'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Friday, 30 September 2022

Sunday, 31 July 2022

Thursday, 24 February 2022

Sunday, 13 February 2022

Friday, 11 February 2022

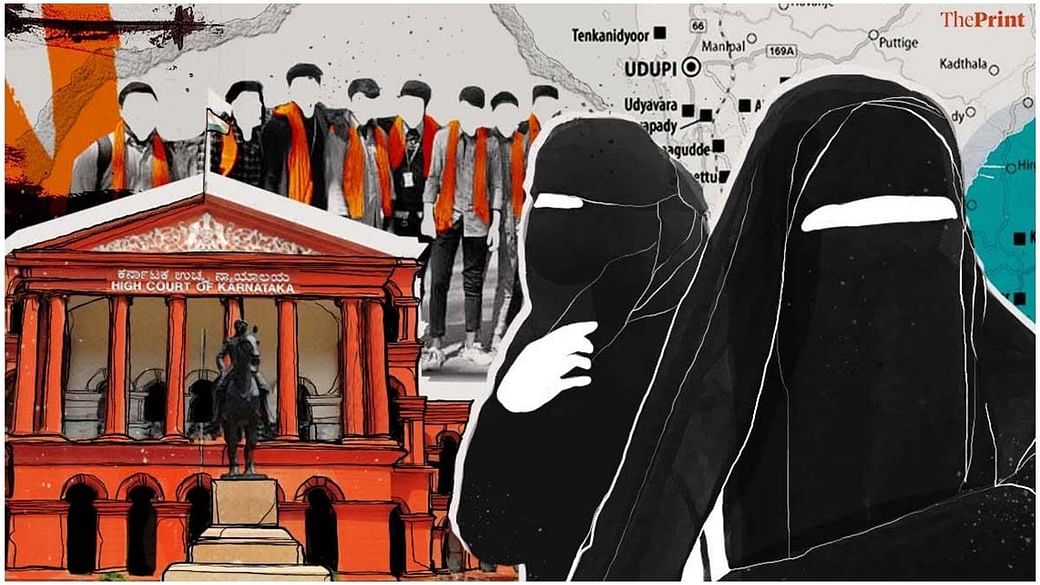

"The Inside Story on The Hijab - School case"

Anusha Ravi Sood in The Print

Udupi: Abdul Shukur took a sip of water and bit into a chikki (peanut bar) at 6:30pm Tuesday. It was his first meal after a day-long fast and he had come to offer prayers at the Jamia Masjid in Udupi, Karnataka. Shukur’s daughter, Muskaan Zainab, studies at the city’s Government Pre-University (PU) College and is one of several students who have petitioned the Karnataka High Court for the right to wear the hijab (headscarf) on campus.

“Our entire family fasted today since our petition was being heard in court. I will fast tomorrow too,” 46-year old Shukur, who runs a small business in Malpe, said.

The hijab row has been making headlines since January, but Shukur claimed the issue was triggered in October when viral photos showed Muslim girls at a protest organised by the Akhil Bharatiya Vidyarthi Parishad (ABVP, the RSS-affiliated students’ body).

The images in question were posted on the Facebook page of the Udupi ABVP on 30 October last year. They showed Muslim girls holding the ABVP flag as part of a protest demanding a probe into the alleged rape of a Manipal student. In the communally sensitive coastal belt of Karnataka, the pictures ignited a controversy.

“I was taken aback to see my daughter there… because she isn’t a member of ABVP,” Shukur said. Furthermore, Muskaan was not wearing her usual headscarf in the photo.

“I asked her why she wasn’t wearing a headscarf in the photo, and that is when she told me that the college doesn’t allow hijabs in classrooms,” he said. This came as a shock to Shukur, who decided to confront the college principal.

He was not the only one taking notice. According to an intel report submitted by the Udupi police to the state government, the Campus Front of India (CFI), which is the students’ wing of the Islamist outfit Popular Front of India (PFI), had approached parents with the offer to help take on the college management.

A source from the CFI who did not wish to be named told ThePrint that the ABVP protest incident had outraged the organisation. It therefore started encouraging Muslim women to refuse to join ABVP events and to fight for their right to wear hijabs in the classroom. The women’s parents also took these demands to the college.

“When I asked the principal why students were being sent to protest without consent and were not allowed to wear headscarves, he said it was a small issue,” Shukur said.

Rudre Gowda, principal of the college, rejected this allegation. “For years, students have been wearing hijabs to campus, but have been removing them during classes. These girls too were adhering to this, but since December, they started demanding that hijab should be allowed during classes too,” Gowda told ThePrint.

The matter quickly led to a standoff between the families of six Muslim students and the college management. The CFI also alleged that the college had, as retaliation, made details of the girls and their families public.

While there were attempts to negotiate an understanding between the students and the college authorities in Udupi, the row escalated rapidly — partly due to political organisations jumping on to the bandwagon and partly due to the wildfire effect of social media.

In January, the students petitioned the Karnataka High Court, by which time the issue was making headlines and had snowballed into communally charged conflicts in several Karnataka colleges.

Also Read: A timeline of how hijab row took centre stage in Karnataka politics and reached HC

Bruised egos and social media hype

Before the hijab issue reached the headlines, there were weeks of efforts to forge an understanding between the families and the college.

A senior leader of the Udupi District Muslim Okkoota — an umbrella organisation of mosques, jamaats, and Islamic organisations in Udupi — told ThePrint on the condition of anonymity that the body had tried its best to convince the families that it was acceptable to remove the hijab in class.

“We advised the girls to not make a big issue out of not wearing hijab inside classrooms. We even took them and their parents to religious clerics and explained that it was okay to remove hijabs in the classroom,” he said.

