'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label American. Show all posts

Showing posts with label American. Show all posts

Friday, 10 November 2023

Monday, 11 April 2022

Monday, 10 June 2013

Soldiers as teachers why not as doctors?

by Archie Bland in The Independent

In its wisdom, the Government has decided to give members of the Armed Forces a fast-track route into teaching. The plan, long in the making, will give former troops the chance to teach even if they don’t hold a university degree, and I'm all for it, but I don’t think the Government is going far enough. Yes, we need a military ethos in our schools. But what about our hospitals?

Think about it. Schools will benefit from the military values of leadership, discipline, motivation and teamwork, as David Laws and Michael Govehave argued, but you know where else those values would be useful? The chaotic world of hospitals! OK, so not all soldiers have an education in medicine. But they have the right values. And the right values are much more important than the right qualifications.

The image of infantrymen moving from the military’s theatres of operations to the hospitals’ operating theatres is not the only one available to demonstrate how absurd this proposal is, how insulting to teachers and children, and how profoundly anti-intellectual, with its contempt for the idea that knowing about things might be a necessary prerequisite for teaching them. And these other modest proposals make still clearer the rationale for the Government’s pursuit of this particular wheeze. Imagine, for instance, that teachers were to be fast-tracked into combat units because of their capacities to work hard, manage people and deal with stressful situations. Or try to picture charity workers getting teaching jobs without a degree because a philanthropic ethos might be just as worth instilling in our children as a military one. Any such suggestion would be greeted, rightly, with puzzlement.

And yet with the military it’s different. This plan is based on an American example – with the difference that in America, 99 per cent of participants already had a degree – and in recent years we’ve been edging closer to the American model of unthinking glorification of our Armed Forces. When soldiers and sailors behave well, their exploits are used as evidence of military nobility. When they behave badly, they are seen as bad apples, and we rarely ask whether their wrongdoing might in fact be the product of a poisoned culture.

I suppose this squeamishness is understandable: ever since the invasion of Afghanistan, we’ve been engaged in brutal conflicts that cost most of us very little, and a few of us a great deal. We owe those few. But squeamishness, and a heavy debt, are not a sensible basis for policy making. So, although it feels frankly treacherous to say so, here goes: a military culture is appropriate for the front line, but not for the classroom, where independent thinking should be considered essential. Soldiers might be brave, and well-disciplined, but if they aren’t well qualified that probably won’t be enough to make them good educators. Teachers are doing something really difficult. And children? Children are not the enemy.

Tuesday, 16 October 2012

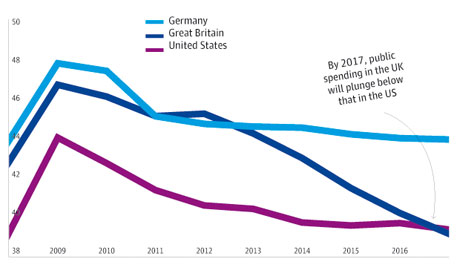

The graph that shows how far David Cameron wants to shrink the state

If the Tories get their way, within five years the UK will have a smaller public sector than any major developed nation

Government spending as a percentage of national GDP. Photograph: IMF WEO Database Oct 2012

This column is normally accompanied by a photo; an illustration that takes its cue from the text. But not today. The chart you see on this page is plainly not decorative: it is the main event. All I'm going to discuss is its implications.

Drawing on IMF figures published last week, the graph compares what will happen to government spending in Britain up to 2017 with the outlook for Germany and the US. And what it shows is that the UK will plunge from public spending on a par with Germany in 2009, to spending less than the US by 2017. Had France, Sweden or Canada been included on this graph, the UK would still come bottom. If George Osborne gets his way, within the next five years, Britain will have a smaller public sector than any other major developed nation.

