'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label money laundering. Show all posts

Showing posts with label money laundering. Show all posts

Saturday, 7 October 2023

Monday, 30 January 2023

Friday, 5 July 2019

How Britain can help you get away with stealing millions: a five-step guide

Dirty money needs laundering if it’s to be of any use – and the UK is the best place in the world to do it writes Oliver Bullough in The Guardian

Kleptocrats, fraudsters and crooks steal hundreds of billions of pounds, dollars and euros from the rest of us every year, but that gives them a problem: how can they stop the rest of us knowing what they’ve done with the proceeds? They have to stop their haul looking suspicious, to cleanse it of any criminal taint, or face losing their hard-stolen cash.

Money laundering, as this process is known, is notoriously difficult to uncover, investigate and prosecute. Occasionally, however, an insider breaks cover – someone such as Howard Wilkinson, who blew the whistle on perhaps the largest money-laundering scheme in history, the movement of €200bn of suspect funds through the Estonian branch of Denmark’s biggest bank between 2007 and 2015, most of it earned in the dodgier corners of the former Soviet Union, some perhaps belonging to Vladimir Putin himself.

“No one really knows where this money went,” Wilkinson, a former Danske Bank employee, told Denmark’s parliament last year. Once the money had got into the global financial system, “it was clean, it was free.”

Britain’s most famous money launderer is HSBC, thanks to its systematic cleansing of the earnings of the Latin American drug cartels over the second half of the last decade, for which it was fined $1.9bn by the US government in 2012. But that was a tiny operation compared to the Danske Bank scandal. If gathered together, the suspect funds moved through the bank’s Estonian outpost could buy HSBC, with more than enough left over to buy Danske Bank too.

The scandal has been big news in Denmark and Estonia, but barely grazed public consciousness in the UK. This is strange, because Britain played a key role. All of the owners of the bank accounts that first aroused Wilkinson’s suspicions had their identity hidden behind corporate structures registered in the UK – including Lantana Trade LLP, the one that may have been connected to Putin. That means this is not just a Russian, Estonian or Danish scandal, but something far closer to home. In November, Wilkinson told a European parliament committee that the countries hosting these companies are just as culpable. “Worst of all is the United Kingdom,” he said. “The United Kingdom is an absolute disgrace.”

The British government is supposedly committed to tackling grand corruption and financial crime, yet Britain’s involvement in this mega-scandal has never been mentioned in parliament, or been addressed by ministers. It is far from the first time that British companies have been involved in high-profile money-laundering. Among the characters who have used British shell companies to hide their money are Paul Manafort, disgraced former chairman of Donald Trump’s election campaign, and Viktor Yanukovich, overthrown president of Ukraine, among thousands of lower-profile opportunists.

It is increasingly hard to avoid the conclusion that Britain tolerates this kind of behaviour deliberately, because of the money it brings into to our economy.

That being so, why should hardened criminals be the only ones getting rich off Britain’s lax enforcement? Here’s how you too can use British shell companies to cleanse your dirty money – in five easy steps.

Step 1: Forget what you think you know

If you have ambitions to steal a lot of money, forget about using cash. Cash is cumbersome, risky and highly limiting. Even if Danske Bank had used the highest denomination banknotes available to it, that €200bn would have weighed 400 tonnes, an amount four times heavier than a blue whale. Just moving it would have been a serious logistical challenge, let alone hiding it. It would have been a magnet for thieves, and would have attracted some unwelcome questions at customs.

If you want to commit significant financial crime, therefore, you need a bank account, because electronic cash weighs nothing, no matter how much of it there is. But that causes a new problem: the bank account will have your name on it, which will alert the authorities to your identity if they come looking.

This is where shell companies come in. Without a company, you have to act in person, which means your involvement is obvious and overt: the bank account is in your name. But using a company to own that bank account is like robbing a house with gloves on – it leaves no fingerprints, as long as the company’s ownership information is hidden from the authorities. This is why all sensible crooks do it.

The next question is what jurisdiction you will choose to register your shell company in. If you Google “offshore finance”, you’ll see photos of tropical islands with palm trees, white sands and turquoise waters. These represent the kind of jurisdictions – “sunny places for shady people” – where we expect to find shell companies. For decades, places such as Anguilla, the British Virgin Islands, Gibraltar and others sold the companies that people hide behind when committing their crimes. But in recent years, the world has changed – those jurisdictions have been cajoled, bullied and persuaded to keep good records of company ownership, and to reveal those records when police officers come looking. They are no longer as useful as they used to be.

So where is? This is where the UK comes in. When it comes to financial crime, Britain is your best friend.

Here is the secret you need to know to get started in the shell company game: the British company registration system contains a giant loophole – the kind of loophole you can drive a billion euros through without touching the sides. That is why UK shell companies have enabled financial crime all over the world, from giant acts of kleptocratic plunder to sad and squalid frauds that rob pensioners of their retirement savings.

So, step one: forget what you think you know about offshore finance. The true image associated with “shell companies” these days should not be an exotic island redolent of the sound of the sea and the smell of rum cocktails, but a damp-stained office block in an unfashionable London suburb, or a nondescript street in a northern city. If you want to set up in the money-laundering business, you don’t need to move to the Caribbean: you’d be far better off doing it from the comfort of your own home.

Steps 1-4: A brief recap

So, to summarise the tricks so far, if you want to create an impenetrable weapon for committing fraud: first, forget about the supposed offshore centres and come to the UK; then take advantage of the super-easy Companies House web portal; then enter false information; and finally make sure that information is plausible enough to deceive a casual observer.

We’re nearly there. It’s time for the final step.

Following his conviction, Brewer’s company National Business Register was removed from the list that Companies House publishes of company formation agents, which had been a key source of new business for him. “There are company formation agents on that list who have permitted huge amounts of fraud, and I’ve been excluded for trying to expose it. I find it incredible that they should turn a blind eye,” he told me. “Is it deliberate? Are they actually trying to get this money into the UK? I don’t want to believe it, but I can’t explain it any other way.”

We don’t know the answer to that, but it does give us lesson number five: don’t worry about it. Commit as much fraud as you like, fill your boots, the only reason anyone would care is if you kick up a fuss. And what sensible fraudster is going to do that?

Kleptocrats, fraudsters and crooks steal hundreds of billions of pounds, dollars and euros from the rest of us every year, but that gives them a problem: how can they stop the rest of us knowing what they’ve done with the proceeds? They have to stop their haul looking suspicious, to cleanse it of any criminal taint, or face losing their hard-stolen cash.

Money laundering, as this process is known, is notoriously difficult to uncover, investigate and prosecute. Occasionally, however, an insider breaks cover – someone such as Howard Wilkinson, who blew the whistle on perhaps the largest money-laundering scheme in history, the movement of €200bn of suspect funds through the Estonian branch of Denmark’s biggest bank between 2007 and 2015, most of it earned in the dodgier corners of the former Soviet Union, some perhaps belonging to Vladimir Putin himself.

“No one really knows where this money went,” Wilkinson, a former Danske Bank employee, told Denmark’s parliament last year. Once the money had got into the global financial system, “it was clean, it was free.”

Britain’s most famous money launderer is HSBC, thanks to its systematic cleansing of the earnings of the Latin American drug cartels over the second half of the last decade, for which it was fined $1.9bn by the US government in 2012. But that was a tiny operation compared to the Danske Bank scandal. If gathered together, the suspect funds moved through the bank’s Estonian outpost could buy HSBC, with more than enough left over to buy Danske Bank too.

The scandal has been big news in Denmark and Estonia, but barely grazed public consciousness in the UK. This is strange, because Britain played a key role. All of the owners of the bank accounts that first aroused Wilkinson’s suspicions had their identity hidden behind corporate structures registered in the UK – including Lantana Trade LLP, the one that may have been connected to Putin. That means this is not just a Russian, Estonian or Danish scandal, but something far closer to home. In November, Wilkinson told a European parliament committee that the countries hosting these companies are just as culpable. “Worst of all is the United Kingdom,” he said. “The United Kingdom is an absolute disgrace.”

