AFP 15 Jun 2013 in TOI

CARDIFF (United Kingdom): England have found themselves at the centre of a tampering row after former captain Bob Willis accused them of scratching the ball.

The alleged incident took place during England's seven-wicket Champions Trophyone-day international defeat by Sri Lanka at The Oval on Thursday when Pakistani umpire Aleem Dar and his New Zealand on-field colleague Billy Bowden ordered one of the balls in use to be changed while the Lankans were batting.

"Let's not beat about the bush -- Aleem Dar is on England's case," Willis told Saturday's edition of the Sun tabloid.

"He knows that one individual is scratching the ball for England -- who I am not going to name -- and that's why the ball was changed," insisted Willis, one of England's greatest fast bowlers.

"Have you ever heard about the batting side or the umpire complaining about the shape of the ball?" added Willis, on of only four England bowlers to have taken 300 Test wickets.

Under current rules for one-day internationals, two white balls are in use for each innings.

Balls can be changed for legitimate reasons, such as being knocked out of shape as a result of forceful hits by batsmen, and are often done so at the request of the fielding side.

However, on Thursday it appeared that it was Sri Lanka's Kumar Sangakkara who complained about the condition of the ball when his side was 119 for two at the halfway stage of their reply to England's seemingly imposing 293 for seven.

England were unhappy as their attack was starting to gain reverse swing, which was key to their opening victory over Australia and is aided by natural wear and tear of the ball, with captain Alastair Cook leading the protests.

However, the replacement ball moved little and Sangakkara went on to complete a superbunbeaten hundred to guide Sri Lanka to victory.

After the match, Cook said: "The ball was changed because it was out of shape. The umpires make these decisions and you have to accept them. Sometimes you don't think they are the right decisions."

But Willis, an England captain in the early 1980s, told the Sun: "How naive does Alastair Cook think we are? He didn't want the ball changed. So why was it changed?

"It is OK for the ball to scuff through natural wear and tear -- but against cricket's laws to use fingernails or other means to alter its condition."

Australian umpire Darrell Hair, together with West Indies' Billy Doctrove, docked Pakistan five runs for ball-tampering during a controversial Test against England in 2006.

Pakistan subsequently forfeited the match in protest -- the first time this had happened in Test history.

They were subsequently exonerated by an International Cricket Council (ICC) investigation and the ensuing row ultimately cost Hair his career as a senior international umpire.

However, the match officials in the England-Sri Lanka match took no similar action and the ICC explained that as the umpires haven't reported anything and no team has complained, they were not planning to take any action.

England must beat New Zealand in Cardiff on Sunday to seal a semi-final spot. If they lose they are out and either Australia or Sri Lanka will go through after their match on Monday.

If the England-New Zealand match is a washout they will need a low scoring Australia victory to go through. If both matches are washed out, England will qualify behind New Zealand.

'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Saturday, 15 June 2013

Friday, 14 June 2013

Why Germany is now 'Europe's biggest brothel'

Legalised prostitution, cut-price offers and a boom in sex tourism mean Germany's red light districts are thriving. But not everyone is happy with the country's liberal legislation

A Ukrainian prostitute in a brothel in Berlin: two-thirds of Germay's sex workers are thought to come from overseas. Photograph: Axel Schmidt/AFP/Getty Images

With skin-tight clothes and bum bags strapped around their waists, sex workers wait by the roadside close to Hackescher Markt, one of Berlin's busiest shopping and entertainment districts. This is a familiar sight just before dark in the capital of a country that has been dubbed "Europe's biggest brothel".

The sex trade in Germany has increased dramatically since prostitution was liberalised in 2002, with more than one million men paying for sex every day here, according to a documentary, Sex – Made in Germany, aired this week on Germany's public broadcaster, ARD.

Based on two years of research using hidden cameras, the film by Sonia Kennebeck and Tina Soliman exposes the "flat-rate" brothels where men pay €49 (£42) for as much sex as they want, as well as a rise in sex tourism, with men from Asia, the Middle East and North America coming to Germany for sex.

Germany's law governing the sex trade is considered one of the most liberal in the world. It was passed by the former coalition government, made up of the Social Democratic Party (SPD) and the Greens, in a bid to strengthen the rights of sex workers and give them access to health insurance and benefits.

