of social mobility are consistently over-optimistic.

European countries have, on average, more redistributive tax systems and more welfare benefits for the poor than the US, and therefore less inequality, after taxes and benefits. Many people see this outcome as a reflection of the different values that shape US and European societies. But cause-and-effect may run the other way: you-deserve-what-you-get beliefs are strengthened by inequality.

Psychologists have shown that people have motivated beliefs: beliefs that they have chosen to hold because those beliefs meet a psychological need. Now, being poor in the US is extremely tough, given the meagre welfare benefits and high levels of post-tax inequality. So Americans have a greater need than Europeans to believe that you deserve what you get and you get what you deserve. These beliefs play a powerful role in motivating yourself and your children to work as hard as possible to avoid poverty. And these beliefs can help alleviate the guilt involved in ignoring a homeless person begging on your street.

This is not just a US issue. Britain is an outlier within Europe, with relatively high inequality and low economic and social mobility. Its recent history fits the cause-and-effect relationship here. Following the election of Margaret Thatcher in 1979, inequality rose significantly. After inequality rose, British attitudes changed. More people became convinced that generous welfare benefits make poor people lazy and that high salaries are essential to motivate talented people. However, intergenerational mobility fell: your income in Britain today is closely correlated with your parents’ income.

If the American Dream and other narratives about everyone having a chance to be rich were true, we would expect the opposite relationship: high inequality (is fair because of) high intergenerational mobility. Instead, we see a very different narrative: people cope with high inequality by convincing themselves it is fair after all. We adopt narratives to justify inequality because society is highly unequal, not the other way round. So inequality may be self-perpetuating in a surprising way. Rather than resist and revolt, we just cope with it. Less Communist Manifesto, more self-help manual.

Inequality begets further inequality. As the top 1% grow richer, they have more incentive and more ability to enrich themselves further. They exert more and more influence on politics, from election-campaign funding to lobbying over particular rules and regulations. The result is a stream of policies that help them but are inefficient and wasteful. Leftwing critics have called it “socialism for the rich”. Even the billionaire investor Warren Buffett seems to agree: “There’s been class warfare going on for the last 20 years and my class has won,” he once said.

This process has been most devastating when it comes to tax. High earners have most to gain from income tax cuts, and more spare cash to lobby politicians for these cuts. Once tax cuts are secured, high earners have an even stronger incentive to seek pay rises, because they keep a greater proportion of after-tax pay. And so on.

Although there have been cuts in the top rate of income tax across almost all developed economies since 1979, it was the UK and the US that were first, and that went furthest. In 1979, Thatcher cut the UK’s top rate from 83% to 60%, with a further reduction to 40% in 1988. Reagan cut the top US rate from 70% in 1981 to 28% in 1986. Although top rates today are slightly higher – 37% in the US and 45% in the UK – the numbers are worth mentioning because they are strikingly lower than in the post-second-world-war period, when top tax rates averaged 75% in the US and were even higher in the UK.

Some elements of the Reagan-Thatcher revolution in economic policy, such as Milton Friedman’s monetarist macroeconomics, have subsequently been abandoned. But the key policy idea to come out of microeconomics has become so widely accepted today that it has acquired the status of common sense: that tax discourages economic activity and, in particular, income tax discourages work.

This doctrine seemingly transformed public debate about taxation from an endless argument over who gets what, to the promise of a bright and prosperous future for all. The “for all” bit was crucial: no more winners and losers. Just winners. And the basic ideas were simple enough to fit on the back of a napkin.

One evening in December 1974, a group of ambitious young conservatives met for dinner at the Two Continents restaurant in Washington DC. The group included the Chicago University economist Arthur Laffer, Donald Rumsfeld (then chief of staff to President Gerald Ford), and Dick Cheney (then Rumsfeld’s deputy, and a former Yale classmate of Laffer’s).

While discussing Ford’s recent tax increases, Laffer pointed out that, like a 0% income tax rate, a 100% rate would raise no revenue because no one would bother working. Logically, there must be some tax rate between these two extremes that would maximise tax revenue. Although Laffer does not remember doing so, he apparently grabbed a napkin and drew a curve on it, representing the relationship between tax rates and revenues. The Laffer curve was born and, with it, the idea of trickle-down economics.