The British government is supposedly committed to tackling grand corruption and financial crime, yet Britain’s involvement in this mega-scandal has never been mentioned in parliament, or been addressed by ministers. It is far from the first time that British companies have been involved in high-profile money-laundering. Among the characters who have used British shell companies to hide their money are Paul Manafort, disgraced former chairman of Donald Trump’s election campaign, and Viktor Yanukovich, overthrown president of Ukraine, among thousands of lower-profile opportunists.

It is increasingly hard to avoid the conclusion that Britain tolerates this kind of behaviour deliberately, because of the money it brings into to our economy.

That being so, why should hardened criminals be the only ones getting rich off Britain’s lax enforcement? Here’s how you too can use British shell companies to cleanse your dirty money – in five easy steps.

Step 1: Forget what you think you know

If you have ambitions to steal a lot of money, forget about using cash. Cash is cumbersome, risky and highly limiting. Even if Danske Bank had used the highest denomination banknotes available to it, that €200bn would have weighed 400 tonnes, an amount four times heavier than a blue whale. Just moving it would have been a serious logistical challenge, let alone hiding it. It would have been a magnet for thieves, and would have attracted some unwelcome questions at customs.

If you want to commit significant financial crime, therefore, you need a bank account, because electronic cash weighs nothing, no matter how much of it there is. But that causes a new problem: the bank account will have your name on it, which will alert the authorities to your identity if they come looking.

This is where shell companies come in. Without a company, you have to act in person, which means your involvement is obvious and overt: the bank account is in your name. But using a company to own that bank account is like robbing a house with gloves on – it leaves no fingerprints, as long as the company’s ownership information is hidden from the authorities. This is why all sensible crooks do it.

The next question is what jurisdiction you will choose to register your shell company in. If you Google “offshore finance”, you’ll see photos of tropical islands with palm trees, white sands and turquoise waters. These represent the kind of jurisdictions – “sunny places for shady people” – where we expect to find shell companies. For decades, places such as Anguilla, the British Virgin Islands, Gibraltar and others sold the companies that people hide behind when committing their crimes. But in recent years, the world has changed – those jurisdictions have been cajoled, bullied and persuaded to keep good records of company ownership, and to reveal those records when police officers come looking. They are no longer as useful as they used to be.

So where is? This is where the UK comes in. When it comes to financial crime, Britain is your best friend.

Here is the secret you need to know to get started in the shell company game: the British company registration system contains a giant loophole – the kind of loophole you can drive a billion euros through without touching the sides. That is why UK shell companies have enabled financial crime all over the world, from giant acts of kleptocratic plunder to sad and squalid frauds that rob pensioners of their retirement savings.

So, step one: forget what you think you know about offshore finance. The true image associated with “shell companies” these days should not be an exotic island redolent of the sound of the sea and the smell of rum cocktails, but a damp-stained office block in an unfashionable London suburb, or a nondescript street in a northern city. If you want to set up in the money-laundering business, you don’t need to move to the Caribbean: you’d be far better off doing it from the comfort of your own home.

Step 2: Set up a company

The second step is easy, and involves creating a company on the Companies House website. Companies House maintains the UK’s registry of corporate structures and publishes information on shareholders, directors, accounts, partners and so on, so anyone can check up on their bona fides.

Setting up a company costs £12 and takes less than 24 hours. According to the World Bank’s annual Doing Business report, the UK is one of the easiest places anywhere to create a company, so you’ll find the process pretty straightforward.

This is another reason not to bother with places like the British Virgin Islands: setting up a company there will cost you £1,000, and you’ll have to go through an agent who will insist on checking your identity before doing business with you. Global agreements now require agents to verify their clients’ identity, to conduct the same kind of “due diligence” process demanded when opening a bank account. Almost all the traditional tax havens have been forced to comply with the rules, or face being blacklisted by the world’s major economies.

This means there are now few jurisdictions left where you can create a genuinely anonymous shell company – and those that remain look so dodgy that your company will practically scream “Beware! Fraudster!” to anyone you try to do business with.

But Britain is an exception. While it has bullied the tax havens into checking up on their customers, Britain itself doesn’t bother with all those tiresome and expensive “due diligence” formalities. It is true that, while registering your company on the Companies House website, you will find that it asks for information such as your name and address. On the face of it, that might look worrying. If you have to declare your name and address, then how will your company successfully shield your identity when you engage in industrial-scale fraud?

Do not be concerned, just read on.

The second step is easy, and involves creating a company on the Companies House website. Companies House maintains the UK’s registry of corporate structures and publishes information on shareholders, directors, accounts, partners and so on, so anyone can check up on their bona fides.

Setting up a company costs £12 and takes less than 24 hours. According to the World Bank’s annual Doing Business report, the UK is one of the easiest places anywhere to create a company, so you’ll find the process pretty straightforward.

This is another reason not to bother with places like the British Virgin Islands: setting up a company there will cost you £1,000, and you’ll have to go through an agent who will insist on checking your identity before doing business with you. Global agreements now require agents to verify their clients’ identity, to conduct the same kind of “due diligence” process demanded when opening a bank account. Almost all the traditional tax havens have been forced to comply with the rules, or face being blacklisted by the world’s major economies.

This means there are now few jurisdictions left where you can create a genuinely anonymous shell company – and those that remain look so dodgy that your company will practically scream “Beware! Fraudster!” to anyone you try to do business with.

But Britain is an exception. While it has bullied the tax havens into checking up on their customers, Britain itself doesn’t bother with all those tiresome and expensive “due diligence” formalities. It is true that, while registering your company on the Companies House website, you will find that it asks for information such as your name and address. On the face of it, that might look worrying. If you have to declare your name and address, then how will your company successfully shield your identity when you engage in industrial-scale fraud?

Do not be concerned, just read on.

Step 3: Make stuff up

This third step may be the hardest to really take in, because it seems too simple. Since 2016, the UK government has made it compulsory for anyone setting up a company to name the individual who actually owns it: “the person with significant control”, or PSC. Before this reform it was possible to own a company with another company and, if that company was not British, the actual owner could hide their identity.

In theory, the introduction of the PSC rule should have prevented the use of a British shell company to anonymously commit financial crime. Don’t worry though, because it didn’t. Here is the secret: no one checks the accuracy of the information you provide when you register with Companies House. You can say pretty much anything and Companies House will accept it.

So this is step three: when you’re entering the information to create your company, make mistakes. Suspicious typos are everywhere once you start delving into the Companies House database. For instance, many money-laundering investigations involving the former USSR eventually bump against a Belgian-based dentist, whose signature adorns the accounts of hundreds, if not thousands, of different companies, including Lantana Trade LLP. When he was tracked down to his home address in Belgium last year, the dentist claimed that his signature had been forged and that he had no connection to the companies. Whoever was filing the documents was remarkably imaginative when it came to spelling his name. Every document filed with the UK registry has the same signature, but his name is spelt in at least eight different ways: Ali Moulaye, Alli Moulaye, Aly Moulaye, Ali Moyllae, Ali Moulae, Ali Moullaye, Aly Moullaye and, oddly, Ian Virel.

With such boundless opportunities for creativity, why not have fun? Recently, while messing about on the Companies House website, I came across a PSC named Mr Xxx Stalin, who is apparently a Frenchman resident in east London. It is perhaps technically possible that Xxx is a genuine name given to Mr Stalin by eccentric parents – but, if so, such eccentric parents are remarkably widespread.

Xxx Stalin led me to a PSC of a different company, who was named Mr Kwan Xxx, a Kazakh citizen, resident in Germany; then to Xxx Raven; to Miss Tracy Dean Xxx; to Jet Xxx; and finally to (their distant cousin?) Mr Xxxx Xxx. These rabbitholes are curiously engrossing, and before long I’d found Mr Mmmmmmm Yyyyyyyyyyyyyyyyyy, and Mr Mmmmmm Xxxxxxxxxxx (correspondence address: Mmmmmmm, Mmmmmm, Mmm, MMM), at which point I decided to stop.