Since then, red light districts have become even more prominent in many major German cities including Berlin, Frankfurt and Hamburg, where the Reeperbahn is, notoriously, the focus for the sex trade. During the 2006 World Cup in Germany, brothels appeared close to football stadiums across the country to cater for fans before and after games.

But more than 10 years after the law was passed, critics are becoming increasingly vocal. They argue that although it may benefit those sex workers who choose to work in the trade, it also makes it easier for women from eastern Europe and countries outside the EU to be forced into prostitution by traffickers. Two-thirds of Germany's estimated 400,000 sex workers come from overseas.

"Migrant women who don't know the language are highly dependent on people to bring them here and to show them around," says Roshan Heiler, head of counselling at the Aachen branch of Solwodi, a women's rights organisation that helps women forced into prostitution.

She is not surprised at the number of men now paying for sex in Germany. "I think it's just a result of the legalisation," she says. "The men are not prosecuted and prices are low."

Meanwhile, Monika Lazar, spokeswoman on women's issues for the Alliance 90/Greens party, has defended the law, saying that making prostitution illegal again is not the way to improve working conditions. "Prostitution is still socially stigmatised, and that has not changed in the few years in which the law has been in effect," she says. "But the law is helping to strengthen the position of prostitutes and ensuring women, and men, are much better protected."

If only Britain had joined the euro

If Gordon Brown had chosen to join the single currency 10 years ago, both the European Union and Britain would be stronger now

Gordon Brown with Paul Boateng and Dawn Primarolo in June 2003, just after his ‘not yet' decision on joining the euro. Photograph: Sean Smith for the Guardian

Ten years ago this week Gordon Brown said no to joining the euro. It is an anniversary on which Bank of England governor Mervyn King, Ukip's Nigel Farage, Unite's Len McCluskey and the Guardian's Larry Elliott, along with most of the British economic establishment, can all agree. On this, Brown was right.

Elliott set out the establishment consensus in a classic piece this month on his alternative history of what would have happened had Britain joined. Essentially, he says, there would have been a bigger boom in the runup to 2007 and a more disastrous bust. Britain would now be struggling to maintain its membership as anti-EU sentiment mushroomed, prompting its eventual exit, dramatising the inherent unsoundness of yoking disparate economies into one inflexible currency.

But there is a more optimistic, alternative history. The first obvious point is that Britain could have joined the euro only if a referendum had been won. A victory would have depended on it being an obvious good deal, with the pound entering at a competitive rate and the euro's structure, rules and governance reformed to accommodate British concerns and interests. The European Central Bank would have needed to look more like the US Federal Reserve, with more scope for fiscal and monetary activism. The Germans would doubtless have insisted, in return, that the EU banking system be more conservatively managed.

The last decade would have been very different. What none of the mockers of the euro ever acknowledge is the economic doomsday machine that Brown created through not joining. By not locking in a competitive pound, Britain suffered a decade of chronic sterling overvaluation, made more acute by the City of London sucking in capital from abroad to finance the extraordinary credit and property boom of those years.

Imports surged and exports sagged; the economy outside banking, which made goods and services to be sold abroad, either stagnated or shrank. Much of the best of UK manufacturing was auctioned off to foreigners. Today we find that, despite a huge currency devaluation, there are just not enough companies to take advantage of it: too much of the rest of British capacity, thanks to foreign takeover, has become a part of global supply chains that are indifferent to exchange-rate variation. Our export response has been feeble; evidence of the economic orthodoxy's inability to devise policies and structures that favour production.

Inside the euro, at a highly competitive exchange rate, Britain's exports would instead have soared, and its traded goods sector would have expanded, not shrunk. Regional cities would have boomed around sustainable activity rather than property and credit. The euro's rules would have meant a less reckless fiscal policy, and banks would have been more constrained in lending for property. They would have had to lend proportionately more to fast-growing real enterprise, reinforced because the new rules would have required them to lend in a more balanced way.

Britain would have entered the 2008 crisis with a far less unbalanced economy, a stronger banking system and international accounts, and a government deficit much less acute. And the reformed eurozone could have responded much more flexibly and cleverly than it did.