Fan or critic, nearly everyone now agrees that this government wants to shrink the state, but very few take on board what that means. This graph shows just how radical those ministerial plans are. Particularly striking is the fact that Britain will end up spending less as a proportion of its national income than even the US, the international byword for a decrepit public sector. According to Peter Taylor-Gooby, professor of social policy at Kent, this will be the first time it has happened since at least 1980 and possibly in recorded history. For it to take place within half a decade is a shift so dramatic that few people in frontline politics, let alone among the electorate, have understood its implications.

Forget all that ministerial guff about the necessity of cutting the public sector to spur economic growth. Had that argument been true, British businesses would be in leonine form by now, instead of their current chronic enfeeblement. It was notable at last week's Tory party conference how Osborne and David Cameron didn't even try to argue for the economic benefits of austerity – how could they? – but grimly asserted that there was no alternative.

Forget, too, the argument that only cuts have kept Britain's borrowing costs from rocketing. In the IMF's summer healthcheck for the UK was another chart which showed that the only nations where interest rates had spiralled upwards were those in the eurozone, and those without control of their own currency and monetary policy. Every other major economy, no matter what their debt load, was able to borrow from the financial markets as cheaply as ever.

Strip away the usual economic and financial alibis for such drastic austerity and what you're inevitably left with is a purely political motive: namely, a desire to transform the British state from being recognisably European, with continental levels of public spending, to something sub-American in its miserliness.

Let me make two caveats. First, there was no way Britain was going to maintain public spending at 2009 levels. That year, the Labour government threw the kitchen sink at the economy, after which you would expect some belt-tightening. Still, as Carl Emmerson of the Institute for Fiscal Studies points out, after both world wars, the level of public spending in Britain rose permanently; you might expect something similar after a once-in-a-lifetime financial crisis. Given how fast Britain is ageing, and how much we will need to spend on pensions and care for the elderly, there is no reason why the state in Britain should shrink back to some magic level of 40% of the economy.

Second, this chart is based on current US budget plans: if Mitt Romney moves into the White House next January, or even if Barack Obama is re-elected and has to strike a bargain with intransigent Republicans, then Washington is also likely to make stringent cuts. But that last qualification only reinforces the larger argument. Whether in Britain or the US, the right are trying to whip the rest of us into a giant race to the bottom, where public services, welfare entitlements and employment rights are all to be tossed overboard.

Cameron admitted as much in last Wednesday's conference speech. Lumping together Nigeria with China and India and Brazil, he described them as "the countries on the rise … lean, fit, obsessed with enterprise, spending money on the future – on education, incredible infrastructure and technology". As anyone who has ever tried to keep a car on the potholed roads of Bihar, in northern India, will know, that description is a giant porky. But Cameron wanted to draw a comparison with "the countries on the slide … fat, sclerotic, over-regulated, spending money on unaffordable welfare systems, huge pension bills, unreformed public services".

From compassionate Conservative to growth rainmaker to state-shrinker, Cameron has gone through a huge change since 2005. But that is nothing like what lies ahead for the rest of Britain in the next five years. Prepare yourself for welfare to be downsized into American-style workfare, for public-sector jobs to be turned into a second-class employment and for services, from school to healthcare, to demand that users pay more to get something decent. The future is American.

Wednesday, 29 February 2012

Warren Buffet - a Jaded Sage?

The

jaded sage

By Chan Akya in Asia Times Online

Warren Buffett, besides being the Sage of Omaha and one of the wealthiest men to ever walk this planet, is also an American hero. A man who popularized the notion of investing your savings prudently, taking a knife to Wall Street excesses and more recently, the architect of an effective minimum tax for rich Americans. All in all, your regular billionaire next door.

Of course I can also recount all the reasons why anyone who bothered to print this article and read the first paragraph got disgusted, crumpled the paper into a little ball and threw it into the nearest waste bin.

You know, stuff like his holdings in major American scams like Moody's which he purchased due to the massive profits they were making from selling fake triple-A ratings all around. Or his rescue of such amazing firms as Goldman Sachs in the midst of the financial crisis, in effect protecting them not so much from aggressive market speculators but perhaps the major regulatory bodies as well (Mr Buffett is a known supporter of and donor to President Barack Obama).

