Germany is right: there is no right to profit, but the right to work is essential

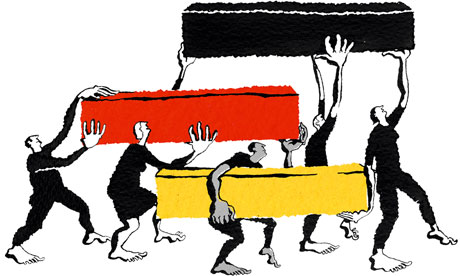

The strength of Germany lies in its medium-sized manufacturing firms, whose ethos includes being socially useful

'The objective of

every German business leader is to earn trust – from employees,

customers, suppliers and society as a whole.' illustration by Belle

Mellor

People talk too much about the economy and not enough about

jobs. When economists, academics and bankers are allowed to lead the

debate, the essential human element goes missing. This is neither

healthy nor practical.

Unemployment should be our prime concern. Spain, with youth joblessness close to 50%, is in the gravest crisis, but there is hardly a government on the planet that is not wondering what it can do to guide school-leavers into work, exploit the skills of older workers, and avoid the apathy and alienation of the jobless, which undermines not just the economy but also the social fabric.

There may be no definitive answer but, over the past half-century, Germany has come closest to finding it. Its postwar economic miracle was impressive, but its more recent ability to ride out recessions and absorb the costs of reunification is, perhaps, even more remarkable. Germany was not immune to the economic crisis of 2008-9, but the jobless rate rose more slowly than elsewhere in Europe. Although in recent months it has edged up towards 6.9%, it remains well below the euro area's 11.7% average. Germany's resilience springs from the strength of its medium-sized, often family-owned manufacturing companies, collectively known as the Mittelstand, which account for 60% of the workforce and 52% of Germany's GDP. So what can we learn from the Germans?

The enduring success of the Mittelstand has been well documented but rarely emulated. The standard excuse is that it is rooted in German history and culture and therefore unexportable. At a time when so much business is conducted on a global scale, via globally accessible media, this excuse is wearing thin.

Let me highlight some of the features unique to the Mittelstand model that I believe everyone should learn from – and imitate if they can. The first is what we might call the Mittelstand ethos – that business is a constructive enterprise that aims to be socially useful. Making a profit is not an end in itself: job creation, client satisfaction and product excellence are just as fundamental. Taking on debt is treated with suspicion. The objective of every business leader is to earn trust – from employees, customers, suppliers and society as a whole. This ethos chimes with the values of prudence and responsibility with which every schoolteacher hopes to imbue their pupils. Consequently, about half of all German high-school students move on to train in a trade. Business and education are natural bedfellows.

The second essential feature of the Mittelstand model is the collaborative spirit that generally exists between employer and employees. This can be dated back to the welfare state that Chancellor Otto von Bismarck established in the late 19th century to head off what he saw as the menace of socialism. Its modern-day equivalent is the system of works councils, which ensures that employees' interests are safeguarded, whether or not they belong to a trade union. German workers expect their employers to keep training them, enhancing their skills. In the post-reunification recession, it seemed only natural to German workers to offer flexibility on wages and hours in return for greater job security. More recently the government protected jobs by subsidising companies that cut hours rather than staff.

A third feature of the Mittelstand model is the determination of German companies to build for the long term. To this end, they tend to keep core functions such as engineering and project management in-house, while outsourcing production whenever this proves more efficient. Mittelstand companies are overwhelmingly privately owned, and thus largely free of pressure to provide shareholder returns. This makes them readier to innovate, and invest a larger proportion of their revenues in R&D. There are Mittelstand companies that file more patents in a year than do some entire European countries. It is one of the underlying reasons for their exporting success, even when their goods seem expensive.

Finally, German companies work closely with their suppliers. This has proved especially valuable in developing Sino-German trade. Unlike most of their international competitors, they are happy to take suppliers' representatives on trade missions. The result is that they can guarantee swift and sure supplies of components and other products. Chinese customers are not the only ones willing to pay extra for this kind of service excellence.

Of course, there are other factors that lie behind the success of the Mittelstand and of the German economy as a whole. Both the economy and political system are highly decentralised, with the result that local banks, businesses, entrepreneurs and politicians know and understand each other, making everyday co-operation easier – while, at the national level, Germany's leaders rarely miss an opportunity to promote their country's industry abroad.

Nonetheless, there is much that non-Germans could learn from. To close the gap between education and business, companies should take a greater interest in their local schools and colleges. If you haven't got spare cash for sponsoring gyms or computer equipment, go and talk to sixth-formers or degree students about what you do. Find out what graduates aspire to. It will help you to work out how to attract the next generation.

If you want to get more out of your employees and suppliers, consult them; invite them into your confidence. Don't complain: "We're not like the Germans. It won't work here." Think of a different way. Try harder.

The same applies to governments. Let me mention one simple legislative option. In German law, the owner of a family business who passes it on to the next generation can avoid paying inheritance tax if, during their tenure, they have increased employment and thereby benefited the economy. What better signal could a government give than by favouring those who create employment?

There is no question in my mind about which is the single most important feature of the Mittelstand model – its underlying ethos, which is based not on dry economic theory, but on everyday, practical humanity. The notion that business should be socially useful may have sprung from Germany's postwar conscience, but it has resonance now, when so many of our citizens are still suffering from the aftermath of the credit crunch and the failures of leadership it exposed.

