‘A state, MMT argues, finances its spending by creating money, not from taxes or borrowing. As nations cannot go bankrupt when they can can print their own currency, deficits and debt don’t matter.’ Photograph: RBA/PR IMAGE

Today, citizens are unwitting participants in a covert policy experiment. It embraces the idea of higher government spending without the necessity of increased taxes. While modern monetary theory (MMT), the doctrine, has obvious appeal for politicians, irrespective of economic religion, the long-term consequences may prove problematic.

A state, MMT argues, finances its spending by creating money, not from taxes or borrowing. As nations cannot go bankrupt when they can print their own currency, deficits and debt don’t matter. Accordingly, governments should spend to ensure full employment, guaranteeing a job for everyone willing to work. Alternatively, though not formally part of MMT, governments can fund universal basic income (UBI) schemes, providing every individual an unconditional flat-rate payment irrespective of circumstances.

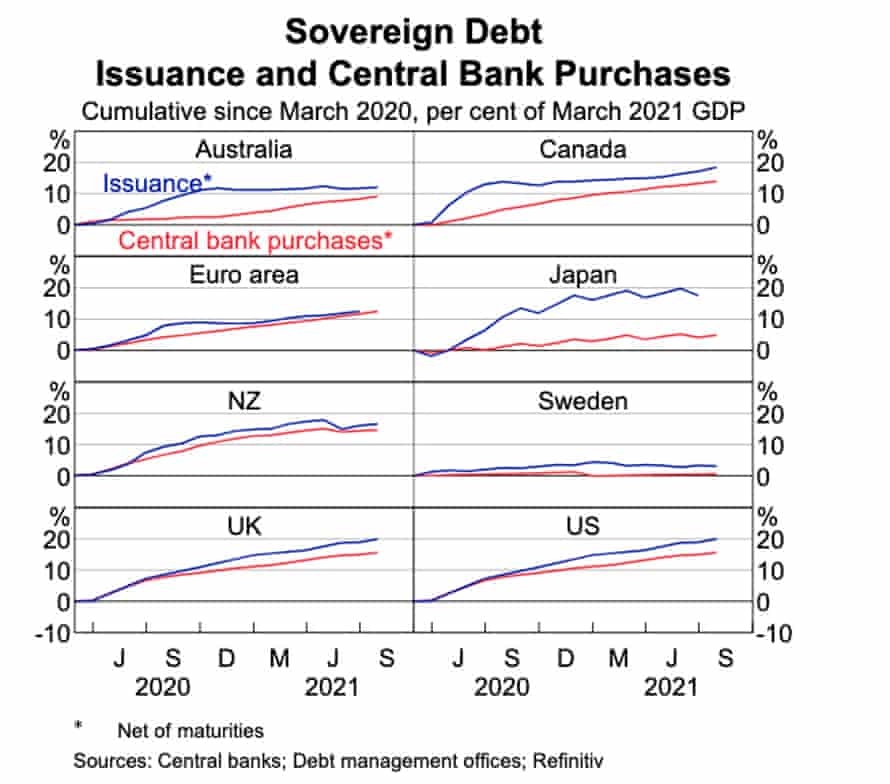

While no government or central bank overtly advocates MMT, since the 2008 global financial crisis and, more recently, the pandemic, policymakers have adopted many of its tenets by stealth. Popular one-off payments and increased welfare entitlements, which could become permanent, increasingly support economic activity. As the graph below highlights, central banks now buy a high percentage of new government debt, effectively financing this additional spending by money creation.

Today, citizens are unwitting participants in a covert policy experiment. It embraces the idea of higher government spending without the necessity of increased taxes. While modern monetary theory (MMT), the doctrine, has obvious appeal for politicians, irrespective of economic religion, the long-term consequences may prove problematic.

A state, MMT argues, finances its spending by creating money, not from taxes or borrowing. As nations cannot go bankrupt when they can print their own currency, deficits and debt don’t matter. Accordingly, governments should spend to ensure full employment, guaranteeing a job for everyone willing to work. Alternatively, though not formally part of MMT, governments can fund universal basic income (UBI) schemes, providing every individual an unconditional flat-rate payment irrespective of circumstances.

While no government or central bank overtly advocates MMT, since the 2008 global financial crisis and, more recently, the pandemic, policymakers have adopted many of its tenets by stealth. Popular one-off payments and increased welfare entitlements, which could become permanent, increasingly support economic activity. As the graph below highlights, central banks now buy a high percentage of new government debt, effectively financing this additional spending by money creation.

Sovereign Debt Issuance and Central Bank purchases. Photograph: Reserve Bank of Australia

Source: Nick Baker, Marcus Miller and Ewan Rankin (2021 September) Government Bond Markets in Advanced Economies During the Pandemic; Reserve Bank of Australia Bulletin

MMT is actually a melange of old ideas: Keynesian deficit spending; the post gold standard ability of nations to create money at will; and quantitative easing (central bank financed government spending) pioneered by Japan. However, there are several concerns about MMT.

First, the source of useful, well-compensated work is unclear. While MMT suggests taxes can be used to direct production, government influence over businesses that create jobs is limited. The impact of labour-reducing technology and competitive global supply chains is glossed over. Getting one person to dig a hole and another to fill it in creates employment, but it is of doubtful economic and social value. The woeful record of postwar centrally planned economies, where people pretended to work and the government pretended to pay them, highlights the issues.

Second, excess government spending and large deficits financed by money creation risk creating inflation. MMT argues that this is a risk only where the economy is at full employment or there is no excess capacity, and can be managed by fine-tuning intervention.

