'People will forgive you for being wrong, but they will never forgive you for being right - especially if events prove you right while proving them wrong.' Thomas Sowell

Search This Blog

Friday, 17 June 2022

Thursday, 16 June 2022

Why we trust fraudsters

From Enron to Wirecard, elaborate scams can remain undetected long after the warning signs appear. What are investors missing? Tom Straw in The FT

In March 2020, the star English fund manager Alexander Darwall spoke admiringly to the chief executive at one of the largest investments in his award-winning portfolio. “The last set of numbers are fantastic,” he gushed, adding: “This is a crazy situation. People should be looking at your company and saying ‘wow’. I’m delighted, I’m delighted to be a shareholder.”

Seated in a swivel chair at his personal conference table, Markus Braun sounded relaxed. The billionaire technologist was dressed all in black, a turtleneck under his suit like some distant Austrian cousin of the late Steve Jobs, and he had little to say about swirling allegations the company had faked its profits for years. “I am very optimistic,” he offered, when Darwall voiced his hope that the controversy would amount to nothing more than growing pains at a fast expanding company.

“I haven’t sold a single share,” Darwall assured him, doing most of the talking, while also acknowledging how precarious the situation was. The Financial Times had reported in October 2019 that large portions of Wirecard’s sales and profits were fraudulent, and published internal company documents stuffed with the names of fake clients. A six-month “special audit” by the accounting firm KPMG was approaching completion. “If it shows anything that senior people misled, that would be a disaster,” Darwall said.

His assessment proved correct. Three months later the company collapsed like a house of cards, punctuated by a final lie: that €1.9bn of its cash was “missing”. In fact, the money never existed and Wirecard had for years relied on a fraud that was almost farcical in its simplicity: a few friends of the company claimed to manage huge amounts of business for Wirecard, with all the vast profits from these partners said to be collected in special bank accounts overseen by a Manila-based lawyer with a YouTube following. Braun, who claims to be a victim of a protégé with security services connections who masterminded the scheme and then absconded to Belarus, faces a trial this autumn alongside two subordinates that will examine how the final years of the fraud were accomplished.

Left behind in the ashes, however, is a much larger question, one which haunts all victims of such scams: how on earth did they get away with it for so long? Wirecard faces serious questions about the integrity of its accounts since at least 2010. Estimates for losses run to more than €20bn, never mind the reputation of Frankfurt as a financial centre. Why did so many inside and outside the company — a long list of investors, bankers, regulators, prosecutors, auditors and analysts — look at the evidence that Wirecard was too good to be true and decide to trust Braun?

---

In 2019 I worked with whistleblowers to expose Wirecard, using internal documents to show the true source of its spellbinding growth in sales and profit. As I faced Twitter vitriol and accusations I was corrupt, the retired American short-seller Marc Cohodes regularly rang me from wine country on the US west coast to deliver pep talks and describe his own attempts to persuade German journalists to see Wirecard’s true colours. “Keep going Dan. I always say, ‘there’s never just one cockroach in the kitchen’.”

He was right on that point: find one lie and another soon follows. But short-sellers who search for overvalued companies to bet against are unusual, because they go looking for fraud and skulduggery. Most investors are not prosecutors fitting facts into a pattern of guilt: they don’t see a cockroach at all.

Think of Elizabeth Holmes, another aficionado of the black turtleneck, who persuaded a group of experts and well-known investors to back or advise her company, Theranos, based on the claim it had technology able to deliver medical results from an improbably small pinprick of blood. The involvement of reputable people and institutions — including retired general James Mattis, former secretary of state Henry Kissinger and former Wells Fargo chief executive Richard Kovacevich as board members — seemed to confirm that all was well.

Another problem is that complex frauds have a dark magic that is different to, say, “Count” Victor Lustig personally persuading two scrap metal dealers he could sell them a decaying Eiffel Tower in 1925. As Dan Davies wrote in his history of financial scams, Lying for Money, “the way in which most white-collar crime works is by manipulating institutional psychology. That means creating something that looks as much as possible like a normal set of transactions. The drama comes much later, when it all unwinds.”

