As you approach Jersey by air, your plane’s shadow touches cliffs rising from the English Channel, then patchwork fields with wooded dingles between them, then four‑square buildings with groomed lawns. Down below, the island is lush and verdant, set in a sparkling procession of eastward-marching waves. It looks like a bit of Devon that ran away to sea and did rather well for itself.

John Christensen grew up in one of those handsome houses, a Norman manor surrounded by fields. “It was heaven,” he said. “There were fantastic beaches, a strong sense of fun, because of the tourism industry. The Beatles played at Springfield in 1963, stuff like that. It was cool.”

Christensen, who was born in 1956, is almost exactly the same age as Jersey’s offshore finance industry. While he was playing with his brothers in the grand rooms of the family home, Jersey lawyers were spotting one of the most profitable loopholes in history.

At that time, the world severely restricted the movement of money. Politicians blamed financial speculators for the Great Depression of the 1930s, and had imposed capital controls to prevent something similar happening again. Pounds were trapped in Britain, where taxes were high. If a person died wealthy, their heirs had to give 80% of any inheritance over £1m to the government.

There was Jersey’s business opportunity: the island had no inheritance tax. If wealthy Brits invested their millions in Jersey, some now-forgotten genius realised, the UK exchequer could not touch them. The money poured in, because the schemes did not end with inheritance: almost any tax could be avoided there, if you planned it right. Where wealthy individuals started, banks soon followed, utterly transforming the island. Bankers and tax exiles moved into St Peter, the parish where Christensen grew up, driving up prices and importing the values and conversation of the City of London to this improbable place.

“Who wants to pay taxes on profits in London when you could do it in Jersey?” Christensen recalled. “It was changing enormously, particularly by the early 1970s when the really big players began to establish themselves.”

Today, the offices of those big players form a wall of glass along the seafront of Jersey’s capital, St Helier: Credit Suisse, Citi, HSBC, Société Générale, PWC. And they oversee a vast amount of money. By 2007, Jersey – home to just 100,000 people – held almost £220bn of deposits, and administered another £221bn of funds, as well as hundreds of billions in trusts. The finance sector’s profits that year were more than £1bn, unemployment was barely 1%, and gross national income per person was significantly higher than in Britain or the US.

From the waterfront, the money spreads inland. St Helier is a prosperous resort with cafes, theatres and covered markets. It is cleaner, busier, neater, brighter than almost any seaside town you will find on the British mainland. Appearances are deceptive, however. Jersey looks rich – but it is heading towards bankruptcy.

In April, officials announced that the budget would be short £125m a year by 2019. “What went wrong?” asked the Jersey Evening Post. And that was just the start of it. By June, the annual deficit – now known on the island as the “black hole” – had been revised upwards to £145m, more than £1 in every five that the government spends. “The black hole is so big,” according to Connect, a Jersey business magazine, that “filling it will take the equivalent of shutting down every school in the island, laying off every teacher, letting the parks turn into overgrown jungles and having our roads literally fall apart.”

That is quite a hole, and the question is, how can Jersey fill it? The solutions are not pretty: voluntary redundancies, compulsory redundancies, new taxes, fewer public services.

Jersey bet its future on finance, allowing its other industries to shrivel, in the belief that it could live well in perpetuity from moving other people’s money around. If that belief was false, then does its fate await another island off the coast of France – one that has also pledged its future to finance? In short, is Jersey’s worrying present Britain’s bleak future?

* * *

Jersey is 19 miles from France, 85 miles from England. It is not a country, nor is it part of another country. It is half-British, half-something-else – 45 square miles of self-governing ambiguity entirely surrounded by water. It gained this peculiar status in 1204, when King John lost the Duchy of Normandy to France. Or rather, he lost most of it. He managed to keep the duchy’s offshore possessions – Jersey, Guernsey, Alderney, Sark, Herm, plus assorted rocks, reefs and islets, collectively known as the Channel Islands.