In any case, both Britain and Europe are now wrestling with depressed economic activity caused by overstretched bank and company balance sheets – and the exchange-rate regime is hardly the cause of this distress. Germany and the stronger EU countries are plainly wrong in their overemphasis on austerity as a solution, but surely right to argue that the only long-term solution is for the whole of Europe to move to their productivist, stakeholder capitalism.

British mainstream commentators see the obvious fissure between the stronger European north and the weaker south as proof positive that the euro is fatally flawed. But suppose countries like Greece or Ireland rise to the German challenge? Already there are encouraging auguries in both. If so, notwithstanding excessive austerity, they could weather the crisis, and become stronger.

There is plainly a chance one or more countries could leave, but there is a greater chance the system in some form will hold – it is in too many countries' interests to avoid failure. Then expect a pan-European recovery to begin in the second half of the decade that will gather strength in the 2020s.

Inside the euro for the last decade, the economic and political debate would have necessarily moved on. Having won a historic referendum decisively affirming Britain's future in Europe, the Blair government would have had to think in European terms about how to produce, invest, innovate and export. Sure, there would have been problems. But Britain outside the euro in 2013, with endless spending cuts, the biggest fall in real wages for a century, 500,000 people relying on food banks, and a weak unbalanced economy, is hardly a land of milk and honey.

Emboldened by his referendum victory, Blair could have sacked Brown before the disastrous second phase of his chancellorship and lacklustre prime ministership. Blairism would have morphed into a new form of European social democracy, fashioning British-style stakeholder capitalism. UK politics would not have moved so decisively to the right, with conservatives preaching free-market Thatcherism while the left clings to a bastard Keynesianism – united only in their belief, against all the evidence including Britain's export performance, that floating exchange rates are a universal panacea.

A single currency demands disciplines and painful trade-offs: but floating exchange rates after a financial crisis are a transmission mechanism for bank-runs and beggar-my-neighbour devaluations. Magic bullets do not exist. Had Britain joined, both we and Europe would have been better placed, and Larry Elliott would now be writing about how better to get Britain to innovate and invest under a fourth-term Labour government. A better world all round.

Thursday, 13 June 2013

They might be living in caves, but it's not the homeless who are hiding

Our urban skins get ever thicker to the soaring numbers of people living on the streets. My solution? Keep building up that sense of comfortable numbness

Grace Dent in The Independent

Homeless men and women close to Stockport, Greater Manchester have been found living in a cave system, huddled in sandstone hideyholes amongst rubbish and food scraps, close to whatever they use as a toilet. Imagine an otherwordly scene from Lord of The Rings, but instead of Hobbits and quests to overcome the dark lord Sauron, actual human beings like you and me and the simple quest to stay alive.

Wellspring, a local homeless charity, say that compared to rough sleeping in the town, the cave-dwellers at least find their new home safe and dry. Britain’s homeless problem burgeons, becoming more complex year on year. Plain facts: the financial crisis of recent years has driven up unemployment to 7.8 per cent. Meanwhile, the cost of living has risen along with house prices, and numbers of homeless people have rocketed. In London homelessness rose by 16 per cent in 2012-13, meanwhile parts of Greater Manchester saw rises of as much as 40 per cent.

When I saw pictures of the cave people in the greater Manchester area, my immediate gut-reaction was to write about them – because no one in modern Britain should live in a cave – but within minutes I questioned whether it was really a story at all. Deep down, who would actually care? Perhaps it’s not the ever-plummeting level of squalor in which we permit human beings in Britain to live that’s of most interest here. What’s interesting is the ever-effective numbness of “the haves” – myself included when faced with “the have-nothings”.

In truth, I often spend a few moments – for the sake of my sanity – trying not to care remotely about the homeless. That girl who sits on the pavement near my house, staring at the floor, day after day, holding a paper cup for change, she’s not homeless really is she? No, most probably she’s part of a begging gang. I can ignore her. I’m very busy. And the skeletal man on crutches who sits in the Tube doorway, sometimes weeping, well I’ve seen him get on the number 158 bus so he must be going somewhere. That’s it, not homeless. Guilt absolved. And that crowd of men and women drinking themselves to death publicly, like a ghoulish piece of performance art, erecting their cardboard bedroom in the doorway of my local library, well, what can actually be done for them? Nothing, I think. In fact part of me is irate at them for messing up the aesthetic splendour of a newly stonewashed building. And will no one think of my house price?

