'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Showing posts with label pyramid. Show all posts

Showing posts with label pyramid. Show all posts

Wednesday, 31 July 2024

Wednesday, 24 July 2024

Sunday, 28 April 2013

Chit Funds, Ponzi Schemes -Different schemes built on different structures

Anguished at the collapse of the unregistered Saradha Group, collection agents and depositors took to Kolkata's streets in protest. Photo: Ashoke Chakrabarty

Even as thousands come to terms with the loss of life savings in the West Bengal “chit funds,” it is interesting to find politicians promising new stern laws against such funds. Absence of laws is the least of the reasons for such schemes flourishing in the State. We are not short of such laws — in fact, we have plenty of laws that prohibit such schemes and provide for the sternest penalties for the perpetrators.

The current scam is an almost identical rerun of one from 25 years ago and the machinery has allowed the same thing to happen. But if a Rs.22,000 crore scheme questions the very institutions that define the system — be it the Supreme Court or SEBI, and the implementation of their orders — there is little surprise that the only succour we can pretend to find is in law-making.

The West Bengal ‘chit funds’ are not chit funds at all, since these have a different structure. Chit funds are mutual credit groups where money circulates among the group members, and the monthly contributions of the chit members are received in rotation by one of the members who bids for it — much like a ‘kitty’. Chit funds are perfectly legal (if they are registered under the Chit Funds Act 1982).

The several names that keep popping up in West Bengal are Collective Investment Schemes or Public Deposit Schemes, which on the face of it do not come under any law. They are structured so as to be neither a ‘public deposit’ nor a ‘collective investment scheme.’ However, this restructuring is purely superficial and takes advantage of apparent legal loopholes. Even the most basic regulation should detect this.

The evolution of regulatory structure in India is a rare case of human learning and we have burnt our fingers every time. Every scam brought in a law; the law is the edifice built on scams and not on intuition.

Money circulation schemes were banned by law in 1978, after Sanchayita Investments went down with money pooled from a few lakh investors in West Bengal. Soon after, chit funds became a hot political issue, leading to a chit fund law in 1982.

So how do scamsters still end up raising several thousand crores? Obviously, so much money is neither raised overnight, nor silently, as there is a massive machinery of agents who do it from the very bottom of the population pyramid. Each scamster innovates a device to sell to unsuspecting depositors — ranging from debentures, preference shares and land deals to advance payment for goods.

The mechanism of these schemes is so simplistic that it is hard not to see that these schemes must go bust.

The promoters who float this fund sign on agents by selling either shares or a stake in a real estate investment fund. They are to get a commission for signing on new people. Suppose an agent signs on 4 people, when each of them signs on another 4, the original agent receives commission for 16 people.

Thus, people at the top make money rapidly, often becoming rich overnight. The people lower down the pyramid see these examples and it is this which makes them greedy, attracting them to sign on as depositors hoping to make easy money.

No matter what the device used, the common thread in these schemes is that the flow of new ‘depositors’ must keep coming in — the only source from which existing depositors can continue to be paid is by inflows from new depositors. Money is initially raised at hefty interest rates, and with attractive periodic prizes, gifts, gala parties, and so on. The agents are given hefty commissions, because the design relies on a highly incentivised structure of brokers or agents.

The cost of interest, plus the agency commissions, the luxurious spending on so-called depositor prizes and the lavish remuneration of the promoters builds up a huge working cost. The company must then make profits at over 25 per cent, a rate which no business can sustain. It is not that these promoters are blue-eyed investors, and they end up sinking funds in illiquid properties, resorts or hotels and often end up making losses.

More often than not, they have dubious intentions and the money from the fund is siphoned off into personal accounts. This is what Ponzi schemes are all about.

The massive money raised surely shows somewhere on the balance sheet of the company, which is filed regularly with the Ministry of Corporate Affairs (MCA). Surprisingly, it is the MCA which is the least proactive in the entire process of bringing the perpetrators to regulatory focus.

