'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label MBA. Show all posts

Showing posts with label MBA. Show all posts

Monday, 15 July 2024

Thursday, 9 February 2023

Are CEOs with MBAs good for business?

Daron Acemoglu in The FT

Every year, tens of thousands of aspiring young moguls enrol at business school for an MBA, hoping to climb the corporate hierarchy. They are following predecessors who now run many leading companies, from Alphabet, Amazon and Apple to Microsoft and Walmart.

And the aim of faculty and administrators remains what Harvard Business School’s first dean, Edwin Gay, expressed in 1908: “To train people to make a decent profit, decently”.

Better knowledge and training can make leaders more innovative and productive, raising the returns to all stakeholders. Better managed businesses can more effectively achieve whatever objectives they set, including helping to tackle the myriad challenges society faces.

But has the MBA actually achieved these goals? Our recent research suggests a much less encouraging picture. Using detailed data on companies and workers from the US and Denmark, we looked at the effects when a chief executive with an MBA or undergraduate business degree takes over from one without such qualifications.

We found no evidence that CEOs with such degrees increase sales, productivity, investment or exports relative to the levels the company achieved before.

The biggest shift when a chief executive with a business degree takes charge is a decline in wages and the share of revenues going to labour, even in countries with different cultures. In the US, wages under business-degree holding CEOs were 6 per cent lower than they would otherwise have been after five years, and labour’s share of revenues was down five percentage points. In Denmark, the figures were respectively 3 per cent and 3 percentage points.

We found no evidence that these were companies with declining sales and appointed leaders with business degrees to rescue them. The patterns are similar when new MBA managers are appointed following the death or retirement of a previous CEO. Nor was there any indication that by reducing wage growth, chief executives with business education were creating more retained earnings to fund investment, which is no higher in their companies.

It may even be that, by ignoring broader stakeholders, such managers damage long-term profitability. For example, we found that higher-skilled employees were more likely to leave after the relative wage declines.

However, shareholders gain from the appointment of a CEO with a business degree — at least in the short term. Share prices increase, and we see more share repurchases in the US and higher dividends in the US and Denmark. Business-educated managers are also paid more.

The reason for the relative decline in workers’ wages and shareholders’ gain is clear. Companies run by CEOs without a business degree share increases in revenues or profits with their workforce — typically one-fifth of higher value-added. This ceases when a business-educated leader takes over. The wage impact is greater in concentrated industries.

It is impossible to know for sure why business-educated leaders have these effects, but our work provides clues. One reason could be the legacy of the economist Milton Friedman’s doctrine from 1970, which stated that “the social responsibility of business is to increase its profits”.

The idea that good managers raise profits is common in business schools and economics departments. Many courses advocate “lean corporations” or “re-engineering businesses” using digital tools to cut costs. It is possible that these ideas encourage leaders to take a tougher stance and ensure higher corporate profits are not shared with employees.

Another factor may be that the majority of business degree students interact closely with each other and often have little contact with blue-collar and clerical workers. As CEOs, they may not see the viewpoint of the rank-and-file or consider workers as stakeholders.

So is the current business school system broken? Not necessarily. First, only a small fraction of students become chief executives. Many work in other managerial positions, where their training may have very different implications.

Second, the majority of the chief executives in our sample received their degree before 2000. Business schools today may have evolved, but there are not enough CEOs with more recent degrees to judge the effects. Indeed, schools do appear to have changed rapidly this century. Many now have ethics courses and prepare their students for diverse careers, including in government service and non-profit organisations. Many students learn about corporate environmental and governance responsibilities.

Being aware of what managers with business degrees used to do is an important step in reflecting on how we can build better programmes.

Third, and most importantly, there is nothing hard-wired about business degrees. What MBAs mean and achieve will change, often prompted by students themselves. If they demand an experience that is richer than the Friedman doctrine and that prepares them for today’s societal challenges, most schools will adapt.

The change will have to start with what is taught in business schools, but it cannot stop there. The whole business school experience may need to be rethought, including how students socialise, form networks and gain experience. It will also have to involve a broader discussion of the social responsibilities of corporations and their business leaders.

Saturday, 26 November 2022

Sunday, 30 October 2022

An MBA becomes PM, when the value of an MBA is questioned

Stephen Chambers in The FT

Rishi Sunak is the first person of colour to become UK prime minister, the first Hindu and the richest premier in modern times. He is also, significantly, the first to hold an MBA degree.

Sunak studied philosophy, politics and economics at Oxford, as so many leading British politicians have. But it is his time at Stanford’s Graduate School of Business — where he met his wife and was drilled in the finer points of competitive advantage and the capital asset pricing model — that sets him apart from his peers.

Stanford Graduate School of Business sits at the heart of Silicon Valley, where Romanesque architecture, sunshine and social liberalism combine with libertarian and free market ideas and a core belief in the redeeming power of technology. It spans both suit-and-tie corporatism and T-shirt-and-sandal activism. Venture enthusiasm and techno-utopianism make for a heady business school environment. Two years in brutally competitive Palo Alto changes more than how people dress.

Amid the Rodin sculptures on campus, Sunak will have absorbed Milton Friedman’s doctrine of shareholder primacy, Michael Porter’s “five forces” framework for understanding how industries work, so-called Monte Carlo simulations, the innovator’s dilemma and an emphasis on spreadsheets — all of it flavoured with Silicon Valley’s distinctive “move fast and break things” worldview. He graduated in 2006, the year Twitter was founded. The financial crisis hadn’t happened so MBAs had not yet been blamed for causing it. This was also the founding year of TOMS shoes, which gave away one pair of shoes to a child in need for every pair bought, the very model of the Silicon Valley social enterprise.

The MBA has arguably been the most influential degree of the last 50 years. It has brought systematic discipline to practices that were previously ad hoc and weakly formalised, and serious analytical rigour to bear on starting, funding, running and advising businesses. It built a bridge between research in disparate disciplines and gave us a framework for talking about companies, competition, innovation and investment.

But recently MBA influence has shown signs of waning. The traditionally high return on investment for the roughly quarter of a million students enrolled globally on such programmes is facing renewed scrutiny in the face of rising tuition fees, while those running the programmes have started to question their methods. What if shareholders aren’t the only people we should care about? What if markets don’t allocate resources optimally for social justice? What if the firm isn’t the most useful unit of analysis for getting things done? What if political reality isn’t captured or expressed by a spreadsheet?

What does it mean to have an MBA as prime minister? Sunak’s Stanford education means he can run the numbers and pitch the vision. He can assess the net present value. He understands organisational behaviour and market-segmentation. But will any of this help when the rational expectations of MBA orthodoxy collide with politics and events?

In his political career to date, Sunak has shown both TOMS shoes and Friedmanite instincts. The UK’s furlough scheme and “eat out to help out”, which he introduced as chancellor under Boris Johnson, were TOMS-ish, almost Keynesian. The austerity measures he is now contemplating suggest the opposite. And MBAs are very good at cutting costs. The economist Daron Acemoglu has suggested that employees in companies run by MBA graduates see their wages fall over a five-year period. Markets and owners like this. Employees probably don’t.

Having an MBA in charge is reassuring if we think of the nation as a corporation. But critics of these programmes point to overconfidence, ethical lapses and a lack of real analytical or empirical evidence for widely adopted strategies. They bemoan an undue focus on case study learning, a lack of emphasis on softer skills, overreliance on corporate acquisitions rather than productivity improvements and a narrow focus on shareholder value.

