'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Sunday, 3 April 2022

Friday, 10 December 2021

Spending without taxing: now we’re all guinea pigs in an endless money experiment

Today, citizens are unwitting participants in a covert policy experiment. It embraces the idea of higher government spending without the necessity of increased taxes. While modern monetary theory (MMT), the doctrine, has obvious appeal for politicians, irrespective of economic religion, the long-term consequences may prove problematic.

A state, MMT argues, finances its spending by creating money, not from taxes or borrowing. As nations cannot go bankrupt when they can print their own currency, deficits and debt don’t matter. Accordingly, governments should spend to ensure full employment, guaranteeing a job for everyone willing to work. Alternatively, though not formally part of MMT, governments can fund universal basic income (UBI) schemes, providing every individual an unconditional flat-rate payment irrespective of circumstances.

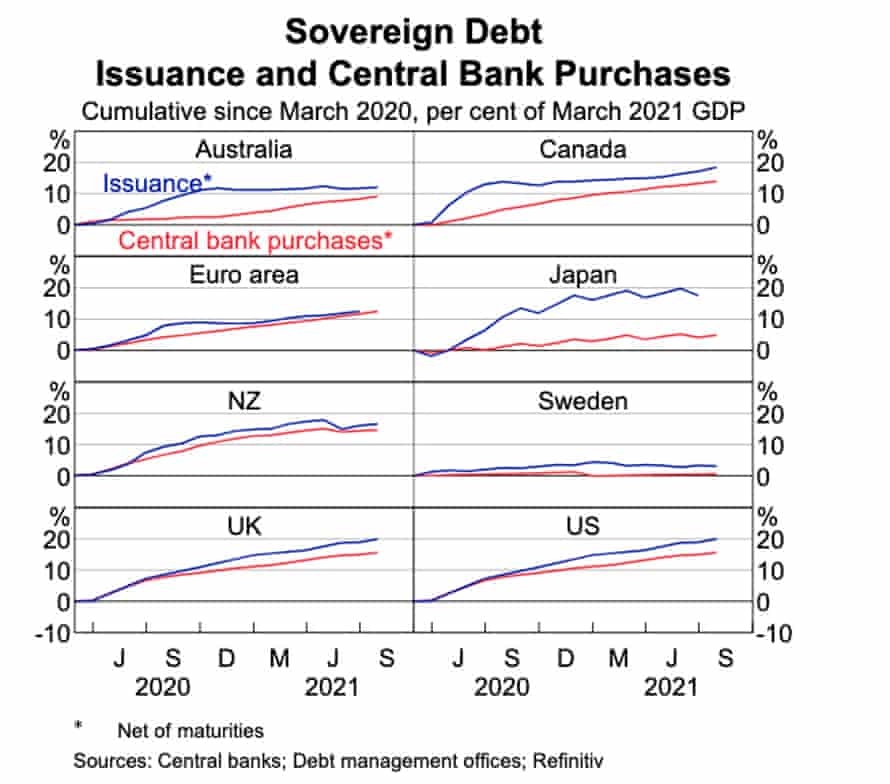

While no government or central bank overtly advocates MMT, since the 2008 global financial crisis and, more recently, the pandemic, policymakers have adopted many of its tenets by stealth. Popular one-off payments and increased welfare entitlements, which could become permanent, increasingly support economic activity. As the graph below highlights, central banks now buy a high percentage of new government debt, effectively financing this additional spending by money creation.

Source: Nick Baker, Marcus Miller and Ewan Rankin (2021 September) Government Bond Markets in Advanced Economies During the Pandemic; Reserve Bank of Australia Bulletin

MMT is actually a melange of old ideas: Keynesian deficit spending; the post gold standard ability of nations to create money at will; and quantitative easing (central bank financed government spending) pioneered by Japan. However, there are several concerns about MMT.

First, the source of useful, well-compensated work is unclear. While MMT suggests taxes can be used to direct production, government influence over businesses that create jobs is limited. The impact of labour-reducing technology and competitive global supply chains is glossed over. Getting one person to dig a hole and another to fill it in creates employment, but it is of doubtful economic and social value. The woeful record of postwar centrally planned economies, where people pretended to work and the government pretended to pay them, highlights the issues.