As trolling goes, it is quite funny, but the implications are also very serious, if you think about what companies are supposed to be for. Limited companies and partnerships have their liability for debts limited, which means that if they go bust, their investors are not personally bankrupted. It’s a form of insurance – society as a whole is accepting responsibility for entrepreneurs’ debts, because we want to encourage entrepreneurial behaviour. In return, entrepreneurs agree to publish details about their companies so we can all check what they are up to, and to make sure they’re not abusing our trust.

The whole point of the PSC registry was to stop fraudsters obscuring their identities behind shell companies, and yet, thanks to Companies House’s failure to check the information provided to it and thus to enforce the rules, they are still doing so. How exactly could society find someone who gives their identity as Mr Xxxxxxxxxxx, and their address as the chorus of a Crash Test Dummies song?

Even when the company documents provide an actual name, rather than a random selection of letters, the information is often very hard to believe. For example, in September, Companies House registered Atlas Integrate Services LLP, which declared a PSC with a date of birth that showed her to be just two months old at the time. In her two months of life, she had not only found time to get started in business, but also apparently to get married, since she was listed as “Mrs”. The LLP’s incorporation document states: “This person holds the right, directly or indirectly, to appoint or remove a majority of the persons who are entitled to take part in the management of the LLP”. It does not explain how exactly a babe in arms would achieve this.

This is not a one-off. The anti-corruption campaign group Global Witness looked into PSCs last year, and found 4,000 of them were under the age of two. One hadn’t even been born yet. At the opposite end of the spectrum, its researchers found five individuals who each controlled more than 6,000 companies. There are more than 4m companies at Companies House, which is a very large haystack to hide needles in.

You don’t actually even need to list a person as your company’s PSC. It’s permissible to say that your company doesn’t know who owns it (no, you’re not misunderstanding; that just doesn’t make sense), or simply to tie the system up in knots by listing multiple companies in multiple jurisdictions that no investigator without the time and resources of the FBI could ever properly check.

This is why step three is such an important one in the five-step pathway to creating a British shell company. If you can invent enough information when filing company accounts, then the calculation that underpins the whole idea of a company goes out of the window: you gain the protection from legal action, without giving up anything in return. It’s brilliant.

But don’t dive in just yet; there are two more steps to follow before you can be confident of doing it properly.

This third step may be the hardest to really take in, because it seems too simple. Since 2016, the UK government has made it compulsory for anyone setting up a company to name the individual who actually owns it: “the person with significant control”, or PSC. Before this reform it was possible to own a company with another company and, if that company was not British, the actual owner could hide their identity.

In theory, the introduction of the PSC rule should have prevented the use of a British shell company to anonymously commit financial crime. Don’t worry though, because it didn’t. Here is the secret: no one checks the accuracy of the information you provide when you register with Companies House. You can say pretty much anything and Companies House will accept it.

So this is step three: when you’re entering the information to create your company, make mistakes. Suspicious typos are everywhere once you start delving into the Companies House database. For instance, many money-laundering investigations involving the former USSR eventually bump against a Belgian-based dentist, whose signature adorns the accounts of hundreds, if not thousands, of different companies, including Lantana Trade LLP. When he was tracked down to his home address in Belgium last year, the dentist claimed that his signature had been forged and that he had no connection to the companies. Whoever was filing the documents was remarkably imaginative when it came to spelling his name. Every document filed with the UK registry has the same signature, but his name is spelt in at least eight different ways: Ali Moulaye, Alli Moulaye, Aly Moulaye, Ali Moyllae, Ali Moulae, Ali Moullaye, Aly Moullaye and, oddly, Ian Virel.

With such boundless opportunities for creativity, why not have fun? Recently, while messing about on the Companies House website, I came across a PSC named Mr Xxx Stalin, who is apparently a Frenchman resident in east London. It is perhaps technically possible that Xxx is a genuine name given to Mr Stalin by eccentric parents – but, if so, such eccentric parents are remarkably widespread.

Xxx Stalin led me to a PSC of a different company, who was named Mr Kwan Xxx, a Kazakh citizen, resident in Germany; then to Xxx Raven; to Miss Tracy Dean Xxx; to Jet Xxx; and finally to (their distant cousin?) Mr Xxxx Xxx. These rabbitholes are curiously engrossing, and before long I’d found Mr Mmmmmmm Yyyyyyyyyyyyyyyyyy, and Mr Mmmmmm Xxxxxxxxxxx (correspondence address: Mmmmmmm, Mmmmmm, Mmm, MMM), at which point I decided to stop.

As trolling goes, it is quite funny, but the implications are also very serious, if you think about what companies are supposed to be for. Limited companies and partnerships have their liability for debts limited, which means that if they go bust, their investors are not personally bankrupted. It’s a form of insurance – society as a whole is accepting responsibility for entrepreneurs’ debts, because we want to encourage entrepreneurial behaviour. In return, entrepreneurs agree to publish details about their companies so we can all check what they are up to, and to make sure they’re not abusing our trust.

The whole point of the PSC registry was to stop fraudsters obscuring their identities behind shell companies, and yet, thanks to Companies House’s failure to check the information provided to it and thus to enforce the rules, they are still doing so. How exactly could society find someone who gives their identity as Mr Xxxxxxxxxxx, and their address as the chorus of a Crash Test Dummies song?

Even when the company documents provide an actual name, rather than a random selection of letters, the information is often very hard to believe. For example, in September, Companies House registered Atlas Integrate Services LLP, which declared a PSC with a date of birth that showed her to be just two months old at the time. In her two months of life, she had not only found time to get started in business, but also apparently to get married, since she was listed as “Mrs”. The LLP’s incorporation document states: “This person holds the right, directly or indirectly, to appoint or remove a majority of the persons who are entitled to take part in the management of the LLP”. It does not explain how exactly a babe in arms would achieve this.

This is not a one-off. The anti-corruption campaign group Global Witness looked into PSCs last year, and found 4,000 of them were under the age of two. One hadn’t even been born yet. At the opposite end of the spectrum, its researchers found five individuals who each controlled more than 6,000 companies. There are more than 4m companies at Companies House, which is a very large haystack to hide needles in.

You don’t actually even need to list a person as your company’s PSC. It’s permissible to say that your company doesn’t know who owns it (no, you’re not misunderstanding; that just doesn’t make sense), or simply to tie the system up in knots by listing multiple companies in multiple jurisdictions that no investigator without the time and resources of the FBI could ever properly check.

This is why step three is such an important one in the five-step pathway to creating a British shell company. If you can invent enough information when filing company accounts, then the calculation that underpins the whole idea of a company goes out of the window: you gain the protection from legal action, without giving up anything in return. It’s brilliant.

But don’t dive in just yet; there are two more steps to follow before you can be confident of doing it properly.

Step 4: Lie – but do so cleverly

Most of the daft examples earlier (Mmmmmmm, Mmmmmm, Mmm, MMM) would not be useful for committing fraud, since anyone looking at them can tell they’re not serious. Cumberland Capital Ltd, however, was a different matter. It looked completely legitimate.

It controlled a company called Tropical Trade, which, in October 2016, cold-called a 63-year-old retired postal worker in Wisconsin identified in court filings as “MJ”. On the phone, a salesman offered her an investment product, which – he said – would make returns of 81%. He chatted about his wife and family and came across as “kind and trustworthy”, MJ later told police. “During two weeks in November of 2016, she allowed Tropical Trade to charge $34,500 on her Mastercard and Visa credit cards,” the filing states. When she tried to get her money back, her emails and calls were ignored, and she never saw it again.

She had fallen victim to the global epidemic of binary-options fraud. Binary options are a form of betting on the stock market that are now banned in many countries – including Israel, where much of the industry was based – since fraudsters used the idea to fix odds, keep winnings and target the vulnerable. According to the FBI, taken as a whole, these fraudsters may have been fleecing their marks of up to $10bn a year.