The key implication that impressed Rumsfeld and Cheney was that, just as tax rates lower than 100% must raise more revenue, cuts in income tax rates more generally could raise revenue. In other words, there could be winners, and no losers, from tax cuts. But could does not mean will. No empirical evidence was produced in support of the mere logical possibility that tax cuts could raise revenue, and even the economists employed by the incoming Reagan administration six years later struggled to find any evidence in support of the idea.

George Osborne, who lowered the UK’s top rate of tax from 50% to 45% in 2013. Photograph: Matt Cardy/PA

Yet it proved irresistible to Reagan, the perennial optimist, who essentially overruled his expert advisers, convinced that the “entrepreneurial spirit unleashed by the new tax cuts would surely bring in more revenue than his experts imagined”, as the historian Daniel T Rodgers put it. (If this potent brew of populist optimism and impatience with economic experts seems familiar today, that might be explained in part by the fact that Laffer was also a campaign adviser to Donald Trump.)

For income tax cuts to raise tax revenue, the prospect of higher after-tax pay must motivate people to work more. The resulting increase in GDP and income may be enough to generate higher tax revenues, even though the tax rate itself has fallen. Although the effects of the big Reagan tax cuts are still disputed (mainly because of disagreement over how the US economy would have performed without the cuts), even those sympathetic to trickle-down economics conceded that the cuts had negligible impact on GDP – and certainly not enough to outweigh the negative effect of the cuts on tax revenues.

But the Laffer curve did remind economists that a revenue-maximising top tax rate somewhere between 0% and 100% must exist. Finding the magic number is another matter: the search continues today. It is worth a brief dig into this research, not least because it is regularly used to veto attempts to reduce inequality by raising tax on the rich. In 2013, for example, the UK chancellor of the exchequer George Osborne reduced the top rate of income tax from 50% to 45%, arguing Laffer-style that the tax cut would lead to little, if any, loss of revenue. Osborne’s argument relied on economic analysis suggesting that the revenue-maximising top tax rate for the UK is about 40%.

Yet the assumptions behind this number are shaky, as most economists involved in producing such figures acknowledge. Let’s begin with the underlying idea: if lower tax rates raise your after-tax pay, you are motivated to work more. It seems plausible enough but, in practice, the effects are likely to be minimal. If income tax falls, many of us cannot work more, even if we wanted to. There is little opportunity to get paid overtime, or otherwise increase our paid working hours, and working harder during current working hours does not lead to higher pay. Even for those who have these opportunities, it is far from clear that they will work more or harder. They may even decide to work less: since after-tax pay has risen, they can choose to work fewer hours and still maintain their previous income level. So the popular presumption that income tax cuts must lead to more work and productive economic activity turns out to have little basis in either common sense or economic theory.

There are deeper difficulties with Osborne’s argument, difficulties not widely known even among economists. It is often assumed that if the top 1% is incentivised by income tax cuts to earn more, those higher earnings reflect an increase in productive economic activity. In other words, the pie gets bigger. But some economists, including the influential Thomas Piketty, have shown this was not true for CEOs and other top corporate managers following the tax cuts in the 1980s. Instead, they essentially funded their own pay rises by paying shareholders less, which led in turn to lower dividend tax revenue for the government. In fact, Piketty and colleagues have argued that the revenue-maximising top income tax rate may be as high as 83%.

The income tax cuts for the rich of the past 40 years were originally justified by economic arguments: Laffer’s rhetoric was seized upon by politicians. But to economists, his ideas were both familiar and trivial. Modern economics provides neither theory nor evidence proving the merit of these tax cuts. Both are ambiguous. Although politicians can ignore this truth for a while, it suggests that widespread opposition to higher taxes on the rich is ultimately based on reasons beyond economics.

When the top UK income tax rate was raised to 50% in 2009 (until Osborne cut it to 45% four years later) the composer Andrew Lloyd Webber, one of Britain’s wealthiest people, responded bluntly: “The last thing we need is a Somali pirate-style raid on the few wealth creators who still dare to navigate Britain’s gale-force waters.” In the US, Stephen Schwarzman, CEO of private equity firm Blackstone, likened proposals to remove a specialised tax exemption to the German invasion of Poland.

While we may scoff at these moans from the super-rich, most people unthinkingly accept the fundamental idea behind them: that income tax is a kind of theft, taking income which is rightfully owned by the person who earned it. It follows that tax is, at best, a necessary evil, and so should be minimised as far as possible. On these grounds, the 83% top tax rate discussed by Piketty is seen as unacceptable.