Second, excess government spending and large deficits financed by money creation risk creating inflation. MMT argues that this is a risk only where the economy is at full employment or there is no excess capacity, and can be managed by fine-tuning intervention.

Third, MMT may weaken the currency. Roughly half of Australia’s government and significant amounts of state, bank and business debt is held by foreigners. Devaluation and loss of investor confidence in the stability of the exchange rate would affect the ability to and cost of borrowing overseas and importing goods. The expense of servicing foreign currency debt would rise.

Fourth, while available to nation states able to issue their own fiat currencies, it is unavailable to state governments, private businesses or households who are major borrowers in Australia.

Fifth, who decides the target employment rate or UBI payment level? Unemployment, inflation and output gaps are difficult to accurately measure in practice. Effects on employment incentives, workforce participation and productivity are untested. How will policymakers control the process or what would happen if MMT failed?

The theory delegates management of MMT operations to politicians, rather than unelected economic mandarins. But financially challenged elected representatives may be poorly equipped for the task. Political considerations and cronyism may influence decisions.

Sixth, there are implications for financial stability. Lower rates, the result of central bank debt purchases, and inflation fears might drive a switch to real assets, increasing the price of property and shares representing claims on underlying cashflows. It may encourage hoarding of commodities. This exacerbates inequality and increases the cost of essentials such as food, fuel and shelter. Fear of debasement of the value of paper money, in part, is behind unproductive speculation in gold and cryptocurrencies.

Seventh, MMT might undermine trust in the currency. Instead of spending the payments, citizens may question a world where governments print money and throw it out of helicopters.

Finally, Japan’s use of persistent deficits to boost short-term economic activity and incur government debt (currently more than 260% of GDP, compared with a global average of about 100%) does not prove the effectiveness of MMT. The country’s circumstances are unique and it has been mired in stagnation for three decades with its GDP largely unchanged.

MMT’s allure is the irresistible promise of freebies; full employment, unlimited higher education, healthcare and government services, state-of-the-art infrastructure, green energy and “the colonisation of Mars”. But monetary manipulation cannot change the supply of real goods and services or overcome resource constraints, otherwise prosperity and utopia would be guaranteed.

While the current game can and will continue for a time, the bill will eventually arrive. The borrowings will have to be paid for out of disposable income, higher taxes or through inflation, which reduces purchasing power, especially of the most vulnerable, and destroys savings. Other than nature’s free bounty, everything has a cost.

Saturday, 17 July 2021

Wednesday, 2 June 2021

2 Why central bankers no longer agree how to handle inflation

Thursday, 15 April 2021

Thursday, 18 March 2021

Time for a great reset of the financial system

A 30-year debt supercycle that has fuelled inequality illustrates the need for a new regime writes CHRIS WATLING in The FT

On average international monetary systems last about 35 to 40 years before the tensions they create becomes too great and a new system is required.

Prior to the first world war, major economies existed on a hard gold standard. Intra-wars, most economies returned to a “semi-hard” gold standard. At the end of the second world war, a new international system was designed — the Bretton Woods order — with the dollar tied to gold, and other key currencies tied to the dollar.

When that broke down at the start of the 1970s, the world moved on to a fiat system where the dollar was not backed by a commodity, and was therefore not anchored. This system has now reached the end of its usefulness.

An understanding of the drivers of the 30-year debt supercycle illustrates the system’s tiredness. These include the unending liquidity that has been created by the commercial and central banks under this anchorless international monetary system. That process has been aided and abetted by global regulators and central banks that have largely ignored monetary targets and money supply growth.

The massive growth of mortgage debt across most of the world’s major economies is one key example of this. Rather than a shortage of housing supply, as is often postulated as the key reason for high house prices, it’s the abundant and rapid growth in mortgage debt that has been the key driver in recent decades.

This is also, of course, one of the factors sitting at the heart of today’s inequality and generational divide. Solving it should contribute significantly to healing divisions in western societies.