However, the students were “adamant”, he said, because they had received backing from the CFI, the campus affiliate of the PFI, an Islamist outfit that was set up in Kerala in 2006 and which the Bharatiya Janata Party (BJP) wants banned because of its allegedly radical tendencies.

“The CFI saw [the hijab conflict] as an opportunity to strengthen its support base,” the Muslim Okkoota leader said. In coastal Karnataka, he explained, the two main students’ bodies are the ABVP and CFI, while the Congress’s campus body, the National Students Union of India (NSUI), does not have a presence in local colleges.

When ThePrint spoke to CFI members in Udupi, they claimed that the organisation got involved only after students of the PU College approached them on 27 December, after their memorandums to the district commissioner and education department officials did not yield results. The students in question also told ThePrint that they were not members of the CFI. However, at least three parents are members of the PFI’s political wing, the Social Democratic Party of India (SDPI).

By the end of December, though, nobody was in the mood for a compromise, according to the Muslim Okkoota leader. He said that the Muslim women’s protest, and the social media traction it got, riled the College Development Committee (CDC), which is empowered by the government to take administrative decisions for public educational institutions.

“In December and January, the students’ protests started getting attention on social media and the press. They were shown standing outside the classroom and making notes since they were not allowed inside. This hurt the egos of the committee members,” he claimed, adding that the senior-most members of this body were members of the BJP and RSS. None of the 21 members in the CDC are from the Muslim community.

The matter had now become a “prestige issue” with the BJP and other Hindutva organisations on one side, and the PFI and its affiliates on the other, the Muslim Okkoota leader said.

BJP vs. PFI

What both Hindutva and Muslim organisations can agree on is that as videos from Udupi went viral, they sparked protests in other districts too. Throughout January and February, Karnataka saw several face-offs in colleges between some students in hijabs and others wielding saffron scarves. Each side holds the other responsible.

BJP leaders maintain that without “instigation” from the PFI, the protests wouldn’t have reached such a magnitude.

“Within two days of the girls’ protest in January outside their classrooms, thousands of social media posts were released. How is that possible without a pre-planned, strategised effort?” V. Sunil Kumar, Minister for Energy and Kannada & Culture, told ThePrint.

“When [Muslim students] started escalating the matter, naturally, students from the Hindu community retaliated — a matter of action and reaction,” Kumar, who is also the MLA from Karkala in Udupi district, added.

Other BJP ministers in the Basavaraj Bommai cabinet have also made similar allegations against the PFI. “Students are being instigated to protest for hijab. The role of the PFI and its student wing CFI will be probed thoroughly,” B.C. Nagesh, Karnataka Minister of Primary & Secondary Education, told reporters Tuesday.

The PFI has denied such allegations and has attempted to distance itself from the row.

“As an organisation, we are working for upliftment of marginalised communities. We are in no way involved in this row. Our student wing (CFI) is only trying to provide moral support to aggrieved students. Communal flareups only benefit the BJP,” Anis Ahmed, national general secretary of the PFI, told ThePrint.

The CFI has acknowledged that it was helping the Muslim women’s agitation in Udupi’s PU College, but denied having any political motives.

“We are a student organisation. We do not have any links with political parties. We are leading the students who are fighting for their rights. Muslim students have been harassed at that institute for years now. This is not a retort that erupted overnight,” Masood Manna, a committee member of CFI Udupi, told ThePrint.

Also Read: The right answer to the wrong hijab question is still a wrong answer

Why the PFI and its affiliates are so controversial

The PFI is the organisational successor of the Kerala-based National Development Front (NDF) and claims to fight for social justice for Muslims, particularly in the southern states of Kerala, Karnataka, and Tamil Nadu.

In 2010, the political wing of the PFI — the Social Democratic Party of India (SDPI) — was registered with the Election Commission. Since then, it has slowly been making inroads in the coastal Karnataka belt. It had one of its biggest triumphs in the December 2021 elections to 58 Urban Local Bodies (ULBs) in Karnataka, when it won six seats.

The CFI, meanwhile, is popular among Muslim students in three districts of coastal Karnataka — Udupi, Dakshin Kannada and Uttar Kannada. The CFI has actively eaten into the popularity of the Congress’s student wing, the NSUI, in the three districts.

However, the PFI has faced allegations of radicalism from the BJP. In April last year, the Union government told the Supreme Court that it was in the process of banning the PFI, claiming that many office-bearers had links with the now banned Student Islamic Movement of India (SIMI). Chargesheets have also been filed against members of PFI over their alleged involvement in various instances of unrest, which the organisation has dismisses as “baseless”.

Notably, some Muslim community leaders also have reservations about the PFI and its branches. The senior Muslim Okkoota leader who was quoted earlier alleged that the hijab protests seemed to be a ploy by the organisation’s political wing to mobilise support.

“All the Muslim girls use the same vocabulary… ‘fundamental rights’, ‘constitutional issue’, ‘hijab is intrinsic to Islam’. While they may have been wearing hijab for years, the words and phrases that are being publicly said are coming from one source,” the Muslim Okkuta leader claimed.

Allegations of “instigation”, however, have also been levelled against Hindutva organisations, which have started a counter-agitation involving saffron shawls and scarves, and an influx into colleges of ‘protesters’ who are not even students.

Doubling down on the hijab

“Perhaps one or two Muslim girls used to wear hijab to college but now the number has drastically increased. They are doing this to assert their religious identity,” Halady Srinivas Poojari, MLA for Kundapur, told ThePrint. He isn’t far off the mark, although there are varying interpretations of why exactly the women are doing so.

According to Abdul Aziz Udyavar, organising secretary of the Udupi District Muslim Okkoota, the fight over the right to wear the hijab has inspired other girls from the community to exercise their constitutionally guaranteed freedoms. “Just because I was not exercising my right before doesn’t mean I shouldn’t do it in the future,” Udyavar said.