Even that supposed act of folksy good humor ("my secretary pays a higher tax rate than I do") hides an ugly word: "legacy". Mr Buffett is old and if he had wanted to pay higher taxes, well he had the last 60 years in which to do it.

But I don't care about any of Mr Buffett's flaws any more than I lose sleep over that stupid woman who unfailingly puts mayonnaise on my sandwich despite being told not to every day. My getting upset doesn't change a thing, and just ends up spoiling my day: it's easier for me to just buy my sandwiches somewhere else. That's where I left Mr Buffett - that is, until his latest investment letter hit the web and through acts of generosity by my friends, made it into my inbox. Ten times over.

Cold on gold

I don't know why so many of them did that - but it may have something to do with his statements about irrational choices that investor make about assets. He writes:

I don't know about you, but if I could travel through the centuries I would sure as hell like to have in my pocket something that would still be worth something in purchasing power that approaches its current value.

Imagine the following scenario: your grandfather leaves us some wealth but you only get it 50 years later. Now, what would you have liked that "wealth" to have been: cash in US dollars or gold coins? Of course other assets would have worked better - "shares in Apple" for example. Then again, if your grandfather had given you shares in Apple and you got them in 1998, your general feelings of gratitude towards him would have been a somewhat dimmer.

Then Mr Buffett goes on with his diatribe:

And all the analysis misses the point about corporate fraud, that uniquely American preoccupation that has seen many a top firm go completely bust because of financial and accounting shenanigans. If Mr Buffett had mentioned BP instead of Exxon (and written this article two years ago rather than now) he would have had egg on his face. (See also "BP, Bhopal and Karma", Asia Times Online, June 19, 2010, one of my past articles on the subject of corporate responsibility.

Mr Buffett misses the point entirely about what gold is and what it is supposed to do. In a world where investors have ample reason to lose faith in governments and the financial system, the position of a common store of value that is recognizable and usable across all humanity and is itself beyond religion and politics in terms of being manipulated around (besides being no mean feat by itself) is made stronger, not weaker.

That is not to say that I am recommending you folks to buy gold and nothing else; my view has always been that a building up a little hedge for your financial assets with physical gold is no bad thing. I don't speculate in gold nor do I believe you should.

Of course, he clarifies similar points later on his spiel as follows:

This is neither about questioning his investment choices nor indeed to taunt a proud American on that country's potential failings. The investor letter though is emblematic of the core ill plaguing the West now; namely a failure to question the current logic of organization underpinning the economy.

On the other end of the scale, it is not immediately apparent that a deleveraging America would need as many cans of sugared water with noxious chemicals as it does now; nor indeed that the current system of savings through stocks could survive a Japan-style lost decade when the locus of the economy shifts from consumption to production.

In a different way of thinking, it is a good thing that Mr Buffett writes his letters the way he does now. Two decades from now, economists and students of finance may ponder the madness of our times that made a man like him the foremost investing genius in the world.

By Chan Akya in Asia Times Online

Warren Buffett, besides being the Sage of Omaha and one of the wealthiest men to ever walk this planet, is also an American hero. A man who popularized the notion of investing your savings prudently, taking a knife to Wall Street excesses and more recently, the architect of an effective minimum tax for rich Americans. All in all, your regular billionaire next door.

Of course I can also recount all the reasons why anyone who bothered to print this article and read the first paragraph got disgusted, crumpled the paper into a little ball and threw it into the nearest waste bin.

You know, stuff like his holdings in major American scams like Moody's which he purchased due to the massive profits they were making from selling fake triple-A ratings all around. Or his rescue of such amazing firms as Goldman Sachs in the midst of the financial crisis, in effect protecting them not so much from aggressive market speculators but perhaps the major regulatory bodies as well (Mr Buffett is a known supporter of and donor to President Barack Obama).