With a new US administration, and the end of the Covid battle in sight with the vaccination rollout under way, now is a good time for the major economies of the west (and ideally the world) to sit down and devise a new international monetary order.

As part of that there should be widespread debt cancellation, especially the government debt held by central banks. We estimate that amounts to approximately $25tn of government debt in the major regions of the global economy.

Whether debt cancellation extends beyond that should be central to the negotiations between policymakers as to the construct of the new system — ideally it should, a form of debt jubilee.

The implications for bond yields, post-debt cancellation, need to be fully thought through and debated. A normalisation in yields, as liquidity levels normalise, is likely.

High ownership of government debt in that environment by parts of the financial system such as banks and insurers could inflict significant losses. In that case, recapitalisation of parts of the financial system should be included as part of the establishment of the new international monetary order. Equally, the impact on pension assets also needs to be considered and prepared for.

Secondly, policymakers should negotiate some form of anchor — whether it’s tying each other’s currencies together, tying them to a central electronic currency or maybe electronic special drawing rights, the international reserve asset created by the IMF.

As highlighted above, one of the key drivers of inequality in recent decades has been the ability of central and commercial banks to create unending amounts of liquidity and new debt.

This has created somewhat speculative economies, overly reliant on cheap money (whether mortgage debt or otherwise) that has then funded serial asset price bubbles. Whilst asset price bubbles are an ever-present feature throughout history, their size and frequency has picked up in recent decades.

As the Fed reported in its 2018 survey, every major asset class over the 20 years from 1997 through to 2018 grew on average at an annual pace faster than nominal GDP. In the long term, this is neither healthy nor sustainable.

With a liquidity anchor in place, the world economy will then move closer to a cleaner capitalist model where financial markets return to their primary role of price discovery and capital allocation based on perceived fundamentals (rather than liquidity levels).

Growth should then become less reliant on debt creation and more reliant on gains from productivity, global trade and innovation. In that environment, income inequality should recede as the gains from productivity growth become more widely shared.

The key reason that many western economies are now overly reliant on consumption, debt and house prices is because of the set-up of the domestic and international monetary and financial architecture. A Great Reset offers therefore opportunity to restore (some semblance of) economic fairness in western, and other, economies.

Thursday, 22 October 2020

The case against Modern Monetary Theory

Stephen King in The FT

In a world in which government debt is rapidly rising, it’s hardly surprising that there’s growing interest among investors in Modern Monetary Theory. After all, one of its central claims is that budget deficits are, from a financing perspective, an irrelevance. So long as increased government borrowing doesn’t lead to inflation — and, at the moment, there really isn’t much of it around — we can all afford to relax.

As Stephanie Kelton notes in her book The Deficit Myth, governments with access to a printing press are “currency issuers” (exceptions include, most obviously, members of the eurozone). As such, all their spending could, in principle, be financed via the creation of cash. Taxes may serve other purposes — the redistribution of income and wealth, the discouragement of “sinful” behaviour — but, in the world of MMT, they serve no useful macroeconomic role.

---Also read

Can governments afford the debts they are piling up?

The magic money tree does exist, according to modern monetary theory

---

In the real world, however, taxes are crucial. The fundamental difference between government finances and those of companies and households is not access to a printing press but, instead, the coercive power to raise taxes. A company making a severe loss cannot reduce that loss by imposing taxes on everyone else. A government can. A worker receiving a pay cut cannot force others to make up the difference. A government can.

Armed with this knowledge, creditors are understandably willing to accept mostly lower returns on government bonds than on other investments. Put simply, the risk of government default in the face of an adverse economic shock is lower than for other would-be borrowers.

Admittedly, there are limits, dictated largely by the political capacity of a government to raise revenues in difficult circumstances. Emerging markets often end up resorting instead to devaluation, default or inflation. In anticipation, borrowing costs spike.

Still, imagine for a moment that governments embrace MMT. Imagine too, as MMT proponents suggest, that control of the printing press is taken away from unelected central bankers and given to “accountable” elected fiscal representatives. Would we be any better off?