Principals of at least three colleges in Kundapur told ThePrint that while some Muslim students had always worn the hijab to classes, the number had increased ever since the row took off in January.

“There is no explicit rule that bans hijab in the college, but there is no rule that permits it either,” Naveen Shetty, principal of R.N. Shetty College, said.

According to him, students who sought permission to wear hijabs earlier could usually do so “as long as it doesn’t cause trouble”. Now, Shetty said, it was causing trouble and so hijabs as well as saffron scarves were banned in the college. “The management decided to ban both explicitly until the time the high court order comes,” Shetty added.

The Udupi PU College students who petitioned the court told ThePrint that they shouldn’t have to choose between their education and wearing a hijab, but said their stance has come at a cost to them.

Abdul Shukur, Muskaan’s father, said he was concerned for the family’s safety. Another student, A.H. Almas, told ThePrint about the hostility that she was encountering.

“When we started protesting, our details were leaked and unknown people follow us around,” she alleged, adding that members of the CFI were giving the women protection.

The Muslim Okkoota had until recently refrained from openly backing the hijab cause but has now reconsidered its decision. “When Muslim girls who are studying at co-ed colleges that have allowed hijab for years started getting targeted, we had to step in since it is injustice being meted out to them,” Ibrahim Sahib Kota, president of the Udupi Muslim Okkoota, said.

‘Senior VHP, Bajrang Dal, Hindu Jagaran Vedike leaders oversee saffron scarf distribution’

When ThePrint visited Mahatma Gandhi Memorial (MGM) College in Udupi, students wearing hijabs were engaged in a face-off with others who had donned saffron scarves and headgear. But, when ThePrint spoke to many of the Hindu protestors, they admitted they were no longer students of the college.

“I studied commerce here and passed out in the 2016-2017 academic year,” Sushanth sheepishly told ThePrint, identifying himself as an ABVP member. “For many years, [Muslim women students] have been wearing hijabs in classrooms but now since they are making a strong assertion of their religious right, should we not as Hindus assert our religious identity too?” he asked, insisting that the protesting Hindu students had all brought their own saffron scarves and shawls.

ThePrint, however, witnessed male protestors distributing saffron shawls to women students who had just arrived at the college. The scene was in line with a couple of videos that went viral this month: One showed students returning their saffron headgear to purported members of the Hindu Jagaran Vedike near their college, and another showed someone in an Innova car distributing saffron scarves to students at a college in Kodagu.

Another protestor, Akshat Pai, said he had graduated from the college in 2014, but was there in his capacity as a Hindu Jagaran Vedike leader. “We haven’t pressured the students into protesting. They are doing it on their own,” Akshat Pai said, as students in saffron accessories hovered around him and asked whether they should leave or stay.

A first-year B.Com. student, a Hindu woman, told ThePrint on the condition of anonymity that many of the protestors did not study at the college. “Why are outsiders coming and supplying saffron scarves to our collegemates?” she asked, adding that she had no problem with the hijab just as her Muslim friends had no objection to the bindi on her forehead.

Harshita, another Hindu student at MGM college, had a different viewpoint. She cited a 5 February government order proscribing clothes that “disturb public law and order” and said that if Muslim women could wear hijabs, Hindus could wear saffron scarves.

Prakash Kukkehalli, Mangaluru unit general secretary of the Hindu Jagaran Vedike, was observing the protest at MGM college from the other side of the road, with young men from the campus occasionally arriving to consult with him.

“We are not instigating students. We are only giving them moral support,” Kukkehalli told ThePrint.

According to him, the PFI, SDPI, and other Muslim organisations were provoking students for political benefit. “They have launched social media warfare to dent the image of India,” he said. “Today they will ask for hijab, tomorrow it will be Sharia law… a separate nation.”

A former ABVP office-bearer, who did not want to be named, told ThePrint how the saffron scarf protest is orchestrated by Hindutva organisations.

“The saffron scarves are procured and distributed by office bearers. Senior leaders of the VHP, Bajrang Dal, Hindu Jagarana Vedike even visit protest sites to observe whom to groom as a leader and if anyone is straying away from discussed slogans or statements,” he said.

This former ABVP leader added that he did not believe in this kind of “communal activism”, whether from Hindus or Muslims, since it only harmed students’ prospects.

“Student activists should be fighting for better colleges, professional courses and employment — not this hijab or saffron scarf fight,” he said.

A deputy superintendent-rank police officer from Udupi told ThePrint that the police were aware of saffron scarves being handed out to students, but that this was not a crime. “Just before students arrive at their colleges, saffron scarves are being handed to them but that is not an offence,” the police officer said.

Over the past few days, though, the protests have taken a more violent turn. The police arrested 15 people in Shivamogga and Bagalkot districts Tuesday. Last week, police in Kundapur, Udupi, arrested two people, Abdul Majeed and Rajab, who were carrying knives near Kundapur Government PU College.

Communally sensitive belt of Karnataka

The three districts of coastal Karnataka — Dakshin Kannada, Uttar Kannada, and Udupi —are often counted among the more communally sensitive regions in India. All three districts have a sizeable population of Muslims as well as Christians.

“There are at least a hundred communal violence incidents in Udupi and Dakshin Kannada alone annually,” Suresh Bhat Bakrabail, an activist of the Karnataka Communal Harmony Forum (which keeps a track of communal violence incidents in coastal Karnataka) told ThePrint. In 2021, in a four-year high, there were more than 120 such incidents in these two districts alone.

Social activists attribute the frequent communal flare-ups in the region, which is frequently described as a “Hindutva laboratory“, largely to incitement from radical Hindu and Muslim organisations.

Monday, 2 March 2020

Thursday, 18 January 2018

Four lessons the Carillion crisis can teach business, government and us

Carillion’s collapse was capitalism in action. Profits are the reward for taking risks, and sometimes the risks materialise. Carillion’s problem was not that its profits were too high, but that they were too low when things started to go wrong. In a free-market system, it’s that simple.