What such frauds exploit is the highly valuable character of trust in modern economies. We go through life assuming the businesses we encounter are real, confident that there are institutions and processes in place to check that food standards are met or accounts are prepared correctly. Horse meat smugglers, Enron and Wirecard all abused trust in complex systems as a whole. To doubt them was to doubt the entire structure, which is what makes their impact so insidious; frauds degrade faith in the whole system.

Trust means not wasting time on pointless checks. Most deceptions would generally have been caught early on by basic due diligence, “but nobody does confirm the facts. There are just too bloody many of them”, wrote Davies. It makes as much sense for a banker to visit every outpost of a company requiring a loan as it would for the buyer of a pint of milk to inquire after the health of the cow. For instance, by the time John Paulson, one of the world’s most famous and successful hedge fund managers, became the largest shareholder in Canadian-listed Sino Forest, its shares had traded for 15 years. Until the group’s 2011 collapse, few thought of travelling to China to see if its woodlands were there.

---

Yet what stands out in the case of Wirecard are the many attempts to check the actual facts. In 2015 a young American investigator, Susannah Kroeber, tried to knock on the doors at several remote Wirecard locations. Between 2010 and 2015 the company claimed to have grown in a series of leaps and bounds by buying businesses all over Asia for tens of millions of euros apiece. In Laos she found nothing at all, in Cambodia only traces. Wirecard’s reception area in Vietnam was like a school lunchroom; the only furniture was a picnic table for six and an open bicycle lock hung from one of the internal doors, a common security measure usually removed at a business expecting visitors. The inside was dim, with only a handful of people visible and many desks empty. She knew something wasn’t right, but she also told me that while she went half mad looking for non-existent addresses on heat-baked Southeast Asian dirt roads, she had an epiphany: “Who in their right mind would go to these lengths just to check out a stock investment?”

Even when Kroeber’s snapshots of empty offices were gathered into a report for her employer, J Capital Research, and presented to Wirecard investors, the response reflected preconceived expectations: these are reputable people, EY is a good auditor, why would they be lying? The short seller Leo Perry described attending an investor meeting where the report was discussed. A French fund manager responded by reporting his own due diligence. He’d asked his secretary to call Wirecard’s Singapore office, the site of its Asian headquarters, and could happily report that someone there had picked up the phone.

The shareholders reacted at an emotional level, showing how fraud exploits human behaviour. “When you’re invested in the success of something, you want to see it be the best it can be, you don’t pay attention to the finer details that are inconsistent”, says Martina Dove, author of The Psychology of Fraud, Persuasion and Scam Techniques. She adds that social proof and deference to authority, such as expert accounting firms, were powerful forces when used to spread the lies of crooks: “If a friend recommends a builder, you trust that builder because you trust your friend.”

Wirecard’s response, in addition to taking analysts on a tour of hastily well-staffed offices in Asia, was to drape itself in complexity. Like WeWork, the office space provider that presented itself as a technology company (and which wasn’t accused of fraud), Wirecard waved a wand of innovation to make an ordinary business appear extraordinary.

At heart, Wirecard’s legitimate operations processed credit and debit card payments for retailers all over the world. It was a competitive field with many rivals, but Wirecard claimed to have become a European PayPal and more, outpacing the competition with profit margins few could match. Wirecard was “a technology company with a bank as a daughter”, Braun said, one using artificial intelligence and cutting-edge security. As the share price rose, so did Braun’s standing as a technologist who heralded the arrival of a cashless society. Who were mere investors to suggest that the results of this whirligig, with operations in 40 countries, were too good to be true?

It seems to me Wirecard used a similar tactic to the founder of software group Autonomy, Mike Lynch, who charged that critics simply didn’t understand the business. (Lynch has lost a civil fraud trial relating to the $11bn sale of the group, denied any wrongdoing, said he will appeal, and is fighting extradition to the US to face fraud charges. Autonomy’s former CFO was convicted of fraud in separate American proceedings.)

When this publication presented internal documents describing a book cooking operation in Singapore, Wirecard focused on the amounts at stake, which were initially small, rather than the unpunished practices of forgery and money laundering, which were damning.