Far from it. Giving elected representatives the keys to the printing press is the equivalent of giving a gambling addict the keys to the casino. For many politicians, the primary objective is to remain in power. As such, they will too often be incentivised to pursue instant gratification at the expense of longer-term stability. In the early-1970s, the UK embarked on what became known as the “Barber boom”, thanks to the efforts of Conservative chancellor of the exchequer Anthony Barber to engineer an election victory in 1974. As it turned out, the Tories lost and, two years later, the UK ignominiously had to accept a bailout from the IMF. Central bank independence provides a useful bulwark against such behaviour.

More importantly, inflation and taxes are, in many ways, simply two sides of the same coin. Those governments without access to tax revenues can instead “debase the coinage”. Supporters of MMT claim this will never happen, yet history suggests otherwise: after all, it has been a tried and tested policy of kings and queens over hundreds of years. Too often, those with access to the printing press are prepared to take undue risks in the hope that “this time it’s different”.

In truth, inflation helps solve the financing issues that proponents of MMT claim no longer exist. Negative real interest rates, a result of higher-than-anticipated inflation, serve to redistribute wealth away from private creditors (pensioners, for example) to public debtors. Much the same could be achieved through a wealth tax. At this point, we come full circle: the distinction between the printing press and taxes begins to break down.

Thanks to Covid-19, government debt is rising rapidly and, for that matter, appropriately. In the face of recurring lockdowns, we are better off allowing companies and workers to enter a period of economic “hibernation” in the hope that, once the virus is under control, they can thaw out. The alternative of multiple business failures and mass unemployment is of no use to anyone. In the process, however, we are in effect borrowing from our collective economic futures. At some point, some of us will be presented with a bill which, if hibernation policies succeed, we will be in a reasonable position to pay. The political process will decide whether that bill comes in the form of higher taxes, more austerity, rising inflation or eventual default. That, I’m afraid, is the deficit reality.

Thursday, 12 September 2019

Central banks were always political – so their ‘independence’ doesn’t mean much

Independent central banks were once all the rage. Taking decisions over interest rates and handing them to technocrats was seen as a sensible way of preventing politicians from trying to buy votes with cheap money. They couldn’t be trusted to keep inflation under control, but central banks could.

And when the global economy came crashing down in the autumn of 2008, it was central banks that prevented another Great Depression. Interest rates were slashed and the electronic money taps were turned on with quantitative easing (QE). That, at least, is the way central banks tell the story.

An alternative narrative goes like this. Collectively, central banks failed to stop the biggest asset-price bubble in history from developing during the early 2000s. Instead of taking action to prevent a ruinous buildup of debt, they congratulated themselves on keeping inflation low.

Even when the storm broke, some institutions – most notably the European Central Bank (ECB) – were slow to act. And while the monetary stimulus provided by record-low interest rates and QE did arrest the slide into depression, the recovery was slow and patchy. The price of houses and shares soared, but wages flatlined.

A decade on from the 2008 crash, another financial crisis is brewing. The US central bank – the Federal Reserve – is coming under huge pressure from Donald Trump to cut interest rates and restart QE. The poor state of the German economy and the threat of deflation means that on Thursday the ECB will cut the already negative interest rate for bank deposits and announce the resumption of its QE programme.

But central banks are almost out of ammo. If cutting interest rates to zero or just above was insufficient to bring about the sort of sustained recovery seen after previous recessions, then it is not obvious why a couple of quarter-point cuts will make much difference now. Likewise, expecting a bit more QE to do anything other than give a fillip to shares on Wall Street and the City is the triumph of hope over experience.

There were alternatives to the response to the 2008 crisis. Governments could have changed the mix, placing more emphasis on fiscal measures – tax cuts and spending increases – than on monetary stimulus, and then seeking to make the two arms of policy work together. They could have taken advantage of low interest rates to borrow more for the public spending programmes that would have created jobs and demand in their economies. Finance ministries could have ensured that QE contributed to the long-term good of the economy – the environment, for example – if they had issued bonds and instructed central banks to buy them.

This sort of approach does, though, involve breaking one of the big taboos of the modern age: the belief that monetary and fiscal policy should be kept separate and that central banks should be allowed to operate free from political interference.