Except that it isn’t quite that simple in this case, because much of Carillion’s work was for the government: building roads and hospitals, running prisons, providing school meals. Whitehall didn’t want the company to go bust, so bunged it a few new contracts when it was already in trouble in the hope that something would turn up. Instead, Carillion staggered on for six months as a zombie company before the banks pulled the plug.

What’s more, the directors of the company took steps to shield themselves from financial risk. The Institute of Directors – which strongly believes in free markets and the profit motive – described a 2016 change to pay policy that made it harder to claw back bonuses as “highly inappropriate”, which of course it was. The company’s workforce, its subcontractors and its pensioners have not been so fortunate.

PFI has been an attempt to prove that it is possible to get world-class public services on the cheap. This is a delusion

Jeremy Corbyn says the demise of Carillion is a watershed moment, and he could well be right. The reputation of business is already at a low ebb and the Carillion saga has everything to get the public fired up: mismanagement, dividends for shareholders and boardroom fat-cattery leading to job losses, pension cuts and more expensive public services. Voter resistance to local councils taking previously outsourced services back in house is likely to be minimal.

The time has come to have a hard look at the private finance deals that have been the vehicle of political choice for delivering infrastructure projects – and, increasingly, public services – for the past quarter of a century. Public-private partnerships started as an accounting wheeze in John Major’s government when it needed a way to prevent spending on capital investment boosting high borrowing built up in the early 90s recession.

‘Gordon Brown (left), chancellor under Tony Blair (right), needed to find a way of building new schools and hospitals promised in opposition.’ Photograph: WPA Pool/Getty Images

But the Conservatives became less wedded to them when an improving economy led to an improvement in the public finances as the 90s wore on. It was Labour’s arrival in office in 1997 that gave private finance a new lease of life. Gordon Brown, Tony Blair’s chancellor, pledged to stick to the tough spending targets inherited from the Tories for two years, but still needed to find a way of building the new schools and hospitals promised in opposition. PFI (the private finance initiative ) – under which the private sector would pay for a new project up front and be paid back by the government over the coming decades – was the answer.

PFI, essentially a live-now pay-later approach, was always an expensive way to fund infrastructure, and the private sector did well out of them.

Life became a lot tougher after 2010, when the coalition government decided its first priority was to reduce a budget deficit at 10% of GDP. Spending on infrastructure was cut, and private sector contractors such as Carillion found Whitehall more miserly when negotiating contracts. Local government, which bore the brunt of government spending cuts, came under pressure to outsource services to save money.

Austerity and PFI was an unhappy marriage. To be sure, taxpayers saved money by getting the private sector to provide services more cheaply. But savings came at a price. Prisoners turned up late for court appearances; schools were built to a lower specification; PFI contractors cut corners to save money whenever they could because the bids put in to win contracts were barely enough to cover their costs. This was a race to the bottom, and Carillion won it.

George Osborne, who masterminded the coalition’s austerity strategy, says the problem was a failure to use more small- and medium-sized companies instead of relying on the big beasts. This is absurd: only large outfits could contemplate taking on large PFI contracts. And in many cases, multifaceted companies such as Carillion used profits from one sector to subsidise losses elsewhere in their portfolios.Q&A

How are you being affected by the Carillion liquidation crisis?Show

There are lessons to be learned from Carillion’s collapse, but the idea that SMEs should be building billion-pound hospitals is not one of them. Lesson one is that governments can have austerity or they can have PFI, but not both together. For the past eight years, it has been possible for the state to borrow for long periods at historically low interest rates. This would have been – and still is – a more cost-effective way of financing big infrastructure projects.

London libraries assess impact of Carillion collapse

Lesson two is that the state is not well equipped to manage big infrastructure projects. There are plenty of examples – the abandonment of the NHS IT project at a cost of £12bn, for example – of official incompetence. Whitehall’s handling of Carillion has left a lot to be desired. No matter what Labour says, the private sector will inevitably have a big role in the delivery of major projects. Even under a Corbyn-led government, there would inevitably be a role for it.

Given that, lesson three is the need to rethink company law. Trade unions felt the full force of the law when they were deemed to have acted badly in the late 70s and 80s; a similar approach for corporate wrongdoing is long overdue. It might simply mean enforcing existing laws more strongly, but the step that would send a shiver through boardrooms would be the end of limited liability for directors of limited companies. Limited liability is supposed to encourage entrepreneurship. In Carillion’s case it seems to have created moral hazard.

The final lesson is for the public. PFI has been an attempt to prove that it is possible to get world-class public services on the cheap. This is a delusion. If we want world-class public services, one way or another they will have to be paid for.

UK finance watchdog exposes lost Private Finance Initiative (PFI) billions

Britain has incurred billions of pounds in extra costs for no clear benefit by using the private finance initiative (PFI) to build much of its infrastructure, the National Audit Office has said.

Recent PFI contracts — for schools, hospitals and other facilities — are between 2 and 4 per cent more expensive than other government borrowing, and involve significant additional fees, the watchdog said in a report published on Thursday.

The GMB union said the NAO’s report showed that PFI was a “catastrophic waste of taxpayers’ money” and projects were “financial time bombs”.

Political criticism of PFI has intensified this week following the liquidation of Carillion, a leading provider. Jeremy Corbyn, the Labour leader, told parliament on Wednesday that Carillion was evidence of a “broken system” and “costly racket”, and called for some companies “to be shown the door”.

Although Theresa May, the prime minister, accused Labour of opposing “the private sector as a whole”, some Conservatives have joined in criticism of PFI.

Former cabinet minister David Willetts, a one-time Treasury official, was a key promoter of the scheme, but this week admitted that some recent projects had gone awry. Carillion’s collapse exposed cases where, in the end, the risk reverted to the government, which had to maintain public services, he said.