When US police came looking for the people behind Cumberland Capital Ltd, they searched the Companies House website and found that its director was an Australian citizen called Manford Martin Mponda. Anyone researching binary-options fraud might quickly conclude that Mponda was a kingpin. He was a serial company director, with some 80 directorships in UK-registered companies to his name, and features in dozens of complaints.

It already looked like a major scandal that British regulation was so lax that Mponda could have been allowed to conduct a global fraud epidemic behind the screen of UK-registered companies, but the reality was even more remarkable: Mponda had nothing to do with it. He was a victim, too.

Police officers suspect that, after Mponda submitted his details to join a binary-options website, his identity was stolen so it could be used to register him as a director of dozens of UK companies. The scheme was only exposed after complaints to consumer protection bodies were passed onto the City of London police, who then asked their Australian colleagues to investigate.

Companies House has since deleted Mponda’s name from documents related to dozens of other companies, but it was too late for “MJ” and thousands of other victims. A small number of the binary-options masterminds have been caught, but the money they stole has vanished into the labyrinth of interlocking shell companies, and the individuals behind Cumberland Capital have not been identified.

“Most of the binary-options firms claimed to be in the UK. People are more likely to deal with a UK company than a company in Israel, as it has a better reputation when it comes to finances,” said DS Alex Eristavi of the City of London Police’s investment fraud team. “Companies House records are provided in good faith. There’s not so much scrutiny as goes on in, say, Italy or Spain, where you have to go through the lawyers and do it properly. Here the information is submitted voluntarily. People don’t realise that, they take it as being carved in stone.”

So here is step four: don’t just lie, lie cleverly. British companies look legitimate, so look legitimate yourself. Steal a real person’s name, and put that on the company documents. Don’t put your own address on the documents, rent a serviced office to take your post: Paul Manafort used one in Finchley, the binary options fraudsters went to Liverpool, and Lantana Trade was based in the London suburb of Harrow.

The financial documents you file look better if they’ve been audited by an accountant, so file genuine-looking accounts, and claim they’ve been audited by a proper accountancy firm. That isn’t checked either, so just find an accountant online and claim you’ve employed them. Accountants quite regularly find themselves contacted about accounts they have never seen before, and make the unwelcome discovery they have been personally named as having approved them.

Most of the daft examples earlier (Mmmmmmm, Mmmmmm, Mmm, MMM) would not be useful for committing fraud, since anyone looking at them can tell they’re not serious. Cumberland Capital Ltd, however, was a different matter. It looked completely legitimate.

It controlled a company called Tropical Trade, which, in October 2016, cold-called a 63-year-old retired postal worker in Wisconsin identified in court filings as “MJ”. On the phone, a salesman offered her an investment product, which – he said – would make returns of 81%. He chatted about his wife and family and came across as “kind and trustworthy”, MJ later told police. “During two weeks in November of 2016, she allowed Tropical Trade to charge $34,500 on her Mastercard and Visa credit cards,” the filing states. When she tried to get her money back, her emails and calls were ignored, and she never saw it again.

She had fallen victim to the global epidemic of binary-options fraud. Binary options are a form of betting on the stock market that are now banned in many countries – including Israel, where much of the industry was based – since fraudsters used the idea to fix odds, keep winnings and target the vulnerable. According to the FBI, taken as a whole, these fraudsters may have been fleecing their marks of up to $10bn a year.

When US police came looking for the people behind Cumberland Capital Ltd, they searched the Companies House website and found that its director was an Australian citizen called Manford Martin Mponda. Anyone researching binary-options fraud might quickly conclude that Mponda was a kingpin. He was a serial company director, with some 80 directorships in UK-registered companies to his name, and features in dozens of complaints.

It already looked like a major scandal that British regulation was so lax that Mponda could have been allowed to conduct a global fraud epidemic behind the screen of UK-registered companies, but the reality was even more remarkable: Mponda had nothing to do with it. He was a victim, too.

Police officers suspect that, after Mponda submitted his details to join a binary-options website, his identity was stolen so it could be used to register him as a director of dozens of UK companies. The scheme was only exposed after complaints to consumer protection bodies were passed onto the City of London police, who then asked their Australian colleagues to investigate.

Companies House has since deleted Mponda’s name from documents related to dozens of other companies, but it was too late for “MJ” and thousands of other victims. A small number of the binary-options masterminds have been caught, but the money they stole has vanished into the labyrinth of interlocking shell companies, and the individuals behind Cumberland Capital have not been identified.

“Most of the binary-options firms claimed to be in the UK. People are more likely to deal with a UK company than a company in Israel, as it has a better reputation when it comes to finances,” said DS Alex Eristavi of the City of London Police’s investment fraud team. “Companies House records are provided in good faith. There’s not so much scrutiny as goes on in, say, Italy or Spain, where you have to go through the lawyers and do it properly. Here the information is submitted voluntarily. People don’t realise that, they take it as being carved in stone.”

So here is step four: don’t just lie, lie cleverly. British companies look legitimate, so look legitimate yourself. Steal a real person’s name, and put that on the company documents. Don’t put your own address on the documents, rent a serviced office to take your post: Paul Manafort used one in Finchley, the binary options fraudsters went to Liverpool, and Lantana Trade was based in the London suburb of Harrow.

The financial documents you file look better if they’ve been audited by an accountant, so file genuine-looking accounts, and claim they’ve been audited by a proper accountancy firm. That isn’t checked either, so just find an accountant online and claim you’ve employed them. Accountants quite regularly find themselves contacted about accounts they have never seen before, and make the unwelcome discovery they have been personally named as having approved them.

Steps 1-4: A brief recap

So, to summarise the tricks so far, if you want to create an impenetrable weapon for committing fraud: first, forget about the supposed offshore centres and come to the UK; then take advantage of the super-easy Companies House web portal; then enter false information; and finally make sure that information is plausible enough to deceive a casual observer.

We’re nearly there. It’s time for the final step.

Step 5: Don’t worry about it

I know what you’re thinking: it cannot be this easy. Surely you’ll be arrested, tried and jailed if you try to follow this five-step process. But if you look at what British officials do, rather than at what they say, you’ll begin to feel a lot more secure. The Business Department has repeatedly been warned that the UK is facilitating this kind of financial crime for the best part of a decade, and is yet to take any substantive action to stop it. (Though, to be fair, it did recently launch a “consultation”.)

Before 2011, only registered company-formation businesses could access Companies House’s web portal, which meant there was a clear connection between an actual verified individual and companies being created, since you could see who had created them. There was still fraud, of course, but it was relatively easy to understand who was responsible.

In 2011, then-business secretary and Liberal Democrat MP Vince Cable decided to open up Companies House, and everything changed. After Cable’s reform, anyone with an internet connection, anywhere in the world, could create a UK company in about as much time as it takes to order a couple of pizzas, and for approximately the same amount of money. The checks were gone; there was no longer any connection to a verifiably existing person; it was as easy to create a UK company as it was to set up a Twitter account. The rationale was that this would unleash the latent entrepreneurship within the British nation by making it easy to turn business ideas into thriving concerns.

Instead of unchaining a new generation of British businesspeople, however, Cable let slip the dogs of fraud. At first, this rather technical modification to an obscure corner of the British machinery of state did not garner much attention, but for people who understood what it meant it was alarming. One such person was Kevin Brewer, a Warwickshire businessman who had been in the company forming business for decades, and who attempted to warn Cable of the potential risks inherent in the new policy.

The method Brewer chose to make his warning was perhaps slightly unwise. He registered a company – John Vincent Cable Services Ltd – with Vince Cable listed as the sole shareholder, then wrote to the business secretary to explain what he had done. It was intended as a demonstration of how easy it is to file unverified information with Companies House, but it failed to focus attention in the way he had hoped. Jo Swinson MP, who worked with Cable, wrote Brewer a stern letter, telling him he should not have done what he did, and assured him that the new system was very good. Brewer concluded that the coalition government was not going to take his concerns seriously.