There is an entire cultural ecosystem that has evolved around the idea of tax-as-theft, recognisable today in politicians’ talk about “spending taxpayers’ money”, or campaigners celebrating “tax freedom day”. This language exists outside the world of politics, too. Tax economists, accountants and lawyers refer to the so-called “tax burden”.

But the idea that you somehow own your pre-tax income, while obvious, is false. To begin with, you could never have ownership rights prior to, or independent from, taxation. Ownership is a legal right. Laws require various institutions, including police and a legal system, to function. These institutions are financed through taxation. The tax and the ownership rights are effectively created simultaneously. We cannot have one without the other.

FacebookTwitterPinterest ‘There’s been class warfare going on for the last 20 years, and my class has won’ … US billionaire Warren Buffett. Photograph: Kevin Lamarque/Reuters

However, if the only function of the state is to support private ownership rights (maintaining a legal system, police, and so on), it seems that taxation could be very low – and any further taxation on top could still be seen as a form of theft. Implicit in this view is the idea of incomes earned, and so ownership rights created, in an entirely private market economy, with the state entering only later, to ensure these rights are maintained. Many economics textbooks picture the state in this way, as an add-on to the market. Yet this, too, is a fantasy.

In the modern world, all economic activity reflects the influence of government. Markets are inevitably defined and shaped by government. There is no such thing as income earned before government comes along. My earnings partly reflect my education. Earlier still, the circumstances of my birth and my subsequent health reflects the healthcare available. Even if that healthcare is entirely “private”, it depends on the education of doctors and nurses, and the drugs and other technologies available. Like all other goods and services, these in turn depend on the economic and social infrastructure, including transport networks, communications systems, energy supplies and extensive legal arrangements covering complex matters such as intellectual property, formal markets such as stock exchanges, and jurisdiction across national borders. Lord Lloyd-Webber’s wealth depends on government decisions about the length of copyright on the music he wrote. In sum, it is impossible to isolate what is “yours” from what is made possible, or influenced, by the role of government.

Talk of taxation as theft turns out to be a variation on the egotistical tendency to see one’s success in splendid isolation, ignoring the contribution of past generations, current colleagues and government. Undervaluing the role of government leads to the belief that if you are smart and hard-working, the high taxes you endure, paying for often wasteful government, are not a good deal. You would be better off in a minimal-state, low-tax society.

One reply to this challenge points to the evidence on the rich leaving their home country to move to a lower tax jurisdiction: in fact, very few of them do. But here is a more ambitious reply from Warren Buffett: “Imagine there are two identical twins in the womb … And the genie says to them: ‘One of you is going to be born in the United States, and one of you is going to be born in Bangladesh. And if you wind up in Bangladesh, you will pay no taxes. What percentage of your income would you bid to be born in the United States?’ … The people who say: ‘I did it all myself’ … believe me, they’d bid more to be in the United States than in Bangladesh.”

Much of the inequality we see today in richer countries is more down to decisions made by governments than to irreversible market forces. These decisions can be changed. However, we have to want to control inequality: we must make inequality reduction a central aim of government policy and wider society. The most entrenched, self-deluding and self-perpetuating justifications for inequality are about morality, not economy. The great economist John Kenneth Galbraith nicely summarised the problem: “One of man’s oldest exercises in moral philosophy … is the search for a superior moral justification for selfishness. It is an exercise which always involves a certain number of internal contradictions and even a few absurdities. The conspicuously wealthy turn up urging the character-building value of privation for the poor.”

The college admissions scandal is a reminder that wealth, not talent, is what determines the opportunities you have in life writes Nathan Robinson in The Guardian

‘There can be never be such thing as a meritocracy, because there’s never going to be fully equal opportunity.’ Photograph: Dan Kitwood/Getty Images

‘There can be never be such thing as a meritocracy, because there’s never going to be fully equal opportunity.’ Photograph: Dan Kitwood/Getty Images

The US college admissions scandal is fascinating, if not surprising. Over 30 wealthy parents have been criminally charged over a scheme in which they allegedly paid a company large sums of money to get their children into top universities. The duplicity involved was extreme: everything from paying off university officials to inventing learning disabilities to facilitate cheating on standardized tests. One father even faked a photo of his son pole vaulting in order to convince admissions officers that the boy was a star athlete.