Labour has promised to bring many PFI contracts back in-house “if necessary” if it wins the next general election. But terminating PFI deals could involve billions of extra fees because most contracts do not include break clauses.

In one example, Liverpool City Council is due to pay a further £47m in fees for Parklands High School in Liverpool, even though the school cost only £24m to build and was shut after 12 years owing to poor teaching standards.

“Many local bodies are now shackled to inflexible PFI contracts that are exorbitantly expensive to change,” said Meg Hillier, chair of the Commons public accounts committee.

Breaking these contracts would involve settling interest rate swaps. The largest 75 PFI schemes would cost £2bn to break, a quarter more than the outstanding debt, even before compensation to shareholders is considered, the NAO said.

PFI can be attractive to government as recorded levels of debt will be lower five years ahead even if it costs significantly more over the full term of a 25-30 year contract, National Audit Office

Stella Creasy, a Labour MP, said the government should negotiate directly with PFI providers or impose a windfall tax on the special purpose vehicles (SPVs) involved. “It might seem that our hands are tied, but they’re not. What we can do is use our tax system,” she said.

PFI was devised in the UK in 1989 but its use jumped while Tony Blair was prime minister in the late 1990s and early 2000s.

It refers to deals where SPVs are set up to finance construction projects. The SPV borrows money to fund the construction, but that debt is mostly not included on the public sector balance sheet. In the last financial year, Britain paid £10bn in PFI fees; future charges amount to £199bn spread over the next three decades.

“PFI can be attractive to government as recorded levels of debt will be lower over the short to medium term (five years ahead) even if it costs significantly more over the full term of a 25-30 year contract,” said the NAO.

Off-balance-sheet public-private partnerships, such as PFI, now represent 1.7 per cent of Britain’s gross domestic product, the third highest ratio in Europe, behind Portugal and Hungary.

The NAO report detailed how the government’s decision-making was slanted in favour of PFI. While the US and Germany compare the cost of private finance with government borrowing costs, Britain’s value-for-money assessment compares it instead with the government discount rate of 3.5 per cent, which is significantly higher.

Overall, any public body “has an incentive to show that private finance offers better value for money than the [public sector comparator] as unless alternative capital funding is made available the project is unlikely to proceed,” the NAO said.

The NAO found that, after former chancellor George Osborne’s relaunch of PFI in 2012, the “fundamentals of the financing structure and contract remain the same”. Ms Hillier said she was concerned the Treasury had not addressed “most of [PFI’s] underlying problems”.

The Treasury argued that PFI contracts have benefits — including making the private sector bear the risk of cost overruns, and introducing an incentive to reduce long-term running costs.

But the NAO collated evidence suggesting that such benefits have failed to materialise. It cited research by the Treasury select committee, which found PFI projects charge higher prices to cover unforeseen costs, and by the Department for Education, which found a school’s construction cost was not affected by how it was financed.

On the question of efficiency, three government departments surveyed by the NAO said operating costs were higher under PFI, while one department said the costs were the same.

The additional costs of PFI were easier identify. Deals and equity investors in agreements signed since 2013 are forecast to receive returns of between 2 and 4 per cent above government borrowing. But on some deals the level is above 5 per cent. In addition, PFI contracts entailed other costs — including fees for arranging the borrowing, which average around 1 per cent of the principal, and management fees, amounting to 1-2 per cent of the total payment.

The value of new PFI deals peaked in 2007-08 at £8.6bn and has declined since, a trend that the NAO attributed to the greater cost of private finance after the financial crisis.

Wednesday, 17 January 2018

The “Inefficient” State Mops up the Disasters caused by “Efficient” Private Companies.

Again the “inefficient” state mops up the disasters caused by “efficient” private companies. Just as the army had to step in when G4S failed to provide security for the London 2012 Olympics, and the Treasury had to rescue the banks, the collapse of Carillion means that the fire service must stand by to deliver school meals.

Two hospitals, both urgently needed, that Carillion was supposed to be constructing, the Midland Metropolitan and the Royal Liverpool, are left in half-built limbo, awaiting state intervention. Another 450 contracts between Carillion and the state must be untangled, resolved and perhaps rescued by the government.

Fire services ready to deliver school meals after Carillion collapse

When you examine the claims made for the efficiency of the private sector, you soon discover that they boil down to the transfer of risk. Value for money hangs on the idea that companies shoulder risks the state would otherwise carry. But in cases like this, even when the company takes the first hit, the risk ultimately returns to the government. In these situations, the very notion of risk transfer is questionable.

Nowhere is it more dubious than when applied to the private finance initiative projects in which Carillion specialised. The PFI was invented by John Major’s Conservative government, but greatly expanded by Tony Blair and Gordon Brown. Private companies finance and deliver public services that governments would otherwise have provided.

The government claimed that the private sector, being more efficient, would provide services more cheaply than the private sector. PFI projects, Blair and Brown promised, would go ahead only if they proved to be cheaper than the “public sector comparator”.

But at the same time, the government told public bodies that state money was not an option: if they wanted new facilities, they would have to use the private finance initiative. In the words of the then health secretary, Alan Milburn: “It’s PFI or bust”. So, if you wanted a new hospital or bridge or classroomor army barracks, you had to demonstrate that PFI offered the best value for money. Otherwise, there would be no project. Public bodies immediately discovered a way to make the numbers add up: risk transfer.

Nurses might be laid off, but the walls will still be painted

The costing of risk is notoriously subjective. Because it involves the passage of a fiendishly complex contract through an unknowable future, you can make a case for almost any value. A study published in the British Medical Journal revealed that, before the risk was costed, every hospital scheme it investigated would have been built much more cheaply with public funds. But once the notional financial risks had been added, building them through PFI came out cheaper in every case, although sometimes by less than 0.1%.