The French took a while to accept the situation: London and Paris tussled over the islands for almost 300 years. Eventually, however, Pope Sixtus IV intervened and, in 1481, issued a papal bull of neutrality. England and France could wage war, but the Channel Islands, by religious injunction, could not. The result was that Jersey traded unimpeded with both sides, and thus its enchanted inbetween life began.

This ambiguous status – Jersey was British enough to have the pound but not British enough to pay taxes – lay at the heart of the island’s offshore industry. By the end of the 1960s, Jersey’s banks had deposits of almost £300m, 10 times the per capita ratio of the UK. In 1970 alone, deposits increased by 45%, and then kept on rising.

The gentleman farmers that ran the island had no experience running an offshore financial centre. So, in 1969, they poached an English economist named Colin Powell from the government of Northern Ireland, to help them understand what was going on. He has guided finance’s colonisation of Jersey ever since, in one role or another. (Some people call him “Jersey’s Jeeves”, which is not exactly flattering to the gentlemen farmers.)

Mount Orgueil Castle overlooking Grouville Bay in Gorey, Jersey. The island looks prosperous but is going broke. Photograph: Alamy

Powell’s approach to British taxes was curiously anarchic for a government economist, akin to the contempt of early pirate radio DJs for the overmighty BBC. “If the attractions of Jersey as a low-tax area stem from the high levels of UK taxation, the island should not be criticised for offering an escape,” Powell argued, in a study of Jersey’s economy published in 1971. In other words: if laws are dumb, there is nothing wrong with working around them.

Jersey did very well out of the strategy that Powell mapped out for it, and the 1970s continued where the 1960s left off. Many of the big North American, European and British banks opened branches in St Helier. They brought the money in and sent it out again, often on the same day. But that allowed them to, in essence, stamp “Made in Jersey” on it, rather than “Made in Britain”, which lowered the tax burden. Jersey’s officials began to describe the island as a “specialist offshoot of the City”: London without the rules, or the taxes.

Powell turned 80 this year, and his current official role is to advise Jersey’s government on “international affairs”. He is long-nosed and lean, and has a disconcertingly precise power of recall over almost any detail of his five decades on the island. He came to Jersey at a time when the British empire’s decline was almost complete. As the old colonies gained independence, Brits returned home, and there were fewer and fewer places to stash their hard-earned pounds out of the reach of Her Majesty’s tax collectors. In 1974, the UK’s top marginal rate of tax on investments income hit 98%. Faced with the prospect of keeping just tuppence of every pound in dividends they earned, rich Britons put as much into Jersey as they could.

“They know that Jersey has political stability, doesn’t have political parties. It’s not going to be faced with a sudden swing to the left, or swing to the right, or whatever direction, a change of tax arrangements. It’s also got fiscal stability,” Powell explained, during a long evening interview in his surprisingly modest office in St Helier.

Foreign businesses that registered in Jersey paid no tax at all, while the local banks, lawyers, accountants, and administrators that helped them paid 20% on their incomes – a fraction of that paid by their counterparts in the UK. The rate was low but, with this much business going on, the government’s coffers swelled. In the three decades after Powell took over, Jersey’s annual budget increased, in real terms, fivefold.

Jersey built new schools, new hospitals, new roads, a new harbour, a new marina. Unemployment was barely 2%. The government had so much money that it squirrelled away a year’s worth of expenditure just in case. And all the time, income tax was only 20p in the pound. There was no inheritance tax; no VAT; no capital gains tax; no tax on corporate profits if your business was outside Jersey. Compare that with strife-torn Britain where, until the very end of Margaret Thatcher’s time in office, the top marginal rate of income tax was 60%, and one in eight adults was out of work.

A gushing article published in 1984 by Chatham House’s World Today magazine noted that Jersey residents had almost twice as many phones per household as Brits, and more than twice as many cars. The island was a miracle of plenty, which somehow combined a comprehensive welfare state with tax rates to satisfy enthusiastic libertarians. Its reputation was of a well-regulated haven in the midst of the political turmoil then afflicting the UK, and the money kept pouring in.