In 2015, there was a general election, Cable lost his seat, the Conservatives formed a majority government, and Brewer decided to try again with the same stunt. He created Cleverly Clogs Ltd, a company apparently owned by three people: James Cleverly MP, Baroness Neville-Rolfe, who was a minister in the business department, and a fictional Israeli called Ibrahim Aman. Brewer was no more successful in persuading Tories than he had been at persuading Liberal Democrats, however. At that point, he gave up on his attempt to show the government it was enabling limitless opportunities for fraud.

There is, it turns out, a simple explanation for why successive governments have failed to do anything about it. Last year, when challenged in the House of Commons, Treasury minister John Glen stated that Companies House simply couldn’t afford to check the information filed with it, since that would cost the UK economy hundreds of millions of pounds a year. This is almost certainly an exaggeration. Anti-corruption activists who have looked at the data say the cost would in fact be far less than that, but the key point is that the reform would pay for itself. As Brewer has pointed out, “the burden of cost is one thing. But the cost of fraud is far greater.”

VAT fraud alone costs the UK more than £1bn a year, while the National Crime Agency estimates the cost of all fraud to the UK economy to be £190bn. The cost to the rest of the world of the money laundering enabled by UK corporate entities is almost certainly far higher. Spending hundreds of millions of pounds to prevent hundreds of billions’ worth of crime looks like a sensible investment, however you look at the data, particularly since the remedy – obliging Companies House to check the accuracy of the information filed on its registry – would be so simple. (When I put this to Companies House, they provided the following statement: “We do not have the statutory power or capability to verify the accuracy of the information that companies provide. However, tackling abuse of the register is a key priority and that’s why we work closely with law enforcement partners to assist their investigations into suspected cases of economic crime and other offences.”)

That is not to say that the government has taken no action. It is illegal to deliberately file false information in registering a company, and punishable by up to two years in prison. In late 2017, Companies House at last alerted prosecutors to the activities of one persistent offender. The target of the prosecution was Kevin Brewer, for the crime of trying to inform politicians about how easy it is to create fake companies.

He was summonsed to appear at Redditch magistrates’ court and, on legal advice, pleaded guilty in March 2018. After adding together his fine, and the government’s costs, he is £23,324 the poorer – quite a high price to pay for blowing the whistle. He is paying it off at £1,000 a month, and remains the only person ever convicted of spoofing the UK’s corporate registry, which is quite a remarkable demonstration of Companies House’s failure to do its job.

I know what you’re thinking: it cannot be this easy. Surely you’ll be arrested, tried and jailed if you try to follow this five-step process. But if you look at what British officials do, rather than at what they say, you’ll begin to feel a lot more secure. The Business Department has repeatedly been warned that the UK is facilitating this kind of financial crime for the best part of a decade, and is yet to take any substantive action to stop it. (Though, to be fair, it did recently launch a “consultation”.)

Before 2011, only registered company-formation businesses could access Companies House’s web portal, which meant there was a clear connection between an actual verified individual and companies being created, since you could see who had created them. There was still fraud, of course, but it was relatively easy to understand who was responsible.

In 2011, then-business secretary and Liberal Democrat MP Vince Cable decided to open up Companies House, and everything changed. After Cable’s reform, anyone with an internet connection, anywhere in the world, could create a UK company in about as much time as it takes to order a couple of pizzas, and for approximately the same amount of money. The checks were gone; there was no longer any connection to a verifiably existing person; it was as easy to create a UK company as it was to set up a Twitter account. The rationale was that this would unleash the latent entrepreneurship within the British nation by making it easy to turn business ideas into thriving concerns.

Instead of unchaining a new generation of British businesspeople, however, Cable let slip the dogs of fraud. At first, this rather technical modification to an obscure corner of the British machinery of state did not garner much attention, but for people who understood what it meant it was alarming. One such person was Kevin Brewer, a Warwickshire businessman who had been in the company forming business for decades, and who attempted to warn Cable of the potential risks inherent in the new policy.

The method Brewer chose to make his warning was perhaps slightly unwise. He registered a company – John Vincent Cable Services Ltd – with Vince Cable listed as the sole shareholder, then wrote to the business secretary to explain what he had done. It was intended as a demonstration of how easy it is to file unverified information with Companies House, but it failed to focus attention in the way he had hoped. Jo Swinson MP, who worked with Cable, wrote Brewer a stern letter, telling him he should not have done what he did, and assured him that the new system was very good. Brewer concluded that the coalition government was not going to take his concerns seriously.

In 2015, there was a general election, Cable lost his seat, the Conservatives formed a majority government, and Brewer decided to try again with the same stunt. He created Cleverly Clogs Ltd, a company apparently owned by three people: James Cleverly MP, Baroness Neville-Rolfe, who was a minister in the business department, and a fictional Israeli called Ibrahim Aman. Brewer was no more successful in persuading Tories than he had been at persuading Liberal Democrats, however. At that point, he gave up on his attempt to show the government it was enabling limitless opportunities for fraud.

There is, it turns out, a simple explanation for why successive governments have failed to do anything about it. Last year, when challenged in the House of Commons, Treasury minister John Glen stated that Companies House simply couldn’t afford to check the information filed with it, since that would cost the UK economy hundreds of millions of pounds a year. This is almost certainly an exaggeration. Anti-corruption activists who have looked at the data say the cost would in fact be far less than that, but the key point is that the reform would pay for itself. As Brewer has pointed out, “the burden of cost is one thing. But the cost of fraud is far greater.”

VAT fraud alone costs the UK more than £1bn a year, while the National Crime Agency estimates the cost of all fraud to the UK economy to be £190bn. The cost to the rest of the world of the money laundering enabled by UK corporate entities is almost certainly far higher. Spending hundreds of millions of pounds to prevent hundreds of billions’ worth of crime looks like a sensible investment, however you look at the data, particularly since the remedy – obliging Companies House to check the accuracy of the information filed on its registry – would be so simple. (When I put this to Companies House, they provided the following statement: “We do not have the statutory power or capability to verify the accuracy of the information that companies provide. However, tackling abuse of the register is a key priority and that’s why we work closely with law enforcement partners to assist their investigations into suspected cases of economic crime and other offences.”)

That is not to say that the government has taken no action. It is illegal to deliberately file false information in registering a company, and punishable by up to two years in prison. In late 2017, Companies House at last alerted prosecutors to the activities of one persistent offender. The target of the prosecution was Kevin Brewer, for the crime of trying to inform politicians about how easy it is to create fake companies.

He was summonsed to appear at Redditch magistrates’ court and, on legal advice, pleaded guilty in March 2018. After adding together his fine, and the government’s costs, he is £23,324 the poorer – quite a high price to pay for blowing the whistle. He is paying it off at £1,000 a month, and remains the only person ever convicted of spoofing the UK’s corporate registry, which is quite a remarkable demonstration of Companies House’s failure to do its job.

Following his conviction, Brewer’s company National Business Register was removed from the list that Companies House publishes of company formation agents, which had been a key source of new business for him. “There are company formation agents on that list who have permitted huge amounts of fraud, and I’ve been excluded for trying to expose it. I find it incredible that they should turn a blind eye,” he told me. “Is it deliberate? Are they actually trying to get this money into the UK? I don’t want to believe it, but I can’t explain it any other way.”

We don’t know the answer to that, but it does give us lesson number five: don’t worry about it. Commit as much fraud as you like, fill your boots, the only reason anyone would care is if you kick up a fuss. And what sensible fraudster is going to do that?

Tuesday, 4 June 2019

Want to tackle inequality? Then first change our land ownership laws

George Monbiot in The Guardian

What is the most neglected issue in British politics? I would say land. Literally and metaphorically, land underlies our lives, but its ownership and control have been captured by a tiny number of people. The results include soaring inequality and exclusion; the massive cost of renting or buying a decent home; the collapse of wildlife and ecosystems; repeated financial crises; and the loss of public space. Yet for 70 years this crucial issue has scarcely featured in political discussions.

Today, I hope, this changes, with the publication of the report to the Labour party – Land for the Many – that I’ve written with six experts in the field. Our aim is to put this neglected issue where it belongs: at the heart of political debate and discussion.

