'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label underemployment. Show all posts

Showing posts with label underemployment. Show all posts

Tuesday, 30 April 2024

Friday, 29 March 2024

Monday, 27 November 2023

Wednesday, 12 December 2018

How one man’s story exposes the myths behind our migration stereotypes

Robert, a Romanian law graduate, didn’t come to the UK to undercut wages. But he ended up in insecure low-paid work writes Aditya Chakrabortty in The Guardian

The best way to defeat a crass generalisation is with specifics, and what Robert’s story tells you is it’s not the migrant worker doing the undercutting here. He even tries to get his British-born workmates to join him in a class action for what’s rightfully theirs. The real problem is instead the imbalance of power between the worker and the employer, which is happily maintained by the same politicians today who claim they want to help the “left behind”.

PMP and the 18,000 or so other employment agencies in Britain are overseen by a government inspectorate of just 11 staff. The director of labour market enforcement in the UK, David Metcalf, admits that a UK employer is likely to be inspected by his team only once every 500 years. Were I an unscrupulous boss, I would take one look at those numbers and ask myself: if I do my worst, what’s the worst that can happen?

What keeps Robert here now is those weekends with his daughter. But after 10 years in Britain he’s learned something else too, about the reality of a country that claims to welcome foreigners, even as they punish them. An economy that promises a better life to those it then sucks dry. A society that kids itself that it’s a soft touch when really, it is as cold and hard as any interminable overnight shift.

Anti-Brexit protesters in November. ‘The likes of Robert make the easiest human punchbags. You rarely see him or the millions of other EU citizens living in Britain on your TV.’ Photograph: Daniel Leal-Olivas/AFP/Getty Images

Amid all the true-blue backbench blowhards and armchair pundits who will occupy the airwaves this Brexit week, one thing is guaranteed: you won’t hear a word from Robert. Why should you? He commands neither power nor status. He has hardly any money either. And yet he is crucial to this debate, because it is people like him that Brexit Britain wants to shut out.

Robert is a migrant, under a prime minister who keeps trying and failing to impose an arbitrary cap on migrants to this country. Born in Timişoara, Romania, he now lives in a democracy that barely batted an eyelid when Nigel Farage said it was OK to be worried about Romanian neighbours. And Robert gets all the brickbats hurled at foreigners down the ages – that he’s only here to take your jobs and claim your benefits (at one and the same time, mystifyingly), to undercut your wages and give nothing back.

What’s left is a 38-year-old tearing himself apart over his broken life. ‘I’m an idiot,' he says. ‘I’ve wasted myself.'

The likes of Robert make the easiest human punchbags. You rarely see him or the millions of other EU citizens living in Britain on your TV. Nor do you hear about them from a political class forever chuntering on about the will of the people, yet too aloof from the people to know who they are or what they want, and too scared of them to engage in dialogue.

Yet Robert (he’s asked that his surname be withheld) is no caricature. It’s not just how he dotes on his daughter and has a streak of irony thicker than the coffee he serves up. It’s also how his life in Britain proves that those declaimed causes of Brexit are both too easy and too far off the mark. However sad his story, it also shows where our economy really is broken – and how it will not be fixed by kicking out migrants.

We met a few weeks ago at his flat on the outskirts of Newcastle upon Tyne. Too bare to be a home, its sole reminder of his old family life is a little girl’s bedroom, kept in unchildlike order for his daughter’s weekend visits. He and his wife split a few months ago, he says, when the family’s money ran out. What’s left now is a bank account in almost permanent overdraft and a 38-year-old man tearing himself apart over his broken life here. “I’m an idiot,” he says. “I’ve wasted myself.”

But please, spare him the migrant stereotypes. Low-skilled? Robert came to the UK in 2008 with a law degree and speaking three languages. Low aspirations? Even while grafting in restaurants and hotels, he fired off over 100 applications for a solicitor’s training contract. That yielded just one interview, in Leeds. Local firms that were happy to have him volunteer for free proved more reluctant to give him a paying job. He ended up in a part of the country that has spent most of the past 40 years trying to recover from Thatcherism’s devastation, and which is even now paying the price in cuts for the havoc wreaked 10 years ago by bankers largely based hundreds of miles away. In a country where relations between regions are as lopsided as they are between workers and bosses, the odds were stacked against him from the start.

