'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label trap. Show all posts

Showing posts with label trap. Show all posts

Thursday, 4 January 2024

Saturday, 23 July 2022

Pakistan - Caught in the Debt Trap

Sultan Ali Allana in The Dawn

THE 22nd IMF programme, circular debt, G2G loans and an imminent 23rd programme lurking around the corner. It reminds one of Jaws the movie, where danger creeps unseen and dread is prevalent amongst all. ‘Borrow more to borrow even more’ versus ‘earn more to borrow less’. Two very different courses, yet interchangeably deployed, admittedly intermittently, in varying blends, over the past 40 to 50 years, have shackled the nation to the debt trap.

Omnipresent in this murky blend, not unlike other debt-laden markets, are what the West terms as ‘economic hitmen’, who pursue self-interests, ostensibly for the greater good. These interests are then propagated scientifically, justified, and then, with the clever manipulation of economic data, communicated to every handheld device.

While economists and financial experts take turns at solving what has now become a complex equation, perhaps it’s time to go back to the basics, which may be termed as Solution 101 — ‘earn more and borrow less’ — a solution which is admittedly easier to state than actualise. It is a course which may well require our urgent attention and, most importantly, political convergence that entails all major political parties, irrespective of their manifestos, unanimously agreeing to sign off on a ‘charter of economy’ that marks milestones at five-year intervals — starting with ‘earn more and borrow less’ to ‘earn more and not borrow at all’ to, ultimately, ‘earn more and build reserves’.

Simply put, this charter may be a 15-year plan for this nation’s way forward and a performance measure to determine the economic achievements of each successive government. Politics and the economy must at all costs be separated in the interest of the nation.

Pakistan’s debt story is interwoven with the country’s 75-year journey. We entered the first IMF programme in 1958 and, since then, it has been one programme after another, while institutional and G2G debts have continued to grow simultaneously. As of Dec 31, 2021, combined foreign currency loans are more than $90.5 billion. The story of Pakistan’s debt is incomplete without taking into account domestic debt, which by the end of December 2021 had crossed Rs26.7 trillion (roughly $151.5bn based on the Dec 31, 2021, closing rate), resulting in total debt in excess of $242bn or around 77 per cent of GDP. There is also the circular debt, which grew from Rs161bn in 2008 to over Rs2.46tr by March 2022. It continues to grow, putting, oil, gas and power supply at risk.

A consolidated picture of Pakistani debt on a per person basis depicts the debt journey. Each Pakistani, irrespective of age and gender, carries upon their shoulders a debt burden of nearly Rs190,000, while devaluation and interest adds to this figure by the day. Pakistan must borrow to pay back its borrowings and borrow to pay back the interest on its borrowings. Bluntly put, we are no longer borrowing for growth, but to service and repay borrowings.

The government may be able to service local currency debt by raising taxes, at the cost of stunting growth; however, foreign currency earnings will have to be significantly enhanced through exports, remittances, privatisation and foreign investments, and imports will have to be managed to make the equation work. Without a balancing act, the debt cycle will grow to untenable levels.

Tough decisions and belt-tightening are essential. The country’s policy framework, which has relied on imports, belies the requirements of a paradigm shift in thinking. The emphasis needs to shift to the development of a robust agro economy, making Pakistan not just self-sufficient in food, thus ensuring future food security, but also a country that can be a global supplier of food. If oil can be extracted (at a cost) and countries can rise to heights unthinkable in the 1960s, surely, agro extraction (at a cost, undoubtedly) can become a source for sustaining growth, which in due course can accelerate industrial growth for a balanced economic model.

The cycle of boom-and-bust can only be broken if there is a meaningful shift in the policy framework. Granting subsidies without assessing the long-term consequences, or imposing heavy taxation regimes, which impair growth, must be examined and thought through. To quote Winston Churchill: “I contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up with the handles.” While building a strong SME and labour-intensive industrial base, with the aim of capitalising on the shifting industrial trend in China, is equally important, a focused approach, which entails start-to-finish government support — some call this the ‘ease of doing business’ — must be given top priority.

Competitive markets drive global agendas where Pakistan will have to situate itself and measure its competitiveness. What has not worked before will certainly not work going forward. It is imperative that we plan for future generations to provision for a fulfilling and debt-free life of progress, prosperity and security. We have heard the endless discussions of experts and also novices who have little understanding but who use economic jargon to impress with ‘solutions’. But why has nothing, or very little, worked? Framing policies, ensuring competency and challenging dogma require political consensus and hard work.