Since 1995, land values in this country have risen by 412%. Land now accounts for an astonishing 51% of the UK’s net worth. Why? In large part because successive governments have used tax exemptions and other advantages to turn the ground beneath our feet into a speculative money machine. A report published this week by Tax Justice UK reveals that, through owning agricultural land, 261 rich families escaped £208m in inheritance tax in 2015-16. Because farmland is used as a tax shelter, farmers are being priced out. In 2011, farmers bought 60% of the land that was on the market; within six years this had fallen to 40%.

Homes are so expensive not because of the price of bricks and mortar, but because land now accounts for 70% of the price

Worse still, when planning permission is granted on agricultural land, its value can rise 250-fold. Though this jackpot was created by society, the owner gets to keep most of it. We pay for this vast inflation in land values through outrageous rents and mortgages. Capital gains tax is lower than income tax, and council tax is proportionately more expensive for the poor than for the rich. As a result of such giveaways, and the amazing opacity of the system, land in the UK has become a magnet for international criminals seeking to launder their money.

We pay for these distortions every day. Homes have become so expensive not because the price of bricks and mortar has risen, but because the land that underlies them now accounts for 70% of their price. Twenty years ago, the average working family needed to save for three years to afford a deposit. Today, it must save for 19 years. Life is even worse for renters. While housing costs swallow 12% of average household incomes for those with mortgages, renters pay 36%.

Because we hear so little about the underlying issues, we blame the wrong causes for the cost and scarcity of housing: immigration, population growth, the green belt, red tape. In reality, the power of landowners and building companies, their tax and financial advantages and the vast shift in bank lending towards the housing sector have inflated prices so much that even a massive housebuilding programme could not counteract them.

The same forces are responsible for the loss of public space in cities, a right to roam that covers only 10% of the land, the lack of provision for allotments and of opportunities for new farmers, and the wholesale destruction of the living world. Our report aims to confront these structural forces and take back control of the fabric of the nation.

A Labour government should replace council tax with a progressive property tax, payable by owners, not tenants. Empty homes should automatically be taxed at a higher rate. Inheritance tax should be replaced with a lifetime gifts tax levied on the recipient. Capital gains tax on second homes and investment properties should match or exceed the rates of income tax. Business rates should be replaced with a land value tax, based on rental value. A 15% offshore tax should be levied on properties owned through tax havens.

To democratise development and planning, we want to create new public development corporations. Alongside local authorities, they would assemble the land needed for affordable homes and new communities. Builders would have to compete on quality, rather than by amassing land banks. These public corporations would use compulsory purchase to buy land at agricultural prices, rather than having to pay through the nose for the uplift created by planning permission. This could reduce the price of affordable homes in the south-east by nearly 50%.

We propose a community participation agency, to help people, rather than big companies, become the driving force in creating local plans and influencing major infrastructure. To ensure a wide range of voices is heard, we suggest a form of jury service for plan-making. To represent children and the unborn, we would like every local authority to appoint a future generations champion.

Councils should have new duties to create parks, urban green spaces, wildlife refuges and public amenities. We propose a new definition of public space, granting citizens a legal right to use it and overturning the power of private landowners in cities to stifle leisure, cultural events and protest.

We propose much tighter rent and eviction controls, and an ambitious social housebuilding programme. We also want to create new opportunities for people to design and build their own homes, supported by a community right to buy of the kind that Scotland enjoys. Compulsory sale orders should be used to bring vacant and derelict land on to the market, and community groups should have first rights to buy it.

To help stabilise land prices and make homes more affordable, we propose a new body, called the Common Ground Trust. When people can’t afford to buy a home, they can ask the trust to purchase the land that underlies it, while they pay only for the bricks and mortar (about 30% of the cost). They then pay the trust a land rent. Their overall housing costs are reduced, while the trust gradually accumulates a pool of land that acts as a buffer against speculation, and creates common ownership on a large scale.

We call for a right to roam across all uncultivated land and waterways (except gardens and similar limitations). We want to change the Allotments Act, to ensure that no one needs wait for a plot for more than a year. We would like to use part of the Land Registry’s vast surplus to help community land trusts buy rural land for farming, forestry, conservation and rewilding. We would like a new English land commission to decide whether to make major farming and forestry decisions subject to planning permission, to help arrest the environmental crisis. And we want to transform the public’s right to know, by ensuring that all information about land ownership, subsidies and planning is published freely as open data.

These proposals, we hope, will make the UK a more equal, inclusive and generous-spirited nation, characterised not by private enclosure and public squalor, but by private sufficiency and public luxury. Our land should work for the many, not just the few.

What is the most neglected issue in British politics? I would say land. Literally and metaphorically, land underlies our lives, but its ownership and control have been captured by a tiny number of people. The results include soaring inequality and exclusion; the massive cost of renting or buying a decent home; the collapse of wildlife and ecosystems; repeated financial crises; and the loss of public space. Yet for 70 years this crucial issue has scarcely featured in political discussions.

Today, I hope, this changes, with the publication of the report to the Labour party – Land for the Many – that I’ve written with six experts in the field. Our aim is to put this neglected issue where it belongs: at the heart of political debate and discussion.

Since 1995, land values in this country have risen by 412%. Land now accounts for an astonishing 51% of the UK’s net worth. Why? In large part because successive governments have used tax exemptions and other advantages to turn the ground beneath our feet into a speculative money machine. A report published this week by Tax Justice UK reveals that, through owning agricultural land, 261 rich families escaped £208m in inheritance tax in 2015-16. Because farmland is used as a tax shelter, farmers are being priced out. In 2011, farmers bought 60% of the land that was on the market; within six years this had fallen to 40%.

Homes are so expensive not because of the price of bricks and mortar, but because land now accounts for 70% of the price

Worse still, when planning permission is granted on agricultural land, its value can rise 250-fold. Though this jackpot was created by society, the owner gets to keep most of it. We pay for this vast inflation in land values through outrageous rents and mortgages. Capital gains tax is lower than income tax, and council tax is proportionately more expensive for the poor than for the rich. As a result of such giveaways, and the amazing opacity of the system, land in the UK has become a magnet for international criminals seeking to launder their money.

We pay for these distortions every day. Homes have become so expensive not because the price of bricks and mortar has risen, but because the land that underlies them now accounts for 70% of their price. Twenty years ago, the average working family needed to save for three years to afford a deposit. Today, it must save for 19 years. Life is even worse for renters. While housing costs swallow 12% of average household incomes for those with mortgages, renters pay 36%.

Because we hear so little about the underlying issues, we blame the wrong causes for the cost and scarcity of housing: immigration, population growth, the green belt, red tape. In reality, the power of landowners and building companies, their tax and financial advantages and the vast shift in bank lending towards the housing sector have inflated prices so much that even a massive housebuilding programme could not counteract them.

The same forces are responsible for the loss of public space in cities, a right to roam that covers only 10% of the land, the lack of provision for allotments and of opportunities for new farmers, and the wholesale destruction of the living world. Our report aims to confront these structural forces and take back control of the fabric of the nation.

A Labour government should replace council tax with a progressive property tax, payable by owners, not tenants. Empty homes should automatically be taxed at a higher rate. Inheritance tax should be replaced with a lifetime gifts tax levied on the recipient. Capital gains tax on second homes and investment properties should match or exceed the rates of income tax. Business rates should be replaced with a land value tax, based on rental value. A 15% offshore tax should be levied on properties owned through tax havens.

To democratise development and planning, we want to create new public development corporations. Alongside local authorities, they would assemble the land needed for affordable homes and new communities. Builders would have to compete on quality, rather than by amassing land banks. These public corporations would use compulsory purchase to buy land at agricultural prices, rather than having to pay through the nose for the uplift created by planning permission. This could reduce the price of affordable homes in the south-east by nearly 50%.

