THERE IS NOTHING dark, still less satanic, about the Revolution Mill in Greensboro, North Carolina. The tall yellow-brick chimney stack, with red bricks spelling “Revolution” down its length, was built a few years after the mill was established in 1900. It was a booming time for local enterprise. America’s cotton industry was moving south from New England to take advantage of lower wages. The number of mills in the South more than doubled between 1890 and 1900, to 542. By 1938 Revolution Mill was the world’s largest factory exclusively making flannel, producing 50m yards of cloth a year.

The main mill building still has the springy hardwood floors and original wooden joists installed in its heyday, but no clacking of looms has been heard here for over three decades. The mill ceased production in 1982, an early warning of another revolution on a global scale. The textile industry was starting a fresh migration in search of cheaper labour, this time in Latin America and Asia. Revolution Mill is a monument to an industry that lost out to globalisation.

In nearby Thomasville, there is another landmark to past industrial glory: a 30-foot (9-metre) replica of an upholstered chair. The Big Chair was erected in 1950 to mark the town’s prowess in furniture-making, in which North Carolina was once America’s leading state. But the success did not last. “In the 2000s half of Thomasville went to China,” says T.J. Stout, boss of Carsons Hospitality, a local furniture-maker. Local makers of cabinets, dressers and the like lost sales to Asia, where labour-intensive production was cheaper.

The state is now finding new ways to do well. An hour’s drive east from Greensboro is Durham, a city that is bursting with new firms. One is Bright View Technologies, with a modern headquarters on the city’s outskirts, which makes film and reflectors to vary the pattern and diffusion of LED lights. The Liggett and Myers building in the city centre was once the home of the Chesterfield cigarette. The handsome building is now filling up with newer businesses, says Ted Conner of the Durham Chamber of Commerce. Duke University, the centre of much of the city’s innovation, is taking some of the space for labs.

North Carolina exemplifies both the promise and the casualties of today’s open economy. Yet even thriving local businesses there grumble that America gets the raw end of trade deals, and that foreign rivals benefit from unfair subsidies and lax regulation. In places that have found it harder to adapt to changing times, the rumblings tend to be louder. Across the Western world there is growing unease about globalisation and the lopsided, unstable sort of capitalism it is believed to have wrought.

A backlash against freer trade is reshaping politics. Donald Trump has clinched an unlikely nomination as the Republican Party’s candidate in November’s presidential elections with the support of blue-collar men in America’s South and its rustbelt. These are places that lost lots of manufacturing jobs in the decade after 2001, when America was hit by a surge of imports from China (which Mr Trump says he will keep out with punitive tariffs). Free trade now causes so much hostility that Hillary Clinton, the Democratic Party’s presidential candidate, was forced to disown the Trans-Pacific Partnership (TPP), a trade deal with Asia that she herself helped to negotiate. Talks on a new trade deal with the European Union, the Transatlantic Trade and Investment Partnership (TTIP), have stalled. Senior politicians in Germany and France have turned against it in response to popular opposition to the pact, which is meant to lower investment and regulatory barriers between Europe and America.

Keep-out signs

The commitment to free movement of people within the EU has also come under strain. In June Britain, one of Europe’s stronger economies, voted in a referendum to leave the EU after 43 years as a member. Support for Brexit was strong in the north of England and Wales, where much of Britain’s manufacturing used to be; but it was firmest in places that had seen big increases in migrant populations in recent years. Since Britain’s vote to leave, anti-establishment parties in France, the Netherlands, Germany, Italy and Austria have called for referendums on EU membership in their countries too. Such parties favour closed borders, caps on migration and barriers to trade. They are gaining in popularity and now hold sway in governments in eight EU countries. Mr Trump, for his part, has promised to build a wall along the border with Mexico to keep out immigrants.

There is growing disquiet, too, about the unfettered movement of capital. More of the value created by companies is intangible, and businesses that rely on selling ideas find it easier to set up shop where taxes are low. America has clamped down on so-called tax inversions, in which a big company moves to a low-tax country after agreeing to be bought by a smaller firm based there. Europeans grumble that American firms engage in too many clever tricks to avoid tax. In August the European Commission told Ireland to recoup up to €13 billion ($14.5 billion) in unpaid taxes from Apple, ruling that the company’s low tax bill was a source of unfair competition.

Free movement of debt capital has meant that trouble in one part of the world (say, America’s subprime crisis) quickly spreads to other parts. The fickleness of capital flows is one reason why the EU’s most ambitious cross-border initiative, the euro, which has joined 19 of its 28 members in a currency union, is in trouble. In the euro’s early years, countries such as Greece, Italy, Ireland, Portugal and Spain enjoyed ample credit and low borrowing costs, thanks to floods of private short-term capital from other EU countries. When crisis struck, that credit dried up and had to be replaced with massive official loans, from the ECB and from bail-out funds. The conditions attached to such support have caused relations between creditor countries such as Germany and debtors such as Greece to sour.

Some claim that the growing discontent in the rich world is not really about economics. After all, Britain and America, at least, have enjoyed reasonable GDP growth recently, and unemployment in both countries has dropped to around 5%. Instead, the argument goes, the revolt against economic openness reflects deeper anxieties about lost relative status. Some arise from the emergence of China as a global power; others are rooted within individual societies. For example, in parts of Europe opposition to migrants was prompted by the Syrian refugee crisis. It stems less from worries about the effect of immigration on wages or jobs than from a perceived threat to social cohesion.