Not only was this exercise (as some prominent civil servants warned) bogus, but the entire concept is negated by the fact that if collapse occurs, the risk ripples through the private sector and into the public. Companies like Carillion might not be too big to fail, but the services they deliver are. You cannot, in a nominal democracy, suddenly close a public hospital, let a bridge collapse, or fail to deliver school meals.

Partly for this reason, and partly because of the inordinate political power of corporations and the people who run them, governments seek to insulate these companies from the very risks they claim to have transferred to them. This could explain why Theresa May’s administration continued to award contracts to Carillion after it had issued a series of profit warnings. Was this an attempt to keep the company in business?

If so, it was one of a long list of measures designed to privatise profit and socialise risk. PFI contracts specify that if there is a conflict between paying the private provider and delivering public services, the payments must come first. However deep the crisis in the NHS becomes, however many people must have their cancer operations postponed or be left to rot on trolleys, the legal priority is still to pay the contractor. Money is officially more valuable than life.

If a PFI consortium is contracted to deliver maintenance and ancillary services, these non-clinical functions are ringfenced, while the clinical services delivered by the public sector must be cut to make room for them. This forces public bodies to respond perversely to a funding crisis: nurses might be laid off, but the walls will still be painted. Many of the contracts cannot be broken for 25 or 30 years, regardless of whether or not they still meet real needs: again, this insulates the private sector from hazard, leaving it with the public. The risk lands not only on the state but also on the people. Carillion leaves behind a series of scandals, such as the food hygiene failure at Swindon’s Great Western Hospital, and the failings at the Surgicentre clinic it ran in Hertfordshire, revealed in a horrifying report in the Observer. Similar crises have attended many other deals with private providers: operating theatres flooded with sewage, power cuts which have left nurses to ventilate patients on life support by hand, school buildings falling apart, useless services continuing to be delivered while essential services are cut.

None of this was unforeseen. Some of us warned again and again during the New Labour years that this programme would prove to be an expensive fiasco. Even the Banker magazine predicted, in 2002, that “eventually an Enron-style disaster will be rerun on a sovereign balance sheet”. But the government didn’t want to know. Nor did the Conservative opposition, whose idea it was in the first place. Nor did the other newspapers, now apparently scratching their heads and wondering how this happened. There is no joy in being proved right, just immense frustration.

Risk to a company is not the same as risk to those who own and run it. The executives keep their payoffs. The shareholders take a hit on part of their portfolios, but limited liability ensures they can walk away from any debts. The company might disappear, but ultimately it’s just a name and some paperwork. But the risks imposed on the people – including the company’s workers – are real. We pay for these risks twice: first, when they are nominally transferred to corporations; then again, when they are returned to us. The word used to describe this process is efficiency.

Wednesday, 30 August 2017

Britain is still a world-beater at one thing: ripping off its own citizens

Aditya Chakrabortty in The Guardian

And so to the big question. The one that has dogged us ever since the EU referendum and haunts every Brexiteer’s chlorinated daydreams. What is Britain for? Cliche-mongers will tell you that Britain lost an empire then couldn’t find a role. They are wrong. After careful study of recent newspaper articles, I have discovered just that new part – and today, dear reader, I am going to share it with you.

The British are now world-beaters at paying other people to rip them off. We are number one at handing over cash to “investors” who do no investing, to “entrepreneurs” who run monopolies – and who then turn around and tap us up for a bit more on the way out.

Consider two stories from the past few days. British Gas announces its electricity prices will rise by 12.5%, starting next month. Just as the cold nights start drawing in, more than 3 million Britons will find their bills are more expensive. Never mind that the competition watchdog judged last year that British Gas and other energy giants were taking well over a billion pounds a year through “excessive prices”. This privatised industry has a tradition of ripping off loyal customers to uphold.

Think about the scandal of people having to pay huge ground rents just to stay in their own homes. For years, big property developers have been flogging the freeholds on newly built estates to speculators, often based offshore, whose only relationship with the people living there is to hit them with ever-larger bills. Tens of thousands of families have been bundled up and turned into human revenue streams. Nor are they alone. Whether as taxpayers or consumers, pretty much everyone in Britain is now human feedstock for Big Capital.

This may not be how you see yourself. After all, you’re a customer and in our dynamic, choice-stuffed markets the customer is king. Except that the propaganda doesn’t match reality. If, like me, you live in London and use water, you are forced to give your business to Thames Water. The same Thames Water that is owned by a consortium of international investors, whose interests were until recently managed by Macquarie, an investment firm with headquarters in Australia. I have reported before on this arrangement, which ran from December 2006 until March of this year. Between 2006 and 2015, Thames Water divvied up £1.6bn in dividends to its small circle of shareholders, who in turn loaded up the company with billions in debt.

These “investors” were not doing much investing – indeed, they will shoulder neither the costs nor the risks of building London’s £4bn super-sewer. Much of the money will come from me and Thames Water’s 15 million other customers, through our bills. Between 2011 and 2015, the company paid no corporation tax at all. Someone bagged a bargain, and it wasn’t the taxpayer.

Think about the train operators that are subsidised to the tune of billions by public money – only to penalise the public with eye-watering fares and crap broadband. We pay them to rip us off. Ponder the new nuclear station about to be built by the Chinese and French at Hinkley Point, at an estimated cost to British households of £30bn. Neither David Cameron nor Theresa May would countenance the British government creating a new power station, but they will pay way over the odds for foreign governments to do so.

Want more examples? Think about the giant outsourcing industry, where a multinational such as G4S can fail to lay on enough guards for the 2012 London Olympics and charge taxpayers for phantom electronic tags on dead criminals – and still be put in charge of securing the Royal Mint.