By the end of the 1980s, Jersey had evolved from simply serving UK depositors keen to avoid tax. It was now happy to help anyone, from anywhere, to avoid anything. When officials in Moscow wanted to hide the Communist party’s funds in the last days of the Soviet Union, they put them in Jersey. When post-Soviet oligarchs wanted to obscure their ownership of assets, they structured them through Jersey. When South Africans wanted to avoid apartheid-related sanctions, they did so through Jersey.

By the end of the 1980s, Jersey was happy to help anyone, from anywhere, to avoid anything

Powell had so much work to do keeping track of the economy he had unleashed that, in 1987, he hired an assistant, John Christensen, the local boy from the Norman manor house. Middle-aged men from Jersey are often of a particular type. They are slim and straight-backed, tanned and neat, with an accent that is somewhere between BBC and colonial. Christensen, who is now 59, is the type’s epitome.

Christensen had volunteered for Oxfam while studying in Britain, and was never a particularly enthusiastic recruit to his native island’s new industry. He remembers complaining about how Jersey was keeping money for corrupt African officials, and being told “nobody gives a shit about Africa anyway”. Over the years, he became increasingly troubled by the amount of dirty money coming in, and the fact no one on the island appeared to care.

For Christensen, the final indignity came in 1993 when a foreign exchange trader defrauded investors (mostly Americans) out of $26m via a Jersey subsidiary – a scam that local authorities refused to investigate for years.

When the scandal attracted the attention of a reporter from the Wall Street Journal a few years later, there was little doubt about the identity of Jersey’s “senior civil servant” who said, of his colleagues: “They are totally out of their depth”. It was effectively Christensen’s resignation letter. He felt that the island was helping foreign villains hide stolen wealth, and wanted no part of it. Besides, the business seemed to be doing as much harm as good to Jersey itself.

“Price inflation had made house prices and labour market costs so high that virtually no other industry apart from finance – international finance – could survive,” Christensen explained. “The housing market was at London levels, no locals could afford to buy, unless they were employed either in the public sector or the finance sector.”

Jersey had not heard the last of him, however. Now there may be times when Powell wishes he had never hired Christensen at all.

* * *

In 1998, the day after quitting his job, John Christensen quit Jersey too, taking with him a decade’s worth of pent-up frustration and a whole lot of insider knowledge. He resolved to reveal what he knew about how offshore finance really works, which has made him an irritant to Jersey’s authorities and a hero to its critics: the closest thing the island has to a Trotsky.

Perhaps his most notable comrade in this struggle is the accountant and Quaker Richard Murphy, whom he met by chance in 2002. “Richard and John have done magical things, absolute miracles,” said Pat Lucas, a teacher on Jersey and another veteran campaigner against the offshore industry. “They have changed the whole narrative.”

Christensen and Murphy were among the founders of the Tax Justice Network(TJN), which investigates the offshore industry, and publishes a Financial Secrecy Index, to assess how tax havens attract illicit cash.

The biennial index, launched in 2009, has consistently ranked Jersey in or close to the top 10 jurisdictions facilitating “illicit financial flows and capital flight” – ahead of the British Virgin Islands, Panama and Gibraltar. Newspapers from around the world picked up on the studies, and highlighted Jersey’s role in sucking wealth out of the countries that need it most.

Every new version of the index was a grenade of bad publicity lobbed at Jersey, increasingly damaging to the island’s reputation. Jersey Finance, the government-funded body for promoting the island’s financial industry, dismissed the 2013 index as “contrived propaganda”, but officials struggled to gain much of a hearing, something many of them appear to find extremely frustrating.