Finally, Robert signed with a temp agency, PMP Recruitment, which in August 2012 placed him with the local Nestlé factory. And that’s where trouble really began.

He had just enrolled in the precarious workforce, which at the last count numbered just over 3.8 million workers across the UK. Never guaranteed work, he had to wait for the offer of shifts to be texted to him a few days beforehand. He did days, nights, whatever was given, and started on the minimum wage in Nestlé’s Fawdon plant – a giant place churning out Toffee Crisps and Rolos and Fruit Pastilles. It was no Willy Wonka-land.

Robert began by “spotting” – standing on a podium overlooking the Blue Riband production line and pulling out imperfect chocolate bars. Seeing the conveyor belt spool along for hours on end made him dizzy, and another recently departed worker tells me he couldn’t bear to do it for long (Nestlé says it has “rotation processes for work that is particularly repetitive”). Stubborn pride made him stick it out for 12-hour shifts. “Leave your head at home,” workmates would advise and, amid the exhaustion of shifts and raising a family, that’s what he did. But bit by bit he noticed things were wrong.

As an agency worker, he says he was doing the same tasks as Nestlé staff, but for less money. They got a pay rise, he alleges, that agency workers didn’t. He would do work classed by the company as “skilled” but instead got “unskilled” rates. His former workmate, who doesn’t wish to be named, tells me this was common practice: “If Nestlé wanted you to come in at an awkward time, they’d say, ‘We can pay you skilled rates’.” Over the years, Robert estimates that he lost out on about £26,000 of income.

Robert was in no man’s land. He was spending his days working for Nestlé but was not their direct employee – even though he gave five years of service at Fawdon. Nor did he have much to do with his recruiters at PMP, a nationwide agency. As for the plant’s trade unions, he saw them as “a waste of space”. He was trapped in an institutional vacuum. The chair of the Law Society’s employment law committee, Max Winthrop, describes such arrangements – working for one company while on the books of another for years on end – as a “fiction”. “The most generous way you can look at it is, it’s a confusing situation. The least generous is that it’s a deliberate attempt to throw sand in everyone’s eyes so we can’t see the true nature of the relationship.” Nestlé says that of its 600 staff at Fawdon, 100 are agency, all via PMP. Over the years, Robert says he saw hundreds of agency staff come and go.

When Robert raised the issue with Nestlé managers, he alleges that shifts were no longer given to him. Finally, just before last Christmas, he resigned. He then tried to get other agency workers to join him in taking Nestlé to court, but they were, he says, “too nervous”. So he launched an employment tribunal case alone and, a few weeks after we met, Nestlé settled out of court. One of the conditions of the settlement is that he cannot discuss it, but Robert knows this article will appear. Citing confidentiality, Nestlé did not want to comment directly on his case but says that, since 2014, all staff in its factories get the living wage, and “we refute any allegation that working conditions at our Fawdon factory are below standard”.

On his PMP payslips Robert also noticed that – as a result of the “recruitment travel scheme” in which the agency had enrolled him – some months he was getting less than minimum wage, a situation for which Winthrop says he “cannot find any justification”. He took PMP to court too, and a couple of months ago was awarded over £2,000 in back pay. PMP wouldn’t comment for this piece, other than to say it is appealing the verdict.

Amid all the true-blue backbench blowhards and armchair pundits who will occupy the airwaves this Brexit week, one thing is guaranteed: you won’t hear a word from Robert. Why should you? He commands neither power nor status. He has hardly any money either. And yet he is crucial to this debate, because it is people like him that Brexit Britain wants to shut out.

