'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label decisions. Show all posts

Showing posts with label decisions. Show all posts

Monday, 17 June 2024

Thursday, 8 August 2013

A Possible solution to the DRS Imbroglio

by Girish Menon

The DRS debate, definitely on the netosphere and to some extent on TV and print media, appears to be a conversation of the deaf. These warriors appear to have wrapped themselves in national colours with scorn and ridicule being the weapons used. Does this win over their opponents? I doubt it, because both groups are dominated by users of terms like 'Luddites' and '100 % foolproof' which instead of persuading the dissenter actually antagonises them. In this piece I will attempt to try to mediate this debate and attempt a possible solution to the imbroglio.

It is a principle of rhetoric that the side demanding a change from the status quo must provide the burden of proof. To that extent I will agree that the pro DRS lobby have already proven that DRS does reduce the number of umpiring errors in a cricket match. I'm sure that BCCI will admit this point. However the ICC's claim that DRS improves decisions by 93 % is in the realm of statistics and it is possible to find methodological grey areas that will challenge this number. So for purposes of this argument I'm willing to discount ICC's claim and willing to start on the premise that DRS does reduce errors by at least 70 %. The debate should actually be more concerned with the next question i.e. 'at what price does one obtain this 70% increase in decision accuracy and is it worthwhile?' This question is ignored by net warriors and media pundits alike and I wonder why?

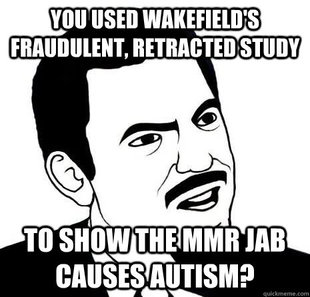

Before I proceed further I wish to remind readers of the MMR scare scandal, not many years ago, that prompted a mass scare in the UK about a triple jab vaccine and its links with autism. Some may recall Andrew Wakefield, an expert, on TV exhorting viewers to avoid the vaccine. The saga ended with Wakefield being discredited and found to have multiple undeclared conflicts of interest in propagating the scare.

-------

Also Read

Cricket and DRS - The Best is not the Enemy of the Good

------

To avoid a similar hijacking of the DRS debate I suggest that all protagonists declare their interests in the matter. I for one have no truck with any cricketing body or media organisation or a technology provider or a provider of a competing technology. Also, I'd like a reduction in umpiring errors at a price that will sustain and grow cricket all over the world.

Similarly it is incumbent on the likes of Michael Vaughan to declare their links with the purveyors of such technologies so that the cricket loving public know that their views are without any profit or personal motive.

While the reliability and validity of DRS technologies has been well debated, the monopoly profits that derive to these suppliers has been largely ignored. I suspect this is the real issue where the BCCI is at loggerheads with the others. As an outsider, I think national cricket boards have their own technology suppliers which they wish to back. They may even have an investment in them which may expose their reluctance to adopt alternative and cheaper solutions to a problem. Jagmohan Dalmiya's argument against the esoteric Duckworth-Lewis method is a case in point.

It is a truism that in the market for technologies, unfortunately, the best technology does not always win. Economics students will be aware that Dvorak keyboards have never made much headway against their QWERTY rivals and Betamax became a cropper to VHS. So just like the well ensconced Duckworth Lewis method, Hot Spot and Hawk Eye hope to become monopoly providers of technology services to the ICC. This will enable them protection from cheaper alternative service providers and will guarantee their promoters life long rents.

There is another dimension to this issue viz. 'Cost'. In 1976 the FIH (International Federation for Hockey) replaced natural turf with astroturf to improve the game. Today, while the game looks good on TV and is fast etc it provides no competition to cricket in countries playing both sports. One possible cause is the decline of the sport in India and Pakistan, the two nations who did not have the financial resources to create adequate 'astroturf based' infrastructure among the lovers of the sport. Along similar lines, the prohibitively expensive DRS technology may bankrupt the smaller cricket boards of the world. I'm sure no warrior on either side of this debate wants a reduction in the numerical diversity of cricket lovers.

I suppose as a way out of this imbroglio would be for the ICC to take ownership of the current technologies and make the technology 'open source'. Allow competitive bidding for DRS services instead of paying monopoly rents to the patent owning suppliers. I'm sure this will reduce the costs for DRS and even the BCCI will be keen to support such a venture.

Wednesday, 13 February 2013

Banker with African experience: 'Send everyone into real banking first'

A man who worked in major British banks across Africa says banks have lost touch with simple financial transactions

The Joris Luyendijk banking blog

- Anthropologist and journalist Joris Luyendijk ventures into the world of finance to find out how it works

- This is an experiment Find out more

- Are you an outsider? Meet the people who work in finance

- Are you an insider? Find out how you can help

- Follow updates here The Joris Luyendijk banking blog

- ... or on Twitter @JLbankingblog

"I grew up in Kenya and in those days the British banks were sources of stability and pride. Indeed, they were the real safety net. My mother worked at a British bank. She never paid a medical bill in her life. The bank took care of that. In many African countries it was the biggest single employer, the biggest single taxpayer … The bank was funding people to go to university … Back in those days banking was a very staid, very respectable profession.

"I went to work for one of the British banks and it was great. I would work in all of the areas of proper commercial banking, each time in a different country. So I'd spend three months in Ghana, in Kenya, Ivory Coast, Zimbabwe. And learn about asset finance (help companies buy equipment), trade finance (help companies trade), balance sheet advisory, structural financing … This would be alternated by six months stints in London to learn risk and treasury management.