John Christensen, director of the Tax Justice Network and the closest thing Jersey has to a Trotsky. Photograph: Martin Godwin for the Guardian

Christensen and Murphy are not solely responsible for Jersey’s troubles but sometimes, when talking to officials, you could be forgiven for thinking they were. (At one point during my interview with the former treasury and resources minister Philip Ozouf, he appeared temporarily to forget he was talking to me. “What’s wrong about that, Mr Murphy? That’s good stuff,” he said, as if fantasising about taking on the turbulent accountant.)

As for Christensen, it is an article of faith on Jersey that he only criticises the island because, in 1998, he did not get a promotion. (“It’s baggage, yeah,” said John Harris, of the Jersey Financial Services Commission, the island’s regulator. “He has baggage, serious baggage.”) This is something Christensen denies, though he is not the kind of man to get into a slanging match.

Murphy, on the other hand, is combative – he advised Jeremy Corbyn during his leadership campaign for the Labour party – and has no such reservations. “They have for 10 years refused to accept that, fundamentally, their business model is, to use a technical term, fucked,” he told me.

If Christensen, Murphy and their gang had been Jersey’s only opponents, the island’s feelings would be hurt, but it would otherwise probably remain unharmed. In Brussels, however, the island has enemies with more powerful weapons than bad publicity. Officials in European countries were furious about Jersey helping their citizens avoid taxes. In 1997, they began to take action.

In a new code of conduct, the EU insisted that all members (as well as those jurisdictions that wanted equal access to its market, such as Jersey) tax local and non-local companies the same. The rules were not to be imposed for another decade, but it was immediately clear that they threatened to destroy Jersey’s business model, which was reliant on giving foreign companies tax advantages denied to locals.

Technically, officials had a choice: they could either raise taxes for foreigners, or cut them for locals, providing everyone ended up being treated the same way. In reality, however, Jersey had no choice at all – not if it wanted to keep its finance industry. Dozens of other small jurisdictions had followed its lead into financial services and, if it raised taxes for everyone to 20%, all the lucrative trade would evaporate from its computer screens, only to condense in places with lower levies: the Isle of Man, Dublin, Singapore or Hong Kong.

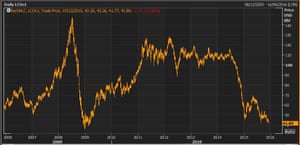

So, in 2008, it abolished taxes for all companies except financial firms (which pay 10%) and utilities (which were left with the 20% rate). The two main tax bands gave the policy its name: Zero-10. And thus, the black hole opened. Between 2009 and 2010, tax receipts from companies fell by almost two-thirds: from £218m to £83m.

As public awareness of the black hole has grown, so has criticism of the government. “This was, once upon time, an inclusive island where we all felt as one, whether you were a politician or a road sweeper or a nurse, whoever. We all shared in the prosperity,” said Nick Corbel, head of Jersey’s branch of Unite, when we met in May. “As a Jerseyman, as someone who was born on the island, and I can trace my heritage back, I love this island, love its people, I love how we used to do things here. But it’s depressing, personally depressing, seeing where this island’s heading, the total lack of compassion and understanding from our leaders There is nothing there at all, they’re absolutely cold.”

Ozouf, the architect of Zero-10, lost his ministerial position after last autumn’s elections, and now works as a sort of roving ambassador. It was in that capacity that we met in Jersey’s Westminster office in September. He is passionate, fluent, charming and prone to speaking in extremely long sentences, without taking a breath. He immediately launched a long denial of the existence of a black hole at all.

“Let’s be clear about what a black hole is. A black hole is an amount of money, which needs to be found in order for the government to put in place its plan to make substantial investments in education and healthcare and improve our society.”

There is something in what he says – nearly half of the deficit is indeed caused by extra spending on healthcare and education – but that is not really the point. The criticism stems from how the government has tried to fill the black hole that it opened. In 2008, it introduced a sales tax, which now adds 5% to the price of almost everything. That has not raised enough money, so now it is looking at other charges: including for medical services, sewage disposal, and more. It is looking to cut benefits for pensioners, single parents and young people, and to lay off public sector workers.

