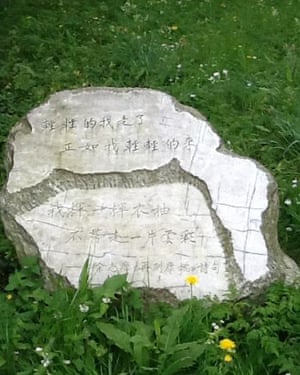

On the edge of Scholar’s Piece, the strip of farmland just behind King’s College, lies a granite stone which has become arguably Cambridge’s most coveted tourist attraction.

For the many students who amble past it every day, it’s easily missed; placed rather innocuously next to the bridge that joins Scholar’s Piece to the rest of the college. But for the thousands of Chinese tourists who travel to Cambridge every year, it is this, rather than the city’s grand 15th-century chapel, meticulously manicured lawns or historical statues, that they’ve come to see.

Carved into the stone are the first and last lines of a poem that has gone down in Chinese folklore. Titled Farewell to Cambridge, it was written in 1928 by Xu Zhimo, a 31-year-old poet and writer who was revisiting King’s after studying there in the early 20s.

Zhimo died three years later in a plane crash, but he would go down as a cult figure in modern Chinese history, immortalised through his premature and tragic end, illicit love affairs and success in introducing western forms into Chinese literature.

The ‘Farewell to Cambridge’ stone. Photograph:Historyworks/Flickr

And while Zhimo spent most of his life in China, Farewell to Cambridge has become his legacy. It is now part of China’s national curriculum, taught to all schoolchildren as an example of the modern poetry movement in the early 20th century.

“The poem is something we’ve all heard of,” says Pei-Ling Lau from Beijing, who is visiting King’s and seeing Zhimo’s stone for the first time. She studied his poem as a compulsory exam text when she was 15: “It’s been adapted into many pop songs too. It paints such a lovely picture of punting in Cambridge, but it wasn’t until I came here that I realised how beautifully it describes the river. It’s special for Chinese people as the life and story of Xu Zhimo is well known, and this was his city. We want to come here and experience that.”

And come they do. Numbers of Chinese tourists visiting the UK have soared in recent years from 115,000 in 2009 to 336,000 in 2014, following the relaxation ofvisa restrictions to Chinese nationals in 2013. With further amendments in the pipeline to boost this lucrative tourist trade, these figures are only set to increase.

But the Chinese are not just interested in Cambridge as a holiday location; they also view it as a key region for property investment. Cambridge’s house prices are soaring, with new figures revealing they have increased by 50% since 2010, driven in large part by the ongoing biotech boom in science parks around the city. And wealthy Chinese appear keen to cash in: the estate agents Savills estimate that in the past year, one in 20 new-build homes across the city and surrounding villages have been bought by Chinese owners.

And while Zhimo spent most of his life in China, Farewell to Cambridge has become his legacy. It is now part of China’s national curriculum, taught to all schoolchildren as an example of the modern poetry movement in the early 20th century.

“The poem is something we’ve all heard of,” says Pei-Ling Lau from Beijing, who is visiting King’s and seeing Zhimo’s stone for the first time. She studied his poem as a compulsory exam text when she was 15: “It’s been adapted into many pop songs too. It paints such a lovely picture of punting in Cambridge, but it wasn’t until I came here that I realised how beautifully it describes the river. It’s special for Chinese people as the life and story of Xu Zhimo is well known, and this was his city. We want to come here and experience that.”

And come they do. Numbers of Chinese tourists visiting the UK have soared in recent years from 115,000 in 2009 to 336,000 in 2014, following the relaxation ofvisa restrictions to Chinese nationals in 2013. With further amendments in the pipeline to boost this lucrative tourist trade, these figures are only set to increase.

But the Chinese are not just interested in Cambridge as a holiday location; they also view it as a key region for property investment. Cambridge’s house prices are soaring, with new figures revealing they have increased by 50% since 2010, driven in large part by the ongoing biotech boom in science parks around the city. And wealthy Chinese appear keen to cash in: the estate agents Savills estimate that in the past year, one in 20 new-build homes across the city and surrounding villages have been bought by Chinese owners.