It’s no secret that wealthy people will do nearly anything to get their kids into good schools. But this scandal only begins to reveal the lies that sustain the American idea of meritocracy. William “Rick” Singer, who admitted to orchestrating the scam, explained that there are three ways in which a student can get into the college of their choice: “There is a front door which is you get in on your own. The back door is through institutional advancement, which is ten times as much money. And I’ve created this side door.” The “side door” he’s referring to is outright crime, literally paying bribes and faking test scores. It’s impossible to know how common that is, but there’s reason to suspect it’s comparatively rare. Why? Because for the most part, the wealthy don’t need to pay illegal bribes. They can already pay perfectly legal ones.

In his 2006 book, The Price of Admission: How America’s Ruling Class Buys Its Way into Elite Colleges, Daniel Golden exposes the way that the top schools favor donors and the children of alumni. A Duke admissions officer recalls being given being given a box of applications she had intended to reject, but which were returned to her for “special” reconsideration. In cases where parents are expected to give very large donations upon a student’s admission, the applicant may be described as an “institutional development” candidate—letting them in would help develop the institution. Everyone by now is familiar with the way the Kushner family bought little Jared a place at Harvard. It only took $2.5m to convince the school that Jared was Harvard material.

The inequality goes so much deeper than that, though. It’s not just donations that put the wealthy ahead. Children of the top 1% (and the top 5%, and the top 20%) have spent their entire lives accumulating advantages over their counterparts at the bottom. Even in first grade the differences can be stark: compare the learning environment at one of Detroit’s crumbling public elementary schools to that at a private elementary school that costs tens of thousands of dollars a year. There are high schools, such as Phillips Academyin Andover, Massachusetts, that have billion dollar endowments. Around the country, the level of education you receive depend on how much money your parents have.

Even if we equalized public school funding, and abolished private schools, some children would be far more equal than others. 2.5m children in the United States go through homelessness every year in this country. The chaotic living situation that comes with poverty makes it much, much harder to succeed. This means that even those who go through Singer’s “front door” have not “gotten in on their own.” They’ve gotten in partly because they’ve had the good fortune to have a home life conducive to their success.

People often speak about “equality of opportunity” as the American aspiration. But having anything close to equal opportunity would require a radical re-engineering of society from top to bottom. As long as there are large wealth inequalities, there will be colossal differences in the opportunities that children have. No matter what admissions criteria are set, wealthy children will have the advantage. If admissions officers focus on test scores, parents will pay for extra tutoring and test prep courses. If officers focus instead on “holistic” qualities, pare. It’s simple: wealth always confers greater capacity to give your children the edge over other people’s children. If we wanted anything resembling a “meritocracy,” we’d probably have to start by instituting full egalitarian communism.

In reality, there can be never be such thing as a meritocracy, because there’s never going to be fully equal opportunity. The main function of the concept is to assure elites that they deserve their position in life. It eases the “anxiety of affluence,” that nagging feeling that they might be the beneficiaries of the arbitrary “birth lottery” rather than the products of their own individual ingenuity and hard work.

There’s something perverse about the whole competitive college system. But we can imagine a different world. If everyone was guaranteed free, high-quality public university education, and a public school education matched the quality of a private school education, there wouldn’t be anything to compete for.

Instead of the farce of the admissions process, by which students have to jump through a series of needless hoops in order to prove themselves worthy of being given a good education, just admit everyone who meets a clearly-established threshold for what it takes to do the coursework. It’s not as if the current system is selecting for intelligence or merit. The school you went to mostly tells us what economic class your parents were in. But it doesn’t have to be that way.

Joshua Chaffin in The FT

William McGlashan had to make his son a football player. And quickly.

In exchange for a $250,000 payment, a California-based university-admissions consultant had arranged for the younger McGlashan to skirt the normal application process at the University of Southern California and be accepted as a prized American football recruit. A “side door” into the university, the consultant, William Singer, called it.

The problem was that the boy did not play football. They did not even have a football team at his secondary school. “We have images of him in lacrosse. I don’t know if that matters,” offered Mr McGlashan, a top executive at the private equity firm TPG and co-founder with rock star Bono of the Rise Fund, a socially conscious investment vehicle.