Officials argue that there is significant room for cuts, and perhaps there is. In Jersey, the average state employee earns £900 a week, almost twice the equivalent salary in the UK. However you look at it, though, ordinary people, through higher prices and pay freezes, job losses and benefit cuts, are plugging a hole left by a massive corporate tax break. By 2012, the sales tax was raising more revenue than the tax on companies.

But Ozouf continues to insist that Jersey had no choice. He needed to cut taxes to keep finance on the island, not least because there are no other industries left to plug the gap.

* * *

There is a claim often made in Jersey that the local economy is a stool with three legs: finance, tourism and agriculture. Before finance, tourism was the sturdiest of the three and the basis of the island’s prosperity. Jersey’s message to postwar British holidaymakers was simple but effective: we’re like France, but without the French people. In 1979, almost 1.5 million people came to Jersey on holiday, the place where you could speak English and eat chips. In 2014, there were just 338,000. The Jersey tourism industry has, essentially, collapsed.

The number of beds in the island’s hotels has almost halved since the late 1990s, and many of the businesses that are left look tired. One hotel on the waterfront in St Helier advertises Fawlty Towers-themed dining nights. It looks out onto a salt-water pool that fills up at high tide, so swimmers do not have to walk out across the beach for a dip. There is a market for that, obviously, but it is not a growing one.

Ted Vibert, 77, ran Jersey’s tourism promotion campaign in the early 1960s, and despairs of what has happened to the island. When we spoke this summer, he had just been to Cyprus for a week at a beachfront hotel, where he could eat and drink as much as he liked, for £400 all in. Low-cost airlines, improved communications, and easier travel have all made foreign holidays cheaper, and Jersey has not tried to compete. Vibert blames finance. It pushed up prices, attracted the best talent, and drew the government’s attention away from tourism. Who needs the hassle of serving tea to middle-aged Brits when you already have more cash than you know what to do with?

Before tourism, the third leg of the stool – agriculture – did most work supporting the island. Jersey is sunny and fertile. Its high-quality woollen goods gave a name – “jersey” – to any kind of long-sleeved top. Jersey cattle, with their deliciously rich milk, and Jersey royal potatoes are famous well beyond the island.

But when I walked for six hours across the island in September, from the airport eastwards, then up to the north coast, I saw just one dairy herd – a clump of honey-gold cows blinking stupidly over a gate – and not much sign of anything but fallow fields, waiting for the potatoes to be planted again in spring. In the 1980s, Jersey glittered with greenhouses growing tomatoes, broccoli, cauliflowers and flowers for the UK market. It does not any more.

“It’s been a gradual decline from the 1970s, when finance took off,” said Graham Le Lay, president of the Jersey Farmers’ Union. “Generally the island is much more prosperous because of it. It’s just unfortunate that it’s been the farmers who’ve been the meat in the sandwich.”

Jersey in the late 1950s, when the island’s offshore finance industry opened for business. Photograph: Popperfoto/Getty Images

Jersey’s financial sector is now seven times larger than the agricultural and hospitality sectors put together. Since the 1970s, the island’s economy has lost two legs, and now Jersey is worryingly dependent on that last leg staying strong.

Jersey has no thinktanks or pollsters. The only daily newspaper, the Jersey Evening Post, was until recently owned by the chief minister, and even now tends to follow the government’s line. As a result, it is extremely hard to get a sense of what ordinary Jerseymen and women think about the transformation of their home from a bucket-and-spade tourist resort to the frontline of financialisation.

It was while looking for pointers that I came across Marigold Dark, a racy dystopian thriller about an alcoholic Jersey private eye confronted with corrupt coppers, amoral financiers and a wealthy foreign oligarch keen to buy up the island. The fictional locals in the book, which was published in March, are resigned to their fate. “We all know that foreign money has the run of this place,” one says. “But it’s quite another thing altogether to openly replace the Jersey flag with a set of splayed arse cheeks and a dollar sign.”