Then there was the thrall of German officials. Three times, in 2008, 2017, and 2019, the financial market regulator BaFin publicly investigated critics of Wirecard, taken by observers as a signal of support. Indeed, BaFin fell for the big lie when faced with an unenviable choice of circumstances: either foreign journalists and speculators were conspiring to attack Germany’s new technology champion using the pages of a prominent newspaper; or senior executives at a DAX 30 company were lying to prosecutors, as well as some of Germany’s most prestigious banks and investment houses. Acting on a claim by Wirecard that traders knew about an FT story before publication, regulators suspended short selling of the stock to protect the integrity of financial markets.

Proximity to the subject won out, but the German authorities were hardly the first to fail in this way. Their US counterparts ignored the urging of Harry Markopolos to investigate the Ponzi schemer Bernard Madoff, a former chairman of the Nasdaq whose imaginary $65bn fund sent out account statements run off a dot matrix printer.

---

For some long-term investors, to doubt Wirecard was surely to doubt themselves. Darwall first invested in 2007, when the share price was around €9. As it rose more than tenfold, his investment prowess was recognised accordingly, attracting money to the funds he ran for Jupiter Asset Management, and fame. He knew the Wirecard staff, they had provided advice on taking payments for his wife’s holiday rental. Naturally he trusted Braun.

Darwall did not respond to requests for comment made to his firm, Devon Equity Management.

In the buildings beyond the shades of Braun’s office, staff rationalised what didn’t fit. Wirecard was a tech company, yet in early 2016 it suffered a tech disaster. On a quiet Saturday afternoon, running down a list of routine maintenance, a tech guy made a typo. He entered the wrong command when decommissioning a Linux server. Instead of taking out the one machine, he watched with rising panic as it killed all of them, pulling the plug on almost the entire company’s operations without warning.

Customers were in the dark, as email was offline and Wirecard had no weekend helpline, and it took days for services to recover. Following the incident, a small but notable proportion of clients left and new business was put on hold as teams placated those they already had, staff recalled. Yet the pace of growth in the published numbers remained strong.

Martin Osterloh, a salesman at Wirecard for 15 years, put the mismatch between claims and capabilities down to spin. Only after the fall was the extent of Wirecard’s hackers, private detectives, intimidation and legal threats exposed to the light. Haphazard lines of communication, disorganisation and poor record keeping created excuses for middle-ranking Wirecard staff and its supervisory board, stories to tell themselves about a failure to integrate and start-up’s culture of experimentation.

It was perhaps not as hard to believe as we might think. Facebook, which has probed the legal boundaries of surveillance capitalism, famously encouraged staff to “move fast and break things”. Business questions often shade grey before they turn black. As Andrew Fastow said of his own career as a fraudster, “I wasn’t the chief finance officer at Enron, I was the chief loophole officer.”

Braun’s protégé was chief operating officer Jan Marsalek, a mercurial Austrian who constantly travelled and struck deals, with no real team to speak of. Boasting that he only slept “in the air”, he would appear at headquarters from one flight with a copy of Sun-Tzu’s The Art of War tucked under an arm, then leave a few hours later for the next. Questions were met with a shrug, that strange arrangements reflected Marsalek’s “chaotic genius”. As scrutiny intensified in the final 18 months, the fraudulent imitation shifted to problem solving, allowing board members and staff to think they were engaged in procedures to improve governance.

After the collapse I shared pretzels with Osterloh on a snowy day in Munich and he seemed embarrassed by events. He and thousands of others had worked on a real business, until they were summarily fired and learned it lost money hand over fist. Osterloh spoke for many when he said: “I’m like the idiot guy in a movie, I got to meet all these guys. The question arises, why were we so naive? And I can’t really answer that question.”

‘If you work hard and succeed, you’re a loser’: can you really wing it to the top?

There are, it seems, two types of “winging it” stories. First, there are the triumphant ones – the victories pulled, cheekily, improbably, from the jaws of defeat. Like the time a historian (who prefers to remain nameless) turned up to give a talk on one subject, only to discover her hosts were expecting, and had advertised, another. “I wrote the full thing – an hour-long show – in 10 panicked minutes,” she says. “At the end, a lady came up to congratulate me on how spontaneous my delivery was.”