Freedom comes at a price and it’s a price we must pay someday. Climate change is upon us, where food security and water management will remain on top of the global agenda for decades to come. Gainful employment for our ever-growing and young population will be challenging. With over 366 million mouths to feed by 2050, surely this must be our primary concern. Debt and more debt are certainly not a solution. It is the problem!

Omnipresent in this murky blend, not unlike other debt-laden markets, are what the West terms as ‘economic hitmen’, who pursue self-interests, ostensibly for the greater good. These interests are then propagated scientifically, justified, and then, with the clever manipulation of economic data, communicated to every handheld device.

While economists and financial experts take turns at solving what has now become a complex equation, perhaps it’s time to go back to the basics, which may be termed as Solution 101 — ‘earn more and borrow less’ — a solution which is admittedly easier to state than actualise. It is a course which may well require our urgent attention and, most importantly, political convergence that entails all major political parties, irrespective of their manifestos, unanimously agreeing to sign off on a ‘charter of economy’ that marks milestones at five-year intervals — starting with ‘earn more and borrow less’ to ‘earn more and not borrow at all’ to, ultimately, ‘earn more and build reserves’.

Simply put, this charter may be a 15-year plan for this nation’s way forward and a performance measure to determine the economic achievements of each successive government. Politics and the economy must at all costs be separated in the interest of the nation.

Pakistan’s debt story is interwoven with the country’s 75-year journey. We entered the first IMF programme in 1958 and, since then, it has been one programme after another, while institutional and G2G debts have continued to grow simultaneously. As of Dec 31, 2021, combined foreign currency loans are more than $90.5 billion. The story of Pakistan’s debt is incomplete without taking into account domestic debt, which by the end of December 2021 had crossed Rs26.7 trillion (roughly $151.5bn based on the Dec 31, 2021, closing rate), resulting in total debt in excess of $242bn or around 77 per cent of GDP. There is also the circular debt, which grew from Rs161bn in 2008 to over Rs2.46tr by March 2022. It continues to grow, putting, oil, gas and power supply at risk.

A consolidated picture of Pakistani debt on a per person basis depicts the debt journey. Each Pakistani, irrespective of age and gender, carries upon their shoulders a debt burden of nearly Rs190,000, while devaluation and interest adds to this figure by the day. Pakistan must borrow to pay back its borrowings and borrow to pay back the interest on its borrowings. Bluntly put, we are no longer borrowing for growth, but to service and repay borrowings.

The government may be able to service local currency debt by raising taxes, at the cost of stunting growth; however, foreign currency earnings will have to be significantly enhanced through exports, remittances, privatisation and foreign investments, and imports will have to be managed to make the equation work. Without a balancing act, the debt cycle will grow to untenable levels.

Tough decisions and belt-tightening are essential. The country’s policy framework, which has relied on imports, belies the requirements of a paradigm shift in thinking. The emphasis needs to shift to the development of a robust agro economy, making Pakistan not just self-sufficient in food, thus ensuring future food security, but also a country that can be a global supplier of food. If oil can be extracted (at a cost) and countries can rise to heights unthinkable in the 1960s, surely, agro extraction (at a cost, undoubtedly) can become a source for sustaining growth, which in due course can accelerate industrial growth for a balanced economic model.

The cycle of boom-and-bust can only be broken if there is a meaningful shift in the policy framework. Granting subsidies without assessing the long-term consequences, or imposing heavy taxation regimes, which impair growth, must be examined and thought through. To quote Winston Churchill: “I contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up with the handles.” While building a strong SME and labour-intensive industrial base, with the aim of capitalising on the shifting industrial trend in China, is equally important, a focused approach, which entails start-to-finish government support — some call this the ‘ease of doing business’ — must be given top priority.

Competitive markets drive global agendas where Pakistan will have to situate itself and measure its competitiveness. What has not worked before will certainly not work going forward. It is imperative that we plan for future generations to provision for a fulfilling and debt-free life of progress, prosperity and security. We have heard the endless discussions of experts and also novices who have little understanding but who use economic jargon to impress with ‘solutions’. But why has nothing, or very little, worked? Framing policies, ensuring competency and challenging dogma require political consensus and hard work.

