As these new crisis bailouts for fossil fuels show, it’s those who are least deserving who get the most government protection

‘Oil companies have already been granted ‘ministerial buddies’ to ‘improve access to government’ – as if they didn’t have enough already.’ Illustration: Andrzej Krauze

Those of us who predicted, during the first years of this century, an imminent peak in global oil supplies could not have been more wrong. People like the energy consultant Daniel Yergin, with whom I disputed the topic, appear to have been right: growth, he said, would continue for many years, unless governments intervened.

Those of us who predicted, during the first years of this century, an imminent peak in global oil supplies could not have been more wrong. People like the energy consultant Daniel Yergin, with whom I disputed the topic, appear to have been right: growth, he said, would continue for many years, unless governments intervened.

Oil appeared to peak in the United States in 1970, after which production fell for 40 years. That, we assumed, was the end of the story. But through fracking and horizontal drilling, production last year returned to the level it reached in 1969. Twelve years ago, the Texas oil tycoon T Boone Pickens announced that “never again will we pump more than 82 million barrels”. By the end of 2015, daily world production reached 97m .

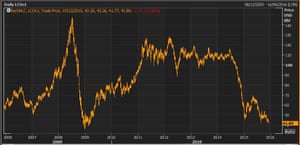

Instead of a collapse in the supply of oil, we confront the opposite crisis: we’re drowning in the stuff. The reasons for the price crash – an astonishing slide from $115 a barrel to less than $30 over the past 20 months – are complex: among them are weaker demand in China and a strong dollar. But an analysis by the World Bank finds that changes in supply have been a much greater factor than changes in demand. Oil production has almost doubled in Iraq, as well as in the US. Saudi Arabia has opened its taps, to try to destroy the competition and sustain its market share – a strategy that some peak oil advocates once argued was impossible.

‘Last week David Cameron flew to Aberdeen, where he announced another £250m of funding for, er, free enterprise, much of which will be used to prop up oil and gas.’ Photograph: Andrew Milligan/AFP/Getty Images

The outcomes are mixed. Cheaper oil means that more will be burned, accelerating climate breakdown. But it also means less investment in future production. Already, $380 billion that was to have been ploughed into oil and gas fields has been delayed. The first places to be spared are those in which extraction is most difficult or hazardous. Fragile ecosystems in the Arctic, in rainforests, in remote and stormy seas, have been granted a stay of execution.

BP reported a massive loss today, partly because of low prices. A falling oil price drags down the price of gas, exposing coal-mining companies to the risk of bankruptcy: good riddance to them. But some renewables firms are being tanked by the same forces; they are losing their subsidies just as gas prices crash. One day they will compete unaided, but not yet.

To cheer or lament these vicissitudes is pointless. They are chance events that counteract each other, and will at some point be reversed. The oil age, which threatens the conditions sustaining life on Earth, will come to an end through political, not economic, change. But the politics, for now, are against us.

Already, according to the International Monetary Fund, more money is spent, directly and indirectly, on subsidising fossil fuels than on funding health services. The G20 countries alone spend over three times as much public money on oil, gas and coal than the whole world does on renewable energy. In 2014, subsidies for fossil fuel production in the UK reached £5bn. Enough? Oh no. While essential public services are being massacred through want of funds, last year the government announced a further £1.3bn in tax breaks for oil companies in the North Sea. Much of this money went to companies based overseas. They must think we’re mad.

Last week David Cameron flew to Aberdeen, where he announced another £250m of funding for, er, free enterprise, much (though not all) of which will be used to prop up oil and gas. A further £20m of public money will be spent on seismic testing. Expect more whale strandings, and ask yourself why the industry that threatens our prosperity shouldn’t cover its own bloody costs.

The energy secretary, Amber Rudd, says she stands “100% behind” this “fantastic industry”. She will “build a bridge to the future for UK oil and gas”. Had she been born 300 years ago, I expect she would have said the same about the slave trade. In a few years’ time her observations will look about as pertinent and about as ethical.

Oil companies have already been granted “ministerial buddies” to “improve access to government” – as if they didn’t have enough already. Now they get an“oil and gas ambassador”, and a new ministerial group, to “reiterate the UK government’s commitment to supporting the oil and gas industry”. A leaked letter shows that Rudd and other ministers want to silence local people by transferring the power to decide whether fracking happens from elected councils to an unelected commission. Let’s sack the electorate and appoint a new one.

Compare all this to the government’s treatment of renewables. Local people have been given special new powers to stop onshore windfarms being built. To the renewables companies Rudd says this: “We need to work towards a market where success is driven by your ability to compete in a market, not by your ability to lobby government.” Strangely, the same rules do not apply to the oil companies. Your friends get protection. The free market is reserved for enemies.

Yes, I do mean enemies. An energy transition threatens the kind of people who attend the Conservative party’s fundraising balls. It corrodes the income of old schoolfriends and weekend guests. For all the talk of enterprise, old money still nurtures its lively hatred of new money, and those who control the public purse use it to protect the incumbents from the parvenus. As they did for the bankers, our political leaders ensure that everyone must pay the costs imposed by the fossil fuel companies – except the fossil fuel companies.

So they lock us into the 20th century, into industrial decline and air pollution, stranded assets and – through climate change – systemic collapse. Governments of this country cannot resist the future forever. Eventually they will succumb to the inexorable logic, and recognise that most of the vast accretions of fossil plant life in the Earth’s crust must be left where they are. And those massive expenditures of public money will prove to be worthless.

Crises expose corruption – that is one of the basic lessons of politics. The oil price crisis finds politicians with their free-market trousers round their ankles. When your friends are in trouble, the rigours imposed religiously on the poor and public services suddenly turn out to be negotiable. Throw money at them, trash their competitors, rig the outcome: those who deserve the least receive the most.

Drivers have saved a fortune thanks to low petrol prices

Drivers have saved a fortune thanks to low petrol prices