Business school admissions departments often say that their students are either “poets” or “quants”. Poets are usually humanities trained and uncomfortable with spreadsheets and valuation exercises. Quants are highly numerate, often with first degrees in engineering. Poets are comfortable with what Keats called “uncertainties, mysteries [and] doubts”. Quants are good at regression analysis. Poets sing, while quants count. Boris Johnson was a poet with a classics degree. He campaigned in poetry, and tried to govern in poetry as well. The UK’s new prime minister can clearly count, while his campaigning was done almost entirely in prose. But does Sunak’s MBA allow him to sing too?

Friday, 27 April 2018

Why we should bulldoze the business school

There are 13,000 business schools on Earth. That’s 13,000 too many. And I should know – I’ve taught in them for 20 years. By Martin Parker in The Guardian

Business schools have huge influence, yet they are also widely regarded to be intellectually fraudulent places, fostering a culture of short-termism and greed. (There is a whole genre of jokes about what MBA – Master of Business Administration – really stands for: “Mediocre But Arrogant”, “Management by Accident”, “More Bad Advice”, “Master Bullshit Artist” and so on.) Critics of business schools come in many shapes and sizes: employers complain that graduates lack practical skills, conservative voices scorn the arriviste MBA, Europeans moan about Americanisation, radicals wail about the concentration of power in the hands of the running dogs of capital. Since 2008, many commentators have also suggested that business schools were complicit in producing the crash.

Having taught in business schools for 20 years, I have come to believe that the best solution to these problems is to shut down business schools altogether. This is not a typical view among my colleagues. Even so, it is remarkable just how much criticism of business schools over the past decade has come from inside the schools themselves. Many business school professors, particularly in north America, have argued that their institutions have gone horribly astray. B-schools have been corrupted, they say, by deans following the money, teachers giving the punters what they want, researchers pumping out paint-by-numbers papers for journals that no one reads and students expecting a qualification in return for their cash (or, more likely, their parents’ cash). At the end of it all, most business-school graduates won’t become high-level managers anyway, just precarious cubicle drones in anonymous office blocks.

These are not complaints from professors of sociology, state policymakers or even outraged anti-capitalist activists. These are views in books written by insiders, by employees of business schools who themselves feel some sense of disquiet or even disgust at what they are getting up to. Of course, these dissenting views are still those of a minority. Most work within business schools is blithely unconcerned with any expression of doubt, participants being too busy oiling the wheels to worry about where the engine is going. Still, this internal criticism is loud and significant.

The problem is that these insiders’ dissent has become so thoroughly institutionalised within the well-carpeted corridors that it now passes unremarked, just an everyday counterpoint to business as usual. Careers are made by wailing loudly in books and papers about the problems with business schools. The business school has been described by two insiders as “a cancerous machine spewing out sick and irrelevant detritus”. Even titles such as Against Management, Fucking Management and The Greedy Bastard’s Guide to Business appear not to cause any particular difficulties for their authors. I know this, because I wrote the first two. Frankly, the idea that I was permitted to get away with this speaks volumes about the extent to which this sort of criticism means anything very much at all. In fact, it is rewarded, because the fact that I publish is more important than what I publish.

Most solutions to the problem of the B-school shy away from radical restructuring, and instead tend to suggest a return to supposedly more traditional business practices, or a form of moral rearmament decorated with terms such as “responsibility” and “ethics”. All of these suggestions leave the basic problem untouched, that the business school only teaches one form of organising – market managerialism.

That’s why I think that we should call in the bulldozers and demand an entirely new way of thinking about management, business and markets. If we want those in power to become more responsible, then we must stop teaching students that heroic transformational leaders are the answer to every problem, or that the purpose of learning about taxation laws is to evade taxation, or that creating new desires is the purpose of marketing. In every case, the business school acts as an apologist, selling ideology as if it were science.

Universities have been around for a millenium, but the vast majority of business schools only came into existence in the last century. Despite loud and continual claims that they were a US invention, the first was probably the École Supérieure de Commerce de Paris, founded in 1819 as a privately funded attempt to produce a grande école for business. A century later, hundreds of business schools had popped up across Europe and the US, and from the 1950s onwards, they began to grow rapidly in other parts of the world.

In 2011, the Association to Advance Collegiate Schools of Business estimated that there were then nearly 13,000 business schools in the world. India alone is estimated to have 3,000 private schools of business. Pause for a moment, and consider that figure. Think about the huge numbers of people employed by those institutions, about the armies of graduates marching out with business degrees, about the gigantic sums of money circulating in the name of business education. (In 2013, the top 20 US MBA programmes already charged at least $100,000 (£72,000). At the time of writing, London Business School is advertising a tuition fee of £84,500 for its MBA.) No wonder that the bandwagon keeps rolling.

For the most part, business schools all assume a similar form. The architecture is generic modern – glass, panel, brick. Outside, there’s some expensive signage offering an inoffensive logo, probably in blue, probably with a square on it. The door opens, automatically. Inside, there’s a female receptionist dressed office-smart. Some abstract art hangs on the walls, and perhaps a banner or two with some hopeful assertions: “We mean business.” “Teaching and Research for Impact.” A big screen will hang somewhere over the lobby, running a Bloomberg news ticker and advertising visiting speakers and talks about preparing your CV. Shiny marketing leaflets sit in dispensing racks, with images of a diverse tableau of open-faced students on the cover. On the leaflets, you can find an alphabet of mastery: MBA, MSc Management, MSc Accounting, MSc Management and Accounting, MSc Marketing, MSc International Business, MSc Operations Management.

There will be plush lecture theatres with thick carpet, perhaps named after companies or personal donors. The lectern bears the logo of the business school. In fact, pretty much everything bears the weight of the logo, like someone who worries their possessions might get stolen and so marks them with their name. Unlike some of the shabby buildings in other parts of the university, the business school tries hard to project efficiency and confidence. The business school knows what it is doing and has its well-scrubbed face aimed firmly at the busy future. It cares about what people think of it.

Even if the reality isn’t always as shiny – if the roof leaks a little and the toilet is blocked – that is what the business-school dean would like to think that their school was like, or what they would want their school to be. A clean machine for turning income from students into profits.

What do business schools actually teach? This is a more complicated question than it first appears. Much writing on education has explored the ways in which a “hidden curriculum” supplies lessons to students without doing so explicitly. From the 1970s onwards, researchers explored how social class, gender, ethnicity, sexuality and so on were being implicitly taught in the classroom. This might involve segregating students into separate classes – the girls doing domestic science and the boys doing metalwork, say – which, in turn, implies what is natural or appropriate for different groups of people. The hidden curriculum can be taught in other ways too, by the ways in which teaching and assessment are practised, or through what is or isn’t included in the curriculum. The hidden curriculum tells us what matters and who matters, which places are most important and what topics can be ignored.

Illustration: Michael Kirkham

In many countries, a lot of work has been done on trying to deal with these issues. Materials on black history, women in science or pop songs as poetry are now fairly routine. That doesn’t mean that the hidden curriculum is no longer a problem, but at least in many of the more enlightened educational systems, it is not now routinely assumed that there is one history, one set of actors, one way of telling the story.