The consensus blossomed during the good times of the late 1990s and early 2000s, and survived the financial crisis of 2008 . But challenges from both the left and right, especially in the US, suggest that it won’t survive the next one. Trump says the Fed has damaged the economy by pushing up interest rates too quickly. Bernie Sanders says the US central bank has been captured by Wall Street. Both arguments are correct. It is a good thing that central bank independence is finally coming under scrutiny.

For a start, it has become clear that the notion of depoliticised central bankers is a myth. When he was governor of the Bank of England, Mervyn King lectured the government about the need for austerity while jealously guarding the right to set interest rates free from any political interference. Likewise, rarely does Mario Draghi, the outgoing president of the ECB, hold a press conference without urging eurozone countries to reduce budget deficits and embrace structural reform.

Central bankers have views and – perhaps unsurprisingly – they tend to be quite conservative ones. As the US economist Thomas Palley notes in a recent paper, central bank independence is a product of the neoliberal Chicago school of economics and aims to advance neoliberal interests. More specifically, workers like high employment because in those circumstances it is easier to bid up pay. Employers prefer higher unemployment because it keeps wages down and profits up. Central banks side with capital over labour because they accept the neoliberal idea that there is a point – the natural rate of unemployment – beyond which stimulating the economy merely leads to higher inflation. They are, Palley says, institutions “favoured by capital to guard against the danger that a democracy may choose economic policies capital dislikes”.

Until now, monetary policy has been deemed too important to be left to politicians. When the next crisis arrives it will become too political an issue to be left to unelected technocrats. If that crisis is to be tackled effectively, the age of independent central banks will have to come to an end.

Thursday, 14 February 2019

Taxes and money - Modern Monetary Theory MMT

Thursday, 7 February 2019

Tuesday, 16 August 2016

Moaning about bad returns on your savings? Stop complaining – it's your fault that interest rates are so low

“Neither a borrower nor a lender be”, warned Polonius. But should he have added “saver” to that list?

The Bank of England’s latest cut in its base rate has piled even more downward pressure on returns offered by banks on cash balances. Santander this week halved the interest rate on its “123” account, one of the few remaining products on the market that had offered a decent return on savings. And there is talk of another Bank rate cut later this year, perhaps down to just 0.1 per cent. Will it be long before furious savers march on the Bank’s Threadneedle Street headquarters with pitchforks and burning torches in their hands?

They should put the pitchforks down.

------Also read

Ever-lower interest rates have failed. It’s time to raise them

-----

There are a number of serious misconceptions regarding the plight of savers that have gone uncorrected for too long. The first is that “saving” only takes the form of cash held on deposit in current accounts (or slightly longer-term savings accounts) at the bank or building society. The truth is that far more of the nation’s wealth is held in company shares, bonds, pensions and property, than on cash deposit.

Shares and pension pots have been greatly boosted by the Bank’s low interest rates and monetary stimulus since 2009. House prices have also done well, also helped by low rates. Savers complain about low returns on cash, yet fail to appreciate the benefit to the rest of their savings portfolios from monetary stimulus.

There’s no denying that annuity rates (products offered by insurance companies that turn your pension pot into an annual cash flow) are at historic low thanks to rock bottom interest rates. Yet, since last year, savers also have the freedom not to buy an annuity upon retirement thanks to former Chancellor George Osborne’s regulatory liberalisation. People can now keep their savings invested in the stock market, liquidating shares when necessary to fund their outgoings.

There has been talk of the latest cut in Bank base rate pushing up accounting deficits in defined benefit retirement schemes to record levels, clobbering pensioners. But this is another misunderstanding.

Yes, some of these schemes, run by weak employers, could fail and need to be bailed out by the Pension Protection Fund. And this could entail reductions in pension pay outs. Yet the larger negative impact of rising pension deficits is likely to be felt by young people in work, rather than pensioners or imminent retirees.

Firms facing spiralling scheme deficits and regulatory calls to inject in more spare cash to reduce them, might well respond by keeping downward pressure on wages or by reducing hiring. In other words, the bill is likely to be picked up by those workers who are not benefiting, and were never going to benefit, from these (now closed) generous retirement schemes.

