'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label coal. Show all posts

Showing posts with label coal. Show all posts

Thursday, 2 March 2023

Wednesday, 16 August 2017

Adani mining giant faces financial fraud claims as it bids for Australian coal loan

by Michael Safi in The Guardian

Exclusive: Allegations by Indian customs of huge sums being siphoned off to tax havens from projects are contained in legal documents but denied by company

Details of the alleged 15bn rupee (US$235m) fraud are contained in an Indian customs intelligence notice obtained by the Guardian, excerpts of which are published for the first time here.

The directorate of revenue intelligence (DRI) file, compiled in 2014, maps out a complex money trail from India through South Korea and Dubai, and eventually to an offshore company in Mauritius allegedly controlled by Vinod Shantilal Adani, the older brother of the billionaire Adani Group chief executive, Gautam Adani.

Vinod Adani is the director of four companies proposing to build a railway line and expand a coal port attached to Queensland’s vast Carmichael mine project.

The proposed mine, which would be Australia’s largest, has been the source of years of intense controversy, legal challenges and protests over its possible environmental impact.

Abbot Point, surrounded by wetlands and coral reefs, is set to become the world’s largest coal port should the proposed Adani expansion go ahead. Photograph: Tom Jefferson / Greenpeace

Expanding the coal port to accommodate the mine will require dredging an estimated 1.1m cubic metres of spoil near the Great Barrier Reef marine park. Coal from the mine will also produce annual emissions equivalent to those of Malaysia or Austria according to one study.

One of the few remaining hurdles for the Adani Group is to raise finance to build the mine as well as a railway line to transport coal from the site to a port at Abbot Point on the Queensland coast.

To finance the railway Adani hopes to persuade the Northern Australia Infrastructure Facility (Naif), an Australian government-backed investment fund, to loan the Adani Group or a related entity about US$700m (A$900m) in public money.

While it awaits the decision on the loan, in Delhi the company is also expecting the judgment of a legal authority appointed under Indian financial crime laws in connection to allegations it siphoned borrowed money overseas.

The Adani Group fully denies the accusations, which it has challenged in submissions to the authority.

The investigation

News of the investigation was first reported in India three years ago, but the full customs intelligence document reveals forensic details of the workings of the alleged fraud which have not been publicly revealed.

The 97-page file accuses the Adani Group of ordering hundreds of millions of dollars’ worth of equipment for an electricity project in western India’s Maharashtra state using a front company in Dubai.

To read the pdf click here.

The Dubai company allegedly sold the exact same equipment back to Adani Group-controlled businesses in India at massively inflated prices, in some instances said to be eight times the sale price.

According to the allegations in the file, the effect of these transactions was that the Adani Group spent an average 400% more for the materials. That money was allegedly paid to a company Indian authorities allege was owned through a series of shell companies leading to a Mauritius trust controlled by Vinod Adani.

If true, one effect of the alleged scheme would have been to move vast sums of money from the Adani Group’s domestic accounts into offshore bank accounts where it could no longer be taxed or accounted for.

Because tariffs for using electricity transmission networks are determined partly by what they cost to build, if the DRI’s accusations are correct, the overvaluation of capital goods would have been likely to have led to higher power prices for Indian consumers.

Adani Power company thermal power plant at Mundra, India. Photograph: Sam Panthaky/AFP/Getty Images

A significant proportion of the money the Adani Group allegedly siphoned out of India was provided by taxpayers in the form of loans from the publicly-owned State Bank of India and ICICI, a private bank. There is no suggestion either bank was aware of or involved in any illegal activity.

‘We are cooperating with investigating agencies’

The Adani Group said in a statement to the Guardian on behalf of itself, its subsidiaries, and Vinod Adani that it “strongly denies the allegations of overvaluation”.

Government loan to Adani could be tainted by interference, economists say

“It is a standard procedure for the group to follow international competitive bidding route for major capital expenditures to ensure transparency and competitiveness in the process. All our transactions are always conducted within the framework of extant regulatory guidelines and provisions,” it said.

“The fact that our projects have incurred the lowest cost across central, state and private utility players has gone to establish the robustness of the processes followed by our group.