Then there is the other kind of winging it story – the kind that ends in ignominy. Remember the safeguarding minister, Rachel Maclean, tying herself in factually inaccurate knots when asked about stop-and-search powers? The Australian journalist Matt Doran, who interviewed Adele without listening to her album? Or the culture secretary, Nadine Dorries, claiming Channel 4 was publicly funded, then that Channel 5 had been privatised?

There are even worse examples. As a young journalist, Sarah Dempster was unwell when she was supposed to review a Meat Loaf concert, so she wrote the piece without attending. “An hour after publication, the paper called to inform me that the gig had, in fact, been cancelled. I was sacked,” she tweeted. “The Sun wrote a piece about it. The headline: ‘MEAT OAF’.”

Why does anyone wing it, and how do they dare? As a lifelong dreary prepper, I have been wondering this since reading a profile in the New York Times of winger extraordinaire Elon Musk. “To a degree unseen in any other mogul, the entrepreneur acts on whim, fancy and the certainty that he is 100% right,” it related, detailing how Musk wings even the biggest decisions, operating on gut feeling and without a business plan, rejecting expert advice.

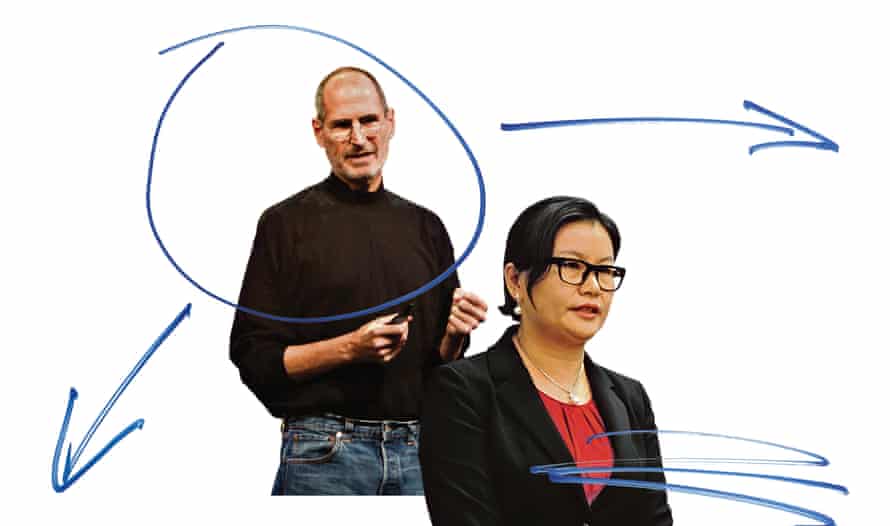

Genius or graft? Apple founder Steve Jobs and Zhou Qunfei, China’s richest woman. Composite: Getty/Shutterstock/Guardian Design

Genius or graft? Apple founder Steve Jobs and Zhou Qunfei, China’s richest woman. Composite: Getty/Shutterstock/Guardian DesignWhat, I wonder, is the appeal of this strategy? And is it a legitimate – indeed, more successful – way of doing business? Can Musk, the CEO of Tesla (a company with a market capitalisation of £570bn) and the founder of SpaceX (the first private company to send humans into space) really be winging it?

Some are sceptical. “Is this self-presentation or an accurate statement?” asks Tomas Chamorro-Premuzic, an organisational psychologist and the author of Why Do So Many Incompetent Men Become Leaders? “Musk is probably way too smart to actually operate under that principle; he uses this arrogant self-presentation to his advantage. Brand Musk accounts for a big chunk of his success.” In contrast, he says, the recent Netflix SpaceX documentary shows Musk as “quite self-critical, quite humble”.

It is an idea echoed by Stefan Stern, a visiting professor at the Bayes Business School at City, University of London and the author of Myths of Management. “I can’t believe that he doesn’t draw on data; it’s a leading-edge thing he’s engaged in. When you promote yourself as a sort of visionary or hero, you absolutely want to try to claim that there’s something special about your insights – they’re not a petty, banal matter of data.”