Robert is a migrant, under a prime minister who keeps trying and failing to impose an arbitrary cap on migrants to this country. Born in Timişoara, Romania, he now lives in a democracy that barely batted an eyelid when Nigel Farage said it was OK to be worried about Romanian neighbours. And Robert gets all the brickbats hurled at foreigners down the ages – that he’s only here to take your jobs and claim your benefits (at one and the same time, mystifyingly), to undercut your wages and give nothing back.

What’s left is a 38-year-old tearing himself apart over his broken life. ‘I’m an idiot,' he says. ‘I’ve wasted myself.'

The likes of Robert make the easiest human punchbags. You rarely see him or the millions of other EU citizens living in Britain on your TV. Nor do you hear about them from a political class forever chuntering on about the will of the people, yet too aloof from the people to know who they are or what they want, and too scared of them to engage in dialogue.

Yet Robert (he’s asked that his surname be withheld) is no caricature. It’s not just how he dotes on his daughter and has a streak of irony thicker than the coffee he serves up. It’s also how his life in Britain proves that those declaimed causes of Brexit are both too easy and too far off the mark. However sad his story, it also shows where our economy really is broken – and how it will not be fixed by kicking out migrants.

We met a few weeks ago at his flat on the outskirts of Newcastle upon Tyne. Too bare to be a home, its sole reminder of his old family life is a little girl’s bedroom, kept in unchildlike order for his daughter’s weekend visits. He and his wife split a few months ago, he says, when the family’s money ran out. What’s left now is a bank account in almost permanent overdraft and a 38-year-old man tearing himself apart over his broken life here. “I’m an idiot,” he says. “I’ve wasted myself.”

But please, spare him the migrant stereotypes. Low-skilled? Robert came to the UK in 2008 with a law degree and speaking three languages. Low aspirations? Even while grafting in restaurants and hotels, he fired off over 100 applications for a solicitor’s training contract. That yielded just one interview, in Leeds. Local firms that were happy to have him volunteer for free proved more reluctant to give him a paying job. He ended up in a part of the country that has spent most of the past 40 years trying to recover from Thatcherism’s devastation, and which is even now paying the price in cuts for the havoc wreaked 10 years ago by bankers largely based hundreds of miles away. In a country where relations between regions are as lopsided as they are between workers and bosses, the odds were stacked against him from the start.

Finally, Robert signed with a temp agency, PMP Recruitment, which in August 2012 placed him with the local Nestlé factory. And that’s where trouble really began.

He had just enrolled in the precarious workforce, which at the last count numbered just over 3.8 million workers across the UK. Never guaranteed work, he had to wait for the offer of shifts to be texted to him a few days beforehand. He did days, nights, whatever was given, and started on the minimum wage in Nestlé’s Fawdon plant – a giant place churning out Toffee Crisps and Rolos and Fruit Pastilles. It was no Willy Wonka-land.

Robert began by “spotting” – standing on a podium overlooking the Blue Riband production line and pulling out imperfect chocolate bars. Seeing the conveyor belt spool along for hours on end made him dizzy, and another recently departed worker tells me he couldn’t bear to do it for long (Nestlé says it has “rotation processes for work that is particularly repetitive”). Stubborn pride made him stick it out for 12-hour shifts. “Leave your head at home,” workmates would advise and, amid the exhaustion of shifts and raising a family, that’s what he did. But bit by bit he noticed things were wrong.

As an agency worker, he says he was doing the same tasks as Nestlé staff, but for less money. They got a pay rise, he alleges, that agency workers didn’t. He would do work classed by the company as “skilled” but instead got “unskilled” rates. His former workmate, who doesn’t wish to be named, tells me this was common practice: “If Nestlé wanted you to come in at an awkward time, they’d say, ‘We can pay you skilled rates’.” Over the years, Robert estimates that he lost out on about £26,000 of income.

