Long Run Aggregate Supply (LRAS):

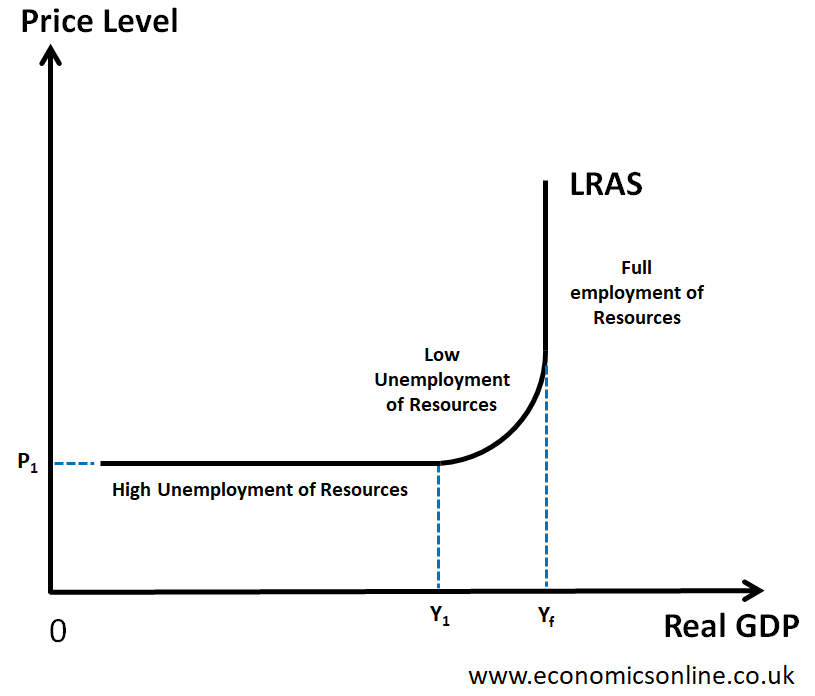

The Long Run Aggregate Supply (LRAS) represents the total output of goods and services that all firms in an economy are willing and able to produce in the long run when all input prices, including wages, have fully adjusted to changes in the overall price level. It is important to note that the LRAS curve is vertical at the full employment level of output.

Differences between Keynesian and Neo-Classical Views on LRAS:

Keynesian View: Keynesian economists argue that the LRAS curve is not necessarily vertical at the full employment level of output. They believe that the economy can have persistent unemployment or output gaps in the long run due to factors like inflexible factor markets, which prevent wages from adjusting quickly to changes in demand and prices.

Neo-Classical View: Neo-Classical economists, on the other hand, contend that the LRAS curve is vertical at the full employment level of output. They believe that the economy will tend to reach full employment in the long run as all input prices, including wages, are flexible and can fully adjust to changes in demand and supply.

Neo-Classical View of Long Run Equilibrium:

The Neo-Classical view describes the process through which an economy adjusts to its long-run equilibrium as follows:

Flexible Prices and Wages: In the long run, all prices and wages are assumed to be flexible and can adjust freely to changes in demand and supply. This implies that any deviations from the full employment level of output will be temporary, as prices and wages will adjust to restore equilibrium.

Self-Correcting Mechanism: If there is an increase in aggregate demand (AD) that pushes the economy beyond the full employment level of output, firms will experience higher demand for their products. They will respond by increasing prices and production, but with fully flexible wages, labor costs will rise in line with prices. As a result, production costs increase, and firms will eventually cut back on hiring and production, moving the economy back towards full employment.

Equilibrium at Potential Output: In the Neo-Classical view, the economy will tend to reach its potential output or full employment level in the long run due to the flexibility of prices and wages. This results in a vertical LRAS curve at the full employment level of output.

Keynesian Disagreement with the Neo-Classical View:

Keynesian economists disagree with the Neo-Classical view of long-run adjustment due to factors such as:

Inflexible Factor Markets: Keynesians argue that in the short run, factor markets, especially the labor market, may not be flexible enough to adjust quickly to changes in demand and prices. Wages may be "sticky," meaning they do not adjust downward in response to decreased demand, leading to persistent unemployment and deviations from full employment in the long run.

Aggregate Demand Management: Keynesian economists advocate for active government intervention through fiscal and monetary policies to manage aggregate demand and stabilize the economy. They believe that relying solely on the self-correcting mechanism of flexible prices and wages may not be sufficient to achieve full employment in the short run.

Assumptions of Flexible Product and Factor Markets:

The Neo-Classical analysis of LRAS is based on the following assumptions:

Flexible Prices: All prices, including those of goods and services, can freely adjust to changes in demand and supply conditions.

Flexible Wages: Wages can adjust promptly to changes in labor market conditions, ensuring that labor costs align with productivity and prices.

Rapid Market Clearing: Markets clear quickly, meaning that any imbalances between demand and supply are corrected swiftly through price and wage adjustments.

Understanding the differences between Keynesian and Neo-Classical views on the LRAS curve and the assumptions underlying each analysis is essential for comprehending the different approaches to macroeconomic policy and the potential implications for economic stability and full employment.