In the early 00s, the Mail and the Express would bang on and on about “Rip-off Britain” and how booze and fags and Levi’s jeans were cheaper abroad. Right under their nose a rip-off industry was getting started in the form of the private finance initiative. Tony Blair saw the arrangement as a way of funding more schools and hospitals without raising taxes or taking on public debt. As York University’s Kevin Farnsworth points out, PFIs also served an ideological purpose. “Try getting change in… public services,” he once chortled to a conference of private equity financiers. “I bear the scars on my back.” PFI – putting the private sector in charge of providing public infrastructure – was one of his ways of getting that change.

These are all examples of losing control – over our bills, over our taxes, over our water and trains and schools

Almost two decades later, we can see the results. PFIs have produced more fleecing than Millets. A PFI primary school in Middlesbrough, only opened in 2006, was demolished in 2015 because its foundations had been built on “defective fill material” – literally, dodgy ground. Children and staff moved to another site – nevertheless, payments on the contract had to be made. In Liverpool, a PFI school has been shut since 2014 – because there aren’t enough pupils to keep it open – yet taxpayers still pay £12,000 a day under the contract. These aren’t one-offs: they are inherent in the structure of PFIs, which dump all the risks on the public and hand the private sector all the rewards.

As the TES (formerly the Times Educational Supplement) found in April, one PFI school in Bristol that needed a new window blind will have to pay £8,154 for it. Another that had to install a tap is facing a bill for £2,211. Private companies get paid for the building, then get paid again for cleaning and maintenance and interest charges. Across the UK there are more than 700 PFI projects with a capital value of around £55bn. It is estimated that they will cost the public more than £300bn.

These are all examples of the public losing control – over our bills, over our taxes, over our water and trains and schools. Will freeing ourselves of the shackles of the European court of justice or EU state aid rules or any other Brexiteer hobbyhorse allow us to “take back control”? On the basics that govern our lives we have lost sovereignty. Brussels didn’t sell us down the river: Thatcher, Blair and Cameron did.

Leaving the EU won’t change any of this. Theresa May will continue to privatise chunks of the NHS. Philip Hammond will still flog Britain to foreign capital as a bargain basement of cheap workers and low taxes – one giant Poundland. And Britons will find more and more aspects of their daily lives picked over by big businesses for revenue streams.

PFI is bankrupting Britain's public services

Stella Creasey in The Guardian

Next time you have an appointment cancelled at hospital, or a headteacher tells you their school will be losing staff because of budget cuts, ask how much PFI debt they have – the answer may surprise you. My hospital trust, in north-east London, spends nearly £150m a year repaying its PFI debt – nearly half of which is on interest payments. If Theresa May is serious about taking on the unacceptable face of capitalism, she could save Britain a fortune if she goes after the legal loan sharks of the public sector.

New research from the Centre for Health and the Public Interest (CHPI) shows just how much these debts are hurting our NHS. Over the next five years, almost £1bn of taxpayer funds will go to PFI companies in the form of pre-tax profits. That’s 22% of the extra £4.5bn given to the Department of Health in the 2015 spending review, and money that would otherwise have been available for patient care.

The company that holds the contract for University College London hospital has made pre-tax profits of £190m over the past decade, out of the £725m the NHS has paid out. This alone could have built a whole new hospital as 80% of PFI hospitals cost less than this to construct. This is not just about poor financial control in the NHS – UK PFI debt now stands at over £300bn for projects with an original capital cost of £55bn.

It’s time to grasp the nettle and get Britain a better line of credit

Private finance initiatives are like hire-purchase agreements – superficially a cheap way to buy something, but the costs quickly add up, and before you know it the debt is crippling.

For decades, governments of both main parties have used them for the simple but ultimately short-sighted view that it keeps borrowing off the books – helping reduce the amount of debt the country appears to have, but at great longer-term expense. Its now painfully clear that the intended benefits of private sector skills to help manage projects have been subsumed in the one-sided nature of these contracts, to devastating effect on budgets.

No political party can claim the moral high ground. The Tories conveniently ignore the fact that these contracts started under the John Major government – and are expanding again under Theresa May, with the PF2 scheme. Labour veers between defensive rhetoric that PFI was the best way to fund the investment our public sector so desperately needed during its last government, and angrily demanding such contracts be cancelled outright, wilfully ignoring what damage this would do to any government’s ability to ever borrow again.

It’s time to grasp the nettle and get Britain a better line of credit. That requires both tough action on the existing contracts to protect taxpayers’ interests, and getting a better deal on future borrowing. Some have already bought out contracts – Northumbria council took out a loan to buy out Hexham hospital’s PFI, and in doing so saved £3.5m every year over the remaining 19-year term. But as the National Audit Office has shown, gains from renegotiating individual contracts are likely to be minimal – what is saved in costs is paid out in fees to arrange.

However, the CHPI research also shows up another interesting facet of PFI. Just eight companies own or appear to have equity stakes in 92% of all the PFI companies in the NHS. Renegotiating not the individual deals done for hospitals or schools, but across the portfolios of the companies themselves could realise substantial gains. Innisfree, which manages my local hospital’s PFI and others across the country and has just 25 staff, stands to make £18bn alone over the coming years. If these companies are resistant to consolidating these loans into a more realistic cost, then it’s time to look again at their tax reliefs, or – given the evidence of excessive profits in this industry that shareholders have received – resurrect one of New Labour’s early hits with a windfall tax on the returns made.

Longer term, we need to ensure there is much more competition for the business of the state. Despite interest rates being low for over a decade, these loans have stayed stubbornly expensive. The lack of viable alternatives – whether public borrowing or bonds – gives these companies a captive market. If the government wants better rates, it needs to ensure there are more options to choose between, whether by allowing local authorities to issue bonds, or reforming Treasury rules that penalise public sector borrowing in the first place.