But in the business school, both the explicit and hidden curriculums sing the same song. The things taught and the way that they are taught generally mean that the virtues of capitalist market managerialism are told and sold as if there were no other ways of seeing the world.

If we educate our graduates in the inevitability of tooth-and-claw capitalism, it is hardly surprising that we end up with justifications for massive salary payments to people who take huge risks with other people’s money. If we teach that there is nothing else below the bottom line, then ideas about sustainability, diversity, responsibility and so on become mere decoration. The message that management research and teaching often provides is that capitalism is inevitable, and that the financial and legal techniques for running capitalism are a form of science. This combination of ideology and technocracy is what has made the business school into such an effective, and dangerous, institution.

We can see how this works if we look a bit more closely at the business-school curriculum and how it is taught. Take finance, for instance. This is a field concerned with understanding how people with money invest it. It assumes that there are people with money or capital that can be used as security for money, and hence it also assumes substantial inequalities of income and wealth. The greater the inequalities within any given society, the greater the interest in finance, as well as the market in luxury yachts. Finance academics almost always assume that earning rent on capital (however it was acquired) is a legitimate and perhaps even praiseworthy activity, with skilful investors being lionised for their technical skills and success. The purpose of this form of knowledge is to maximise the rent from wealth, often by developing mathematical or legal mechanisms that can multiply it. Successful financial strategies are those that produce the maximum return in the shortest period, and hence that further exacerbate the social inequalities that made them possible in the first place.

Or consider human resource management. This field applies theories of rational egoism – roughly the idea that people act according to rational calculations about what will maximise their own interest – to the management of human beings in organisations. The name of the field is telling, since it implies that human beings are akin to technological or financial resources insofar as they are an element to be used by management in order to produce a successful organisation. Despite its use of the word, human resource management is not particularly interested in what it is like to be a human being. Its object of interest are categories – women, ethnic minorities, the underperforming employee – and their relationship to the functioning of the organisation. It is also the part of the business school most likely to be dealing with the problem of organised resistance to management strategies, usually in the form of trade unions. And in case it needs saying, human resource management is not on the side of the trade union. That would be partisan. It is a function which, in its most ambitious manifestation, seeks to become “strategic”, to assist senior management in the formulation of their plans to open a factory here, or close a branch office there.

A similar kind of lens could be applied to other modules found in most business schools – accounting, marketing, international business, innovation, logistics – but I’ll conclude with business ethics and corporate social responsibility – pretty much the only areas within the business school that have developed a sustained critique of the consequences of management education and practice. These are domains that pride themselves on being gadflies to the business school, insisting that its dominant forms of education, teaching and research require reform. The complaints that propel writing and teaching in these areas are predictable but important – sustainability, inequality, the production of graduates who are taught that greed is good.

The problem is that business ethics and corporate social responsibility are subjects used as window dressing in the marketing of the business school, and as a fig leaf to cover the conscience of B-school deans – as if talking about ethics and responsibility were the same as doing something about it. They almost never systematically address the simple idea that since current social and economic relations produce the problems that ethics and corporate social responsibility courses treat as subjects to be studied, it is those social and economic relations that need to be changed.

You might well think that each of these areas of research and teaching are innocuous enough in themselves, and collectively they just appear to cover all the different dimensions of business activity – money, people, technology, transport, selling and so on. But it is worth spelling out the shared assumptions of every subject studied at business school.

The first thing that all these areas share is a powerful sense that market managerial forms of social order are desirable. The acceleration of global trade, the use of market mechanisms and managerial techniques, the extension of technologies such as accounting, finance and operations are not routinely questioned. This is a progressive account of the modern world, one that relies on the promise of technology, choice, plenty and wealth. Within the business school, capitalism is assumed to be the end of history, an economic model that has trumped all the others, and is now taught as science, rather than ideology.

The second is the assumption that human behaviour – of employees, customers, managers and so on – is best understood as if we are all rational egoists. This provides a set of background assumptions that allow for the development of models of how human beings might be managed in the interests of the business organisation. Motivating employees, correcting market failures, designing lean management systems or persuading consumers to spend money are all instances of the same sort of problem. The foregrounded interest here is that of the person who wants control, and the people who are the objects of that interest can then be treated as people who can be manipulated.

The final similarity I want to point to concerns the nature of the knowledge being produced and disseminated by the business school itself. Because it borrows the gown and mortarboard of the university, and cloaks its knowledge in the apparatus of science – journals, professors, big words – it is relatively easy to imagine that the knowledge the business school sells and the way that it sells it somehow less vulgar and stupid than it really is.

The easiest summary of all of the above, and one that would inform most people’s understandings of what goes on in the B-school, is that they are places that teach people how to get money out of the pockets of ordinary people and keep it for themselves. In some senses, that’s a description of capitalism, but there is also a sense here that business schools actually teach that “greed is good”. As Joel M Podolny, the former dean of Yale School of Management, once opined: “The way business schools today compete leads students to ask, ‘What can I do to make the most money?’ and the manner in which faculty members teach allows students to regard the moral consequences of their actions as mere afterthoughts.”

In many countries, a lot of work has been done on trying to deal with these issues. Materials on black history, women in science or pop songs as poetry are now fairly routine. That doesn’t mean that the hidden curriculum is no longer a problem, but at least in many of the more enlightened educational systems, it is not now routinely assumed that there is one history, one set of actors, one way of telling the story.

But in the business school, both the explicit and hidden curriculums sing the same song. The things taught and the way that they are taught generally mean that the virtues of capitalist market managerialism are told and sold as if there were no other ways of seeing the world.

If we educate our graduates in the inevitability of tooth-and-claw capitalism, it is hardly surprising that we end up with justifications for massive salary payments to people who take huge risks with other people’s money. If we teach that there is nothing else below the bottom line, then ideas about sustainability, diversity, responsibility and so on become mere decoration. The message that management research and teaching often provides is that capitalism is inevitable, and that the financial and legal techniques for running capitalism are a form of science. This combination of ideology and technocracy is what has made the business school into such an effective, and dangerous, institution.

We can see how this works if we look a bit more closely at the business-school curriculum and how it is taught. Take finance, for instance. This is a field concerned with understanding how people with money invest it. It assumes that there are people with money or capital that can be used as security for money, and hence it also assumes substantial inequalities of income and wealth. The greater the inequalities within any given society, the greater the interest in finance, as well as the market in luxury yachts. Finance academics almost always assume that earning rent on capital (however it was acquired) is a legitimate and perhaps even praiseworthy activity, with skilful investors being lionised for their technical skills and success. The purpose of this form of knowledge is to maximise the rent from wealth, often by developing mathematical or legal mechanisms that can multiply it. Successful financial strategies are those that produce the maximum return in the shortest period, and hence that further exacerbate the social inequalities that made them possible in the first place.

Or consider human resource management. This field applies theories of rational egoism – roughly the idea that people act according to rational calculations about what will maximise their own interest – to the management of human beings in organisations. The name of the field is telling, since it implies that human beings are akin to technological or financial resources insofar as they are an element to be used by management in order to produce a successful organisation. Despite its use of the word, human resource management is not particularly interested in what it is like to be a human being. Its object of interest are categories – women, ethnic minorities, the underperforming employee – and their relationship to the functioning of the organisation. It is also the part of the business school most likely to be dealing with the problem of organised resistance to management strategies, usually in the form of trade unions. And in case it needs saying, human resource management is not on the side of the trade union. That would be partisan. It is a function which, in its most ambitious manifestation, seeks to become “strategic”, to assist senior management in the formulation of their plans to open a factory here, or close a branch office there.