“It may be noted that Mr Vinod Adani who is the elder brother of Mr Gautam Adani has been a non-resident Indian for about 30 years and has his own established business interests outside India,” the statement said.

“Adani Group is aware of the investigations being conducted by the DRI, and has fully cooperated, and shall continue to cooperate with the investigating agencies.”

The Australian loan

The Adani Group, or a linked entity, has reportedly been granted “conditional approval” for the US$700m (AU$900m) concessional loan from Naif, the Australian government investment fund.

But due to secrecy around the operation of the investment fund, it is not clear whether the loan application discloses the existence of the DRI notice or the ongoing legal proceedings, or whether the applicant is required to do so under the Naif’s anti-money laundering provisions.

Adani Group chairman Gautam Adani meets with Queensland premier Annastacia Palaszczuk in 2016. Photograph: Cameron Laird/AAP

Adani Group did not clarify whether it had informed Naif about the allegations when asked by the Guardian.

Naif’s investment mandate includes a clause preventing it from “act[ing] in a way that is likely to cause damage to the commonwealth government’s reputation, or that of a relevant state or territory government”.

Vinod Adani is currently listed as the sole director of four Singapore-based companies which, through their Australian subsidiaries, are proposing to build the railway line using the government loan. The companies also control a project to expand the Abbot Point port.

All four entities are ultimately owned by Atulya Resources Limited, an Adani-controlled company in the Cayman Islands.

Status of the Indian investigation

The Guardian understands the allegations of over-invoicing have been passed from the DRI to the Enforcement Directorate (ED), an Indian agency tasked with investigating financial crimes.

The Adani Group says the case is currently before a legal authority, the Adjudicating Authority, indicating that Indian officials are pressing either to seize assets they regard as being connected to money laundering or to levy a fine up to three times the sum allegedly siphoned overseas.

The company declined requests to clarify what if any penalty the authorities are seeking, but a spokesman said a decision was expected shortly. “We follow the process of corporate governance and comply with the applicable laws,” he said.

“All our transactions are always conducted within the framework of law. We have already submitted our detailed reply. Adjudication process on the subject is going on and we expect the order in near future.”

The Guardian is publishing excerpts from the DRI file in the interests of ensuring Naif, as well as the public, have access to as much relevant information as possible in assessing whether Adani or linked companies would be suitable recipients of public money.

In a separate case last year, six Adani subsidiaries were listed among 40 other companies being investigated for allegedly running a similar price-inflation scheme. The companies are accused of inflating the price of coal imports from Indonesia to hide profits in overseas tax havens.

The DRI and the ED did not respond to a request to clarify the status of the investigations.

The alleged money trail

India is electricity-starved. More than 240 million Indians – enough people to form the fifth-largest country on Earth – lack access to regular power.

In the early 1990s, to encourage power companies to build electrical infrastructure, the Indian government eliminated import tariffs on technical equipment such as reactors and transformers. Profit margins on these projects increased overnight.

Adani saw the business opportunity. In 2010, the Maharashtra Eastern Grid Power Transmission Company Limited (MEGPTCL), a wholly owned subsidiary of Adani Enterprises, was granted a license to develop two electricity transmission networks in the north-east of the state.

The company used another Adani subsidiary, PMC Projects, to source the equipment it would need to build the networks. In turn, PMC, subcontracted the work to a company in Dubai.

According to the investigators’ report, bank records suggest that that company, Electrogen Infra FZE (EIF), charged significant – and to Indian authorities, suspicious – markups on the equipment it sold to PMC.

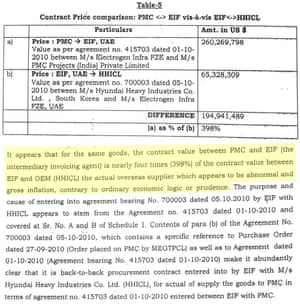

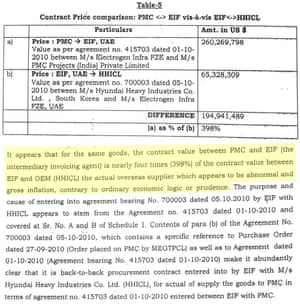

In one of the 57 invoices cited in the report, EIF is alleged to have ordered equipment from Hyundai Heavy Industries in South Korea. Bank records allegedly show the company paid Hyundai about US$65m.