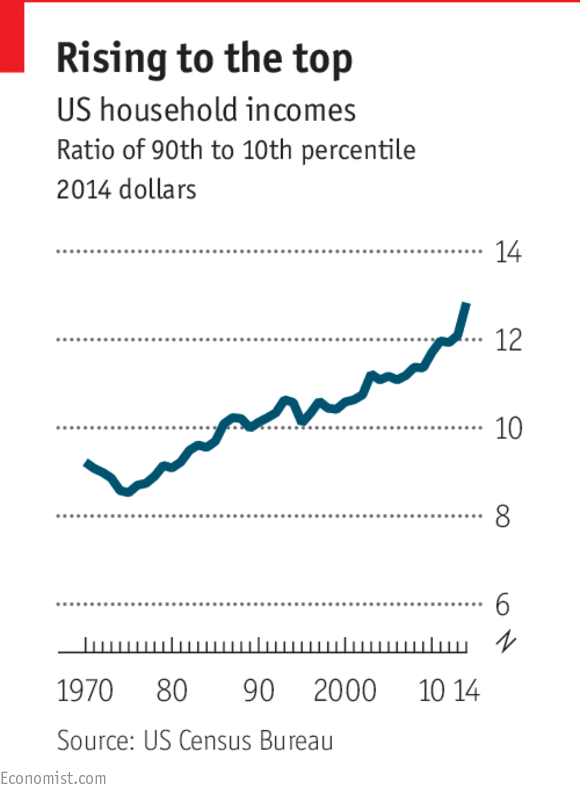

But there is a material basis for discontent nevertheless, because a sluggish economic recovery has bypassed large groups of people. In America one in six working-age men without a college degree is not part of the workforce, according to an analysis by the Council of Economic Advisers, a White House think-tank. In Britain, though more people than ever are in work, wage rises have not kept up with inflation. Only in London and its hinterland in the south-east has real income per person risen above its level before the 2007-08 financial crisis. Most other rich countries are in the same boat. A report by the McKinsey Global Institute, a think-tank, found that the real incomes of two-thirds of households in 25 advanced economies were flat or fell between 2005 and 2014, compared with 2% in the previous decade. The few gains in a sluggish economy have gone to a salaried gentry.

This has fed a widespread sense that an open economy is good for a small elite but does nothing for the broad mass of people. Even academics and policymakers who used to welcome openness unreservedly are having second thoughts. They had always understood that free trade creates losers as well as winners, but thought that the disruption was transitory and the gains were big enough to compensate those who lose out. However, a body of new research suggests that China’s integration into global trade caused more lasting damage than expected to some rich-world workers. Those displaced by a surge in imports from China were concentrated in pockets of distress where alternative jobs were hard to come by.

It is not easy to establish a direct link between openness and wage inequality, but recent studies suggest that trade plays a bigger role than previously thought. Large-scale migration is increasingly understood to conflict with the welfare policy needed to shield workers from the disruptions of trade and technology.

The consensus in favour of unfettered capital mobility began to weaken after the East Asian crises of 1997-98. As the scale of capital flows grew, the doubts increased. A recent article by economists at the IMF entitled “Neoliberalism: Oversold?” argued that in certain cases the costs to economies of opening up to capital flows exceed the benefits.

Multiple hits

This special report will ask how far globalisation, defined as the freer flow of trade, people and capital around the world, is responsible for the world’s economic ills and whether it is still, on balance, a good thing. A true reckoning is trickier than it might appear, and not just because the main elements of economic openness have different repercussions. Several other big upheavals have hit the world economy in recent decades, and the effects are hard to disentangle.

First, jobs and pay have been greatly affected by technological change. Much of the increase in wage inequality in rich countries stems from new technologies that make college-educated workers more valuable. At the same time companies’ profitability has increasingly diverged. Online platforms such as Amazon, Google and Uber that act as matchmakers between consumers and producers or advertisers rely on network effects: the more users they have, the more useful they become. The firms that come to dominate such markets make spectacular returns compared with the also-rans. That has sometimes produced windfalls at the very top of the income distribution. At the same time the rapid decline in the cost of automation has left the low- and mid-skilled at risk of losing their jobs. All these changes have been amplified by globalisation, but would have been highly disruptive in any event.

The second source of turmoil was the financial crisis and the long, slow recovery that typically follows banking blow-ups. The credit boom before the crisis had helped to mask the problem of income inequality by boosting the price of homes and increasing the spending power of the low-paid. The subsequent bust destroyed both jobs and wealth, but the college-educated bounced back more quickly than others. The free flow of debt capital played a role in the build-up to the crisis, but much of the blame for it lies with lax bank regulation. Banking busts happened long before globalisation.

Superimposed on all this was a unique event: the rapid emergence of China as an economic power. Export-led growth has transformed China from a poor to a middle-income country, taking hundreds of millions of people out of poverty. This achievement is probably unrepeatable. As the price of capital goods continues to fall sharply, places with large pools of cheap labour, such as India or Africa, will find it harder to break into global supply chains, as China did so speedily and successfully.

This special report will disentangle these myriad influences to assess the impact of the free movement of goods, capital and people. It will conclude that some of the concerns about economic openness are valid. The strains inflicted by a more integrated global economy were underestimated, and too little effort went into helping those who lost out. But much of the criticism of openness is misguided, underplaying its benefits and blaming it for problems that have other causes. Rolling it back would leave everyone worse off.

No comments:

Post a Comment