The author, Paul Bisson, is an English teacher in St Helier. The book, he told me, is a satire, but it reflects a genuine unease about what has happened to the island. “The finance industry has been good to Jersey in the years gone by. But what irks me is the fact we seem to have put too many eggs in one basket, it’s almost like we’ve surrendered part of our soul to finance,” he said, over tea in a cafe in the middle of St Helier. He did not really know if other people shared his concerns. Most people don’t much like to talk about it, he told me.

Most people prefer not to get engaged in politics at all. The States Assembly influences every aspect of life on Jersey, and crafts the regulations for the island’s financial sector, but it does so with almost no popular involvement. Turnout in St Helier was less than 30% in last year’s general election.

The speaker of the assembly – the bailiff, who is also the chief judge – is unelected, while its members are chosen from a talent pool slightly smaller than that of Crawley borough council. That’s a worrying prospect for anyone keen on rigorous oversight, and it has translated into important aspects of financial regulation going through on the nod.

It is hardly surprising that Jersey’s politicians should want to protect its finance sector, however, even at the cost of the rest of the economy disappearing. The miracle of offshore has conjured wealth for everyone lucky enough to live on Jersey. In betting terms, Jersey picked the fastest and strongest horse in the field, and staked its future on it. Then the horse had a heart attack.

* * *

It is only when the tide goes out, Warren Buffett has said of financial skulduggery, that you discover who has been swimming naked. When the credit crunch sucked the liquidity out of the world’s markets, Jersey was revealed to be not so much skinny-dipping, as dumping toxic waste on the beach.

The first inklings of Jersey’s role in the greatest financial crisis in history came in August 2007, when HBOS – the bank created out of Halifax and the Bank of Scotland – announced it was going to loan money to a Jersey-registered debt vehicle named Grampian Funding, which had assets of £18bn.

“News that Grampian existed, never mind that it was the largest banking conduit in Europe and now needed financial assistance from its parent, came as a total shock, akin to discovering a face you thought you were familiar with had suddenly grown an enormous protrusion,” the Scotsman wrote at the time.

And, as grim news followed grim news that autumn, bank after bank – among them, most dramatically, Northern Rock – admitted that they too had their own Jersey-based shadow operations funding the mortgages that eventually blew up the British financial system.

The problems of the struggling banks mostly came down to the same thing: they borrowed money, processed it and lent it out via a giant financial sausage machine. That was not a problem as long as there was money available. As soon as the credit supply stopped, however, there was no meat to go in the sausages, and the whole machine seized up. So how come no one noticed what the banks were up to? They put the sausage machines in Jersey, in something called charitable trusts. When you create a trust, you no longer own your assets, so you do not have to declare ownership, but the trustee carries out the instructions you issued when you did own them. There is no public register of trusts.

Jersey’s financial sector is now seven times larger than the agricultural and hospitality sectors put together. Since the 1970s, the island’s economy has lost two legs, and now Jersey is worryingly dependent on that last leg staying strong.

Jersey has no thinktanks or pollsters. The only daily newspaper, the Jersey Evening Post, was until recently owned by the chief minister, and even now tends to follow the government’s line. As a result, it is extremely hard to get a sense of what ordinary Jerseymen and women think about the transformation of their home from a bucket-and-spade tourist resort to the frontline of financialisation.

It was while looking for pointers that I came across Marigold Dark, a racy dystopian thriller about an alcoholic Jersey private eye confronted with corrupt coppers, amoral financiers and a wealthy foreign oligarch keen to buy up the island. The fictional locals in the book, which was published in March, are resigned to their fate. “We all know that foreign money has the run of this place,” one says. “But it’s quite another thing altogether to openly replace the Jersey flag with a set of splayed arse cheeks and a dollar sign.”