Freedom comes at a price and it’s a price we must pay someday. Climate change is upon us, where food security and water management will remain on top of the global agenda for decades to come. Gainful employment for our ever-growing and young population will be challenging. With over 366 million mouths to feed by 2050, surely this must be our primary concern. Debt and more debt are certainly not a solution. It is the problem!

Sunday, 3 November 2019

How to Keep the Wrong Women out of Your Life | Dr. Shawn T. Smith PsyD | Full Speech

You never have to chase women

The Rational Male by Rollo Tomassi

Tuesday, 11 June 2019

How India could sidestep the Middle Income Trap

Rathin Roy - Economic Adviser to the Indian Government

Thursday, 9 May 2019

Pakistan and the IMF program

Najam Sethi

The 248-page document presents the September 2008 revision of the US Army Field Manual (FM) 3-05.130, Army Special Operations Forces Unconventional Warfare, establishing keystone doctrine for Army special operations forces (ARSOF) operations in unconventional warfare (UW). The purpose of the manual is to be useful to understanding the nature of UW and its role in the nation's application of power.

Unconventional Warfare, as of this manual is being defined as Operations conducted by, with, or through irregular forces in support of a resistance movement, an insurgency, or conventional military operations., reflecting two important criteria: UW must be conducted by, with, or through surrogates; and such surrogates must be irregular forces.

The nine chapters cover topics such as Special Forces, Psychological as well as Civil Affairs Operations, while also covering general doctrine, policies and planning considerations in respect to Army special operations forces.

Download

Wednesday, 4 September 2013

We need a fair system for restructuring sovereign debt

If the debt vultures have their way, there will never be a fresh start for indebted countries - and no one will agree to restructuring

If the debt vultures have their way, there will never be a fresh start for indebted countries - and no one will agree to restructuring. Photograph: Joe Petersburger/Getty Images/National Geographic Creative

A recent decision by a United States appeals court threatens to upend global sovereign debt markets. It may even lead to the US no longer being viewed as a good place to issue sovereign debt. At the very least, it renders non-viable all debt restructurings under the standard debt contracts. In the process, a basic principle of modern capitalism – that when debtors cannot pay back creditors, a fresh start is needed – has been overturned.

The trouble began a dozen years ago, when Argentina had no choice but to devalue its currency and default on its debt. Under the existing regime, the country had been on a rapid downward spiral of the kind that has now become familiar in Greece and elsewhere in Europe. Unemployment was soaring, and austerity, rather than restoring fiscal balance, simply exacerbated the economic downturn.

Devaluation and debt restructuring worked. In subsequent years, until the global financial crisis erupted in 2008, Argentina's annual GDP growth was 8% or higher, one of the fastest rates in the world.

Even former creditors benefited from this rebound. In a highly innovative move, Argentina exchanged old debt for new debt – at about 30 cents on the dollar or a little more – plus a GDP-indexed bond. The more Argentina grew, the more it paid to its former creditors.

Argentina's interests and those of its creditors were thus aligned: both wanted growth. It was the equivalent of a "Chapter 11" restructuring of American corporate debt, in which debt is swapped for equity, with bondholders becoming new shareholders.

Debt restructurings often entail conflicts among different claimants. That is why, for domestic debt disputes, countries have bankruptcy laws and courts. But there is no such mechanism to adjudicate international debt disputes.

Once upon a time, such contracts were enforced by armed intervention, as Mexico, Venezuela, Egypt, and a host of other countries learned at great cost in the nineteenth and early twentieth centuries. After the Argentine crisis, President George W. Bush's administration vetoed proposals to create a mechanism for sovereign-debt restructuring. As a result, there is not even the pretence of attempting fair and efficient restructurings.

Poor countries are typically at a huge disadvantage in bargaining with big multinational lenders, which are usually backed by powerful home-country governments. Often, debtor countries are squeezed so hard for payment that they are bankrupt again after a few years.

Economists applauded Argentina's attempt to avoid this outcome through a deep restructuring accompanied by the GDP-linked bonds. But a few "vulture" funds – most notoriously the hedge fund Elliott Management, headed by the billionaire Paul E. Singer – saw Argentina's travails as an opportunity to make huge profits at the expense of the Argentine people. They bought the old bonds at a fraction of their face value, and then used litigation to try to force Argentina to pay 100 cents on the dollar.