There is no right to make a profit, and profit has no intrinsic value. But there is a right to work, and it is fundamental to human dignity. Without an opportunity to contribute with our hands or brains, we have no stake in society and our governments lack true legitimacy. There can be no more urgent challenge for our leaders. The title of the next G8 summit should be a four-letter word that everyone understands – jobs.

Unemployment should be our prime concern. Spain, with youth joblessness close to 50%, is in the gravest crisis, but there is hardly a government on the planet that is not wondering what it can do to guide school-leavers into work, exploit the skills of older workers, and avoid the apathy and alienation of the jobless, which undermines not just the economy but also the social fabric.

There may be no definitive answer but, over the past half-century, Germany has come closest to finding it. Its postwar economic miracle was impressive, but its more recent ability to ride out recessions and absorb the costs of reunification is, perhaps, even more remarkable. Germany was not immune to the economic crisis of 2008-9, but the jobless rate rose more slowly than elsewhere in Europe. Although in recent months it has edged up towards 6.9%, it remains well below the euro area's 11.7% average. Germany's resilience springs from the strength of its medium-sized, often family-owned manufacturing companies, collectively known as the Mittelstand, which account for 60% of the workforce and 52% of Germany's GDP. So what can we learn from the Germans?

The enduring success of the Mittelstand has been well documented but rarely emulated. The standard excuse is that it is rooted in German history and culture and therefore unexportable. At a time when so much business is conducted on a global scale, via globally accessible media, this excuse is wearing thin.

Let me highlight some of the features unique to the Mittelstand model that I believe everyone should learn from – and imitate if they can. The first is what we might call the Mittelstand ethos – that business is a constructive enterprise that aims to be socially useful. Making a profit is not an end in itself: job creation, client satisfaction and product excellence are just as fundamental. Taking on debt is treated with suspicion. The objective of every business leader is to earn trust – from employees, customers, suppliers and society as a whole. This ethos chimes with the values of prudence and responsibility with which every schoolteacher hopes to imbue their pupils. Consequently, about half of all German high-school students move on to train in a trade. Business and education are natural bedfellows.

The second essential feature of the Mittelstand model is the collaborative spirit that generally exists between employer and employees. This can be dated back to the welfare state that Chancellor Otto von Bismarck established in the late 19th century to head off what he saw as the menace of socialism. Its modern-day equivalent is the system of works councils, which ensures that employees' interests are safeguarded, whether or not they belong to a trade union. German workers expect their employers to keep training them, enhancing their skills. In the post-reunification recession, it seemed only natural to German workers to offer flexibility on wages and hours in return for greater job security. More recently the government protected jobs by subsidising companies that cut hours rather than staff.

A third feature of the Mittelstand model is the determination of German companies to build for the long term. To this end, they tend to keep core functions such as engineering and project management in-house, while outsourcing production whenever this proves more efficient. Mittelstand companies are overwhelmingly privately owned, and thus largely free of pressure to provide shareholder returns. This makes them readier to innovate, and invest a larger proportion of their revenues in R&D. There are Mittelstand companies that file more patents in a year than do some entire European countries. It is one of the underlying reasons for their exporting success, even when their goods seem expensive.

Finally, German companies work closely with their suppliers. This has proved especially valuable in developing Sino-German trade. Unlike most of their international competitors, they are happy to take suppliers' representatives on trade missions. The result is that they can guarantee swift and sure supplies of components and other products. Chinese customers are not the only ones willing to pay extra for this kind of service excellence.

Of course, there are other factors that lie behind the success of the Mittelstand and of the German economy as a whole. Both the economy and political system are highly decentralised, with the result that local banks, businesses, entrepreneurs and politicians know and understand each other, making everyday co-operation easier – while, at the national level, Germany's leaders rarely miss an opportunity to promote their country's industry abroad.

Nonetheless, there is much that non-Germans could learn from. To close the gap between education and business, companies should take a greater interest in their local schools and colleges. If you haven't got spare cash for sponsoring gyms or computer equipment, go and talk to sixth-formers or degree students about what you do. Find out what graduates aspire to. It will help you to work out how to attract the next generation.

If you want to get more out of your employees and suppliers, consult them; invite them into your confidence. Don't complain: "We're not like the Germans. It won't work here." Think of a different way. Try harder.

The same applies to governments. Let me mention one simple legislative option. In German law, the owner of a family business who passes it on to the next generation can avoid paying inheritance tax if, during their tenure, they have increased employment and thereby benefited the economy. What better signal could a government give than by favouring those who create employment?

There is no question in my mind about which is the single most important feature of the Mittelstand model – its underlying ethos, which is based not on dry economic theory, but on everyday, practical humanity. The notion that business should be socially useful may have sprung from Germany's postwar conscience, but it has resonance now, when so many of our citizens are still suffering from the aftermath of the credit crunch and the failures of leadership it exposed.

There is no right to make a profit, and profit has no intrinsic value. But there is a right to work, and it is fundamental to human dignity. Without an opportunity to contribute with our hands or brains, we have no stake in society and our governments lack true legitimacy. There can be no more urgent challenge for our leaders. The title of the next G8 summit should be a four-letter word that everyone understands – jobs.