Perhaps the biggest misconception about savings is that low returns on cash deposits are somehow all the fault of the Bank of England. This shows a glaring ignorance of the bigger economic picture.

Excess savings in the global economy – in particular from China, Japan, Germany and the Gulf states – have been exerting massive downward on long-term interest rates in western countries for almost two decades. To put it simply, the world has more savings than it is able to digest. It is this global 'savings glut’ that has driven down long-term interest rates, making baseline returns so low everywhere.

It’s legitimate to wonder whether further cuts in short-term rates by the Bank of England will have much positive affect on the UK economy. But the savings lobby seems to believe that it’s the duty of the Bank to raise short-term rates, regardless of the bigger picture, in order to give people a better return on their cash savings today. This would be madness.

Yes, the Bank of England could jack up short-term rates – but the most likely outcome of this would be to deepen the downturn. And for what? It would mean a higher income for cash savers, but survey research suggests most would simply bank the cash gain rather than spending it, delivering no aggregate stimulus to growth.

Share and other asset prices would also most likely take a beating, undermining the rest of savers’ wealth portfolios. Do savers really believe a 10 per cent fall in the value of their house is a price worth paying for a couple of extra percentage points of interest on their current accounts?

Moreover, the Bank of England’s responsibility is to set interest rates for the good of the whole economy, not for one interest group within it. As Andy Haldane, the Bank’s chief economist pointed out at the weekend, keeping rates on hold (never mind increasing them) would considerably increase unemployment. And the people who would suffer in those circumstances would probably be those who have not even had a chance to build up any savings.

No sensible policymaker or economist wants low interest rates for their own sake. They are a means to an end: to help the economy return to its potential growth rate. When growth has hit that target it will, in time, necessitate higher short-term rates to keep inflation in check.

So for short-term rates to rise, the economy needs to pick up speed. That’s what the Bank of England has been trying to achieve since 2009. Yes, the process has been frustratingly protracted, like jumpstarting an old banger with a flat battery, but the situation would have been worse without Threadneedle Street’s efforts.

If savers are frustrated with low deposit returns they should focus their anger on the global savings glut and the failure (and refusal) of governments in Asia and Europe to rebalance their domestic economies. Other legitimate targets are excessive domestic austerity here in Britain, from the coalition and current governments since 2010, which have delivered a feeble recovery since the Great Recession, and also the Brexit vote which has forced the Bank of England into hosing the economy down with yet more emergency monetary support this month.

And if they voted for the latter two – austerity and Brexit – then savers might care to look in the mirror if they want to see one of the true causes of their frustration.

Monday, 15 August 2016

Ever-lower interest rates have failed. It’s time to raise them

When the Bank of England reduced the base rate to a record low this month, there was one, tiny consolation for savers. The governor, Mark Carney – almost the only individual to have emerged from the Brexit shambles unscathed – said he was “not a fan” of negative interest rates. He thus seemed to rule out the nightmare – for anyone even just in the black – that we would have to pay the banks for keeping our money, rather than the other way round.

Carney’s effective rejection of negative rates – as already introduced in Japan and Sweden – was welcome. But it does little to help UK savers, who are recommended, in that infuriating phrase, to “shop around” for higher rates. Shop around if you like, but I was recently informed by two banks that rates were being reduced below 0.5%, and short of entrusting your cash to an emerging market, real options are few.

If the next thing is overt, as opposed to covert – charging for current accounts – then we will be in negative territory in fact if not in name. Then what? Despite everything I was brought up to believe, stashing cash under the mattress suddenly looks like sage planning.

The catastrophic fall in returns to savers over the past few years is, of course, a long-term consequence of the financial crisis; but a grievously neglected one. Each time rates have been reduced, the loudest voice has been that of creditors and their advocates. The supposed rationale is that low rates will get us all spending so as to get the economy growing again.