The implication is that Musk is like those schoolkids who claim not to have done a minute’s revision, then ace the exam. There is, the argument goes, something innately appealing about someone operating effortlessly on flair, instinct and inspiration: a Steve Jobs, not a Zhou Qunfei – the discreet founder of Lens Technology and the richest woman in China, who, Chamorro-Premuzic says, credits her success to “hard work and a relentless desire to learn”.

“There’s something romantic to the idea that there are mavericks who don’t need to work very hard,” adds Chamorro-Premuzic. “We say we value hard work and dedication, but, by definition, talent is more of an extraordinary gift and we celebrate that more.”

The leadership expert Eve Poole agrees. “No one wants to make it feel like hard work,” she says. “No one wants to say: ‘I slaved in front of a spreadsheet for 20 hours before I made that decision.’”

For Stern, Boris Johnson’s apparent penchant for winging it carries a similar message. “When he says: ‘We got the big calls right,’ he’s saying: ‘These small-minded people obsess about data and numbers and statistics, but with my instinct, my judgment, I – the uniquely gifted, insightful leader – got the big calls right.’ It’s not even true!”

His self-presentation as “a charismatic figure with panache who is apparently spontaneous” is particularly interesting, Stern says, given that “the other thing we know about Johnson is he’s not spontaneous, he doesn’t have good lines off the cuff”. (See that disastrous CBI Peppa Pig speech in November, recent prime minister’s questions performances or his testy, defensive responses in more probing interviews.)

Is there any foundation for the notion that gut feeling is superior to pedestrian, data-driven decision-making? The cognitive psychologist Gary Klein has spent his career researching intuition in decision-making; 35 years on, his research on how firefighters act swiftly under pressure in tough situations is still cited. “We weren’t looking for intuition,” he says. Rather, his team’s original theory was that firefighters might be rapidly evaluating two options when they decided how to tackle a fire. “They told us: ‘We don’t compare any options.’ More than that, they said: ‘We never make any decisions.’” Klein didn’t understand how firefighters could believe only one course of action was possible and land on it without making comparisons.

Further digging revealed a different picture. With 15 to 20 years of experience, Klein explains, the firefighters were classifying the situation based on fires they had seen – a process known as “pattern matching”. The second step Klein called “mental simulation”: the firefighters would visualise how a course of action would run and adjust their model accordingly. “It’s a blend of intuition and analysis,” says Klein. The process was near-instantaneous. “Most decisions were made in less than a minute.”

So, what looks like winging it can, in fact, be instinctive decision-making backed up by experience – what Poole calls “really quick heuristics in your brain … synaptic connections established through years of conditioning”. Leaders who trust that, she says, “are just fucking excellent”.

This decision-making model is common in one of the areas where people are least comfortable with the idea of winging it: healthcare. No one wants to end up in the hands of a seat-of-the-pants neurosurgeon, but Klein’s research suggests medical professionals use intuitive decision-making and gut feeling as a matter of course.

His book The Power of Intuition tells the story of an experienced neonatal intensive care unit nurse accurately diagnosing a baby with sepsis just by walking past the incubator and getting a gut feeling, when a less experienced nurse who had been conscientiously tracking all the infant’s vitals had failed to spot it. “An experienced physician sees a cluster of cues and says sepsis. We’ve heard stories of someone who was just a resident; there was a tough case and they called the attending physician. The attending physician does not even enter the room and from the door just looks at the patient and sees there’s an issue and says: ‘Ah, congestive heart failure.’”

Firefighters in New York. Gary Klein’s research suggests they use ‘a blend of intuition and analysis’ to make quick decisions. Photograph: Anadolu Agency/Getty Images

Firefighters in New York. Gary Klein’s research suggests they use ‘a blend of intuition and analysis’ to make quick decisions. Photograph: Anadolu Agency/Getty ImagesThe experiences that feed intuition can be less concrete. Poole has been researching what humans still have to offer in a world in which AI is ever-more powerful, such as what she calls “witch-style intuition” – that sense of foreboding when you enter a room or meet someone. “We all know we have had those feelings and we tend to discount them and think they’re a bit silly and weird,” she says. “But I think it’s probably coming from the collective historical unconscious, trying to keep us safe as a species.” There are, she says, two strands: “your own, desperately hard-earned gut feeling, laid down in templates of data and knowledge, then the spooky ephemera that you can pick up through ‘spidey sense’, which I think can still be really reliable.”