Americans have seen how financial firms put their own interests ahead of those of the country – and the world. The vulture funds have raised greed to a new level.

Their litigation strategy took advantage of a standard contractual clause (called pari passu) intended to ensure that all claimants are treated equally. Incredibly, the US Court of Appeals for the Second Circuit in New York decided that this meant that if Argentina paid in full what it owed those who had accepted debt restructuring, it had to pay in full what it owed to the vultures.

If this principle prevails, no one would ever accept debt restructuring. There would never be a fresh start – with all of the unpleasant consequences that this implies.

In debt crises, blame tends to fall on the debtors. They borrowed too much. But the creditors are equally to blame – they lent too much and imprudently. Indeed, lenders are supposed to be experts on risk management and assessment, and in that sense, the onus should be on them. The risk of default or debt restructuring induces creditors to be more careful in their lending decisions.

The repercussions of this miscarriage of justice may be felt for a long time. After all, what developing country with its citizens' long-term interests in mind will be prepared to issue bonds through the US financial system, when America's courts – as so many other parts of its political system – seem to allow financial interests to trump the public interest?

Countries would be well advised not to include pari passu clauses in future debt contracts, at least without specifying more fully what is intended. Such contracts should also include collective-action clauses, which make it impossible for vulture funds to hold up debt restructuring. When a sufficient proportion of creditors agree to a restructuring plan (in the case of Argentina, the holders of more than 90% of the country's debt did), the others can be forced to go along.

The fact that the International Monetary Fund, the US Department of Justice, and anti-poverty NGOs all joined in opposing the vulture funds is revealing. But so, too, is the court's decision, which evidently assigned little weight to their arguments.

For those in developing and emerging-market countries who harbor grievances against the advanced countries, there is now one more reason for discontent with a brand of globalization that has been managed to serve rich countries' interests (especially their financial sectors' interests).

In the aftermath of the global financial crisis, the United Nations Commission of Experts on Reforms of the International Monetary and Financial System urged that we design an efficient and fair system for the restructuring of sovereign debt. The US court's tendentious, economically dangerous ruling shows why we need such a system now.

Monday, 10 June 2013

Cloud computing is a trap, warns GNU founder Richard Stallman

Web-based programs like Google's Gmail will force people to buy into locked, proprietary systems that will cost more and more over time, according to the free software campaigner

- Bobbie Johnson, technology correspondent

- guardian.co.uk,

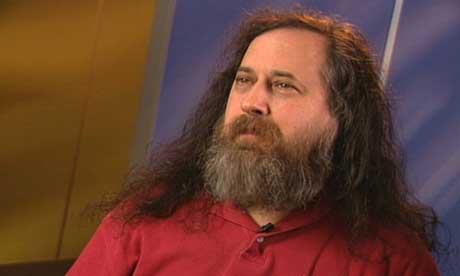

Richard Stallman on cloud computing: "It's stupidity. It's worse than stupidity: it's a marketing hype campaign." Photograph: www.stallman.org

The concept of using web-based programs like Google's Gmail is "worse than stupidity", according to a leading advocate of free software.

Cloud computing – where IT power is delivered over the internet as you need it, rather than drawn from a desktop computer – has gained currency in recent years. Large internet and technology companies including Google, Microsoft and Amazon are pushing forward their plans to deliver information and software over the net.

But Richard Stallman, founder of the Free Software Foundation and creator of the computer operating system GNU, said that cloud computing was simply a trap aimed at forcing more people to buy into locked, proprietary systems that would cost them more and more over time.

"It's stupidity. It's worse than stupidity: it's a marketing hype campaign," he told The Guardian.

"Somebody is saying this is inevitable – and whenever you hear somebody saying that, it's very likely to be a set of businesses campaigning to make it true."

The 55-year-old New Yorker said that computer users should be keen to keep their information in their own hands, rather than hand it over to a third party.

His comments echo those made last week by Larry Ellison, the founder of Oracle, who criticised the rash of cloud computing announcements as "fashion-driven" and "complete gibberish".

"The interesting thing about cloud computing is that we've redefined cloud computing to include everything that we already do," he said. "The computer industry is the only industry that is more fashion-driven than women's fashion. Maybe I'm an idiot, but I have no idea what anyone is talking about. What is it? It's complete gibberish. It's insane. When is this idiocy going to stop?"