A similar kind of lens could be applied to other modules found in most business schools – accounting, marketing, international business, innovation, logistics – but I’ll conclude with business ethics and corporate social responsibility – pretty much the only areas within the business school that have developed a sustained critique of the consequences of management education and practice. These are domains that pride themselves on being gadflies to the business school, insisting that its dominant forms of education, teaching and research require reform. The complaints that propel writing and teaching in these areas are predictable but important – sustainability, inequality, the production of graduates who are taught that greed is good.

The problem is that business ethics and corporate social responsibility are subjects used as window dressing in the marketing of the business school, and as a fig leaf to cover the conscience of B-school deans – as if talking about ethics and responsibility were the same as doing something about it. They almost never systematically address the simple idea that since current social and economic relations produce the problems that ethics and corporate social responsibility courses treat as subjects to be studied, it is those social and economic relations that need to be changed.

You might well think that each of these areas of research and teaching are innocuous enough in themselves, and collectively they just appear to cover all the different dimensions of business activity – money, people, technology, transport, selling and so on. But it is worth spelling out the shared assumptions of every subject studied at business school.

The first thing that all these areas share is a powerful sense that market managerial forms of social order are desirable. The acceleration of global trade, the use of market mechanisms and managerial techniques, the extension of technologies such as accounting, finance and operations are not routinely questioned. This is a progressive account of the modern world, one that relies on the promise of technology, choice, plenty and wealth. Within the business school, capitalism is assumed to be the end of history, an economic model that has trumped all the others, and is now taught as science, rather than ideology.

The second is the assumption that human behaviour – of employees, customers, managers and so on – is best understood as if we are all rational egoists. This provides a set of background assumptions that allow for the development of models of how human beings might be managed in the interests of the business organisation. Motivating employees, correcting market failures, designing lean management systems or persuading consumers to spend money are all instances of the same sort of problem. The foregrounded interest here is that of the person who wants control, and the people who are the objects of that interest can then be treated as people who can be manipulated.

The final similarity I want to point to concerns the nature of the knowledge being produced and disseminated by the business school itself. Because it borrows the gown and mortarboard of the university, and cloaks its knowledge in the apparatus of science – journals, professors, big words – it is relatively easy to imagine that the knowledge the business school sells and the way that it sells it somehow less vulgar and stupid than it really is.

The easiest summary of all of the above, and one that would inform most people’s understandings of what goes on in the B-school, is that they are places that teach people how to get money out of the pockets of ordinary people and keep it for themselves. In some senses, that’s a description of capitalism, but there is also a sense here that business schools actually teach that “greed is good”. As Joel M Podolny, the former dean of Yale School of Management, once opined: “The way business schools today compete leads students to ask, ‘What can I do to make the most money?’ and the manner in which faculty members teach allows students to regard the moral consequences of their actions as mere afterthoughts.”

Illustration: Michael Kirkham

This picture is, to some extent, backed up by research, although some of this is of dubious quality. There are various surveys of business-school students that suggest that they have an instrumental approach to education; that is to say, they want what marketing and branding tells them that they want. In terms of the classroom, they expect the teaching of uncomplicated and practical concepts and tools that they deem will be helpful to them in their future careers. Philosophy is for the birds.

As someone who has taught in business schools for decades, this sort of finding doesn’t surprise me, though others suggest rather more incendiary findings. One US survey compared MBA students to people who were imprisoned in low-security prisons and found that the latter were more ethical. Another suggested that the likelihood of committing some form of corporate crime increased if the individual concerned had experience of graduate business education, or military service. (Both careers presumably involve absolving responsibility to an organisation.) Other surveys suggest that students come in believing in employee wellbeing and customer satisfaction and leave thinking that shareholder value is the most important issue, and that business-school students are more likely to cheat than students in other subjects.

Whether the causes and effects (or indeed the findings) are as neat as surveys like this might suggest is something that I doubt, but it would be equally daft to suggest that the business school has no effect on its graduates. Having an MBA might not make a student greedy, impatient or unethical, but both the B-school’s explicit and hidden curriculums do teach lessons. Not that these lessons are acknowledged when something goes wrong, because then the business school usually denies all responsibility. That’s a tricky position, though, because, as a 2009 Economist editorial put it, “You cannot claim that your mission is to ‘educate the leaders who make a difference to the world’ and then wash your hands of your alumni when the difference they make is malign”.

After the 2007 crash, there was a game of pass-the-blame-parcel going on, so it’s not surprising that most business-school deans were also trying to blame consumers for borrowing too much, the bankers for behaving so riskily, rotten apples for being so bad and the system for being, well, the system. Who, after all, would want to claim that they merely taught greed?

The sorts of doors to knowledge we find in universities are based on exclusions. A subject is made up by teaching this and not that, about space (geography) and not time (history), about collectives of people (sociology) and not about individuals (psychology), and so on. Of course, there are leakages and these are often where the most interesting thinking happens, but this partitioning of the world is constitutive of any university discipline. We cannot study everything, all the time, which is why there are names of departments over the doors to buildings and corridors.

However, the B-school is an even more extreme case. It is constituted through separating commercial life from the rest of life, but then undergoes a further specialisation. The business school assumes capitalism, corporations and managers as the default form of organisation, and everything else as history, anomaly, exception, alternative. In terms of curriculum and research, everything else is peripheral.

Most business schools exist as parts of universities, and universities are generally understood as institutions with responsibilities to the societies they serve. Why then do we assume that degree courses in business should only teach one form of organisation – capitalism – as if that were the only way in which human life could be arranged?

The sort of world that is being produced by the market managerialism that the business school sells is not a pleasant one. It’s a sort of utopia for the wealthy and powerful, a group that the students are encouraged to imagine themselves joining, but such privilege is bought at a very high cost, resulting in environmental catastrophe, resource wars and forced migration, inequality within and between countries, the encouragement of hyper-consumption as well as persistently anti-democratic practices at work.

Selling the business school works by ignoring these problems, or by mentioning them as challenges and then ignoring them in the practices of teaching and research. If we want to be able to respond to the challenges that face human life on this planet, then we need to research and teach about as many different forms of organising as we are able to collectively imagine. For us to assume that global capitalism can continue as it is means to assume a path to destruction. So if we are going to move away from business as usual, then we also need to radically reimagine the business school as usual. And this means more than pious murmurings about corporate social responsibility. It means doing away with what we have, and starting again.

This picture is, to some extent, backed up by research, although some of this is of dubious quality. There are various surveys of business-school students that suggest that they have an instrumental approach to education; that is to say, they want what marketing and branding tells them that they want. In terms of the classroom, they expect the teaching of uncomplicated and practical concepts and tools that they deem will be helpful to them in their future careers. Philosophy is for the birds.

As someone who has taught in business schools for decades, this sort of finding doesn’t surprise me, though others suggest rather more incendiary findings. One US survey compared MBA students to people who were imprisoned in low-security prisons and found that the latter were more ethical. Another suggested that the likelihood of committing some form of corporate crime increased if the individual concerned had experience of graduate business education, or military service. (Both careers presumably involve absolving responsibility to an organisation.) Other surveys suggest that students come in believing in employee wellbeing and customer satisfaction and leave thinking that shareholder value is the most important issue, and that business-school students are more likely to cheat than students in other subjects.