Robert was in no man’s land. He was spending his days working for Nestlé but was not their direct employee – even though he gave five years of service at Fawdon. Nor did he have much to do with his recruiters at PMP, a nationwide agency. As for the plant’s trade unions, he saw them as “a waste of space”. He was trapped in an institutional vacuum. The chair of the Law Society’s employment law committee, Max Winthrop, describes such arrangements – working for one company while on the books of another for years on end – as a “fiction”. “The most generous way you can look at it is, it’s a confusing situation. The least generous is that it’s a deliberate attempt to throw sand in everyone’s eyes so we can’t see the true nature of the relationship.” Nestlé says that of its 600 staff at Fawdon, 100 are agency, all via PMP. Over the years, Robert says he saw hundreds of agency staff come and go.

When Robert raised the issue with Nestlé managers, he alleges that shifts were no longer given to him. Finally, just before last Christmas, he resigned. He then tried to get other agency workers to join him in taking Nestlé to court, but they were, he says, “too nervous”. So he launched an employment tribunal case alone and, a few weeks after we met, Nestlé settled out of court. One of the conditions of the settlement is that he cannot discuss it, but Robert knows this article will appear. Citing confidentiality, Nestlé did not want to comment directly on his case but says that, since 2014, all staff in its factories get the living wage, and “we refute any allegation that working conditions at our Fawdon factory are below standard”.

On his PMP payslips Robert also noticed that – as a result of the “recruitment travel scheme” in which the agency had enrolled him – some months he was getting less than minimum wage, a situation for which Winthrop says he “cannot find any justification”. He took PMP to court too, and a couple of months ago was awarded over £2,000 in back pay. PMP wouldn’t comment for this piece, other than to say it is appealing the verdict.

The best way to defeat a crass generalisation is with specifics, and what Robert’s story tells you is it’s not the migrant worker doing the undercutting here. He even tries to get his British-born workmates to join him in a class action for what’s rightfully theirs. The real problem is instead the imbalance of power between the worker and the employer, which is happily maintained by the same politicians today who claim they want to help the “left behind”.

PMP and the 18,000 or so other employment agencies in Britain are overseen by a government inspectorate of just 11 staff. The director of labour market enforcement in the UK, David Metcalf, admits that a UK employer is likely to be inspected by his team only once every 500 years. Were I an unscrupulous boss, I would take one look at those numbers and ask myself: if I do my worst, what’s the worst that can happen?

What keeps Robert here now is those weekends with his daughter. But after 10 years in Britain he’s learned something else too, about the reality of a country that claims to welcome foreigners, even as they punish them. An economy that promises a better life to those it then sucks dry. A society that kids itself that it’s a soft touch when really, it is as cold and hard as any interminable overnight shift.

Sunday, 6 October 2013

What kind of a recovery is this when so many people are crippled by debt?

Financial despair, often fuelled by payday lending, poisons the present and undermines hope and opportunity

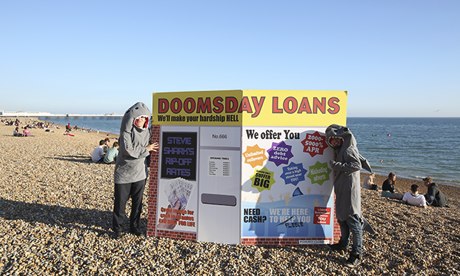

Anti-payday loans campaigners at Brighton for the Labour conference. Photograph: David Levene for the Observer

Britain is once again being talked about as a place of prosperity. We are told to be relieved that the worst of the financial crisis has passed; the nation is becoming, according to David Cameron, a land of opportunity. Yet the same government that talks tough on national debt turns a blind eye to the personal debt the public have racked up on their watch. So while confidence may return to Britain's elite, millions of others endure sleepless nights about their future.

These are the people drowning in debts built up coping with the consequences of a recession in which wages froze but prices continued to rise. With little help from the government or banks, payday lending filled the gap. That leaves many people trapped, balancing multiple loans with multiple companies. They are trying to put food on their tables and heat their homes while paying off high-cost debts. One constituent was juggling eight different payday loans, to try and cover lost hours at work. She eventually lost her flat and only cleared her debt with her redundancy payoff; she is now back in rental property.

Last week, a Sure Start in Walthamstow, north-east London, told me of 30 clients served with eviction notices the day the benefit cap was introduced. Parents not even given a chance by landlords now face an overcrowded private rental sector that shuns housing benefit claimants. Several have been referred to social services as fears about debt and homelessness create unbearable stress.