The growing number of people storing information on internet-accessible servers rather than on their own machines, has become a core part of the rise of Web 2.0 applications. Millions of people now upload personal data such as emails, photographs and, increasingly, their work, to sites owned by companies such as Google.

Computer manufacturer Dell recently even tried to trademark the term "cloud computing", although its application was refused.

But there has been growing concern that mainstream adoption of cloud computing could present a mixture of privacy and ownership issues, with users potentially being locked out of their own files.

Stallman, who is a staunch privacy advocate, advised users to stay local and stick with their own computers.

"One reason you should not use web applications to do your computing is that you lose control," he said. "It's just as bad as using a proprietary program. Do your own computing on your own computer with your copy of a freedom-respecting program. If you use a proprietary program or somebody else's web server, you're defenceless. You're putty in the hands of whoever developed that software."

Tuesday, 3 January 2012

The power to say no

Pritish Nandy02 January 2012, 09:18 PM IST

My worst failing is my inability to say No. This year I intend to correct that. I will clearly and unequivocally say No when I want to. Not a Maybe or a Perhaps; a straight, categorical No.

For people like me it’s not easy. We were brought up being told that No is impolite, rude, and politically incorrect. There are nicer ways to turn down a request. You can gently fob it off. Or procrastinate. Or do what my friend Husain, the painter, always did. He said Yes to everything and promptly disappeared. Poof! People have waited for him to inaugurate an event in London while he went off to New York for a party. No, Husain never allowed a commitment, any commitment to burden him. He happily failed each, knowing fully that he will be forgiven for his indiscretions. He blamed it on his poor memory. But memory had nothing to do with it. Insouciance did.

My friend Mario was identical. He did hundreds of cartoons for me when I was editor, but never on time. Give Mario a deadline and you could be sure he will miss it. He completed every assignment but in his own time. I remember he once came to me with a cartoon so late that I had forgotten what it was for. But no, he never said No. He was always polite, always proper and agreed to any deadline I set him because he knew he would not have to keep to it. We decided to do a book together, of naughty limericks, largely based on Indian politics. I waited three years for him to complete the drawings. By the time they were ready, I had lost the manuscript. (We didn’t have computers in those days and typescripts were easy to lose.)

I smoked my first cigarette at 7 because I couldn’t say No. I downed my first whisky at 9, smoked grass at 11, all because I couldn’t say No. Luckily I found it all quite boring and so, by the time I was 16, it was all over and I was ready to take on life on my own terms. Minor addictions have never distracted me since. I listen to Vivaldi, read Dylan Thomas, try to figure out why Damien Hirst is such a vastly over rated artist. I can spend all day listening to Mallikarjun Mansur and marvelling at his genius if only I can say No to a million silly, irrelevant commitments I pick up, for people I barely know.

My father died because he couldn’t say No to a doctor, a family friend in Jabalpur who convinced him that prostrate surgery was the easiest thing on earth, and he could do it in his own nursing home. By the time I heard of it and rushed there, he was already in a coma from which he never recovered. We finally pulled the plug on him. My mother lost our family home in Kolkata because she couldn’t say No to her landlord, who requested her to give up her decades old tenancy because his family had grown, needed more space. Even before she packed up her meagre belongings and came to me here, the landlord had sold off the house. Yes. Life makes suckers of us all. Especially those prone to saying Yes.

I was reading the cover story in a news magazine recently which argued that the most important thing you can tell your doctor is No. Most people suffer because they say Yes and get lumped with medication they don’t need, tests that are not necessary, and surgeries they could have done without. This is true at the dinner table as well, or in a restaurant. The more often you say No to the lip smacking food there, the better your health will be. The day we can say No to all the candidates when voting, the quality of our politicians will improve.

Life is a honey trap. Everyone’s waiting for you to say Yes. The moment you do, you are entrapped by absolute, arrant nonsense, breathtakingly packaged, aggressively promoted, seductively laid out in front of you, and completely irrelevant to your life or well being. The wise man says No. The fool succumbs. 2012 is my year to say No. An emphatic, easy No. Like Eric Bana told his handler in the last scene of Spielberg’s masterpiece, Munich. If a patriot who risked his life hunting down terrorists can say that, so can you and I.

Subscribe to:

Comments (Atom)