Whether the causes and effects (or indeed the findings) are as neat as surveys like this might suggest is something that I doubt, but it would be equally daft to suggest that the business school has no effect on its graduates. Having an MBA might not make a student greedy, impatient or unethical, but both the B-school’s explicit and hidden curriculums do teach lessons. Not that these lessons are acknowledged when something goes wrong, because then the business school usually denies all responsibility. That’s a tricky position, though, because, as a 2009 Economist editorial put it, “You cannot claim that your mission is to ‘educate the leaders who make a difference to the world’ and then wash your hands of your alumni when the difference they make is malign”.

After the 2007 crash, there was a game of pass-the-blame-parcel going on, so it’s not surprising that most business-school deans were also trying to blame consumers for borrowing too much, the bankers for behaving so riskily, rotten apples for being so bad and the system for being, well, the system. Who, after all, would want to claim that they merely taught greed?

The sorts of doors to knowledge we find in universities are based on exclusions. A subject is made up by teaching this and not that, about space (geography) and not time (history), about collectives of people (sociology) and not about individuals (psychology), and so on. Of course, there are leakages and these are often where the most interesting thinking happens, but this partitioning of the world is constitutive of any university discipline. We cannot study everything, all the time, which is why there are names of departments over the doors to buildings and corridors.

However, the B-school is an even more extreme case. It is constituted through separating commercial life from the rest of life, but then undergoes a further specialisation. The business school assumes capitalism, corporations and managers as the default form of organisation, and everything else as history, anomaly, exception, alternative. In terms of curriculum and research, everything else is peripheral.

Most business schools exist as parts of universities, and universities are generally understood as institutions with responsibilities to the societies they serve. Why then do we assume that degree courses in business should only teach one form of organisation – capitalism – as if that were the only way in which human life could be arranged?

The sort of world that is being produced by the market managerialism that the business school sells is not a pleasant one. It’s a sort of utopia for the wealthy and powerful, a group that the students are encouraged to imagine themselves joining, but such privilege is bought at a very high cost, resulting in environmental catastrophe, resource wars and forced migration, inequality within and between countries, the encouragement of hyper-consumption as well as persistently anti-democratic practices at work.

Selling the business school works by ignoring these problems, or by mentioning them as challenges and then ignoring them in the practices of teaching and research. If we want to be able to respond to the challenges that face human life on this planet, then we need to research and teach about as many different forms of organising as we are able to collectively imagine. For us to assume that global capitalism can continue as it is means to assume a path to destruction. So if we are going to move away from business as usual, then we also need to radically reimagine the business school as usual. And this means more than pious murmurings about corporate social responsibility. It means doing away with what we have, and starting again.

Tuesday, 9 June 2015

Dying at 22 is too steep a price for being ‘the best’

Shobhaa De in The Times of India

My heart broke while reading the tragic account written by a devastated father on hearing about his 22-year-old son’s sudden death in a San Francisco parking lot some weeks ago. Sarvshreshth Gupta had done all the ‘right things’ ambitious Indian parents expect from their children. He was supposed to be living the Great American Dream, after graduating from the University of Pennsylvania, interning with Credit Suisse and Deutsche Bank, before landing a job as a financial analyst with Goldman Sachs in San Francisco. His young life followed the golden script written for — and sometimes by — aspiring desi students. Those who toil hard to get into the best business schools in the US, achieve great grades, repay huge loans, make their folks proud, bag high-paying jobs, work harder still… and then collapse! Like young Sarvshreshth did. The unreasonable pressure of a system that expects young people to sweat blood so as to make other people rich, finally got to the analyst — perhaps, had he listened to his father and walked out of his job a few hours earlier, he would have been alive. Fired, perhaps. But alive.

Sarvshreshth’s exchanges with his sensitive, understanding father tell their own story. And it’s a pretty common one. He writes of being severely sleep deprived, working for 20 hours a day, spending nights in an empty office, completing presentations while prepping for a client meeting early the next morning… all the while putting up with the tyranny of a senior VP breathing down his neck — pushing, pushing, pushing. Whenever his father advised him to take it easy and look after his health, Sarvshreshth would bravely reply, “Come on, Papa. I am young and strong. Investment banking is hard work.” As it turns out, the young man was not as strong as he imagined. And yes, the hard work as an investment banker is precisely what killed him.

When I came across the grieving father’s poignant online essay, ‘A Son Never Dies’, I thought about several parents and their children in similar situations. I thought about my own children and their friends… what a scary world they occupy. Look around and you will find many other Sarvshreshths — young men who are literally killing themselves in jobs that pay big bucks, but extract a gigantic price. Yes, Indians today can lay claim to being the best-educated, highest paid ethnic group in America. But, at what cost?

Right now, hundreds of over-wrought parents are undertaking pricey campus tours of various universities abroad. They believe this is their ‘duty’ since they want their kids to ‘get the best’. Is this what they mean by ‘the best’ ? We have equally good universities in India. What sort of absurd pressure is this that forces parents and students to go overseas in the hope of ‘bettering prospects’? Why not have confidence in your child’s ability to shine in India, without going through the sort of trauma Sarvshreshth suffered? Yes, we have ragging in our colleges, and no, some of our academic laurels are not as prestigious in global job markets as Ivy League degrees. So what? If you’ve got it, you will make it. Anywhere!

Just a short while before Sarvshreshth’s body was found (cause of death not officially declared so far), his father had told him to take 15 days’ leave and come home. The fatigued son’s forlorn response was, “They will not allow”. Hours later, he was dead. This sad story should act as a wake-up call for both over-ambitious parents and over-achieving children. Not everybody can take the almost inhuman pressure of the rat race. This young man was missing home-cooked food, the comfort of family and an emotionally reassuring environment. If only he’d had the courage to say, ‘To hell with it…’ and come home, his devastated father would not be writing that pathos-filled essay today.

It’s time we took a fresh look at our craze for ‘foreign degrees’ and ‘foreign jobs’. Today there are over 100,000 Indian students on US campuses. Most will think of this time as the best years of their lives. Some will stay on and be successful there. Others will return and pursue successful careers back home. But a few will crack, crumble and succumb under pressure. The system sees all kinds. But this is not about the survivors. This is about the vulnerable. Every parent wants a child to succeed. But not at the cost of their life.

I wish Sarvshreshth’s father Sunil Gupta would take this important message to many more parents still debating about their child’s future. Earning a degree and bagging a great job are fine goals. But living a wholesome life with people who love and respect you is infinitely more rewarding in the long run.

Irony. This was the worst thing to happen to a young man whose name means ‘The Best’.

Monday, 27 October 2014

Lessons from a bank robbery

Courtesy Rishi Singh

During a recent robbery, the bank robber shouted: "Don't move. The money is insured and ultimately belongs to the government, and Your life belongs to you."

Everyone in the bank laid down quietly.

This is called "Mind Changing Concept” or Paradigm Shift Changing the conventional way of thinking.

When a lady lay on the table provocatively, the robber shouted at her: "Please be civilised! This is a robbery and not a rape!"

This is called "Being Professional” Focus only on what you are trained to do!