We propose a community participation agency, to help people, rather than big companies, become the driving force in creating local plans and influencing major infrastructure. To ensure a wide range of voices is heard, we suggest a form of jury service for plan-making. To represent children and the unborn, we would like every local authority to appoint a future generations champion.

Councils should have new duties to create parks, urban green spaces, wildlife refuges and public amenities. We propose a new definition of public space, granting citizens a legal right to use it and overturning the power of private landowners in cities to stifle leisure, cultural events and protest.

We propose much tighter rent and eviction controls, and an ambitious social housebuilding programme. We also want to create new opportunities for people to design and build their own homes, supported by a community right to buy of the kind that Scotland enjoys. Compulsory sale orders should be used to bring vacant and derelict land on to the market, and community groups should have first rights to buy it.

To help stabilise land prices and make homes more affordable, we propose a new body, called the Common Ground Trust. When people can’t afford to buy a home, they can ask the trust to purchase the land that underlies it, while they pay only for the bricks and mortar (about 30% of the cost). They then pay the trust a land rent. Their overall housing costs are reduced, while the trust gradually accumulates a pool of land that acts as a buffer against speculation, and creates common ownership on a large scale.

We call for a right to roam across all uncultivated land and waterways (except gardens and similar limitations). We want to change the Allotments Act, to ensure that no one needs wait for a plot for more than a year. We would like to use part of the Land Registry’s vast surplus to help community land trusts buy rural land for farming, forestry, conservation and rewilding. We would like a new English land commission to decide whether to make major farming and forestry decisions subject to planning permission, to help arrest the environmental crisis. And we want to transform the public’s right to know, by ensuring that all information about land ownership, subsidies and planning is published freely as open data.

These proposals, we hope, will make the UK a more equal, inclusive and generous-spirited nation, characterised not by private enclosure and public squalor, but by private sufficiency and public luxury. Our land should work for the many, not just the few.

Wednesday, 16 August 2017

Adani mining giant faces financial fraud claims as it bids for Australian coal loan

by Michael Safi in The Guardian

Exclusive: Allegations by Indian customs of huge sums being siphoned off to tax havens from projects are contained in legal documents but denied by company

Details of the alleged 15bn rupee (US$235m) fraud are contained in an Indian customs intelligence notice obtained by the Guardian, excerpts of which are published for the first time here.

The directorate of revenue intelligence (DRI) file, compiled in 2014, maps out a complex money trail from India through South Korea and Dubai, and eventually to an offshore company in Mauritius allegedly controlled by Vinod Shantilal Adani, the older brother of the billionaire Adani Group chief executive, Gautam Adani.

Vinod Adani is the director of four companies proposing to build a railway line and expand a coal port attached to Queensland’s vast Carmichael mine project.

The proposed mine, which would be Australia’s largest, has been the source of years of intense controversy, legal challenges and protests over its possible environmental impact.

Abbot Point, surrounded by wetlands and coral reefs, is set to become the world’s largest coal port should the proposed Adani expansion go ahead. Photograph: Tom Jefferson / Greenpeace

Expanding the coal port to accommodate the mine will require dredging an estimated 1.1m cubic metres of spoil near the Great Barrier Reef marine park. Coal from the mine will also produce annual emissions equivalent to those of Malaysia or Austria according to one study.

One of the few remaining hurdles for the Adani Group is to raise finance to build the mine as well as a railway line to transport coal from the site to a port at Abbot Point on the Queensland coast.

To finance the railway Adani hopes to persuade the Northern Australia Infrastructure Facility (Naif), an Australian government-backed investment fund, to loan the Adani Group or a related entity about US$700m (A$900m) in public money.

While it awaits the decision on the loan, in Delhi the company is also expecting the judgment of a legal authority appointed under Indian financial crime laws in connection to allegations it siphoned borrowed money overseas.

The Adani Group fully denies the accusations, which it has challenged in submissions to the authority.

The investigation

News of the investigation was first reported in India three years ago, but the full customs intelligence document reveals forensic details of the workings of the alleged fraud which have not been publicly revealed.

The 97-page file accuses the Adani Group of ordering hundreds of millions of dollars’ worth of equipment for an electricity project in western India’s Maharashtra state using a front company in Dubai.

To read the pdf click here.

The Dubai company allegedly sold the exact same equipment back to Adani Group-controlled businesses in India at massively inflated prices, in some instances said to be eight times the sale price.

According to the allegations in the file, the effect of these transactions was that the Adani Group spent an average 400% more for the materials. That money was allegedly paid to a company Indian authorities allege was owned through a series of shell companies leading to a Mauritius trust controlled by Vinod Adani.

If true, one effect of the alleged scheme would have been to move vast sums of money from the Adani Group’s domestic accounts into offshore bank accounts where it could no longer be taxed or accounted for.

Because tariffs for using electricity transmission networks are determined partly by what they cost to build, if the DRI’s accusations are correct, the overvaluation of capital goods would have been likely to have led to higher power prices for Indian consumers.

Adani Power company thermal power plant at Mundra, India. Photograph: Sam Panthaky/AFP/Getty Images

A significant proportion of the money the Adani Group allegedly siphoned out of India was provided by taxpayers in the form of loans from the publicly-owned State Bank of India and ICICI, a private bank. There is no suggestion either bank was aware of or involved in any illegal activity.

‘We are cooperating with investigating agencies’

The Adani Group said in a statement to the Guardian on behalf of itself, its subsidiaries, and Vinod Adani that it “strongly denies the allegations of overvaluation”.

Government loan to Adani could be tainted by interference, economists say

“It is a standard procedure for the group to follow international competitive bidding route for major capital expenditures to ensure transparency and competitiveness in the process. All our transactions are always conducted within the framework of extant regulatory guidelines and provisions,” it said.

“The fact that our projects have incurred the lowest cost across central, state and private utility players has gone to establish the robustness of the processes followed by our group.

“It may be noted that Mr Vinod Adani who is the elder brother of Mr Gautam Adani has been a non-resident Indian for about 30 years and has his own established business interests outside India,” the statement said.

“Adani Group is aware of the investigations being conducted by the DRI, and has fully cooperated, and shall continue to cooperate with the investigating agencies.”

The Australian loan

The Adani Group, or a linked entity, has reportedly been granted “conditional approval” for the US$700m (AU$900m) concessional loan from Naif, the Australian government investment fund.

But due to secrecy around the operation of the investment fund, it is not clear whether the loan application discloses the existence of the DRI notice or the ongoing legal proceedings, or whether the applicant is required to do so under the Naif’s anti-money laundering provisions.

Adani Group chairman Gautam Adani meets with Queensland premier Annastacia Palaszczuk in 2016. Photograph: Cameron Laird/AAP

Adani Group did not clarify whether it had informed Naif about the allegations when asked by the Guardian.

Naif’s investment mandate includes a clause preventing it from “act[ing] in a way that is likely to cause damage to the commonwealth government’s reputation, or that of a relevant state or territory government”.

Vinod Adani is currently listed as the sole director of four Singapore-based companies which, through their Australian subsidiaries, are proposing to build the railway line using the government loan. The companies also control a project to expand the Abbot Point port.

All four entities are ultimately owned by Atulya Resources Limited, an Adani-controlled company in the Cayman Islands.

Status of the Indian investigation

The Guardian understands the allegations of over-invoicing have been passed from the DRI to the Enforcement Directorate (ED), an Indian agency tasked with investigating financial crimes.

The Adani Group says the case is currently before a legal authority, the Adjudicating Authority, indicating that Indian officials are pressing either to seize assets they regard as being connected to money laundering or to levy a fine up to three times the sum allegedly siphoned overseas.

The company declined requests to clarify what if any penalty the authorities are seeking, but a spokesman said a decision was expected shortly. “We follow the process of corporate governance and comply with the applicable laws,” he said.

“All our transactions are always conducted within the framework of law. We have already submitted our detailed reply. Adjudication process on the subject is going on and we expect the order in near future.”

The Guardian is publishing excerpts from the DRI file in the interests of ensuring Naif, as well as the public, have access to as much relevant information as possible in assessing whether Adani or linked companies would be suitable recipients of public money.