The author, Paul Bisson, is an English teacher in St Helier. The book, he told me, is a satire, but it reflects a genuine unease about what has happened to the island. “The finance industry has been good to Jersey in the years gone by. But what irks me is the fact we seem to have put too many eggs in one basket, it’s almost like we’ve surrendered part of our soul to finance,” he said, over tea in a cafe in the middle of St Helier. He did not really know if other people shared his concerns. Most people don’t much like to talk about it, he told me.

Most people prefer not to get engaged in politics at all. The States Assembly influences every aspect of life on Jersey, and crafts the regulations for the island’s financial sector, but it does so with almost no popular involvement. Turnout in St Helier was less than 30% in last year’s general election.

The speaker of the assembly – the bailiff, who is also the chief judge – is unelected, while its members are chosen from a talent pool slightly smaller than that of Crawley borough council. That’s a worrying prospect for anyone keen on rigorous oversight, and it has translated into important aspects of financial regulation going through on the nod.

It is hardly surprising that Jersey’s politicians should want to protect its finance sector, however, even at the cost of the rest of the economy disappearing. The miracle of offshore has conjured wealth for everyone lucky enough to live on Jersey. In betting terms, Jersey picked the fastest and strongest horse in the field, and staked its future on it. Then the horse had a heart attack.

* * *

It is only when the tide goes out, Warren Buffett has said of financial skulduggery, that you discover who has been swimming naked. When the credit crunch sucked the liquidity out of the world’s markets, Jersey was revealed to be not so much skinny-dipping, as dumping toxic waste on the beach.

The first inklings of Jersey’s role in the greatest financial crisis in history came in August 2007, when HBOS – the bank created out of Halifax and the Bank of Scotland – announced it was going to loan money to a Jersey-registered debt vehicle named Grampian Funding, which had assets of £18bn.

“News that Grampian existed, never mind that it was the largest banking conduit in Europe and now needed financial assistance from its parent, came as a total shock, akin to discovering a face you thought you were familiar with had suddenly grown an enormous protrusion,” the Scotsman wrote at the time.

And, as grim news followed grim news that autumn, bank after bank – among them, most dramatically, Northern Rock – admitted that they too had their own Jersey-based shadow operations funding the mortgages that eventually blew up the British financial system.

The problems of the struggling banks mostly came down to the same thing: they borrowed money, processed it and lent it out via a giant financial sausage machine. That was not a problem as long as there was money available. As soon as the credit supply stopped, however, there was no meat to go in the sausages, and the whole machine seized up. So how come no one noticed what the banks were up to? They put the sausage machines in Jersey, in something called charitable trusts. When you create a trust, you no longer own your assets, so you do not have to declare ownership, but the trustee carries out the instructions you issued when you did own them. There is no public register of trusts.

The Esplanade in St Helier, Jersey, home to many of the island’s offshore banking offices. Photograph: Alamy

Jersey’s trust law allowed banks to obscure the vast number of mortgages they were issuing, making it look like HBOS was safe from the US housing crash when actually it had $30bn invested in American mortgages. This enthusiastic lending stripped banks of the cushions of cash they normally keep to protect them if their loans go bad. When the market collapsed, the banks were unprotected. They had been so greedy for business, they had undermined their own future.

Such misuse of trusts was not new. The US energy giant Enron had used Jersey to hide the extent of its debts prior to its collapse in 2001. What was new in the credit crunch was quite how much this chicanery ended up costing the British taxpayer.

On 17 February 2008, Britain said it would nationalise Northern Rock (which had its own Jersey trust named Granite), the first in a series of banks brought into public ownership. The final cost of picking up the pieces of these exploded banks was in the hundreds of billions of pounds. Jersey did not contribute a penny to cleaning up the mess it had made.

The US, Britain and the EU have since obliged Jersey to exchange information on any citizens using the island’s banks, some of which now refuse to serve UK-resident clients.

This has all put Jersey officials on the defensive, and they have hired academics to combat their troublingly persistent critics. One report examined the impact of Jersey on the UK, and argued that it supported 180,000 British jobs. Another report last year suggested that Jersey could be central to attracting investment into Africa. A third report defended offshore finance, and dismissed the Tax Justice Network’s calculation that tax havens hide up to $32tn from proper scrutiny.