For those acclimatised to living not just with mortgages at absurdly low levels, but with overdrafts and credit-card debt as well – the benefits are evident. The cost of servicing that debt is reduced, and repay-day is again postponed. Small matter that the credit bonanza of the early 2000s was a direct cause of the financial crisis, and that we are also being urged to save for our retirement: ever-cheaper credit remains the economic growth hormone of choice.

For those of us told from childhood not to live beyond our means, who have also done our best to save for retirement, the potential effects are dire. Whenever I hear any mention of a new round of quantitative easing or a cut in interest rates, another dark cloud appears on my financial horizon – and not mine alone. We were led to expect a return on our savings that would supplement our pensions; a half of 1% even on a goodly sum will not do that.

Those now contemplating retirement on private sector, non-final salary, non-index-linked pensions – the majority – will see the rewards for their prudence not just trimmed, but slashed.

With interest rates low, investment funds look attractive

All the talk of intergenerational strife and the “plight of the millennials” omits the betrayal and impoverishment of savers, who are mostly older and have no means of increasing their income. What use is cheap credit to them? You don’t get a 1% tracker mortgage on care home fees.

The focus on house prices as the evil of evils for the young is also misleading. Low interest rates have helped push up housing costs in areas of high demand by making mammoth mortgages affordable. Saving for a deposit is the problem, and low interest rates don’t help.

There are signs, though, that the doctrine of ever-lower interest rates may be starting to run out of road. In the Financial Times last week a fund manager dared to challenge the orthodoxy that low interest rates necessarily stimulate demand. In the same paper, a reader argued that lower rates made him sit on his savings rather than spend. I suspect it has the same effect on others.

There are surely compelling reasons for a rethink. Reducing the cost of borrowing has not, in fact, led to a consumer boom, nor even to more modest growth. Without a perceptible rise in their incomes, it would seem that most people err on the side of caution. Either that, or their credit, however cheap, is maxed out.

We savers, meanwhile, are hanging on to what we have, for fear of even worse returns, and perhaps higher inflation, to come. Nor are negative rates likely to change this. The Japanese have not gone out to spend, even though this might seem a logical response; the result has rather been less money in banks and more, it is assumed, under beds.

So if ultra-low interest rates are not stimulating growth, and if they are simultaneously undermining messages about sound money and saving for retirement, how about trying the opposite? A rise in rates, perhaps?

The very idea would, of course, be greeted by warnings about mortgage defaults, repossessions, and hitting the poor disproportionately. But low rates tend not to benefit those on the brink; and an initially modest rise would offer a salutary reminder that borrowing has a cost. It could also exert downward pressure on house prices.

More immediately, it could encourage those of us in the black to indulge in a spot of so-called discretionary spending. In all, we could be reaching a point where the pluses of a rate increase outweigh the minuses. For savers, that point can’t come soon enough.

Sunday, 26 February 2012

Some History of Monetary Unions

Making friends the shared currency way

Far from being a recent innovation, there have been monetary unions for almost as long as there has been money. But across two and a half millennia, and whatever varied forms they may have taken, few of them have endured, which helps explain why they've been so easily and so largely forgotten.

It's no exaggeration to say that European history is littered with the ruins of earlier endeavours. The most immediate predecessor to the EMU was the 19th Century Latin Monetary Union, which attempted to unify several European currencies at a time when most circulating coins were still made of gold or silver.

It came into being in August 1866; its initial members were France, Belgium, Italy and Switzerland, and they agreed that their national currencies should be standardised and interchangeable. There was no shared, single legal tender, but the currencies of the member countries were pegged at a fixed rate with each other.

Two years later, the four founding nations were joined by Spain and Greece and in 1889 the union was further enlarged by admitting Romania, Bulgaria, Venezuela, Serbia and San Marino. Thus the enlarged Latin Monetary Union lasted until World War I, which abruptly brought to an end the global financial system based on the gold standard. The result was that the LMU effectively came to an end in 1914, although it lingered on as a legal entity until its formal dissolution in 1927.

The second was that Britain must give up shillings and pence and decimalise its coinage to bring it into line with the other European currencies. Neither of these proposals was deemed acceptable, and so then, as in 1999, Britain stayed out, and left the continentals to their own devices. It also showed no interest in another and even more grandiose scheme floated by the French in 1867, for what was termed a "universal currency", which would have been based on equivalent gold coins to be issued by France, Britain and the United States.