According to the DRI, it sold the same equipment to PMC for about US$260m – a mark-up of nearly 400%.

Extract from page 14-15 of the Directorate of Revenue Intelligence file on Adani Group. Photograph: The Guardian

“[This] appears to be an abnormal and gross inflation, contrary to ordinary economic logic and prudence,” investigators concluded.

In total, the report alleges EIF made about 26 orders from Hyundai Heavy Industries and sold them onto PMC for an average mark-up of more than 400%, making a profit margin of US$189m.

There is no suggestion Hyundai Heavy Industries or any other supplier was aware of or involved in any illegality.

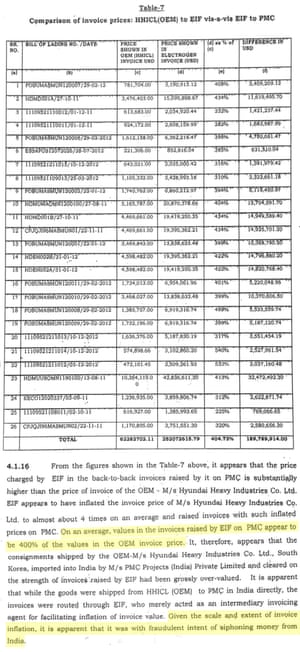

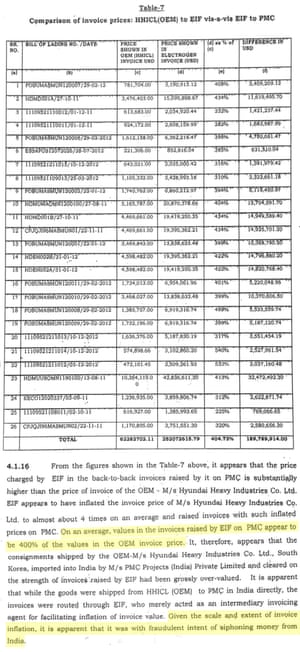

Extract page 19-20 of the DRI file, section 4.1.16. Photograph: The Guardian

EIF allegedly purchased another 25 shipments of equipment from three companies in China. According to the report, these were sold to the Adani Group for an average markup of about 860%.

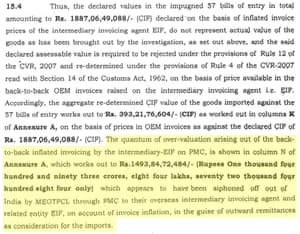

Investigators calculated the total assessable value of the allegedly marked-up invoices to be nearly 15bn rupees.

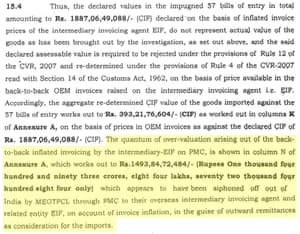

Extract from page 78-79 of the DRI file, section 15.4. Photograph: The Guardian

“Given the scale and extent of invoice inflation, it is apparent that it [was done] with fraudulent intent of siphoning money from India,” the DRI said.

Who controls the companies?

Key to the alleged fraud, according to investigators, is that EIF, the company subcontracted to purchase the equipment from manufacturers in South Korea and China, was directly controlled by the Adani Group and its associates.

Investigators claim EIF was partly staffed by ex-Adani Group employees who had recently left the company.

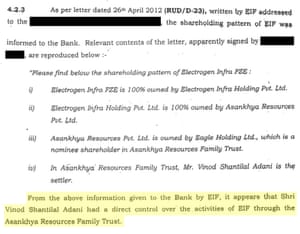

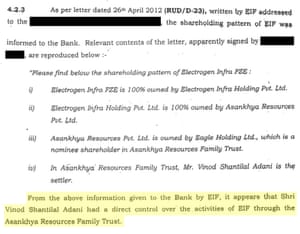

According to a letter from the company to an Indian bank that is cited in the notice, EIF was owned by another company called Electrogen Infra Holding Pvt Ltd (EIH). The trail of ownership eventually leads to a trust based in Mauritius – headed by Vinod Adani.