When the bank robbers returned home, the younger robber (MBA trained) told the older robber (who has only completed Year 6 in primary school): "Big brother, let's count how much we got."

The older robber rebutted and said: "You are very stupid. There is so much money it will take us a long time to count. Tonight, the TV news will tell us how much we robbed from the bank!"

This is called "Experience” Often, experience is more important than paper qualifications!

After the robbers had left, the bank manager told the bank supervisor to call the police quickly. But the clever supervisor said to him: "Wait! Let us take out $10 million from the bank for ourselves and add it to the $70 million that we have previously embezzled from the bank”.

This is called "Swim with the tide” with experience and dishonesty. Converting an unfavorable situation to your advantage with resourcefulness and cunning!

The supervisor says: "It will be good if there is a robbery every other month."

This is called "Changing priority”. Personal Happiness is as or more important than your job”.

The next day, the TV news reported that $100 million was taken from the bank. The robbers counted and counted and counted, but they could only account for $20 million.

The robbers were very angry and complained: "We risked our lives and only took $20 million. The bank manager took $80 million with a snap of his fingers. It looks like it is better to be educated and in a position of power than to be a thief!"

This is called "Knowledge is worth as much as gold"! And one can reap riches with deftness, crookedness and dishonest inclination with guts"

Wednesday, 13 March 2013

The Ten Biggest Lies of B-School

Comment Now

Follow Comments

I went to B-School about 10 years ago. I remember the good times, the parties, the camaraderie. I also remember the long hours in the library, working on team projects with other keen classmates, and the sense of accomplishment at graduation.

However, 10 years later, Business School missed out on a lot in terms of teaching me the skills needed to succeed in my career and life.

Here are the ten biggest lies of B-School you should protect yourself against:

1. You will be rich. My experience (and from talking to others) is that it will take you 2 or 3 times as long as you think it will take to succeed after Business School. So take it easy running up your student loans and credit card debts expecting you’re going to be a rock star later.

2. You are smarter than people without an MBA. You were smart enough to get in to Business School. That doesn’t mean you are smarter than other people without an MBA. Stay humble.

3. There’s always a right answer. B-School students are usually very analytical and achievement-oriented. They like to think there’s always a “best” answer. There’s not. The perfect answer is always the enemy of the good enough one. You make decisions you can with the best information available. Life and business today doesn’t let you count how many angels can fit on the head of a pin.

4. If you’ve made it this far (to B-School), you’re destined to succeed. In my B-School, there were always amazingly talented executives coming in to give talks on business and life. They’d always compliment us on what a great school we attended and why we had our future by the tail. It made us all feel invincible — destined to succeed once we set out on our various career paths. It doesn’t work that way. I know B-School classmates who’ve failed miserably, under-achieved, gotten divorced, gotten severely depressed, etc. B-School is a great educational opportunity in life, but you still have to go out there and succeed. Nothing is given to you as a birthright.

4. If you’ve made it this far (to B-School), you’re destined to succeed. In my B-School, there were always amazingly talented executives coming in to give talks on business and life. They’d always compliment us on what a great school we attended and why we had our future by the tail. It made us all feel invincible — destined to succeed once we set out on our various career paths. It doesn’t work that way. I know B-School classmates who’ve failed miserably, under-achieved, gotten divorced, gotten severely depressed, etc. B-School is a great educational opportunity in life, but you still have to go out there and succeed. Nothing is given to you as a birthright.

5. You know how to “fix” the first few companies you join after school. You’ve probably worked at companies were people who’ve been there for 2 decades roll their eyes telling you about the new hotshot MBA who just started and is now telling everyone how to do their jobs. It’s so clear to him, yet others find it deeply offensive that he would think he knows how the company works when they’ve spent countless years there and are still trying to figure it out. All hotshot MBAs should wear tape over their mouths for the first 3 months on the job and not be allowed to “fix” anything.

6. Discounted Cash Flow (DCF) will always tell you what a company is worth. MBAs love DCF. They think the true answer to what a company is worth is always a DCF away. Just crank it out on a spreadsheet or whiteboard, show the boss, and move on to the next problem. Unless you’re going to be a sell-side analyst, you’ll never do a DCF after B-School. And even the sell-side analysts get their underlings to do them. And no one reading your reports will read them anyway.

7. The “soft” courses (leadership and people management) are least important. I remember talking to the professors from theManagement Department at my school who had to teach the courses on leadership and people management. They used to lament that the MBAs never paid attention to them in class. Yet, the Executive MBAs (usually in their 40s or 50s) always told them that these courses were the most important of all the B-School classes they took. You learn after B-School that the perfect answer or strategy means nothing if you can’t get people around you to buy in to it and help you achieve it. To do that, you need to motivate them, listen to them, connect with them, and support them when they need it.

8. You are going to be more creative and entrepreneurial after Business School than before. In my experience, B-School makes you less creative, the longer you’re in it. They teach courses on entrepreneurship but it’s kind of an oxymoron the idea of the analysis paralysis B-School Students being entrepreneurial. You will learn a lot of tools and frameworks in B-School, but you won’t learn how to start a company. You just need to start a company.

9. Your peers will give you lots of tips and insights that will help you succeed in your career. In my experience, the majority of B-School students are lemmings. They don’t know what they want to do afterwards, so they just do what their peers say they should do (maybe that’s why they applied to B-School in the first place). Ten years ago, everyone at my school wanted to be a dot com entrepreneur. That didn’t work out so well and most students later went back to being investment bankers or management consultants. Your peers don’t know what you want to do with your career. You need to start listening to that voice inside your head.

10. The Ivy League MBAs will be even more successful. An Ivy League credential will be a big plus for you on your resume – no question. However, you have to realize that if you’re getting an Ivy League MBA, you’re probably 10x more susceptible to the previous 9 lies than other MBAs. Don’t let yourself be the next Jeff Skilling, the smart Harvard MBA, who worked at McKinsey and then went to Enron and drove the company off a cliff. He had a golden resume – and where did it get him?

If you treat B-School like an amazing educational experience, chances are you’ll get a lot out of it. Just keep your attitude and sense of entitlement in check.As Casey Kasam used to say, “Keep your feet on the ground, and keep reaching for the stars.”

Sunday, 7 October 2012

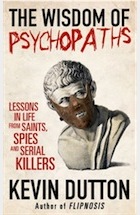

A convincing study shows that business leaders and serial killers share a mindset

The Wisdom of Psychopaths by Kevin Dutton – review

Christian Bale as Patrick Bateman in the 2000 film adaptation of Bret Easton Ellis’s novel American Psycho. Photograph: Moviestore Collection/Rex

Do you think like a psychopath? It has been claimed that one quick way of telling is to read the following story and see what answer to its final question first pops into your head:

- The Wisdom of Psychopaths

- by Kevin Dutton

- Buy it from the Guardian bookshop

- Tell us what you think: Star-rate and review this book

While attending her mother's funeral, a woman meets a man she's never seen before. She quickly believes him to be her soulmate and falls head over heels. But she forgets to ask for his number, and when the wake is over, try as she might, she can't track him down. A few days later she murders her sister. Why?

