Charity is a cold, grey loveless thing. If a rich man wants to help the poor, he should pay his taxes gladly, not dole out money at a whim.” It is a phrase commonly ascribed to Clement Attlee – the credit actually belongs to his biographer, Francis Beckett – but it elegantly sums up the case for progressive taxation. According to a report by the Swiss bank UBS, last year billionaires made more money than any other point in the history of human civilisation. Their wealth jumped by a fifth – a staggering $8.9tn – and 179 new billionaires joined an exclusive cabal of 2,158. Some have signed up to Giving Pledge, committing to leave half their wealth to charity. While the richest man on earth, Jeff Bezos – who has $146bn to his name – has not, he has committed £2bn to tackling homelessness and improving education.

Who can begrudge the generosity of the wealthy, you might say. Wherever you stand on the concentration of wealth and power in the hands of a tiny global elite, surely such charity should be applauded? But philanthropy is a dangerous substitution for progressive taxation. Consider Bono, a man who gained a reputation for ceaselessly campaigning for the world’s neediest. Except his band, U2, moved their tax affairs from Ireland to the Netherlandsin 2006 in order to avoid tax. Bono himself appeared in the Paradise Papers – a huge set of documents exposing offshore investments by the wealthy – after he invested in a company based in Malta that bought a Lithuanian firm. This behaviour is legal: Bono himself said of U2’s affairs it was “just some smart people we have … trying to be sensible about the way we’re taxed”.

And he’s right: rich people and major corporations have the means to legally avoid tax. It’s estimated that global losses from multinational corporations shifting their profits are about $500bn a year, while cash stashed in tax havens is worth at least 10% of the world’s economy. It is the world’s poorest who suffer the consequences. Philanthropy, then, is a means of making the uber rich look generous, while they save far more money through exploiting loopholes and using tax havens.

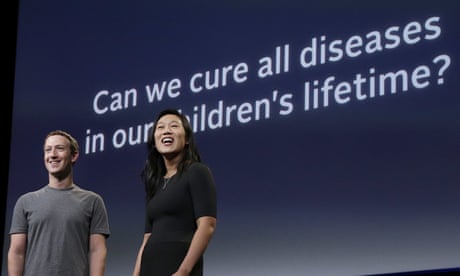

The trouble with charitable billionaires

There’s another issue, too. The decision on how philanthropic money is spent is made on the whims and personal interests of the wealthy, rather than what is best. In the US, for example, only 12% of philanthropic money went to human services: it was more likely be spent on arts and higher education. Those choosing where the money goes are often highly unrepresentative of the broader population, and thus more likely to be out of touch with their needs. In the US, 85% of charitable foundation board members are white, and just 7% are African Americans. Money raised by progressive taxation, on the other hand, is spent by democratically accountable governments that have to justify their priorities, which are far more likely to relate to social need.

What is striking is that even as the rich get richer, they are spending less on charity, while the poor give a higher percentage of their income to good causes. That the world’s eight richest people have as much wealth as the poorest half of humanity is a damning indictment of our entire social order. The answer to that is not self-serving philanthropy, which makes a wealthy elite determined to put vast fortunes out of reach of the authorities look good. We need global tax justice, not charitable scraps dictated by the fancies of the elite.

No comments:

Post a Comment