At one point such fetid thoughts would never have crossed my mind, but the downturn has been long, the homeless keep multiplying, and our urban skins become ever thicker. So like most bleeding-heart liberals I am pained by the cave people of Stockport, but am yet to go into full St Francis of Assisi mode, and fling open my own front door.

Instead, I sit patiently waiting for “something to be done”, such as the industrious hammering up of the “affordable homes” that several Governments in my lifetime have promised. Obviously, in truth, builders and councils have no true interest in building dirt-cheap accommodation. That’s why flyers for luxury two-bedroom executive apartments, for £250,000, flood my letterbox daily. Neither do I envisage a full-throated “Golly, we were wrong” return to public housing by the Conservatives – or Labour having any muscle to do anything, especially as these days socialists love owning homes too.

Broadly speaking, I would say the Government has no real concern or plans for the rising numbers of rough sleepers, as the impoverished don’t fit in with ideals of enterprise or self-interest. Obviously, several ears may have pricked up when an advertising agency experimented with making homeless people into 4G hotspots, in Texas, last March, but attention dwindled soon after. Furthermore I hold no hope of the homeless wangling their way onto half-buy schemes, of which the paperwork is more flummoxing and the cost more expensive than a regular mortgage. Do I have any solutions? One-bedroom stackable pods, built by charities (aka The Nimby armageddon)? Wide-scale homelessness “boot camps” where thousands of jobless graduates, trained in social care, help people in a life quandary? OK, that’s a bit kumbayah isn’t it? And, now I’ve written it down, perhaps a tiny bit Third Reich too. So, indeed, my current approach to homelessness is to build on my ongoing, ever-comfortable numbness, possibly leading one day to my simply stepping over a corpse on the way to ASDA mumbling “Oh, what a shame! Something must really be done.” If anything, Stockport’s cave people might be making a point. They’re isolated from help, but at least they’re avoiding our hand-wringing and ultimate hypocrisy.

To fix whistleblower, bank moves from verse to worse

The HinduEmbarrassed by revelations about its curious dealings with corporate clients, the Bank of Maharashtra has declared war on whistleblowers. File photo

Union leader Devidas Tuljapurkar faces victimisation and possible dismissal by the Bank of Maharashtra, as it suspects him of being the whistleblower behind a story in “The Hindu” on July 7, 2012.

For one unfortunate whistleblower, things have gone from verse to worse. Embarrassed by revelations about its curious dealings with corporate clients, the Bank of Maharashtra has declared war on whistleblowers. And since it can’t pinpoint them, the bank has gone after internal critics on novel grounds. It has chargesheeted a Union leader and ex-Director of the BoM for acts “prejudicial to the interests of the Bank.” That is, for publishing 19 years ago, a poem it calls ‘vulgar and obscene,’ in the Union’s in-house magazine, ‘Bulletin.’ That poem is the basis of the Bank’s charge sheet against a worker with an impeccable service record.

In 1984, the Marathi poet Vasant Dattatraya Gurjar wrote a satirical poem titledGandhi Mala Bhetla Hota (Gandhi met me) which shook the literary world with its polemical content. In 2013, Devidas Tuljapurkar, General Secretary of the All-India Bank of Maharashtra Employees Federation, faces victimisation and possible dismissal by the bank, ostensibly because the Bulletin, of which he was editor, carried that poem in 1994!

The real reasons for going after Mr. Tuljapurkar appear to have little to do with poetry and seem far more prosaic. He has been a thorn in the flesh of his management. Both, as an alert employee and, for a while, as Workman Director on the bank’s Board. He has also drawn the RBI’s attention to the BoM’s odd handling of some corporate accounts and advances which, he charges, are being favoured at the expense of BoM’s main depositors — lakhs of small farmers, working people and retired employees. But the BoM leadership has something more against him. They suspect him — with no basis or proof — of being the whistleblower behind a story in The Hindu, July 7, 2012. That story exposed how the bank had granted a Rs. 150-crore loan to a defaulter owing BoM Rs. 40 crore by greatly weakening the terms of the original sanction letter. The defaulter company was a part of the United Breweries (UB) group headed by Vijay Mallya. The expose embarrassed Bank Chairman and Managing Director (CMD) Narendra Singh, sparking a whistleblower witch-hunt.