Extract from page 21-22 of the DRI file, section 4.2.3. Photograph: The Guardian

Investigators concluded: “From the above information given to the bank by EIF, it appears that Vinod Adani had a direct control over the activities of EIF through the Asankhya Resources Family Trust.”

Vinod Adani is also listed as having been the director of EIH between January 2010 and May 2011, though the notice states he told investigators he had no involvement in the day-to-day running of the company.

Investigators also claim to have discovered that an employee of the Adani Group subsidiary PMC had been granted permission by EIF staff to sign multimillion-dollar supply contracts on its behalf.

“All these go to show that there is no distinction between PMC and EIF, they are only working for common interest as part of a large modus-operandi for siphoning off money from India by invoice inflation,” investigators concluded.

The DRI and the ED were both contacted for comment. Attempts were made to contact EIF but the company could not be reached on its listed email or phone number.

Hyundai Heavy Industries did not respond to a request for comment.

It is unclear when the allegations of invoice inflation will be resolved in Delhi other than the Adani spokesman saying that they expected an order “in near future.” In Queensland, Naif’s decision on whether to grant Adani the nearly A$1bn loan is expected by the end of this year.

Exclusive: Allegations by Indian customs of huge sums being siphoned off to tax havens from projects are contained in legal documents but denied by company

Men wearing masks of Australian prime minister Malcolm Turnbull and Adani chairman Gautam Adani protest outside Parliament House in Canberra. Photograph: Lukas Coch/AAP

A global mining giant seeking public funds to develop one of the world’s largest coal mines in Australia has been accused of fraudulently siphoning hundreds of millions of dollars of borrowed money into overseas tax havens.

Indian conglomerate the Adani Group is expecting a legal decision in the “near future” in connection with allegations it inflated invoices for an electricity project in India to shift huge sums of money into offshore bank accounts.

A global mining giant seeking public funds to develop one of the world’s largest coal mines in Australia has been accused of fraudulently siphoning hundreds of millions of dollars of borrowed money into overseas tax havens.

Indian conglomerate the Adani Group is expecting a legal decision in the “near future” in connection with allegations it inflated invoices for an electricity project in India to shift huge sums of money into offshore bank accounts.

Details of the alleged 15bn rupee (US$235m) fraud are contained in an Indian customs intelligence notice obtained by the Guardian, excerpts of which are published for the first time here.

The directorate of revenue intelligence (DRI) file, compiled in 2014, maps out a complex money trail from India through South Korea and Dubai, and eventually to an offshore company in Mauritius allegedly controlled by Vinod Shantilal Adani, the older brother of the billionaire Adani Group chief executive, Gautam Adani.

Vinod Adani is the director of four companies proposing to build a railway line and expand a coal port attached to Queensland’s vast Carmichael mine project.

The proposed mine, which would be Australia’s largest, has been the source of years of intense controversy, legal challenges and protests over its possible environmental impact.

Abbot Point, surrounded by wetlands and coral reefs, is set to become the world’s largest coal port should the proposed Adani expansion go ahead. Photograph: Tom Jefferson / Greenpeace

Expanding the coal port to accommodate the mine will require dredging an estimated 1.1m cubic metres of spoil near the Great Barrier Reef marine park. Coal from the mine will also produce annual emissions equivalent to those of Malaysia or Austria according to one study.

One of the few remaining hurdles for the Adani Group is to raise finance to build the mine as well as a railway line to transport coal from the site to a port at Abbot Point on the Queensland coast.

To finance the railway Adani hopes to persuade the Northern Australia Infrastructure Facility (Naif), an Australian government-backed investment fund, to loan the Adani Group or a related entity about US$700m (A$900m) in public money.

While it awaits the decision on the loan, in Delhi the company is also expecting the judgment of a legal authority appointed under Indian financial crime laws in connection to allegations it siphoned borrowed money overseas.