“Their argument [that of the TJN] is largely based on the fact that it [offshore finance] is illegitimate and not transparent and I think that’s just, like, so 10 years ago. These guys need to get up to speed,” said John Harris, director general of the Jersey Financial Services Commission. “The requirements we put through are as strict as anywhere in the world, and a damn sight better than mainland economies.”

Chief Minister of Jersey Ian Gorst and other officials insist that the island is now more transparent than many onshore jurisdictions. (In 2015, the island fell to 16th on the TJN’s financial secrecy index, behind Germany, the US, Japan and the UK.) Gorst and his allies say that Jersey’s new approach is shown in the case of General Sani Abacha, the brutal 1990s military ruler of Nigeria. Yes, Jersey looked after his money in the bad old days but, in 2014, Jersey returned £315m to the Nigerian authorities. It no longer wants that kind of client.

They insist that this is a reformed Jersey, running neighbourly policies with the rest of the world, filling a niche for a well-regulated offshore jurisdiction. But does that niche exist? If Jersey cannot act like a tax haven, what exactly is the point of it? That, anyway, is what the world’s banks appear to have concluded.

The number of banks licensed on Jersey fell from 73 at the turn of the millennium to 33 last year. Bank deposits peaked in 2007 and by 2014 had fallen by almost 40% to £136.6 billion. The island’s financial industry contracted by a third over the same period, and the number of its clients fell by a sixth in 2014 alone.

Meanwhile, the rest of Jersey’s economy is worryingly hollow. One in 10 of its jobs are now based on zero hours contracts, compared to one in 40 in the UK.

One in 10 of Jersey's jobs are now based on zero hours contracts, compared to one in 40 in the UK

All of this makes it look less and less likely that Jersey will be able to raise the taxes it needs to fill its black hole, which means that there is a lesson here for Britain. With high property prices, a brain drain into financial services, successive governments favouring banking over other industries, and a revolving door between finance and public administration, the parallels between Jersey and its larger island neighbour are too obvious to ignore. In fact, the Tax Justice Network has a name for the phenomenon: “the finance curse”.

“For two decades, I’ve heard Jersey politicians promising to diversify the island’s economy, but the island is now more dependent on offshore finance than it was 20 years ago,” Christensen said. “If George Osborne is serious about wanting to build a northern powerhouse, he should read up on the finance curse and take appropriate measures to tackle the dominance of the City of London.”

* * *

Jersey, however, appears as determined as ever to ignore Christensen’s warnings. The government has been touring the world in search of new business, in south-east Asia, the Middle East, in Russia and in Africa. “[The world] changed very dramatically during the financial crisis,” Chief Minister Gorst told the assembly in June. “We are in a fight. We are in a fight for our survival. We are in a fight for jobs and the prosperity of our children.”

His government is building new offices, to house the people who will move the money around, when it arrives. Key to this strategy is the Jersey International Finance Centre, a vast new project that will add half a million square feet of floorspace to the office buildings along St Helier’s esplanade. The architect’s plans for the first block show a glass and steel box, with a woman in high-heeled sandals striding briskly past, files under her arm. The sun is shining, the pavement is free of litter.

It looks lovely, but locals are not convinced, not least because there are as yet almost no companies to go into these offices. In June, some 3,000 protesters formed a human chain around the site and waved signs asking “What part of NO don’t you understand?”

In October, a committee from the States Assembly said the project was not commercially viable, posed a considerable risk to the public purse, and would cost more money than it would earn. Only one tenant has signed up to lease premises in the new development, which looks extraordinarily speculative for a government already facing a cash crunch. Construction has begun anyway.

Perhaps Jersey has bet so much on finance that it can no longer afford to stop increasing its stake. It will have to keep doubling its bet until the money runs out. If it cannot live forever from finance, it looks like it is going to die in the attempt.