Here were signs and portents aplenty of recent British attitudes and behaviour.

As Walter Bagehot, the essayist and editor of The Economist, put it in the late 1860s, there seemed to be a real danger that, "Before long, all Europe, save England, will have one money, and England will be left outstanding with another money."

If this happened, Bagehot went on, "We shall, to use the vulgar expression, 'be left out in the cold'. If we could adopt this coinage ourselves without material inconvenience, I confess I, for one, should urge our doing so."

But Bagehot believed that the practical difficulties of such a step were "simply insurmountable". He feared more generally that "the attempt to found a universal money is not possible now", and the unhappy fate of the Latin Monetary Union would later bear him out. Yet with the establishment of the late 20th Century European Monetary Union, it did seem as if the state of affairs, which Bagehot one day envisaged - and feared - had come very close to realisation.

But in 2001, Greece joined the European Monetary Union, and the rest, as they say, is history - but a history that is not yet anything like being over.

Ever since it gained its hard-fought independence from the Ottoman Empire in 1832, Greece has been plagued by recurrent budget crises, frequent state defaults and long periods during which it's effectively been cut off from the international capital markets.

So while it was one of the earliest nations to join the Latin Monetary Union, its membership soon became more a cause of concern than celebration, for its chronically weak economy meant successive Greek governments responded by decreasing the amount of gold in their coins, thereby debasing their currency in relation to those of other nations in the union and in violation of the original agreement.

So irresponsible and unacceptable did Greece's behaviour become that it was formally expelled from the Latin Monetary Union in 1908. As a result, some effort was made to readjust the nation's

monetary policy and Greece was readmitted to the Union two years later. But by then, the whole enterprise was increasingly fragile, its future looked increasingly uncertain, and the outbreak of WWI was only four years off.

Less successful was the Scandinavian Monetary Union, established between Denmark and Sweden in 1873, which was joined by Norway two years later. The aim was to do for Scandinavia what the Latin Monetary Union was attempting more broadly for Europe as a whole but it, too, effectively ceased to function on the outbreak of WWI and it was formally brought to an end in 1924.

Such efforts to create common currencies during the 19th and 20th Centuries are only the most recent examples of a process that's been going on for almost as long as coinage itself has existed. It's an intriguing historical irony that among the pioneers of these endeavours seem to have been none other than the ancient Greeks.

One of the earliest examples of such a union occurred sometime about 400BC, along the western coast of Asia Minor, where seven Greek states allied themselves and produced a coinage that directly foreshadowed later European monetary unions. On the front of the coins was a common design of the baby Heracles strangling a snake, and the first three letters of the Greek word for alliance. On the reverse, each state placed its own particular image. All these coins were minted to the same weight and formed a unified currency, which was the tangible symbol of the seven members' economic alliance.

No-one quite knows why or when this early effort at a monetary union collapsed but 200 years later, the ancient Greeks had another try, organised through what was known as the Achaean League, an alliance of territories and city states covering the whole of the Peloponnese that had been formed about 280BC.

Once again, their shared currency had a common obverse design, in this case the head of Zeus, and reverse patterns that were specific to the individual issuing authority.

The result, according to the historian Polybius, was that the Greeks "had not only formed an allied and friendly community but they have the same laws, weights, measures and coinage, as well as the same officials, council and courts of justice". Here was a level of integration, which the most ardent and ambitious Eurocrat of today might envy and this may help explain why, unlike the Latin or the Scandinavian monetary unions, the Achaean League lasted for well over 100 years.

Its eventual dissolution, in 146BC, was not because the members of the league fell out with each other, over the currency or anything else but was the result of an external shock in the form of a crushing military defeat by the Romans at the Battle of Corinth. Which leaves us with the following paradox: the ancient Greeks were pioneers of monetary unions and were quite eager to keep them in being.

Modern Greece, by contrast, has been a threat and a danger to any monetary union that it has ever joined.