It can, but it isn’t always. Intuition of any kind is not infallible. Klein describes it as a “data point”: something to take into consideration, not to accept uncritically. One area in which intuition gives demonstrably poor outcomes is recruitment. As Chamorro-Premuzic explains, unstructured interview processes increase and reinforce conscious and unconscious biases about candidates. We all believe our own intuition to be superior, he says: “In an interview situation, this is a big problem, because hiring managers think they have an ability to see through candidates and to understand whether they are competent.” Companies will spend large budgets on diversity and inclusion, “then tell you they hire for ‘culture fit’ – and the main way to evaluate culture fit is whether somebody ‘feels right’ in a job interview. Even if managers are well-meaning and open-minded, they will gravitate towards candidates who are like them and they are comfortable with.”

Moreover, studies show that people tend to make up their mind in the first 60 or 90 seconds, he says. This is pattern recognition gone wrong, according to Stern. When decision-makers see someone who reminds them of themselves, they think: “Oh yeah, he’s got the right stuff. I used to be like him.”

Donald Trump springs to mind here. I read Klein a typical Trump pronouncement: “I have a gut and my gut tells me more sometimes than anybody else’s brain can ever tell me.” It reminds Klein of two dangerous fallacies about intuition: “One, some people think intuition is innate ability, which I don’t think it is; it’s based on experience. Two, intuition is a general skill and will apply in lots of different situations. I don’t think that’s true.” Having decent intuition in an area where you have professional experience – “like real estate”, he says, pointedly – does not mean you have a transferable skill.

Talking to people who admit to winging it reveals that, mainly, they mean the “good” kind of intuition: calling on a wealth of relevant experience and deploying it in defined circumstances. That often involves an element of performance, where spontaneity can be the secret ingredient.

Susannah, who works in publishing, says: “I love to wing it in sales presentations. When I wing it, I suddenly find a new angle; it works every time. But only, I think, because I’m winging stuff I already know deeply.” Kathy, a senior financial services strategist, says: “If it’s something I don’t know at all, I won’t wing it, but in my area of expertise I’m the queen of prep five minutes before the meeting.”

These are the good wingers, but of course the bad ones are out there – the lazy, the grandiose blaggers and the bullshitters, too often in positions of power. “There are a lot of men, particularly, who do that,” says Poole. “I think it does appeal to people who don’t feel anything any more – it’s all so boring and that’s the way they get some feelings. It gives them a massive adrenaline rush; it makes them feel very powerful and victorious.” It is not usually a successful long-term strategy, she adds, comfortingly; what Chamorro-Premuzic calls “the sense of Teflon-style immunity” betrays them eventually. “I just think you get caught out. It’s the spin of the wheel and that’s why I hate it: it’s so risky for your organisation.”

But we still admire them, buy their products, even vote for them. Why do we fall for it? It is a lack of “followership maturity”, according to Chamorro-Premuzic, and varies from culture to culture. “I grew up in South America, where if you work hard and you succeed you’re automatically a loser,” he says. “Whereas if you bullshit and deceive people, we should worship you. There are cultures that truly value self-improvement, hard work and knowledge and there are cultures that value confidence.”

A country that wants to be entertained, he says, is likely to apply low standards for leadership, preferring self-belief to caution and hard work. “Whether it’s Trump, Boris, Steve Jobs, Elon Musk – they celebrate them because they challenge the establishment. When they behave in anarchic ways, disrespecting the rules, I think they can channel the anger that people have.” The kicker is that we assume there’s some competence behind the blagging and bluster, that the emperor is fully clothed. But how do we work out if it is true: spreadsheet or gut?

Monday, 13 June 2022

The WTO’s lonely struggle to defend global trade

What role does the organisation have in an era of fracturing multinational alliances and fears of deglobalisation? Andy Bounds in The FT