The Adani Group fully denies the accusations, which it has challenged in submissions to the authority.

The investigation

News of the investigation was first reported in India three years ago, but the full customs intelligence document reveals forensic details of the workings of the alleged fraud which have not been publicly revealed.

The 97-page file accuses the Adani Group of ordering hundreds of millions of dollars’ worth of equipment for an electricity project in western India’s Maharashtra state using a front company in Dubai.

To read the pdf click here.

The Dubai company allegedly sold the exact same equipment back to Adani Group-controlled businesses in India at massively inflated prices, in some instances said to be eight times the sale price.

According to the allegations in the file, the effect of these transactions was that the Adani Group spent an average 400% more for the materials. That money was allegedly paid to a company Indian authorities allege was owned through a series of shell companies leading to a Mauritius trust controlled by Vinod Adani.

If true, one effect of the alleged scheme would have been to move vast sums of money from the Adani Group’s domestic accounts into offshore bank accounts where it could no longer be taxed or accounted for.

Because tariffs for using electricity transmission networks are determined partly by what they cost to build, if the DRI’s accusations are correct, the overvaluation of capital goods would have been likely to have led to higher power prices for Indian consumers.

Adani Power company thermal power plant at Mundra, India. Photograph: Sam Panthaky/AFP/Getty Images

A significant proportion of the money the Adani Group allegedly siphoned out of India was provided by taxpayers in the form of loans from the publicly-owned State Bank of India and ICICI, a private bank. There is no suggestion either bank was aware of or involved in any illegal activity.

‘We are cooperating with investigating agencies’

The Adani Group said in a statement to the Guardian on behalf of itself, its subsidiaries, and Vinod Adani that it “strongly denies the allegations of overvaluation”.

Government loan to Adani could be tainted by interference, economists say

“It is a standard procedure for the group to follow international competitive bidding route for major capital expenditures to ensure transparency and competitiveness in the process. All our transactions are always conducted within the framework of extant regulatory guidelines and provisions,” it said.

“The fact that our projects have incurred the lowest cost across central, state and private utility players has gone to establish the robustness of the processes followed by our group.

“It may be noted that Mr Vinod Adani who is the elder brother of Mr Gautam Adani has been a non-resident Indian for about 30 years and has his own established business interests outside India,” the statement said.

“Adani Group is aware of the investigations being conducted by the DRI, and has fully cooperated, and shall continue to cooperate with the investigating agencies.”

The Australian loan

The Adani Group, or a linked entity, has reportedly been granted “conditional approval” for the US$700m (AU$900m) concessional loan from Naif, the Australian government investment fund.

But due to secrecy around the operation of the investment fund, it is not clear whether the loan application discloses the existence of the DRI notice or the ongoing legal proceedings, or whether the applicant is required to do so under the Naif’s anti-money laundering provisions.

Adani Group chairman Gautam Adani meets with Queensland premier Annastacia Palaszczuk in 2016. Photograph: Cameron Laird/AAP

Adani Group did not clarify whether it had informed Naif about the allegations when asked by the Guardian.

Naif’s investment mandate includes a clause preventing it from “act[ing] in a way that is likely to cause damage to the commonwealth government’s reputation, or that of a relevant state or territory government”.

Vinod Adani is currently listed as the sole director of four Singapore-based companies which, through their Australian subsidiaries, are proposing to build the railway line using the government loan. The companies also control a project to expand the Abbot Point port.

All four entities are ultimately owned by Atulya Resources Limited, an Adani-controlled company in the Cayman Islands.

Status of the Indian investigation

The Guardian understands the allegations of over-invoicing have been passed from the DRI to the Enforcement Directorate (ED), an Indian agency tasked with investigating financial crimes.

The Adani Group says the case is currently before a legal authority, the Adjudicating Authority, indicating that Indian officials are pressing either to seize assets they regard as being connected to money laundering or to levy a fine up to three times the sum allegedly siphoned overseas.

The company declined requests to clarify what if any penalty the authorities are seeking, but a spokesman said a decision was expected shortly. “We follow the process of corporate governance and comply with the applicable laws,” he said.