“They [USC] don’t have a lacrosse team,” Mr Singer responded. Then he took matters into his own hands. “I’m going to make him a kicker/punter,” he decided, listing specialist positions in the sport often occupied by the slight of frame. “I’ll get a picture and figure out how to Photoshop and stuff.”

“He does have really strong legs,” Mr McGlashan joked.

The two men bantered about the deal, and how Mr Singer had made other applicants appear to be champion water polo players for the same purpose. Months earlier, the 55-year-old Mr McGlashan had paid Mr Singer $50,000 to have someone doctor his son’s university entrance exam. “Pretty funny. The way the world works these days is unbelievable,” Mr McGlashan observed.

"I can do anything and everything, if you guys are amenable to doing it" William Singer, founder of The Edge College & Career Network

Those discussions are reproduced in a criminal complaint filed by the Justice Department on Tuesday after an investigation into bribery in college admissions that resulted in charges against 50 individuals — including prominent actors and investors — and involved some of the most prestigious names in US higher education.

At the centre of the scheme was Mr Singer, 58, who was fired in 1988 as a high school basketball coach in Sacramento because of his abusive behaviour toward referees. He later reinvented himself as a svengali in Newport Beach for his apparent mastery of the increasingly cut-throat university admissions game. On Tuesday Mr Singer pleaded guilty to federal charges including racketeering conspiracy and obstruction of justice.

“OK, so, who we are — what we do is help the wealthiest families in the US get their kids into school,” Mr Singer told one prospective client, Gordon Caplan, the co-chairman of the prominent US law firm Willkie Farr & Gallagher.

In extensive phone conversations authorities recorded with 32 parents, Mr Singer comes off as an indispensable problem-solver and quasi-magician — a man able to spare one client, the actress of Lori Loughlin, the apparent indignity of having to send her daughter to Arizona State University.

“I can make [test] scores happen, and nobody on the planet can get scores to happen,” he boasted to one client of his consultancy, The Edge College & Career Network.

“She won’t even know that it happened. It will happen as though, she will think that she’s really super smart, and she got lucky on a test, and you got a score now. There’s lots of ways to do this. I can do anything and everything, if you guys are amenable to doing it.”

All told, Mr Singer collected about $25m in bribes over a seven-year period, according to authorities.

US college admissions are supposed to be a merit-based business. But it has always had its set-aside places for legacy applicants and the children of those willing to fork over enough money.

At a time when the affordability of university education is emerging as a major political issue, the revelation that the moneyed elites had gamed the system for their children — at the expense of more deserving candidates — is likely to be seized on by politicians.

Daniel Golden won a Pulitzer Prize for his book, The Price of Admission, which detailed the underside of the business at a time when globalisation was raising the value of a prestigious university degree — and making it evermore competitive for students to access them.

Writing for The Guardian newspaper in 2016, Mr Golden called it the “grubby secret of American higher education: that the rich buy their underachieving children’s way into elite universities with massive, tax-deductible donations”.

He claimed that President Donald Trump’s son-in-law Jared Kushner — not regarded as a brilliant scholar in high school — was accepted by Harvard not long after his father Charles made a $2.5m donation to the university.

Mr Singer called that “the backdoor”. At The Edge, he came up with a “side door”: arranging bribes for tennis, sailing and soccer coaches so that they would sneak his applicants into school as ostensible sports stars.

As the criminal complaint noted, many of the schools reserve admissions spaces for their athletics department: “At Georgetown, approximately 158 admissions slots are allocated to athletic coaches, and students recruited for those slots have substantially higher admissions prospects than non-recruited students.”

USC, a school that was once considered more expensive than selective, was one of Mr Singer’s best bets. With the alleged connivance of the school’s senior women’s athletic director, Donna Heinel, he wangled spots for applicants supposedly destined for its water polo, basketball, football and rowing teams. Ms Heinel and the water polo coach, Jovan Vavic, were dismissed by the school on Tuesday and also criminally charged.

Running through the complaint is the angst of affluent parents caught up in a school admissions process that is increasingly viewed as a make-or-break gateway to future success.

One of those charged, Agustin Huneeus, a California vineyard owner, appears tormented that his daughter is losing out to Mr McGlashan’s son, a schoolmate.

“Is Bill [McGlashan] doing any of this shit? Is he just talking a clean game with me and helping his kid or not? Cause he makes me feel guilty.”

Mr Huneeus paid $50,000 for someone to doctor his daughter’s college entrance exam. She ended up scoring in the 96th percentile.