Benefit cuts are the tip of the iceberg of pressures pushing the public into the red. As working hours have been slashed, so a wave of part-time jobs has led to underemployment and wasted productivity. Rail and energy prices have rocketed without competition from government to drive down the costs of getting to work or keeping warm. Asking those with thousands in unsecured personal debt – our current national average is £8,000 and growing – to take on risks and responsibilities is a non-starter. What hope saving for old age or social care costs, sending children to university or a housing deposit when the end of the month, let alone the end of the year, appears so distant for so many?

Which is why the toxicity of payday lending doesn't just feed today's cost of living crisis, but affects tomorrow's country of opportunity too. Cameron talks about prospects, but by his inaction we know his vision is one for the privileged few.

The failure of Project Merlin to lend to businesses shows coalition incompetence; the failure to provide affordable credit to our communities in such circumstances is inexcusable. Little wonder payday lenders now make £1m each week bleeding cash from consumers desperate to bridge the gap between a rocky jobs market and rising everyday expenses.

Such borrowing only compounds budgeting problems. Debt charity StepChange report 22% of payday loan clients have council tax arrears compared with 13% of all other clients, and 14% of them are behind on rent compared to 9% of all other clients. Such difficulties are music to the ears of companies for whom the more in debt a customer is the more profit they make.

Not every customer gets into financial difficulty, but enough find the price they pay for credit means they have to borrow again; 50% of profits in this industry come from refinancing, with those who take loans out repeatedly creating the largest return. One company makes 23% of its total profit from just 34,000 people who borrow every month, not able to cover their outgoings without such expensive finance. In turn, such loans devastate credit ratings, leaving users few other options to make ends meet.

Plans from the Financial Conduct Authority to limit rolling over of loans and lender access to bank accounts offer some progress. Yet until we deal with the cost of credit itself, there is little prospect of real change or protection for British consumers. Capping the total cost of credit, as they have in Japan and Canada, sets a ceiling on the amount charged, including interest rates, admin fees and late repayments. This allows borrowers to have certainty about debts they incur and firms have little incentive to keep pushing loans as they hit a limit on what they can squeeze out of a customer.

Lenders aggressively campaign against such measures knowing their profits, not customers, would take a hit. They threaten that caps would drive them out of business and push borrowers to illegal lenders – when evidence from other countries shows the reverse is true. Labour's commitment to capping in the face of such industry and government opposition reflects not just different priorities but different perspectives about in whose interests to act.

Only this government would make a virtue of defending companies that most now agree are out of control. The Office of Fair Trading is so concerned it has referred the entire industry to the Competition Commission. Its report into payday lending details how consumers are repeatedly sold loans they cannot hope to clear. The Citizens Advice Bureau found 76% of payday loan customers would have a misconduct case to take to the Financial Ombudsman. Despite overwhelming evidence of the toxic nature of their business model, these companies are being allowed to continue trading as if the consumer detriment it causes is a matter for the borrower to navigate rather than of public interest to address. Wanting to get regulation right should not prevent us from acting to avoid what, if left unchecked, will no doubt become the next mis-selling debacle akin to PPI.

In its willingness to front out concern about the fate of its 5 million customers, the danger is that this industry – and this government – wins the argument. They portray financial regulation as anti-competitive, anti-personal responsibility and anti-British, conveniently overlooking the market failure their behaviour represents.

This fosters a pessimism that the best we can do is pick up the pieces of the lives ruined, homes lost and credit ratings destroyed by companies exploiting the desperation of a country living on tick. Supporting alternative credit is vital, but so, too, is securing an alternative credit market and collective consumer action.

The longer we wait to learn the lessons of other countries on the use of caps, real-time credit checking and credit unions, the more people these legal loan sharks will snare into a cycle of inescapable debt – and a future where that land of opportunity is all too far away.

Stella Creasy is Labour MP for Walthamstow

Subscribe to:

Comments (Atom)