(The author, a specialist in financial law and visiting faculty at prominent universities, can be contacted at vinod@vinodkothari.com)

Wednesday, 10 April 2013

The Herbalife saga is practically a made-for-Hollywood script

Herbalife is a diet company that excels at drama. It has Wall Street titans sparring, KPMG resigning and investors confused

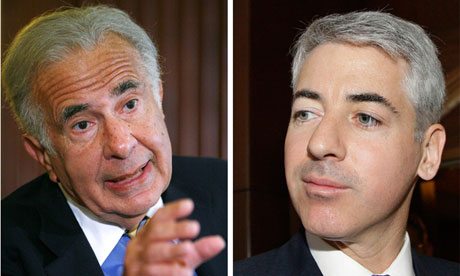

Bill Ackman (right) traded insults with fellow hedge funder Carl Icahn on television over Herbalife. Photograph: Reuters

There is something about diet company Herbalife that makes very rich men act very strangely. The weight-loss company should be relatively unremarkable. Instead it's been in the center of a dramatic story that should have Hollywood calling.

It has everything – intense, dashing hedge-fund titans embroiled in a public war, allegations of pyramid schemes, billions of dollars riding on on the outcome and now, as of today, a rogue auditor who risked his entire career by allegedly squirreling away inside information to make himself a profit. The Herbalife scandal even features Carl Icahn, one of the 1980s corporate raiders who reportedly inspired the timeless capitalist character of Gordon Gekko. If Wall Street wars got Oscars, Herbalife would be a top contender.

With so much heady money and power surrounding Herbalife, it's no surprise that the wafting scent of greed would envelop one of the people whose virtue should have been above reproach: the company's auditor, the prestigious accounting firm KPMG.

Auditors are not glamorous people. If investment bankers are the popular, fratty jocks of the financial world, and traders are the kids who love to hang out with their Camaros, auditors are more like the bespectacled stars of the math team. They are accountants – precise and cautious by nature – and, as a result, they have all the usual attendant social insecurities that nerds do: they're so happy just to be invited to the party that they may not judge too carefully the underage drinking and drugs that are going on. When auditors get into trouble – as they did with companies like Enron and WorldCom – it's usually because they were too eager to please their clients that they kept quiet when they saw something wrong. They didn't want to lose their place at the party.

So the "rogue auditor" is a rare character to cast. Auditors are often guilty of neglect, or looking the other way; rarely do they do something really bold and reckless like trade on inside information. Yet, apparently prompted by the drama around Herbalife, this is what a partner with the company's auditor, KPMG, did, according to Herbalife.

KPMG fired the rogue auditor on 5 April and told Herbalife about the whole debacle yesterday. This morning, Herbalife's stock was halted for an unusually long time – two hours – as the company tried to decide how to tell investors.

During that time, traders and journalists took to Twitter to speculate on what could possibly be so horrible that it would require the company to completely stop trading its stock for most of the morning.

The answer, it turns out, was pretty bad.

The partner at KPMG was entrusted with combing Herbalife's financial statements for errors. Unfortunately, according to Herbalife's version of the story, he also shared the company's confidential information with someone else, presumably so they could make a profit of their own. That would give him an incentive to mess with the company's results to help his own financial interests. As a result, KPMG's entire opinion on the company is reduced to worthless chaos; the auditor said it had to withdraw its reports on Herbalife for the last three fiscal years.

Herbalife, already embroiled in months of wars between its investors, hastened to assure everyone that the company was still sound. It stressed that KPMG had resigned as its auditor purely because of the possible insider trading and "not for any reason related to Herbalife's financial statements, its accounting practices, the integrity of Herbalife's management or for any other reason".

Herbalife managed to contain the damage: by halting the stock for two hours, it had raised expectations that the news would be far worse. The stock fell only 1% on the news when it finally came out. However, there was still evidence of chaos. In the same statement, Herbalife said that KPMG had said the three years of financial statements could both be "continued to be relied upon" and "should no longer be relied upon".

So that clears things up.

This only adds another twist for the Herbalife saga that's been playing out on the larger Wall Street stage. It was only three months ago that the distinguished Carl Icahn was publicly trading insults on television with Bill Ackman, the silver-haired, baby-faced boy wonder of investing. Ackman has argued that Herbalife is a pyramid scheme and has bet against the company; Icahn took the other side of the bet. Daniel Loeb, who was previously a friend of Ackman's, shocked the investing world by switching allegiances and taking Icahn's side.

There's a lot more information that has yet to come out about the problem with KPMG and Herbalife. That's good if you're in Hollywood. It means there's enough time to run through the casting. What do you think of Alan Alda, Elliott Gould, or Frank Langella to play Carl Icahn? John Slattery to play Bill Ackman? Michael Sheen as Dan Loeb? Philip Seymour Hoffman as the rogue auditor?

Now who's going to call John Grisham and tell him about all this?

Subscribe to:

Comments (Atom)