As our public services struggle under the pressure of PFI, Labour must lead this debate to show how we can not only learn from our past, but also provide answers for the future too. The government has already spent £100bn buying the debt of banks through quantitative easing. With Brexit expected not only to add £60bn to our country’s debt but also affect our access to European central bank funds, taking on our expensive creditors is a battle no prime minister can ignore in the fight to stop Britain going bust.

Tuesday, 23 August 2016

Follow the money: how left-behind cities can hold their corporate bullies to account

If you walk along Britain’s poorest streets, the phrase “left behind” – in vogue again after many such places voted to leave the EU – takes on a complex meaning. It’s not just that they are lagging behind the richer, better-connected places. It can seem, as you survey the pound stores and shuttered pubs, that these towns have been discarded: left behind, as in “unwanted on the journey”. Wealth has flowed out of them to somewhere else.

The logical question should be: who did this? Sometimes it’s obvious: in Ebbw Vale, for example, the answer is the Anglo-Dutch steel company Corus, which closed the plant in 2002. In many places it’s not obvious. Jobs seep away; council services are privatised; bus timetables dwindle; the local school gets taken over by a “superhead” from somewhere else, outsourcing the dinner ladies on day one. You can get angry about it, but there is nobody specific to be angry at.

Faced with the same problem, union and community organisers in the US have, in the past 12 months, adopted a novel way of fighting back. Through a campaign group called Hedge Clippers, they have begun tracing the lineages of financial power behind the decisions that affect specific places, and targeting those financiers – pension funds – with a new kind of pressure.

Steve Lerner, one of the instigators of the 1980s Justice for Janitors campaign, which, for the first time, organised migrant cleaning workers in the US, explains how the tactic evolved. “We were organising janitors working for contract cleaning companies: but they’re just middlemen,” he said. “So we targeted the building owners. It turned out they, too, were dependent on banks and pension companies, so we got a trillion dollars worth of pension money to say it won’t invest unless there is decent pay. Then we asked ourselves: OK, what else do they own?”

It turns out, quite a lot. In Baltimore, the city’s privatised water industry hiked its bills. Then, when people started to fall behind in payments, the city agreed to bundle up their unpaid bills into a financial vehicle called a “tax lien” and sell it to investors. The investors can, after two years, evict people from their homes for non-payment.

When campaigners looked at who was buying up the debt, they included an anonymous company linked to one of the biggest hedge funds in America: Fortress Investments, with $23bn worth of assets invested in “the largest pension funds, university endowments and foundations”.

Since the 2008 crisis, with returns on government bonds negative, and stock market dividends depressed, pension funds have been pouring money into the hedge fund sector. “It’s a form of assisted suicide,” Lerner argues: “Workers are investing their pension money into firms whose mission is to destroy us.”

He set up Hedge Clippers, which aims to force pension funds to divest from companies whose investment strategies fuel the cycle of impoverishment.

If you apply the same approach to Britain, you’re dealing with a different ecosystem. No city has yet securitised the unpaid debts of the poor, as Baltimore did. While there is no shortage of predatory lenders to the poor, there are – after a campaign led by Labour MP Stella Creasy – at least elementary controls on them.

However, pension funds are now the biggest source of money for UK hedge funds, according to a Financial Conduct Authority survey last year, with 43% of their money coming from institutional investors. The most obvious act of financial predation is the private finance initiative (PFI), where schools and hospitals were built with vastly lucrative private loans. As a result, the taxpayer is committed to paying back £232bn on assets worth £57bn.

Many pension funds, either directly or indirectly, are investing in the so-called “infrastructure funds” who buy up PFI debt. The investment analyst Preqin found 588 institutional investors worldwide with “a preference for funds targeting PFI”, 40% of which were based in Europe.

Tracing the more complex ways institutional finance is funding the cycle of impoverishment is not easy. What you would want to know, in places such as Stoke-on-Trent or Newport, is not just who took the decisions to close high-value workplaces but, more importantly, who makes the decisions that lead to chronic under-investment now. Governments, including the devolved ones of the UK, spend a lot of time and money effectively bribing global companies to create jobs and keep them in Britain’s depressed areas. Communities themselves have little or no input into the process, which is in any case all carrot and no stick.

Lerner’s initiative in the US grew out of trade union activism, because the unions there learned to follow the money instead of wasting time trying to negotiate with the powerless underlings of global finance. They worked out that, in an age where the workplace and the community can seem like two different spheres of activism, it is the finance system that links the two.

Older ‘left-behind’ voters turned against a political class with values opposed to theirs

Union organising of the unorganised, and community activism in Britain have both traditionally been weak because top-down Labourism has been strong. Faced with PFI, predatory loans, rip-off landlords and privatisation, the British way is to demand legislation, not chain yourself to the door of a Mayfair hedge fund.

With or without Jeremy Corbyn, the near-impossibility of Labour gaining a Commons majority in 2020 – whether because of Scotland, boundary changes, a hostile media or self-destruction – has to refocus the left on to what is possible to achieve from below. We have to start, as the Americans did, by mapping the invisible forces that strip jobs, value and hope out of communities; make them visible; trace their dependencies and then use direct action to kick them in the corporate goolies until they desist.

Sunday, 12 April 2015

Every man, woman and child in Britain is more than £3,400 in debt – without knowing it and without borrowing a single penny

The situation is expected to worsen as PFI projects spread across the world (Getty)

The situation is expected to worsen as PFI projects spread across the world (Getty) Gateway Surgical Centre, London, is run by Barts Health NHS Trust, which is struggling under a £7bn PFI (Alamy)

Gateway Surgical Centre, London, is run by Barts Health NHS Trust, which is struggling under a £7bn PFI (Alamy) PFI contracts could escalate like America’s subprime mortgage fiasco (Getty)

PFI contracts could escalate like America’s subprime mortgage fiasco (Getty)