“All our transactions are always conducted within the framework of law. We have already submitted our detailed reply. Adjudication process on the subject is going on and we expect the order in near future.”

The Guardian is publishing excerpts from the DRI file in the interests of ensuring Naif, as well as the public, have access to as much relevant information as possible in assessing whether Adani or linked companies would be suitable recipients of public money.

In a separate case last year, six Adani subsidiaries were listed among 40 other companies being investigated for allegedly running a similar price-inflation scheme. The companies are accused of inflating the price of coal imports from Indonesia to hide profits in overseas tax havens.

The DRI and the ED did not respond to a request to clarify the status of the investigations.

The alleged money trail

India is electricity-starved. More than 240 million Indians – enough people to form the fifth-largest country on Earth – lack access to regular power.

In the early 1990s, to encourage power companies to build electrical infrastructure, the Indian government eliminated import tariffs on technical equipment such as reactors and transformers. Profit margins on these projects increased overnight.

Adani saw the business opportunity. In 2010, the Maharashtra Eastern Grid Power Transmission Company Limited (MEGPTCL), a wholly owned subsidiary of Adani Enterprises, was granted a license to develop two electricity transmission networks in the north-east of the state.

The company used another Adani subsidiary, PMC Projects, to source the equipment it would need to build the networks. In turn, PMC, subcontracted the work to a company in Dubai.

According to the investigators’ report, bank records suggest that that company, Electrogen Infra FZE (EIF), charged significant – and to Indian authorities, suspicious – markups on the equipment it sold to PMC.

In one of the 57 invoices cited in the report, EIF is alleged to have ordered equipment from Hyundai Heavy Industries in South Korea. Bank records allegedly show the company paid Hyundai about US$65m.

According to the DRI, it sold the same equipment to PMC for about US$260m – a mark-up of nearly 400%.

Extract from page 14-15 of the Directorate of Revenue Intelligence file on Adani Group. Photograph: The Guardian

“[This] appears to be an abnormal and gross inflation, contrary to ordinary economic logic and prudence,” investigators concluded.

In total, the report alleges EIF made about 26 orders from Hyundai Heavy Industries and sold them onto PMC for an average mark-up of more than 400%, making a profit margin of US$189m.

There is no suggestion Hyundai Heavy Industries or any other supplier was aware of or involved in any illegality.

Extract page 19-20 of the DRI file, section 4.1.16. Photograph: The Guardian

EIF allegedly purchased another 25 shipments of equipment from three companies in China. According to the report, these were sold to the Adani Group for an average markup of about 860%.

Investigators calculated the total assessable value of the allegedly marked-up invoices to be nearly 15bn rupees.

Extract from page 78-79 of the DRI file, section 15.4. Photograph: The Guardian

“Given the scale and extent of invoice inflation, it is apparent that it [was done] with fraudulent intent of siphoning money from India,” the DRI said.

Who controls the companies?

Key to the alleged fraud, according to investigators, is that EIF, the company subcontracted to purchase the equipment from manufacturers in South Korea and China, was directly controlled by the Adani Group and its associates.

Investigators claim EIF was partly staffed by ex-Adani Group employees who had recently left the company.

According to a letter from the company to an Indian bank that is cited in the notice, EIF was owned by another company called Electrogen Infra Holding Pvt Ltd (EIH). The trail of ownership eventually leads to a trust based in Mauritius – headed by Vinod Adani.

Extract from page 21-22 of the DRI file, section 4.2.3. Photograph: The Guardian

Investigators concluded: “From the above information given to the bank by EIF, it appears that Vinod Adani had a direct control over the activities of EIF through the Asankhya Resources Family Trust.”

Vinod Adani is also listed as having been the director of EIH between January 2010 and May 2011, though the notice states he told investigators he had no involvement in the day-to-day running of the company.

Investigators also claim to have discovered that an employee of the Adani Group subsidiary PMC had been granted permission by EIF staff to sign multimillion-dollar supply contracts on its behalf.

“All these go to show that there is no distinction between PMC and EIF, they are only working for common interest as part of a large modus-operandi for siphoning off money from India by invoice inflation,” investigators concluded.