Even that supposed act of folksy good humor ("my secretary pays a higher tax rate than I do") hides an ugly word: "legacy". Mr Buffett is old and if he had wanted to pay higher taxes, well he had the last 60 years in which to do it.

But I don't care about any of Mr Buffett's flaws any more than I lose sleep over that stupid woman who unfailingly puts mayonnaise on my sandwich despite being told not to every day. My getting upset doesn't change a thing, and just ends up spoiling my day: it's easier for me to just buy my sandwiches somewhere else. That's where I left Mr Buffett - that is, until his latest investment letter hit the web and through acts of generosity by my friends, made it into my inbox. Ten times over.

Cold on gold

I don't know why so many of them did that - but it may have something to do with his statements about irrational choices that investor make about assets. He writes:

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.Okay, so if I understand this right, Mr Buffett objects to the fact that gold cannot be manipulated, conjured up out of thin air and that it draws a bunch of people weary of Keynesian money printing into its fold. I am not going to suggest that Mr Buffett is thick or something, but isn't all of the above the very point about owning a store of value in the first place?

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As "bandwagon" investors join any party, they create their own truth - for a while.

I don't know about you, but if I could travel through the centuries I would sure as hell like to have in my pocket something that would still be worth something in purchasing power that approaches its current value.

Imagine the following scenario: your grandfather leaves us some wealth but you only get it 50 years later. Now, what would you have liked that "wealth" to have been: cash in US dollars or gold coins? Of course other assets would have worked better - "shares in Apple" for example. Then again, if your grandfather had given you shares in Apple and you got them in 1998, your general feelings of gratitude towards him would have been a somewhat dimmer.

Then Mr Buffett goes on with his diatribe:

Today the world's gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce - gold's price as I write this - its value would be $9.6 trillion. Call this cube pile A. Let's now create a pile B costing an equal amount. For that, we could buy all US cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world's most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?Yup, valid points there. Then, again Mr Buffett, I wonder how those farmers would pay for the oil to use in their harvesters and how those oil workers would pay for all the grains they would need to eat. Would they own shares in each other and pay the other party dividends in kind? Or would they transact with a common currency, like gold?

... A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops - and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

And all the analysis misses the point about corporate fraud, that uniquely American preoccupation that has seen many a top firm go completely bust because of financial and accounting shenanigans. If Mr Buffett had mentioned BP instead of Exxon (and written this article two years ago rather than now) he would have had egg on his face. (See also "BP, Bhopal and Karma", Asia Times Online, June 19, 2010, one of my past articles on the subject of corporate responsibility.

Mr Buffett misses the point entirely about what gold is and what it is supposed to do. In a world where investors have ample reason to lose faith in governments and the financial system, the position of a common store of value that is recognizable and usable across all humanity and is itself beyond religion and politics in terms of being manipulated around (besides being no mean feat by itself) is made stronger, not weaker.

That is not to say that I am recommending you folks to buy gold and nothing else; my view has always been that a building up a little hedge for your financial assets with physical gold is no bad thing. I don't speculate in gold nor do I believe you should.

Of course, he clarifies similar points later on his spiel as follows:

My own preference - and you knew this was coming - is our third category: investment in productive assets, whether businesses, farms, or real estate. Ideally, these assets should have the ability in inflationary times to deliver output that will retain its purchasing-power value while requiring a minimum of new capital investment. Farms, real estate, and many businesses such as Coca-Cola, IBM and our own See's Candy meet that double-barreled test. Certain other companies - think of our regulated utilities, for example - fail it because inflation places heavy capital requirements on them. To earn more, their owners must invest more. Even so, these investments will remain superior to nonproductive or currency-based assets. Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper (as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola or some See's peanut brittle. In the future the US population will move more goods, consume more food, and require more living space than it does now. People will forever exchange what they produce for what others produce.Really? The best that Mr Buffett can conjure up as stores of "productive" assets are those that generate software consulting services, sugared water with noxious chemicals and over-sweet artificially flavored foodstuffs? Is it possible that all of these companies will even exist 200 years from now, or will a bunch of lawsuits or corporate fraud take one or more of them down as they have many an American corporation?