Like Mr McGlashan, Mr Huneeus also opted to pay Mr Singer $250,000 to buy her admission to USC — in this case as a star water polo player. The girl was late in sending a picture so Mr Singer found one of an actual water polo player and submitted that instead.

On one occasion Mr Singer had two different clients unwittingly sitting fraudulent entrance exams in the same testing room. In order for the scheme to work, he repeatedly emphasised to parents it was essential that they petitioned for medical exemptions so that their children could be given extra time to complete the test — ideally a few days. That way proctors bribed by Mr Singer would have occasion to adjust the results.

“What happened is, all the wealthy families that figured out that if I get my kid tested and they get extended time, they can do better on the test. So most of these kids don’t even have issues, but they’re getting time. The playing field is not fair,” Mr Singer explains to Mr Caplan, the lawyer, as he markets his services.

“No, it’s not. I mean this is, to be honest, it feels a little weird. But,” Mr Caplan responds.

Ultimately, one thing that Mr Caplan and the parents shared was a determination to keep the scheme secret from the children they were desperate to help. It was no easy feat since, in some cases, test scores would be massively inflated for mediocre — even poor — students.

There was also the need to secure the medical waivers and then petition for the students to take the test at specific facilities in Houston or Hollywood controlled by Mr Singer. (He often advised parents to tell authorities their students had to travel on the appointed date for a wedding or bar mitzvah.)

“Now does he, here’s the only question, does he know? Is there a way that he doesn’t know what happened?” Mr McGlashan asked of his son at one point.

Mr McGlashan — who was placed on “indefinite administrative leave” by TPG on Tuesday and did not respond to requests for comment — seemingly managed to put aside his reservations.

So did another parent, Marci Palatella, the chief executive of a California liquor distributor. She and her spouse paid Mr Singer $500,000 to secure their son’s admission to USC after apparently hearing about his services from “people at Goldman Sachs who have, you know, recommended you highly”.

As Ms Palatella later confided to Mr Singer, she and her partner “laugh every day” about the scheme. “We’re like, ‘It was worth every cent.’”

FBI affidavit: overview of the conspiracy

Parents paid about $25m in bribes between 2011 and 2018.

Colleges and universities involved included Yale University, Stanford University, the University of Texas, the University of Southern California, and the University of California Los Angeles, Georgetown and Wake Forest

Bribes to college entrance exam administrators allowed a third party to assist in cheating on college entrance exams, in some cases posing as the actual students, and in others by providing students with answers during the exams or by correcting their answers after they had completed the exams

Bribes to university athletic coaches and administrators to designate students as purported athletic recruits regardless of their athletic abilities, and, in some cases, even though they did not play the sport they were purportedly recruited to play

Having a third party take classes in place of the actual students, with the understanding that grades earned in those classes would be submitted as part of the student’s college applications

Submitting falsified applications for admission to universities that included the fraudulently obtained exam scores and class grades, and often listed fake awards and athletic activities

Disguising the nature and source of the bribe payments by funnelling the money through the accounts of a purported, tax-deductible, charity, The Key Worldwide Foundation, from which many of the bribes were then paid

Today’s titans of tech and finance want to solve the world’s problems, as long as the solutions never, ever threaten their own wealth and power. by Anand Giridharadas in The Guardian

A successful society is a progress machine. It takes in the raw material of innovations and produces broad human advancement. America’s machine is broken. The same could be said of others around the world. And now many of the people who broke the progress machine are trying to sell us their services as repairmen.

When the fruits of change have fallen on the US in recent decades, the very fortunate have basketed almost all of them. For instance, the average pretax income of the top 10th of Americans has doubled since 1980, that of the top 1% has more than tripled, and that of the top 0.001% has risen more than sevenfold – even as the average pretax income of the bottom half of Americans has stayed almost precisely the same. These familiar figures amount to three-and-a-half decades’ worth of wondrous, head-spinning change with zero impact on the average pay of 117 million Americans. Globally, over the same period, according to the World Inequality Report, the top 1% captured 27% of new income, while the bottom half of humanity – presently, more than 3 billion people – saw 12% of it.