The DRI and the ED were both contacted for comment. Attempts were made to contact EIF but the company could not be reached on its listed email or phone number.

Hyundai Heavy Industries did not respond to a request for comment.

It is unclear when the allegations of invoice inflation will be resolved in Delhi other than the Adani spokesman saying that they expected an order “in near future.” In Queensland, Naif’s decision on whether to grant Adani the nearly A$1bn loan is expected by the end of this year.

Sunday, 6 December 2015

The India that says no

Tunku Varadarajan in the Indian Express

Prime Minister Narendra Modi addressing during the International Solar Alliance in Paris on Monday. (PTI Photo)

Prime Minister Narendra Modi addressing during the International Solar Alliance in Paris on Monday. (PTI Photo)

As foreign pundits took aim at India, the director of the Indian cricket team was quick to shoot back. “Which rule tells me the ball can’t turn on Day One?” said a mouthy Ravi Shastri. “Where does it tell me in the rulebook it can only swing and seam?” India has to sink or swim when playing abroad, so touring teams should expect no different in India.

Prime Minister Narendra Modi addressing during the International Solar Alliance in Paris on Monday. (PTI Photo)

Prime Minister Narendra Modi addressing during the International Solar Alliance in Paris on Monday. (PTI Photo)

These last days have seen a fascinating demonstration of righteous assertiveness by Indians. In Paris, Narendra Modi was at the world climate conference defending India’s right to burn coal, it being the cheapest and most profuse of the country’s present sources of energy, entirely mined at home (unlike oil, imported from the world’s volatile hell-holes, and over whose price India has little positive control).

Back in smoggy India, another leader, India’s Test cricket captain Virat Kohli, was defending the country’s repeated resort to slow, turning pitches in the series against South Africa, this type of pitch being the most reliable source of victory at home for the spin-focused Indian cricket team.

In both cases, what we were seeing was a species of indignant, nationalist pushback against standards set by the West, and Western expectations of “fair play” that work to India’s apparent disadvantage.

Modi was blunt and eloquent. Having “powered their way to prosperity on fossil fuel when humanity was unaware of its impact”, he wrote in an op-ed in the Financial Times, it was “morally wrong” of the industrialised West to deny India the right to use the same sources of energy today to pull its people out of poverty. “Justice demands that, with what little carbon we can still safely burn, developing countries are allowed to grow.”

The message embedded here was that the West is guilty of double-standards in seeking to deny India access to the very fuels that had served the occident so well for centuries — and for doing so just as India is primed for a Great Leap Forward. In response to his assertion of India’s transitional developmental rights, Modi earned patronising lectures from the usual suspects, including the tirelessly sanctimonious The New York Times.

Double-standards were also the theme of the Indian cricket complaint. Responding to the barrage of English and Australian criticisms of the Nagpur pitch — where South Africa were spin-dried in just three days — the captain, manager and players of the Indian team took a leaf out of Modi’s book. Why are your standards the norm, they said to Western critics, and our standards — Indian standards — the aberration?

At issue is the belief, rife in English and Australian cricket circles, that green pitches that seam and bounce are fair and manly, the proper surfaces on which to play a game of cricket. These are the pitches one encounters in England and Australia because they are the natural products of local conditions. They also suit the style of play of teams from these countries, while cramping the style of visiting Indian players.

In contrast, Indian pitches are bereft of grass and turn early in a Test match. They are described by foreign cricket writers — often the loudest promoters of the too-much-spin-is-immoral school of thought — as Dust Bowls, conjuring images of famine, and of hardscrabble conditions unsuited to civilised cricket.

As foreign pundits took aim at India, the director of the Indian cricket team was quick to shoot back. “Which rule tells me the ball can’t turn on Day One?” said a mouthy Ravi Shastri. “Where does it tell me in the rulebook it can only swing and seam?” India has to sink or swim when playing abroad, so touring teams should expect no different in India.

As with cricket, so with carbon. “The lifestyles of a few must not crowd out the opportunities for many,” said Modi in Paris. Hands off our coal. And hands off our pitches. This is the India that can say No.

Subscribe to:

Comments (Atom)