But no whistleblower was found. And after several transfers of senior officers within the bank, the search hit a dead-end. Ironically, it was an unthinking action of the Reserve Bank of India that handed the BoM management a scapegoat: Devidas Tuljapurkar.

Mr. Tuljapurkar told The Hindu, “Last October, I wrote a letter to RBI Governor D. Subba Rao highlighting questionable corporate advances and imprudent banking decisions of BoM at the instance of CMD Narendra Singh.” The letter, written in his capacity as a Union leader, was backed up with facts and documents. Having served as a Director on the Board of BoM from 2004 to 2009, he was very familiar with the rules and procedures.

However, the RBI failed to protect his identity as a whistleblower. In one of those unthinking acts of bureaucracy, the RBI routinely forwarded Mr. Tuljapurkar’s letter to the very BoM management that it exposed, for their comments. The bank had found its scapegoat and Mr. Tuljapurkar’s ordeal began. “Since I had written a letter to RBI, the management assumed that it was also I who had leaked that story about gifting a Rs. 150-crore loan to Mallya’s company. They wanted to corner me, so they started scanning my history,” he says.

And all they could come up with was a poem from 1984. Vasant Gurjar’s poem is a political satire that is scathing about the followers of Mahatma Gandhi who, in the poet’s view, were merely serving their own interests. In 1994, the poem was published in the ‘Bulletin’ the house magazine of the Union. In March 1995, an organisation called the ‘Patit Pavan Sanghatana’ filed a complaint against the Bulletin for publishing the ‘obscene’ and ‘vulgar’ poem. As editor of the Bulletin, Mr. Tuljapurkar was made an accused in the case.

This May 3, 19 years later, the BoM management issued an internal charge sheet against Mr. Tuljapurkar. It accuses him of ‘publishing such an inflammatory, vulgar, obscene and objectionable material in the magazine “Bulletin” meant for bank employees …” And claims that circulating that issue of the Bulletin on the BoM’s premises (in 1994) was “prejudicial to the interests of the Bank.”

Interestingly, the ‘State Performances Scrutiny Board, Government of Maharashtra’, headed by well-known Marathi poet F.M. Shinde, has a very different take on the poem. In January 2011 the Scrutiny Board made it clear that the poem is neither obscene nor vulgar. “What Gandhi had envisioned about Swarajya is nowhere to be seen. The poet has expressed this in satirical form,” Mr. Shinde had said.

Apart from ignoring the Board’s view, the BoM seems to take no notice of the Supreme Court’s order in the case against Mr. Tuljapurkar. “After the FIR in 1995, we approached both the sessions court and the High Court to discharge me from the case. But that was rejected and our appeal is pending in the Supreme Court,” he says. “The apex court, in its order dated July 7, 2010, stayed all proceedings in lower courts in this case and the actual trial has not even started in any court.”

The charge sheet accuses Mr. Tuljapurkar of not disclosing this pending litigation against him while serving as the Workman Director of the bank and for knowingly making ‘false statements’ in the forms of the bank. BoM CMD Narendra Singh took personal interest in the entire matter, says Mr. Tuljapurkar. The CMD placed the 19-year old case before the board meeting in January this year, recommending action against the union leader.

All this sidesteps the truth that Mr. Tuljapurkar’s name was mentioned in the FIR as editor of the Bulletin and not in any ‘personal capacity.’ It also ignores the fact that even charges in the case are yet to be framed. Calls, faxes and emails from The Hindu to Mr. Singh have so far drawn no response.

Meanwhile, an outraged All India Bank Employees’ Association (AIBEA), to which Mr. Tuljapurkar’s union is affiliated, has called for an agitation across the entire BoM on June 17. “We demand immediate withdrawal of the charge sheet slapped against him and thorough investigation of loans sanctioned by the bank to various corporates ever since the present chairman took charge,” CH. Venkatachalam, General Secretary, AIBEA, told The Hindu. He added that the BoM being a public sector bank, every citizen had a right to express concern about its financial health. “We shall fight back any attempt at victimisation.”