In a separate case last year, six Adani subsidiaries were listed among 40 other companies being investigated for allegedly running a similar price-inflation scheme. The companies are accused of inflating the price of coal imports from Indonesia to hide profits in overseas tax havens.

The DRI and the ED did not respond to a request to clarify the status of the investigations.

The alleged money trail

India is electricity-starved. More than 240 million Indians – enough people to form the fifth-largest country on Earth – lack access to regular power.

In the early 1990s, to encourage power companies to build electrical infrastructure, the Indian government eliminated import tariffs on technical equipment such as reactors and transformers. Profit margins on these projects increased overnight.

Adani saw the business opportunity. In 2010, the Maharashtra Eastern Grid Power Transmission Company Limited (MEGPTCL), a wholly owned subsidiary of Adani Enterprises, was granted a license to develop two electricity transmission networks in the north-east of the state.

The company used another Adani subsidiary, PMC Projects, to source the equipment it would need to build the networks. In turn, PMC, subcontracted the work to a company in Dubai.

According to the investigators’ report, bank records suggest that that company, Electrogen Infra FZE (EIF), charged significant – and to Indian authorities, suspicious – markups on the equipment it sold to PMC.

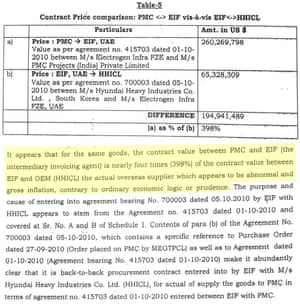

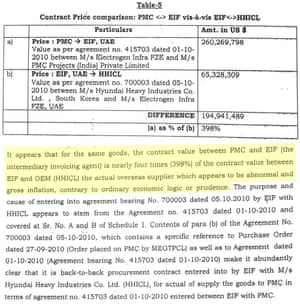

In one of the 57 invoices cited in the report, EIF is alleged to have ordered equipment from Hyundai Heavy Industries in South Korea. Bank records allegedly show the company paid Hyundai about US$65m.

According to the DRI, it sold the same equipment to PMC for about US$260m – a mark-up of nearly 400%.

Extract from page 14-15 of the Directorate of Revenue Intelligence file on Adani Group. Photograph: The Guardian

“[This] appears to be an abnormal and gross inflation, contrary to ordinary economic logic and prudence,” investigators concluded.

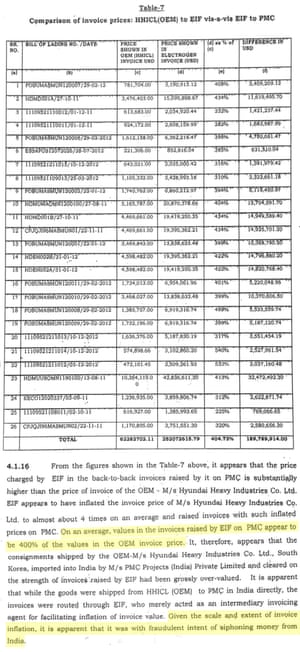

In total, the report alleges EIF made about 26 orders from Hyundai Heavy Industries and sold them onto PMC for an average mark-up of more than 400%, making a profit margin of US$189m.

There is no suggestion Hyundai Heavy Industries or any other supplier was aware of or involved in any illegality.

Extract page 19-20 of the DRI file, section 4.1.16. Photograph: The Guardian

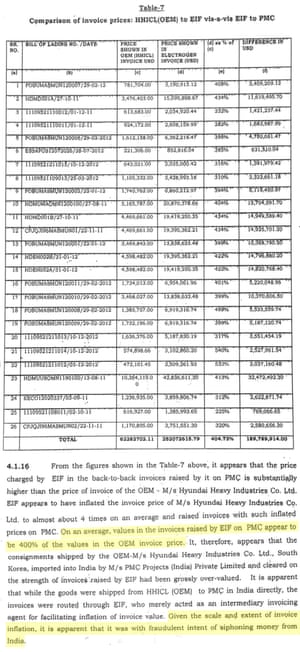

EIF allegedly purchased another 25 shipments of equipment from three companies in China. According to the report, these were sold to the Adani Group for an average markup of about 860%.

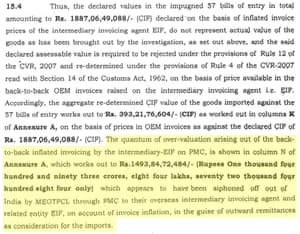

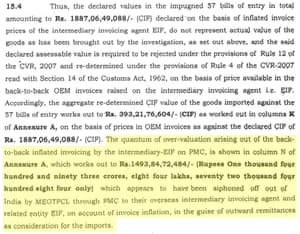

Investigators calculated the total assessable value of the allegedly marked-up invoices to be nearly 15bn rupees.

Extract from page 78-79 of the DRI file, section 15.4. Photograph: The Guardian

“Given the scale and extent of invoice inflation, it is apparent that it [was done] with fraudulent intent of siphoning money from India,” the DRI said.

Who controls the companies?

Key to the alleged fraud, according to investigators, is that EIF, the company subcontracted to purchase the equipment from manufacturers in South Korea and China, was directly controlled by the Adani Group and its associates.

Investigators claim EIF was partly staffed by ex-Adani Group employees who had recently left the company.

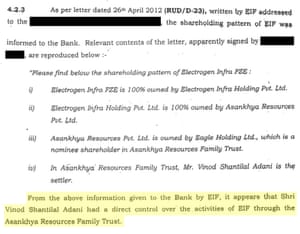

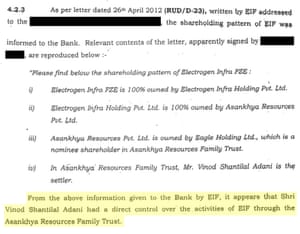

According to a letter from the company to an Indian bank that is cited in the notice, EIF was owned by another company called Electrogen Infra Holding Pvt Ltd (EIH). The trail of ownership eventually leads to a trust based in Mauritius – headed by Vinod Adani.

Extract from page 21-22 of the DRI file, section 4.2.3. Photograph: The Guardian

Investigators concluded: “From the above information given to the bank by EIF, it appears that Vinod Adani had a direct control over the activities of EIF through the Asankhya Resources Family Trust.”

Vinod Adani is also listed as having been the director of EIH between January 2010 and May 2011, though the notice states he told investigators he had no involvement in the day-to-day running of the company.

Investigators also claim to have discovered that an employee of the Adani Group subsidiary PMC had been granted permission by EIF staff to sign multimillion-dollar supply contracts on its behalf.

“All these go to show that there is no distinction between PMC and EIF, they are only working for common interest as part of a large modus-operandi for siphoning off money from India by invoice inflation,” investigators concluded.

The DRI and the ED were both contacted for comment. Attempts were made to contact EIF but the company could not be reached on its listed email or phone number.

Hyundai Heavy Industries did not respond to a request for comment.

It is unclear when the allegations of invoice inflation will be resolved in Delhi other than the Adani spokesman saying that they expected an order “in near future.” In Queensland, Naif’s decision on whether to grant Adani the nearly A$1bn loan is expected by the end of this year.

Exclusive: Allegations by Indian customs of huge sums being siphoned off to tax havens from projects are contained in legal documents but denied by company

Men wearing masks of Australian prime minister Malcolm Turnbull and Adani chairman Gautam Adani protest outside Parliament House in Canberra. Photograph: Lukas Coch/AAP

A global mining giant seeking public funds to develop one of the world’s largest coal mines in Australia has been accused of fraudulently siphoning hundreds of millions of dollars of borrowed money into overseas tax havens.

Indian conglomerate the Adani Group is expecting a legal decision in the “near future” in connection with allegations it inflated invoices for an electricity project in India to shift huge sums of money into offshore bank accounts.

A global mining giant seeking public funds to develop one of the world’s largest coal mines in Australia has been accused of fraudulently siphoning hundreds of millions of dollars of borrowed money into overseas tax havens.