Looking to invest? … Tourists enjoy a punt tour along the river. Photograph: Chris Radburn/PA

“There is undoubtedly interest in Cambridge as a place to live from Chinese buyers,” says Ed Meyer, head of residential at Savills Cambridge. “But as well as an investment, the major driver for this is education. The majority of Chinese buyers are coming here with younger children, to try and integrate them into Cambridge society and the schools round here, with the view that they will hopefully go to the university in future. And Xu Zhimo’s legacy definitely seems to be ingrained in their psyche. At some point they always explain, ‘Oh, and we know about Cambridge because we learnt about it in the poem at school.’”

Cambridge’s academic reputation is instilled into virtually all Chinese children at a young age. While domestic universities such as Peking and Tsinghua are respected, those who can afford it are increasingly opting to put their money into sending their children abroad for schooling, with the hope of gaining them an edge in a hyper-competitive job market when they return home. Such are the employability benefits associated with a Cambridge education that increasing numbers are sending their children to the various “feeder schools” around the city to boost their chances of a successful application.

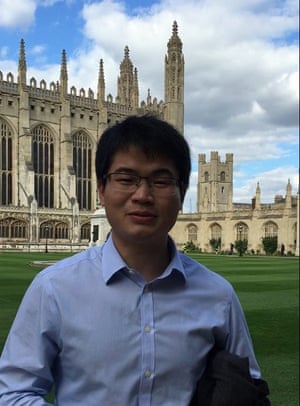

Cambridge PhD student Zongyin Yang. Photograph: David Cox

“The reputations of the great universities are passed down from parents to children,” says Zongyin Yang, a PhD student at Cambridge who grew up in Wenzhou. “There’s a respect and curiosity which is instilled at a young age. It’s why Chinese families bring their toddlers to see the campuses. Most children grow up hearing about these ‘dream places’.”

According to China’s Ministry of Education, 459,800 students enrolled at overseas universities in 2014, an increase of 11.1% on the previous year. Of these, 423,000 were entirely funded by their families. And at the top of their list is Cambridge: Chinese students make up the largest ethnic population at the university, with a total of around 900 enrolled for the current academic year.

“A Cambridge degree is definitely perceived to be superior in the recruitment process due to the strength of the brand name,” says Zheng Yao, who studied at Cambridge before returning to Beijing. “There’s a widespread perception that your earning potential in China will be much greater – but the reality is quite different. Pay for new graduates is in fact very limited, no matter where you’ve studied.”

Volatile market

Buying property in Cambridge also makes financial sense for Chinese families looking to invest their money outside of the increasingly volatile market back home. “Chinese parents would rather their children pay rent to them than to another landowner, keeping the money in the family,” explains Keri Wong, a Cambridge student from Guangzhou. “And while the Chinese middle classes have a lot of savings, the market at home is regarded as really unstable. UK property is an attractive divestment. Plus property investment presents the option of being able to eventually gain UK residency status.”

We don’t want our housing market going through a boom-or-bust cycle based on the Chinese economyDuncan Stott

But not everyone is welcoming the new residents. “At some point the world economy will shift and overseas investors will decide that they’re better placing their money elsewhere,” says Duncan Stott, of the local campaign groupPricedOut. “But we don’t want our housing market going through a boom-or-bust cycle based on the Chinese economy. We need a more stable housing market so prices aren’t going to be going up faster than people can earn, before plunging and dropping people into negative equity.”

Stott and many others are especially unhappy about the trend of overseas buyers purchasing homes entirely for investment purposes and leaving them empty for several years, before selling them at a profit. While council taxes are raised on empty properties, the inflation in their price means this does not prove a deterrent. Kevin Price, Cambridge’s executive councillor for housing, says there are currently 240 homes in the city sitting empty.

Is it fair to blame this on the interest from China in particular? “Houses are a safe, strong investment which appeals to people both overseas and those already living here,” says David Bentley, of estate agent Bidwells. “Cambridge is a global brand, so it’s not just the Chinese looking to invest here. We’ve seen a big influx of Russian money too. And the Chinese are typically buying not just as an investment, but for their children, sometimes even before they’ve reached school age.”