"As I said, I have a quantitative background and later on I worked in commodity trading, in London. I was analysing a £2bn book on a daily basis. I'd risk analyse all the trades, which was a truly privileged position as I could see everything that went into a decision to trade or not, as well as get to see the process from trade through settlement to collateral management.

"Working on a trading floor in London was an interesting and different experience. On a trading floor you'd have the back-office doing the paperwork, the middle-office looking at risk and compliance, traders in front office. In Africa the back- and middle-office could be in one person before skill levels built up enough for separating the functions.

"More importantly, the distance between your work and its consequences on the ground was very short in Africa. But in London the actual economy was so far removed from your work it might as well not exist. Traders would come into work, turn on the computer and on their screen they find money, right there. That creates such a different mentality from what I had been doing in Africa. That was very surprising for me to see, that you could be a trader without ever having seen what banking actually is. To this day I can go to Lagos and say: I built that shopping mall. And that bridge. What actual, concrete achievement can a trader point to? I hear someone complained there was no social function to trading recently?

"Why am I different from those who went onto the trading floor? I suppose it's personality and values. In the late 90s in Africa, I saw whole families, solid middle-class people, get wiped out by a combination of bad government and IMF policies and a corrupt financial sector. That really drove home to me just how important stable financial institutions are. Over-indebted countries, an insolvent banking sector, rising unemployment as social spending falls… may seem new to southern Europe but some of us watched this movie before.

"After a few years on that commodity trading desk, I was hired by a major European bank to set up an Africa desk. I thought, great. Some time after that, they closed the desk because they had decided to concentrate on the American sub-prime market. In essence, they went from real banking to moving around and speculating with pieces of paper.

"This showed how people at the top of banks have huge influence. They govern how capital is allocated. Given all the new regulation like Basel III and the Dodd-Frank act… All that happens with new, ever more complex rules is that people get very good at getting round them. More and more, success in investment banking amounts to being able to game the rules and get capital. Trading floor politicians, I call them.

"There was a time that you could be a very successful manager at a major company, say, Boots, and after managing and growing that business for a decade, you'd become a bank chairman. That is no longer the case. Now bankers are recruited straight out of elite universities, they've never seen how you actually run a business. All the way to the top it's an insulated community.

"Still, the financial industry can turn around very fast. You change the hiring and recruiting. Send everyone into real banking first, before they can go into investment banking. So everyone starts in retail, where you actually see that old lady stumble in with her savings to make a deposit, see that local businessman struggling to run his company and pay wages. You make a number of real loans to businesses, proper commercial lending. Next you spend two years in restructuring, cleaning up after a bad loan – and you learn what happens when your bank lends money to the wrong party.

"I recollect one bank, Standard Chartered used to do this. You could not go into corporate or investment banking before working in retail commercial banking.

"The industry also needs to change the rules. Banking must become very simple again, where everyone should be able to determine the health of an institution.

"I seem to recall reading that Barclays paid more in bonuses than in taxes or dividends one year? First time in my life that I wondered about what our industry had become? I thought of Zambia, Kenya, Nigeria… All these places were Barclays and Standard Chartered were the single biggest tax payer, single biggest employer. Tells you why the industry is pivoting away from the city.

"You're asking about finance and development? Well, there are difficult choices. Tobacco, agribusiness, mining used to build more schools, clinics and houses in Africa than any amount of aid. Do we want to see corporations increase their footprint? That's a typical trade-off. Major companies are often the only real safety net for their employees and families. But, say, with tobacco, is it acceptable … Canada is having this debate now.

"Anyway, by now they've probably stopped caring for employees anyway, forced by their shareholders to concentrate exclusively on their quarterly earnings. This has been happening across the board. When companies' decisions should factor in the next 25 years, these days it's more the next 25 weeks!

"It's rarely easy in Africa. Sure, you can demand that this western bank or that stop funding, say, mining. Let me tell you, there is a lot of shady money clamouring to replace us. Drug money, money from piracy, from trading blood diamonds and other illicit resource sales, money looted by corrupt officials … The mining company prefers to deal with a western bank, as they have high professional operating standards and support. If western banks withdraw, for example because we don't want to do any business in Zimbabwe any longer, then it's the other money moving in. That shady money will have no standards regarding corruption, pollution and workers' rights. Banks can spot and be a part of stopping corruption.

"In my experience battling corruption in Africa often comes down to a gut feeling. You're taking a company public, in a so-called IPO. Among the shareholders there's this one mysterious party holding 5%. Do you demand that party release all the names behind it, not just the shell companies but the actual owners? In return for access to western investors, our banks could if they wanted to.

"Africa desperately needs so-called 'deeper capital markets'. If more local people make local deposits, and they invest those in their own country, there are none of the currency or inflation risks you have with foreign investors. But since there are so few solid local places for the African middle class to invest in, most of it goes into real estate which then becomes massively overheated.

"Securitisation, currency and interest swaps ... These instruments, if applied correctly, could do a massive good in Africa. Africa desperately needs 10, 20, 30 years' money, ie long-term investments. To build roads, railroads, bridges, airports, irrigation projects.

"The City could do this. Go back to real banking."

Subscribe to:

Comments (Atom)