That vast numbers of Americans and others in the west have scarcely benefited from the age is not because of a lack of innovation, but because of social arrangements that fail to turn new stuff into better lives. For example, American scientists make the most important discoveries in medicine and genetics and publish more biomedical research than those of any other country – but the average American’s health remains worse and slower-improving than that of peers in other rich countries, and in some years life expectancy actually declines. American inventors create astonishing new ways to learn thanks to the power of video and the internet, many of them free of charge – but the average US high-school leaver tests more poorly in reading today than in 1992. The country has had a “culinary renaissance”, as one publication puts it, one farmers’ market and Whole Foods store at a time – but it has failed to improve the nutrition of most people, with the incidence of obesity and related conditions rising over time.

The tools for becoming an entrepreneur appear to be more accessible than ever, for the student who learns coding online or the Uber driver – but the share of young people who own a business has fallen by two-thirds since the 1980s. America has birthed both a wildly successful online book superstore, Amazon, and another company, Google, that has scanned more than 25m books for public use – but illiteracy has remained stubbornly in place, and the fraction of Americans who read at least one work of literature a year has dropped by almost a quarter in recent decades. The government has more data at its disposal and more ways of talking and listening to citizens – but only a quarter as many people find it trustworthy as did in the tempestuous 1960s.

Meanwhile, the opportunity to get ahead has been transformed from a shared reality to a perquisite of already being ahead. Among Americans born in 1940, those raised at the top of the upper middle class and the bottom of the lower middle class shared a roughly 90% chance of realising the so-called American dream of ending up better off than their parents. Among Americans born in 1984 and maturing into adulthood today, the new reality is split-screen. Those raised near the top of the income ladder now have a 70% chance of realising the dream. Meanwhile, those close to the bottom, more in need of elevation, have a 35% chance of climbing above their parents’ station. And it is not only progress and money that the fortunate monopolise: rich American men, who tend to live longer than the average citizens of any other country, now live 15 years longer than poor American men, who endure only as long as men in Sudan and Pakistan.

Thus many millions of Americans, on the left and right, feel one thing in common: that the game is rigged against people like them. Perhaps this is why we hear constant condemnation of “the system”, for it is the system that people expect to turn fortuitous developments into societal progress. Instead, the system – in America and across much of the world – has been organised to siphon the gains from innovation upward, such that the fortunes of the world’s billionaires now grow at more than double the pace of everyone else’s, and the top 10% of humanity have come to hold 85% of the planet’s wealth. New data published this week by Oxfam showed that the world’s 2,200 billionaires grew 12% wealthier in 2018, while the bottom half of humanity got 11% poorer. It is no wonder, given these facts, that the voting public in the US (and elsewhere) seems to have turned more resentful and suspicious in recent years, embracing populist movements on the left and right, bringing socialism and nationalism into the centre of political life in a way that once seemed unthinkable, and succumbing to all manner of conspiracy theory and fake news. There is a spreading recognition, on both sides of the ideological divide, that the system is broken, that the system has to change.

Some elites faced with this kind of gathering anger have hidden behind walls and gates and on landed estates, emerging only to try to seize even greater political power to protect themselves against the mob. (We see you, Koch brothers!) But in recent years a great many fortunate Americans have also tried something else, something both laudable and self-serving: they have tried to help by taking ownership of the problem. All around us, the winners in our highly inequitable status quo declare themselves partisans of change. They know the problem, and they want to be part of the solution. Actually, they want to lead the search for solutions. They believe their solutions deserve to be at the forefront of social change. They may join or support movements initiated by ordinary people looking to fix aspects of their society. More often, though, these elites start initiatives of their own, taking on social change as though it were just another stock in their portfolio or corporation to restructure. Because they are in charge of these attempts at social change, the attempts naturally reflect their biases.

For the most part, these initiatives are not democratic, nor do they reflect collective problem-solving or universal solutions. Rather, they favour the use of the private sector and its charitable spoils, the market way of looking at things, and the bypassing of government. They reflect a highly influential view that the winners of an unjust status quo – and the tools and mentalities and values that helped them win – are the secret to redressing the injustices. Those at greatest risk of being resented in an age of inequality are thereby recast as our saviours from an age of inequality. Socially minded financiers at Goldman Sachs seek to change the world through “win-win” initiatives such as “green bonds” and “impact investing”. Tech companies such as Uber and Airbnb cast themselves as empowering the poor by allowing them to chauffeur people around or rent out spare rooms. Management consultants and Wall Street brains seek to convince the social sector that they should guide its pursuit of greater equality by assuming board seats and leadership positions.