This is neither about questioning his investment choices nor indeed to taunt a proud American on that country's potential failings. The investor letter though is emblematic of the core ill plaguing the West now; namely a failure to question the current logic of organization underpinning the economy.

On the other end of the scale, it is not immediately apparent that a deleveraging America would need as many cans of sugared water with noxious chemicals as it does now; nor indeed that the current system of savings through stocks could survive a Japan-style lost decade when the locus of the economy shifts from consumption to production.

In a different way of thinking, it is a good thing that Mr Buffett writes his letters the way he does now. Two decades from now, economists and students of finance may ponder the madness of our times that made a man like him the foremost investing genius in the world.

Wednesday, 19 October 2011

In the Premier League the endgame of rampant capitalism is being played out

An unsustainable system where the rich win and the poor go to the wall. We see it in English football – and beyond

Illustration by Belle Mellor

It's a newspaper convention that the front and back pages are a

world apart, as if news and sport inhabit two different spheres with

little to say to each other. Indeed, it used to be an article of faith

that "sport and politics don't mix", with the former no more than a form

of escapism from the latter. And yet the Occupy Wall Street and London Stock Exchange

protests that led the weekend news bulletins might not be entirely

unrelated to the Premier League results that closed them. For the

current state of our football sheds a rather revealing light on the

current state of both our politics and our economy. Or, as one sage of

the sport puts it: "As ever, the national game reflects the nation's

times."

What that reflection says is that Britain, or England, has become the home of a turbo-capitalism that leaves even the land of the let-it-rip free market – the United States – for dust. If capitalism is often described metaphorically as a race in which the richest always win, football has turned that metaphor into an all too literal reality.

Let's take as our text a series of reports written by the sage just quoted, namely the Guardian's David Conn, who has carved a unique niche investigating the politics and commercialisation of football. Conn elicited a candid admission from the new American owners of Liverpool Football Club, who confessed that part of the lure of buying a stake in what they called the "EPL" – the English Premier League – was that they get to keep all the money they make, rather than having to share it as they would have to under the – their phrase – "very socialistic" rules that operate in US sport. In other words, England has become a magnet for those drawn to behave in a way they couldn't get away with at home.

Start with first principles. Of course, inequality is built into sport: some people are simply stronger or faster than others. What makes sport compelling is watching closely matched individuals or teams compete to come out on top.

But a different kind of inequality matters too: money. A rich club can buy up all the best players and win every time. That's the story of today's Premier League, as super-flush Manchester United sweep all before them, challenged only by local rivals Manchester City – now endowed by an oil billionaire – and Chelsea, funded to the hilt by a Russian oligarch. This, then, becomes a different kind of competition, a battle not of skill, pace and temperament but of pounds, shillings and pence. The clearest manifestation of that came at the close of the transfer window, when the biggest teams splashed out millions to buy the top talent. It means the half-dozen top sides, already at a different level from the rest, soared even higher towards the stratosphere and out of reach – in just the same way that the super-rich float ever further away from everyone else, the 1% in a different league from the 99%, as the Occupy protesters would put it.

Nothing you can do about that, says dogmatic capitalism. You can no more stop the richest teams dominating football than you can prevent the fastest sprinter winning gold. That's the force of the market, all but a law of nature.

Except along comes American sport to show us another way. First, there are those rules on revenue-sharing that so frustrated Liverpool's new owners. All the money that, say, a baseball team makes – from tickets, TV rights and merchandise – is taxed by the major league that runs the sport and spread around the other clubs, so that the richest cannot dwarf the rest. That isn't because the titans of Major League Baseball have read too much Marx. It's because they understand that their sport is worth nothing if it stops being a real competition, if only a handful of the wealthiest teams ever have a chance of winning. Redistributing the wealth around the league ensures their sport doesn't become boring. It does not level the playing field, but it comes very close.