Third, MMT may weaken the currency. Roughly half of Australia’s government and significant amounts of state, bank and business debt is held by foreigners. Devaluation and loss of investor confidence in the stability of the exchange rate would affect the ability to and cost of borrowing overseas and importing goods. The expense of servicing foreign currency debt would rise.

Fourth, while available to nation states able to issue their own fiat currencies, it is unavailable to state governments, private businesses or households who are major borrowers in Australia.

Fifth, who decides the target employment rate or UBI payment level? Unemployment, inflation and output gaps are difficult to accurately measure in practice. Effects on employment incentives, workforce participation and productivity are untested. How will policymakers control the process or what would happen if MMT failed?

The theory delegates management of MMT operations to politicians, rather than unelected economic mandarins. But financially challenged elected representatives may be poorly equipped for the task. Political considerations and cronyism may influence decisions.

Sixth, there are implications for financial stability. Lower rates, the result of central bank debt purchases, and inflation fears might drive a switch to real assets, increasing the price of property and shares representing claims on underlying cashflows. It may encourage hoarding of commodities. This exacerbates inequality and increases the cost of essentials such as food, fuel and shelter. Fear of debasement of the value of paper money, in part, is behind unproductive speculation in gold and cryptocurrencies.

Seventh, MMT might undermine trust in the currency. Instead of spending the payments, citizens may question a world where governments print money and throw it out of helicopters.

Finally, Japan’s use of persistent deficits to boost short-term economic activity and incur government debt (currently more than 260% of GDP, compared with a global average of about 100%) does not prove the effectiveness of MMT. The country’s circumstances are unique and it has been mired in stagnation for three decades with its GDP largely unchanged.

MMT’s allure is the irresistible promise of freebies; full employment, unlimited higher education, healthcare and government services, state-of-the-art infrastructure, green energy and “the colonisation of Mars”. But monetary manipulation cannot change the supply of real goods and services or overcome resource constraints, otherwise prosperity and utopia would be guaranteed.

While the current game can and will continue for a time, the bill will eventually arrive. The borrowings will have to be paid for out of disposable income, higher taxes or through inflation, which reduces purchasing power, especially of the most vulnerable, and destroys savings. Other than nature’s free bounty, everything has a cost.

Source: Nick Baker, Marcus Miller and Ewan Rankin (2021 September) Government Bond Markets in Advanced Economies During the Pandemic; Reserve Bank of Australia Bulletin

MMT is actually a melange of old ideas: Keynesian deficit spending; the post gold standard ability of nations to create money at will; and quantitative easing (central bank financed government spending) pioneered by Japan. However, there are several concerns about MMT.

First, the source of useful, well-compensated work is unclear. While MMT suggests taxes can be used to direct production, government influence over businesses that create jobs is limited. The impact of labour-reducing technology and competitive global supply chains is glossed over. Getting one person to dig a hole and another to fill it in creates employment, but it is of doubtful economic and social value. The woeful record of postwar centrally planned economies, where people pretended to work and the government pretended to pay them, highlights the issues.

Second, excess government spending and large deficits financed by money creation risk creating inflation. MMT argues that this is a risk only where the economy is at full employment or there is no excess capacity, and can be managed by fine-tuning intervention.

Third, MMT may weaken the currency. Roughly half of Australia’s government and significant amounts of state, bank and business debt is held by foreigners. Devaluation and loss of investor confidence in the stability of the exchange rate would affect the ability to and cost of borrowing overseas and importing goods. The expense of servicing foreign currency debt would rise.

Fourth, while available to nation states able to issue their own fiat currencies, it is unavailable to state governments, private businesses or households who are major borrowers in Australia.

Fifth, who decides the target employment rate or UBI payment level? Unemployment, inflation and output gaps are difficult to accurately measure in practice. Effects on employment incentives, workforce participation and productivity are untested. How will policymakers control the process or what would happen if MMT failed?

The theory delegates management of MMT operations to politicians, rather than unelected economic mandarins. But financially challenged elected representatives may be poorly equipped for the task. Political considerations and cronyism may influence decisions.

Sixth, there are implications for financial stability. Lower rates, the result of central bank debt purchases, and inflation fears might drive a switch to real assets, increasing the price of property and shares representing claims on underlying cashflows. It may encourage hoarding of commodities. This exacerbates inequality and increases the cost of essentials such as food, fuel and shelter. Fear of debasement of the value of paper money, in part, is behind unproductive speculation in gold and cryptocurrencies.

Seventh, MMT might undermine trust in the currency. Instead of spending the payments, citizens may question a world where governments print money and throw it out of helicopters.

Finally, Japan’s use of persistent deficits to boost short-term economic activity and incur government debt (currently more than 260% of GDP, compared with a global average of about 100%) does not prove the effectiveness of MMT. The country’s circumstances are unique and it has been mired in stagnation for three decades with its GDP largely unchanged.

MMT’s allure is the irresistible promise of freebies; full employment, unlimited higher education, healthcare and government services, state-of-the-art infrastructure, green energy and “the colonisation of Mars”. But monetary manipulation cannot change the supply of real goods and services or overcome resource constraints, otherwise prosperity and utopia would be guaranteed.

While the current game can and will continue for a time, the bill will eventually arrive. The borrowings will have to be paid for out of disposable income, higher taxes or through inflation, which reduces purchasing power, especially of the most vulnerable, and destroys savings. Other than nature’s free bounty, everything has a cost.

No comments:

Post a Comment