If the first answer that springs to your mind is some variation of jealousy and revenge – she discovers her sister has been seeing the man behind her back – then you are in the clear. But if your first response to this puzzle is "because she was hoping the man would turn up to her sister's funeral as well", then by some accounts you have the qualities that might qualify you to be a cold-blooded killer – or a captain of industry, a nerveless surgeon, a recruit for the SAS – or which may well make you a commission-rich salesman, a winning barrister, a charismatic clergyman or a red-top journalist. The little parable purports to reveal those qualities – an absence of emotion in decision making, a cold focus on outcomes, an extremely ruthless and egocentric logic – which tend to show up in disproportionate degrees in all those individuals.

There is a problem though. When Kevin Dutton, the author of this compulsive quest into the psychopathic mind, tried the question on some real psychopaths, not one of them came up with the "second funeral" motive. As one commented: "I might be nuts but I'm not stupid."

The admirable quality of this book is Dutton's refusal to accept easy answers in one of the more sensational fields of popular psychology. He comes at the challenge of deconstructing the advantages and dangers of psychopathic behaviour with two distinct motivations. First, the academic rigour of a research fellow at Magdalen College, Oxford. Second, with the more human need to understand the character of his late father, a market trader in the East End, a man with an "uncanny knack of getting exactly what he wanted", who could sell anything to anybody, because to him "there were no such things as clouds, only silver linings". Psychopaths, we learn, are the ultimate optimists; they always think things will work in their favour.

Dutton's curiosity takes him from boardrooms and law courts to neurological labs. He tries in different ways to get inside the heads of those individuals for whom killing has been a way of life – from Bravo Two Zero's Andy McNab to the video game-obsessed inmates of Broadmoor's secure wards. In his effort to get to their truths he has a tendency to write with the one-tone-fits-all breeziness of the excited enthusiast; at certain points his insistent chattiness jars. Though he demonstrates few of the characteristics of psychopaths himself, none of the limited range of cold fury of Viking "berserkers" or the wilful icy detachment of brain surgeons, he is in thrall to their possibilities. Perhaps, he argues, we all are.

Dutton's book at any rate supports the idea that to thrive a society needs its share of psychopaths – about 10%. It not only shows the value of the emotionally detached mind in bomb disposal but also the uses of the psychopath's ability to intuit anxiety as demonstrated by, for example, customs officials. Along the way his analysis tends to reinforce the idea that the chemistry of megalomania which characterises the psychopathic criminal mind is a close cousin to the set of traits often best rewarded by capitalism. Dutton draws on a 2005 study that compared the profiles of business leaders with those of hospitalised criminals to reveal that a number of psychopathic attributes were arguably more common in the boardroom than the padded cell: notably superficial charm, egocentricity, independence and restricted focus. The key difference was that the MBAs and CEOs were encouraged to exhibit these qualities in social rather than antisocial contexts.

As Dutton details this relationship, part of you is left wondering if the judge who recently praised a housebreaker for his courage and resourcefulness, and expressed the hope that in the future he might use his energies in more constructive directions, might have had Dutton's book by his bedside. Certainly you are left wondering if corporations that really want to find driven leaders might be as well to conduct their recruitment round in the juvenile courts as the universities. In this sense it is hard to know which is more chilling: the scene in which Dutton weighs a serial killer's brain in his hands and reveals it to be in no way tangibly different from yours or mine, or the research that shows the ability of American college students to empathise with others has, in the past 30 years, reduced by 40%…

Saturday, 12 May 2012

An Article against MBAs

Bloodless bean-counters rule over us – where are the leaders?

The inexorable march of the managerialists is creating resentment and social division.

Charles Moore in The Telegraph

Recently, a man got in touch with me who works for the defence services contractor QinetiQ. He wanted to complain about the way it was run. The company, in his view, suffers from “managerialism”.

Managerialists, he says, are “a group who consider themselves separate from

the organisations they join”. They are not interested in the content of the

work their organisation performs. They are a caste of people who think they

know how to manage. They have studied “The 24-hour MBA”. There is a clear

benefit from their management, for them: they arrange their own very high

salaries and bonuses. Then they can leave quickly with something that looks

good on the CV. The benefit to the company is less clear.

I also spoke to a former senior employee of QinetiQ. He corroborated my informant’s points with gusto. He said managerialists were particularly unsuited to industries such as QinetiQ’s, where scientific knowledge is all. He put it simply: “People who are making bits of technology, or servicing them, should know about technology.”

Skills are not infinitely transferable. “You used to be the editor of a broadsheet newspaper,” he said to me. “How do you think a former chief executive of Ford would perform if he suddenly came and edited a national title?” (or, he politely didn’t say, if the reverse were to happen).

The lack of knowledge at the top of a firm obviously creates a practical problem – “You don’t have people to get under the bonnet. They can only kick the tyres and change the oil.” They don’t understand the needs of the core customer. It also, in his view, creates a moral problem. The workers cannot respect their bosses. Management becomes “not symbiotic, but parasitic”.

I do not know whether these men are right about QinetiQ. I have no experience

of the company and no technical expertise. One must also allow for the fact

that, in any organisation, there are people with axes to grind. But I did

find the way they talked striking. It seemed to accord with so many things I

hear about life in so many organisations.

It is a big complaint, for example, about the modern National Health Service. Nowadays, on the dubious principle that all businesses and services are essentially the same, managers are a non-medical breed. The effect can be laughable. I heard of a case in which the managers told the doctors in a big hospital to save money by sending all their instruments away to a centralised off-site sterilising unit. Fine, said one mischievous consultant, but in that case may I have a second set of instruments so that I can work on my patients in emergencies? The managers, having no idea about his instruments, thought he probably could. “That’ll be £2 million then,” he said.

Comparable problems afflict the Armed Forces. They have fought several wars in the past 15 years, dealing with a Ministry of Defence staffed by people who know nothing about war. More generally in the Civil Service, it has become common to reduce specialist skills – language training in the Foreign Office, for example – and to move able people around from department to department. The present permanent secretary of the Home Office had never worked there before she took her present post at the beginning of last year. Since it is a department of fantastic complexity, it is perhaps not surprising that it has recently taken a series of tumbles on such issues as deportations and borders.

You find this hollowing-out everywhere. In schools, the head who does not teach is now a familiar, indeed dominant figure. University vice-chancellors, instead of being dons who move from their subject into administration for a period of their lives, are now virtually lifelong managers, with hugely increased salaries to match. It is even commonplace for charities to be run by people with no commitment to the charity’s specific purpose, but proud possession of what they call the necessary “skill-sets”, such as corporate governance.

With the rise of the managerialist comes a special language – a weird combination of semi-spiritual banality (“unlocking energies”), euphemism, and legalese. If you want to see the difference between people steeped in their trade and people steeped in managerialism, compare the testimony, at the Leveson Inquiry, of the Murdochs, father and son. The wicked old man spoke in the language, simultaneously sharp and blunt, of people who know and run their business. The evasive son adopted the locutions taught in business-school courses, honed by big law firms, footnoted by anxious compliance officers.

My friend at QinetiQ draws my attention to some of the usages which predominate where managerialism rules. The system of internal communications becomes a platform not for sharing knowledge but for propaganda. Human Resources invent things like the Personal Improvement Programme, which is really a means of punishing staff. “Consultation”, he says, is a word meaning that managerialists “tell you what they are going to do, 30 days before they do it”.

These habits are now pervasive across industry and the public services. “Diversity” is always “celebrated”, but it never means diversity of thought. The people who tell you they are “passionate about” X or Y are usually the most bloodless ones in the outfit.