The proof is in the stats so beloved of sporting obsessives. Over the past 19 seasons, 12 different teams have won baseball's biggest prize. In the 19 seasons since the Premier League was created, only four teams have won; Manchester United alone have won the title 12 of those 19 times.

It's not just revenue-sharing that ensures true competition. In American football and basketball a salary cap applies, limiting how much each club can pay in wages and thereby preventing the richest teams making their domination permanent by snapping up all the best players. (A "luxury tax" performs a similar function in baseball.) In the same spirit, teams in all major US sports submit to a "draft", in which they take turns picking from a pool of newly eligible players, so that the equivalent of Chelsea or Manchester City can't gobble up all the fresh talent, but instead have to let the Blackburns or Wigans have a go.

Put like that, it seems fantastical. Who can imagine Old Trafford voluntarily snaffling less of the pie, so that clubs in smaller cities with smaller grounds, and therefore weaker gate receipts, get a look in? And yet English football used to work just like that. When the founders of the Football League gathered in a Manchester hotel in 1888, they fretted over how they might ensure that a fixture between, say, Derby County and Everton remained a real contest. They agreed the home side should give a proportion of its takings to the visitors, a system that held firm till 1983.

Clubs shared the TV money when it came too, spreading it around all 92 league clubs. But the big teams always resented subsidising the minnows; indeed, the Premier League was formed out of the biggest 20 clubs' express desire to keep Rupert Murdoch's millions for themselves. That TV money is at least partly spread throughout the Premier League, but now there are noises about ending even that small nod towards wealth-sharing, so that the biggest half-dozen teams can keep every penny for themselves.

Not for the first time, it's fallen to Europe to act. Upcoming Uefa "financial fair play" rules will require teams to live within their earnings, which should put an end to the sugar daddy handouts of Man City and Chelsea. But that 2014 change will push clubs to maximise their revenue, which is bound, in turn, to mean even less sharing. Football will still be a game determined by who has most money.

There are three consequences of this strange gulf between our rules and those across the Atlantic. First, football's most storied clubs have become attractive to foreign tycoons who sniff a licence to print money, unrestricted. Second, we've established a model that is inherently unsustainable, involving colossal debts that cripple all those without a billionaire to bail them out. Since 1992, league clubs and one Premier League team – Portsmouth – have fallen insolvent 55 times. Third, we risk killing the golden goose, turning an activity that should be thrilling into a non-contest whose outcome is all but preordained.

Hmm, a system that sees our biggest names falling to leveraged takeovers – think Kraft's buy-up of Cadbury – thereby selling off the crown jewels of our collective culture in the name of a rampant capitalism that is both unsustainable and ultimately joyless. That doesn't just sound like the state of the national game, that sounds like the state of the nation.

What that reflection says is that Britain, or England, has become the home of a turbo-capitalism that leaves even the land of the let-it-rip free market – the United States – for dust. If capitalism is often described metaphorically as a race in which the richest always win, football has turned that metaphor into an all too literal reality.

Let's take as our text a series of reports written by the sage just quoted, namely the Guardian's David Conn, who has carved a unique niche investigating the politics and commercialisation of football. Conn elicited a candid admission from the new American owners of Liverpool Football Club, who confessed that part of the lure of buying a stake in what they called the "EPL" – the English Premier League – was that they get to keep all the money they make, rather than having to share it as they would have to under the – their phrase – "very socialistic" rules that operate in US sport. In other words, England has become a magnet for those drawn to behave in a way they couldn't get away with at home.

Start with first principles. Of course, inequality is built into sport: some people are simply stronger or faster than others. What makes sport compelling is watching closely matched individuals or teams compete to come out on top.

