The British steel industry is in a perilous position right now.

Tata Steel is looking to pull out of the UK; they own most of Britain's steelworks.

It's led to mutterings of government intervention, after all they put up the cash to bail out the banks in 2008.

Why shouldn't they do the same for the steel industry?

The thing is, they're totally different situations.

Some of the banks were unable to balance their books with the Bank of England, and some ATMs ran out cash.

The government stepped in and first saved Northern Rock.

Then it was Bradford and Bingley, closely followed by taking stakes in RBS, Lloyds TSB, HBOS.

The reasons behind the global financial crisis were complex, countless films and documentaries have been made in an attempt to explain why it happened.

Everyone involved in the bailout assumed the banks would recover, and they did (even if it feels like it took forever).

The economy can survive without British steel

The UK is a global centre for banking. Without banks there is nobody to lend money to people to start businesses, or buy homes.

A lot depends on our banks, not just in the UK but around the world.

That's clearly not the same for steel.

One of the problems is the UK industry has been shrinking for a long time. Employment has fallen from around 50,000 in 1990 to under 20,000 today.

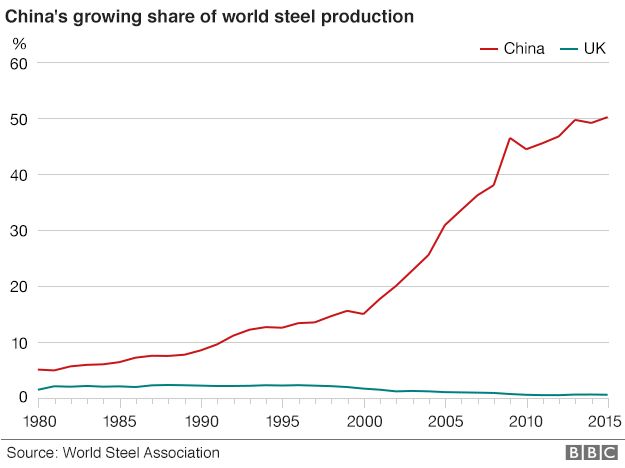

Other countries, such as China, make steel, and they do it for cheaper than we do. The people in the steel industry and the towns like Port Talbot depend on the steel industry, but the rest of the economy will cope without it.

Globally we are a major player in the financial market but our steel output is actually fairly insignificant. We currently put out around 12 million tonnes a year; China's output is 822 million tonnes - although the British industry does tend to specialise in high quality, high value steel.

Does it make financial sense?

The government will be weighing up the financial cost of making thousands of people unemployed.

One think-tank, the Institute for Public Policy Research, estimates that as many as 40,000 jobs depend on the sector.

During the financial crisis UK unemployment peaked at 2.7 million - a little over 8% of the total workforce. If we hadn't bailed out the banks it's likely that figure would have been even higher, costing the government huge amounts of money in benefits and lost tax revenue.

In the UK we have a workforce of around 31 million. 40,000 is just 0.12% of that workforce. When Port Talbot steelworks is thought to be losing around £1 million a day the government may find that number a little more palatable.

The government can't legally buy the plants

The Prime Minister himself, David Cameron has indicated that they're unwilling to buy the plants: "I don't believe nationalisation is the right answer".

Whether they are willing or not might be irrelevant though, because the UK is a member of the European Union.

By law EU member states cannot rescue failing companies in the steel sector.

These are rules that were agreed on by every member of the EU, including the UK.

Exceptions to those rules on bailing out companies exist, but governments have to prove their economy is in danger - that's why they allowed the banks to be rescued.

But the EU has decided that allowing failing steel companies to go bust is good for the union as a whole.

But...

Unlikely as it may be the EU does still have the final say so it's not entirely impossible for the government to step in.

The decisions on state aid are often highly political though, but ultimately the Commission can decide to approve it.

But if any of the 28 member states don't agree they can challenge the decision - and that can take lots more time.

No comments:

Post a Comment