“The reputations of the great universities are passed down from parents to children,” says Zongyin Yang, a PhD student at Cambridge who grew up in Wenzhou. “There’s a respect and curiosity which is instilled at a young age. It’s why Chinese families bring their toddlers to see the campuses. Most children grow up hearing about these ‘dream places’.”

According to China’s Ministry of Education, 459,800 students enrolled at overseas universities in 2014, an increase of 11.1% on the previous year. Of these, 423,000 were entirely funded by their families. And at the top of their list is Cambridge: Chinese students make up the largest ethnic population at the university, with a total of around 900 enrolled for the current academic year.

“A Cambridge degree is definitely perceived to be superior in the recruitment process due to the strength of the brand name,” says Zheng Yao, who studied at Cambridge before returning to Beijing. “There’s a widespread perception that your earning potential in China will be much greater – but the reality is quite different. Pay for new graduates is in fact very limited, no matter where you’ve studied.”

Volatile market

Buying property in Cambridge also makes financial sense for Chinese families looking to invest their money outside of the increasingly volatile market back home. “Chinese parents would rather their children pay rent to them than to another landowner, keeping the money in the family,” explains Keri Wong, a Cambridge student from Guangzhou. “And while the Chinese middle classes have a lot of savings, the market at home is regarded as really unstable. UK property is an attractive divestment. Plus property investment presents the option of being able to eventually gain UK residency status.”

We don’t want our housing market going through a boom-or-bust cycle based on the Chinese economyDuncan Stott

But not everyone is welcoming the new residents. “At some point the world economy will shift and overseas investors will decide that they’re better placing their money elsewhere,” says Duncan Stott, of the local campaign groupPricedOut. “But we don’t want our housing market going through a boom-or-bust cycle based on the Chinese economy. We need a more stable housing market so prices aren’t going to be going up faster than people can earn, before plunging and dropping people into negative equity.”

Stott and many others are especially unhappy about the trend of overseas buyers purchasing homes entirely for investment purposes and leaving them empty for several years, before selling them at a profit. While council taxes are raised on empty properties, the inflation in their price means this does not prove a deterrent. Kevin Price, Cambridge’s executive councillor for housing, says there are currently 240 homes in the city sitting empty.

Is it fair to blame this on the interest from China in particular? “Houses are a safe, strong investment which appeals to people both overseas and those already living here,” says David Bentley, of estate agent Bidwells. “Cambridge is a global brand, so it’s not just the Chinese looking to invest here. We’ve seen a big influx of Russian money too. And the Chinese are typically buying not just as an investment, but for their children, sometimes even before they’ve reached school age.”

The link between Cambridge and China goes back to the 19th century, when the university reformed itself based on the Chinese imperial examination system, before launching the UK’s first professorship of Chinese in 1888.

Two centuries on, the link only looks set to strengthen. With the Home Office launching a new visa system that allowsChinese tourists to make multiple visits over a two-year period, and school and university applications rising every year, the distinct Chinese presence in the city is surely only going to grow.

And for local residents already worried that Cambridge’s housing supply isn’t keeping up with demand, the potential impact of such interest remains a concern – even if, as Bentley points out, the percentage of purchases from overseas buyers is still relatively small.

“It’s a difficult problem to do anything about, but having such strong interest from Chinese buyers just puts even more pressure on an already strained housing market,” Stott adds. “It simply makes it more and more difficult for people who already live here to be able to own their own homes.”

Two centuries on, the link only looks set to strengthen. With the Home Office launching a new visa system that allowsChinese tourists to make multiple visits over a two-year period, and school and university applications rising every year, the distinct Chinese presence in the city is surely only going to grow.

And for local residents already worried that Cambridge’s housing supply isn’t keeping up with demand, the potential impact of such interest remains a concern – even if, as Bentley points out, the percentage of purchases from overseas buyers is still relatively small.

“It’s a difficult problem to do anything about, but having such strong interest from Chinese buyers just puts even more pressure on an already strained housing market,” Stott adds. “It simply makes it more and more difficult for people who already live here to be able to own their own homes.”

No comments:

Post a Comment