But a different kind of inequality matters too: money. A rich club can buy up all the best players and win every time. That's the story of today's Premier League, as super-flush Manchester United sweep all before them, challenged only by local rivals Manchester City – now endowed by an oil billionaire – and Chelsea, funded to the hilt by a Russian oligarch. This, then, becomes a different kind of competition, a battle not of skill, pace and temperament but of pounds, shillings and pence. The clearest manifestation of that came at the close of the transfer window, when the biggest teams splashed out millions to buy the top talent. It means the half-dozen top sides, already at a different level from the rest, soared even higher towards the stratosphere and out of reach – in just the same way that the super-rich float ever further away from everyone else, the 1% in a different league from the 99%, as the Occupy protesters would put it.

Nothing you can do about that, says dogmatic capitalism. You can no more stop the richest teams dominating football than you can prevent the fastest sprinter winning gold. That's the force of the market, all but a law of nature.

Except along comes American sport to show us another way. First, there are those rules on revenue-sharing that so frustrated Liverpool's new owners. All the money that, say, a baseball team makes – from tickets, TV rights and merchandise – is taxed by the major league that runs the sport and spread around the other clubs, so that the richest cannot dwarf the rest. That isn't because the titans of Major League Baseball have read too much Marx. It's because they understand that their sport is worth nothing if it stops being a real competition, if only a handful of the wealthiest teams ever have a chance of winning. Redistributing the wealth around the league ensures their sport doesn't become boring. It does not level the playing field, but it comes very close.

The proof is in the stats so beloved of sporting obsessives. Over the past 19 seasons, 12 different teams have won baseball's biggest prize. In the 19 seasons since the Premier League was created, only four teams have won; Manchester United alone have won the title 12 of those 19 times.

It's not just revenue-sharing that ensures true competition. In American football and basketball a salary cap applies, limiting how much each club can pay in wages and thereby preventing the richest teams making their domination permanent by snapping up all the best players. (A "luxury tax" performs a similar function in baseball.) In the same spirit, teams in all major US sports submit to a "draft", in which they take turns picking from a pool of newly eligible players, so that the equivalent of Chelsea or Manchester City can't gobble up all the fresh talent, but instead have to let the Blackburns or Wigans have a go.

Put like that, it seems fantastical. Who can imagine Old Trafford voluntarily snaffling less of the pie, so that clubs in smaller cities with smaller grounds, and therefore weaker gate receipts, get a look in? And yet English football used to work just like that. When the founders of the Football League gathered in a Manchester hotel in 1888, they fretted over how they might ensure that a fixture between, say, Derby County and Everton remained a real contest. They agreed the home side should give a proportion of its takings to the visitors, a system that held firm till 1983.

Clubs shared the TV money when it came too, spreading it around all 92 league clubs. But the big teams always resented subsidising the minnows; indeed, the Premier League was formed out of the biggest 20 clubs' express desire to keep Rupert Murdoch's millions for themselves. That TV money is at least partly spread throughout the Premier League, but now there are noises about ending even that small nod towards wealth-sharing, so that the biggest half-dozen teams can keep every penny for themselves.

Not for the first time, it's fallen to Europe to act. Upcoming Uefa "financial fair play" rules will require teams to live within their earnings, which should put an end to the sugar daddy handouts of Man City and Chelsea. But that 2014 change will push clubs to maximise their revenue, which is bound, in turn, to mean even less sharing. Football will still be a game determined by who has most money.

There are three consequences of this strange gulf between our rules and those across the Atlantic. First, football's most storied clubs have become attractive to foreign tycoons who sniff a licence to print money, unrestricted. Second, we've established a model that is inherently unsustainable, involving colossal debts that cripple all those without a billionaire to bail them out. Since 1992, league clubs and one Premier League team – Portsmouth – have fallen insolvent 55 times. Third, we risk killing the golden goose, turning an activity that should be thrilling into a non-contest whose outcome is all but preordained.

Hmm, a system that sees our biggest names falling to leveraged takeovers – think Kraft's buy-up of Cadbury – thereby selling off the crown jewels of our collective culture in the name of a rampant capitalism that is both unsustainable and ultimately joyless. That doesn't just sound like the state of the national game, that sounds like the state of the nation.

Subscribe to:

Comments (Atom)