If the departmental inquiry against Mr. Tuljapurkar proceeds the way bank management wants, it could result in his dismissal. A whistleblower exposing the questionable actions of a public sector bank could be dismissed for publishing a poem in 1994. He is also a man who, while a director of the bank, transferred all the money he received as sitting charges for Board meetings to the Union’s account via cheque, accepting no monetary benefits as a director.

“I wrote to RBI because I found Mr. Singh’s financial moves unhealthy for the bank’s future. Hence I’m being targeted and victimised. They aim to make an example of me so nobody in future will dare raise his voice. It has to be stopped,” he said.

Wednesday, 12 June 2013

I'm an everythingist – craving new experiences, but unwilling to put the work in

Everythingism is the deadly combination of perfectionism plus narcissism plus utter laziness – which explains why I haven't read Crime and Punishment

Crime and Punishment: details available on Wikipedia. Photograph: CBW/Alamy

When I was pregnant, someone told me that she read Dostoevsky novels to her baby, both in the womb and after he was born. Apparently, at about two months old, he would respond with delight every time he heard the character names he had heard so many times in utero.

Massively annoyed by this insufferable woman and her competitive wankery, I resolved to go home and do exactly the same thing. Only I had never read any Dostoevsky, and wasn't sure that I could be arsed, in my seventh month of gestation, to begin a literary journey into desperate horse-flogging Russians and Siberian internment camps. So I went straight to the Wikipedia page for Crime and Punishment and skipped to the list of character names instead.

"Raskolnikov! Svidrigailov! Dunechka!" I barked at my foetus for no discernible reason, the laptop balanced precariously on my bump, while my internal smugometer wavered somewhere between pride and existential despair. A little like the characters in the books. Perhaps.

It was some time after this that I took a long, soft look at my slapdash, half-arsed approach to life, and realised that I am an everythingist. This is a word I have invented to describe the sort of person who is greedy for the benefit of all new experiences, but unwilling to put the work in to fully commit to any of them. An everythingist leaves no experiential stone unturned, which means doing absolutely everything by halves. It is the deadly combination of perfectionism plus narcissism plus utter laziness. It will get you nowhere in the end. Halfway there at best. Every time an everythingist's mother opens her mouth, the words "oh just bloody well get on with it" come out.

Here's how to tell if you, too, are an everythingist. Do you clutch your phone in your hand at all times, like a beacon against the cold, a magic talisman with its promise of otherness, betterness, of more attractive people desirous of your company elsewhere? Does it ensure you are unable to quite go with a plan or be in the moment because of all the other plans and moments where you might be, cheating on yourself with your other selves? Does your phone give you FOMO (AKA fear of missing out) for the party you're not at, even when you're at it? Did the news that Prism could be spying on all of our data give you a giddy rush when you thought that one of the lockdown powergeeks might be looking in and realising that you – you! – are the chosen one? Do you tend to fall asleep in your clothes, just in case the revolution should begin outside your bedroom window in the night?

Do you, like me, think that fairytale endings will magically happen to your life – ie, you will fall in deep rewarding love and raise daughters with Rapunzel hair in a beautiful Welsh farmhouse one day, writing novels on a typewriter, milking your nanny goats at dawn? Of course, this all will have to happen magically as you absolutely refuse to give up nightclubs and the closest you have come to milking your nanny goats at dawn was all a case of mistaken identity and that restraining order for going within a 40-metre ring of the late-night Turkish greengrocers is a gross infringement on your civil liberties, which you will sort out as soon as you find the bit of paper they wrote it on.

The everythingist can't be tied down by a job and so they work freelance (ie are self-unemployed). They don't want to be restricted by narrow labels like straight or gay because they believe their sexuality to be a fluid concept (i.e. they keep getting dumped). They are breathlessly addicted to their youth, despite being 12 years older than their parents were when they had them; can't read a book to the end because they've already started two more; and they need to know, at all times, that they could, in theory, if they wanted to, at any point, run away to Rio de Janeiro.

