Research has found that the UK's biggest public companies have more than 8,000 subsidiaries or joint ventures in tax havens – but which businesses have the most?

• Get the data

• More data journalism and data visualisations from the Guardian

• Get the data

• More data journalism and data visualisations from the Guardian

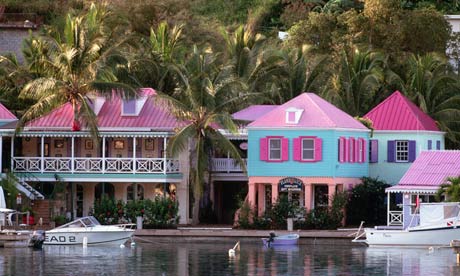

Tortola, the capital of the British Virgin Islands, which in turn is the global capital of offshore finance – how many UK companies have subsidiaries there? Photograph: Neil Rabinowitz/ Neil Rabinowitz/CORBIS

Which major UK corporations keep subsidiaries in tax havens? The short answer, according to updated research by development charity ActionAid, appears to be almost all of them.

The research found 98 of the 100 companies in the FTSE 100 – the hundred biggest publicly listed UK corporations – had subsidiaries, associates, or joint ventures in countries defined by the charity as tax havens.

These included well-known offshore tax havens, such as the British Virgin Islands and Cayman Islands, as well as larger "onshore" countries which have been criticised for low taxes, lax regulatory regimes, or stringent corporate secrecy rules. The charity has provided a full rationale for its list of havens here.

The figures were collated through a months-long process began in September 2012 (and using the FTSE 100's composition at that date), using official corporate documentation.

In their extensive annual reports, many companies list a small number of "principal" subsidiaries – but buried in further filings, or in documents submitted to US authorities, lie dozens or hundreds more, scattered across the world. However, even once the existence of the offshore subsidiaries is known, no further information can be obtained, due to strict secrecy rules in most offshore jurisdictions.

Of course, a company's presence in a given jurisdiction doesn't itself demonstrate tax avoidance in any country, and there is no suggestion any of the listed companies have any offshore structures not permitted under UK law – and many of the FTSE 100 companies are keen to note they are major UK taxpayers.

However, given the renewed focus on offshore secrecy, and pressure on tax havens for greater transparency and accountability, an insight into the extent of the jurisdictions' usage is telling.

The top ten companies by offshore usage are listed below (note WPP's list is based on a 2011 SEC filing, and as in more recent submissions the company has taken advantage of an exemption allowing it to list only a small number of "principal" subsidiaries)

The research also shows which sectors make the most use of tax havens. Four out of five overseas companies operated by real estate companies are located in tax havens, compared with about one in three travel and leisure businesses.

We've included a summary table showing the total number of subsidiaries each FTSE 100 company has in tax havens, and how many of those are in countries with ties to the UK (Crown dependencies like Jersey and Guernsey, or British overseas territories like the BVI) – and the full country-by-country data is in the linked spreadsheet at the foot of this post.

Do you spot anything of interest in this data – or have you got thoughts on visualising it? Let us know what you make in the comments, or via Twitter @GuardianData

No comments:

Post a Comment