In such cultures, just as the experts, the professionals and the technicians bitterly resent the managerialists for neither understanding nor caring, so the managerialists secretly detest the professionals who, they believe, get in the way of their rationalisations. They are desperate to “let go” of such people. Very unhappy organisations result.

A few weeks ago, after Dr Rowan Williams had given notice of his retirement as Archbishop of Canterbury, there was a story about his potential successor, Dr John Sentamu, the Archbishop of York. Dr Sentamu’s critics, apparently, had been saying that he was too much like an African tribal chief. Friends of Dr Sentamu were angry at what they saw as a racial slur.

But it struck me that the qualities of a tribal chief are now shockingly rare in big modern organisations. They might be just the job, and not only for the poor old C of E. The point about a tribe is that it unites its members by ties that are very hard to break. Tribalism, for sure, can be a bad thing, but a tribe understands matters of life and death. It recognises the importance of yesterday and tomorrow as much as today. It maintains the interest of the whole over that of a particular part. The chief of the tribe is not a manager: he is a leader.

No one sensible thinks that a large organisation can exist without being managed. Old stagers in companies, regiments, professions and, in my own experience, newspapers, easily over-romanticise their achievements and are unfair about the poor “bean-counters” who make the sums add up. But management should not dominate. As Lord Slim, who brilliantly led the British Army through the Burma campaign, put it: “Managers are necessary; leaders are essential.” We now have unprecedented numbers of the former, not so many of the latter.

Because, since the credit crunch, Everything Is Different Now, this problem is causing real social division. It explains much of the rage about executive pay. It is not so much the numerical difference between the top and the bottom which causes the anger, as the sense about why that difference exists. It has been arranged by the managerialists. It may even be the chief purpose of the managerialists’ working lives, as they edge towards the exit with the largest portable share of the takings available.

It is a big complaint, for example, about the modern National Health Service. Nowadays, on the dubious principle that all businesses and services are essentially the same, managers are a non-medical breed. The effect can be laughable. I heard of a case in which the managers told the doctors in a big hospital to save money by sending all their instruments away to a centralised off-site sterilising unit. Fine, said one mischievous consultant, but in that case may I have a second set of instruments so that I can work on my patients in emergencies? The managers, having no idea about his instruments, thought he probably could. “That’ll be £2 million then,” he said.

Comparable problems afflict the Armed Forces. They have fought several wars in the past 15 years, dealing with a Ministry of Defence staffed by people who know nothing about war. More generally in the Civil Service, it has become common to reduce specialist skills – language training in the Foreign Office, for example – and to move able people around from department to department. The present permanent secretary of the Home Office had never worked there before she took her present post at the beginning of last year. Since it is a department of fantastic complexity, it is perhaps not surprising that it has recently taken a series of tumbles on such issues as deportations and borders.

You find this hollowing-out everywhere. In schools, the head who does not teach is now a familiar, indeed dominant figure. University vice-chancellors, instead of being dons who move from their subject into administration for a period of their lives, are now virtually lifelong managers, with hugely increased salaries to match. It is even commonplace for charities to be run by people with no commitment to the charity’s specific purpose, but proud possession of what they call the necessary “skill-sets”, such as corporate governance.

With the rise of the managerialist comes a special language – a weird combination of semi-spiritual banality (“unlocking energies”), euphemism, and legalese. If you want to see the difference between people steeped in their trade and people steeped in managerialism, compare the testimony, at the Leveson Inquiry, of the Murdochs, father and son. The wicked old man spoke in the language, simultaneously sharp and blunt, of people who know and run their business. The evasive son adopted the locutions taught in business-school courses, honed by big law firms, footnoted by anxious compliance officers.

My friend at QinetiQ draws my attention to some of the usages which predominate where managerialism rules. The system of internal communications becomes a platform not for sharing knowledge but for propaganda. Human Resources invent things like the Personal Improvement Programme, which is really a means of punishing staff. “Consultation”, he says, is a word meaning that managerialists “tell you what they are going to do, 30 days before they do it”.

These habits are now pervasive across industry and the public services. “Diversity” is always “celebrated”, but it never means diversity of thought. The people who tell you they are “passionate about” X or Y are usually the most bloodless ones in the outfit.

In such cultures, just as the experts, the professionals and the technicians bitterly resent the managerialists for neither understanding nor caring, so the managerialists secretly detest the professionals who, they believe, get in the way of their rationalisations. They are desperate to “let go” of such people. Very unhappy organisations result.

A few weeks ago, after Dr Rowan Williams had given notice of his retirement as Archbishop of Canterbury, there was a story about his potential successor, Dr John Sentamu, the Archbishop of York. Dr Sentamu’s critics, apparently, had been saying that he was too much like an African tribal chief. Friends of Dr Sentamu were angry at what they saw as a racial slur.

But it struck me that the qualities of a tribal chief are now shockingly rare in big modern organisations. They might be just the job, and not only for the poor old C of E. The point about a tribe is that it unites its members by ties that are very hard to break. Tribalism, for sure, can be a bad thing, but a tribe understands matters of life and death. It recognises the importance of yesterday and tomorrow as much as today. It maintains the interest of the whole over that of a particular part. The chief of the tribe is not a manager: he is a leader.

No one sensible thinks that a large organisation can exist without being managed. Old stagers in companies, regiments, professions and, in my own experience, newspapers, easily over-romanticise their achievements and are unfair about the poor “bean-counters” who make the sums add up. But management should not dominate. As Lord Slim, who brilliantly led the British Army through the Burma campaign, put it: “Managers are necessary; leaders are essential.” We now have unprecedented numbers of the former, not so many of the latter.

Because, since the credit crunch, Everything Is Different Now, this problem is causing real social division. It explains much of the rage about executive pay. It is not so much the numerical difference between the top and the bottom which causes the anger, as the sense about why that difference exists. It has been arranged by the managerialists. It may even be the chief purpose of the managerialists’ working lives, as they edge towards the exit with the largest portable share of the takings available.

Sunday, 2 September 2007

About MBA education!

- The principal achievements of a business school education are:

"First, to equip students with a vocabulary that enables them to talk authoritatively about subjects they did not understand.

Second, to give students the ability to withstand any amount of disconfirming evidence.

Third, to give students a ticket of admission to a job where they could learn something about management".

------

- All MBA graduates should have a skull and crossbones on their foreheads along with warnings that they are not fit to manage.

--------

- The business community has run one of the most successful sales campaigns of the 20th century - persuading most of us that business people have the answer to everything from biscuitmaking to hospitals to schools.

------

- Modern business methods based on the so called 'management sciences' taught in business schools are not infallible.

-----

- One of the weaknesses of the business culture and its "management sciences" is that it is too certain; it does not allow for questioning of its wisdom and it often ignores the voice of experience.

Extracted from India's Unending Journey by Mark Tully

"First, to equip students with a vocabulary that enables them to talk authoritatively about subjects they did not understand.

Second, to give students the ability to withstand any amount of disconfirming evidence.

Third, to give students a ticket of admission to a job where they could learn something about management".

------

- All MBA graduates should have a skull and crossbones on their foreheads along with warnings that they are not fit to manage.

--------

- The business community has run one of the most successful sales campaigns of the 20th century - persuading most of us that business people have the answer to everything from biscuitmaking to hospitals to schools.

------