The everythingist works from home, revelling in their freedom to go for a walk in the sunshine while other sad jobsworthy losers are stuck at their desks with not so much as a freelancer's liedown to look forward to. The everythingist has been planning this walk in the sunshine for 17 days now, having been quite distracted by all the freelancer's liedowns that it is their right and freedom to enjoy. In their lunch hour. I mean, why not? It's not as if there's any lunch.

If you are not an everythingist, and you're one of those people who gets stuff done and gets over it – I realise now that you have the greatest freedom of all. The freedom to finish things, and not have all your half-read books, half-written books and half-experienced experiences clanking around your neck like shells. I can only apologise for how I used to giggle at you for being boring and keeping lists and being on time while I dashed over half an hour late to meet you, hopes and dreams blinding my eyes so that I couldn't read a bus timetable. I'm so sorry now. For everything.

Pick 'em early? The fate of young English talent.

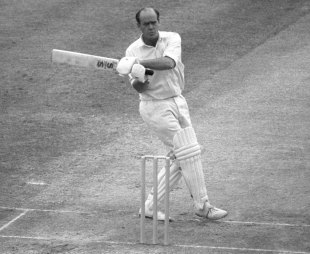

Brian Close: the youngest male cricketer to play Tests for England © PA Photos

Enlarge

It was a day for history at North Marine Road. Yorkshire, like the venerable Almanack, are celebrating their 150th anniversary this year. Sunday was also 50 years removed from the first of Geoffrey Boycott's 151 centuries in a Roses game at Bramall Lane, an occasion marked with the presentation of a framed scorecard. And then there was Matthew Fisher, all of 15 years and 212 days old, the youngest player to appear in a competitive county game since Charles Young, who turned out for Hampshire against Kent in 1867, aged 15 years and 131 days.

There is an inevitable melancholy about this great wash of time, refracted through the boys at either end of it. Young, a left-hand allrounder who was born in India, played 38 games across the next 18 years before slipping away into history. No one knows when or where he died, or the circumstances surrounding his end. He was here and then he was gone. We're left with his wickets and his runs and his odd little record, which may stand forever. Fisher is from an entirely different world and a more focused and intense game, yet prodigies always carry with them a chance of unfulfilment that can be unsettling.

Fifteen, you think, that's just too early, isn't it, however good you may be. For a start, it is such a brief span. Boycott had been retired for 11 years by the time Fisher was born, and no doubt Geoffrey could (and perhaps has) told the young man how fleeting those years can feel.

Yorkshire know a prodigy when they see one. Their 2nd XI keeper Barney Gibson was 15 years and 27 days old when he played against Durham University. Tim Bresnan got a Sunday League game as a 16-year-old. They had the young Sachin, of course, and before him Kevin Sharp, who seemed set for greatness after making a double-hundred for Young England and appearing in the first team at 18.

Then there was Brian Close, a man whose legend exists on different terms to those that his precocity seemed sure to dictate. Born in the same town, Rawdon, as Hedley Verity, he played Under-18 cricket at the age of 11, appeared for Leeds United and England youth as an amateur footballer and was considered bright enough to have attended Oxford or Cambridge had he chosen that path. Instead he became the youngest man ever to play for England in a Test match, in July 1949 at the age of 18, whilst in the process of completing the "double" of 1000 runs and 100 wickets in his first season (another record). Had the world known then that Close would make his final Test appearance almost 27 years later it might have imagined a new Leviathan had come, yet he played just 22 times for England.

In its place, Close's fame is based around his unyielding toughness, the brilliance of his captaincy (six wins and a draw in his seven Tests as England skipper; sacked after being accused of time-wasting in a game for Yorkshire) and his ability to nurture young players both in cricket and in life. Perhaps some of that understanding came from his earliest years, and the burden that they bestowed. He was by almost any measure a wonderful player, almost 35,000 runs, 1171 wickets and 800 catches batting left-handed and bowling right, and yet his first season casts its long shadow.

We are programmed to think that the earlier a talent emerges, the bigger it must be. That is not always the case. It will certainly not be rounded enough to offer anything other than promise, and promise is ephemeral stuff, available only for the briefest of moments. Matthew Fisher has promise, and our good wishes. What he needs most now is simply time.

Subscribe to:

Posts (Atom)