Conferences and ideas festivals sponsored by plutocrats and big business – such as the World Economic Forum, which is under way in Davos, Switzerland, this week – host panels on injustice and promote “thought leaders” who are willing to confine their thinking to improving lives within the faulty system rather than tackling the faults. Profitable companies built in questionable ways and employing reckless means engage in corporate social responsibility, and some rich people make a splash by “giving back” – regardless of the fact that they may have caused serious societal problems as they built their fortunes. Elite networking forums such as the Aspen Institute and the Clinton Global Initiative groom the rich to be self-appointed leaders of social change, taking on the problems people like them have been instrumental in creating or sustaining. A new breed of community-minded so-called B Corporations has been born, reflecting a faith that more enlightened corporate self-interest – rather than, say, public regulation – is the surest guarantor of the public welfare. A pair of Silicon Valley billionaires fund an initiative to rethink the Democratic party, and one of them can claim, without a hint of irony, that their goals are to amplify the voices of the powerless and reduce the political influence of rich people like them.

Bill Clinton and Richard Branson at a Clinton Global Initiative event in New York in 2006. Photograph: Tina Fineberg/AP

This genre of elites believes and promotes the idea that social change should be pursued principally through the free market and voluntary action, not public life and the law and the reform of the systems that people share in common; that it should be supervised by the winners of capitalism and their allies, and not be antagonistic to their needs; and that the biggest beneficiaries of the status quo should play a leading role in the status quo’s reform.

This is what I call MarketWorld – an ascendant power elite defined by the concurrent drives to do well and do good, to change the world while also profiting from the status quo. It consists of enlightened businesspeople and their collaborators in the worlds of charity, academia, media, government and thinktanks. It has its own thinkers, whom it calls “thought leaders”, its own language, and even its own territory – including a constantly shifting archipelago of conferences at which its values are reinforced and disseminated and translated into action. MarketWorld is a network and community, but it is also a culture and state of mind.

The elites of MarketWorld often speak in a language of “changing the world” and “making the world a better place” – language more typically associated with protest barricades than ski resorts. Yet we are left with the inescapable fact that even as these elites have done much to help, they have continued to hoard the overwhelming share of progress, the average American’s life has scarcely improved, and virtually all of the US’s institutions, with the exception of the military, have lost the public’s trust.

One of the towering figures in this new approach to changing the world is the former US president Bill Clinton. After leaving office in 2001, he came to champion, through his foundation and his annual Clinton Global Initiative gatherings in New York, a mode of public-private world improvement that brought together actors like Goldman Sachs, the Rockefeller Foundation and McDonald’s, sometimes with a governmental partner, to solve big problems in ways plutocrats could get on board with.

After the populist eruption that resulted in Hillary Clinton’s defeat in the 2016 US election, I asked the former president what he thought lay behind the surge of public anger. “The pain and road rage we see reflected in the election has been building a long time,” he said. He thought the anger “is being fed in part by the feeling that the most powerful people in the government, economy and society no longer care about them or look down on them. They want to become part of our progress toward shared opportunities, shared stability and shared prosperity.” But when it came to his proposed solution, it sounded a lot like the model to which he was already committed: “The only answer is to build an aggressive, creative partnership involving all levels of government, the private sector and nongovernment organisations to make it better.”

In other words, the only answer is to pursue social change outside of traditional public forums, with the political representatives of mankind as one input among several, and corporations having the big say in whether they would sponsor a given initiative or not. The public’s anger, of course, has been directed in part at the very elites he had sought to convene, on whom he had gambled his theory of post-political problem-solving, who had lost the trust of so many millions of people, making them feel betrayed, uncared for and scorned.

What people have been rejecting in the US – as well as in Britain, Hungary and elsewhere – was, in their view, rule by global elites who put the pursuit of profit above the needs of their neighbours and fellow citizens. These were elites who seemed more loyal to one another than to their own communities; elites who often showed greater interest in distant humanitarian causes than in the pain of people 10 miles to the east or west. Frustrated citizens felt they possessed no power over the spreadsheet- and PowerPoint-wielding elites commensurate with the power these elites had gained over them – whether in switching around their hours or automating their plant or quietly slipping into law a new billionaire-made curriculum for their children’s school. What they did not appreciate was the world being changed without them.