The human kennels we hear about didn’t spring up by accident. This broken market is the result of 30 years of bad housing policy

Two foot three inches isn’t much. It’s only a little higher than the world’s smallest woman, Jyoti Amge. Your average two-year-old has long rocketed past that line. Glue a couple of my school rulers together and you’re nearly there.

To get to their rented room in Hendon, on the outskirts of north London, tenants of Yaakov Marom had to crawl up a staircase with a head height as low as 2ft 3in (69cm). True, in parts they could stretch up to 3ft 11in (119cm) – which is just about enough headroom for an Ewok. For the privilege of sleeping in a human kennel, a couple were paying Marom £420 a month.

Blame it on my own frayed synapses, but I can no longer get quite so shocked by such stories. How many versions of it have we seen before? Beds in sheds; lodgers in garages; tiny studios let for huge sums. As this paper reported on Saturday, just down the road from Marom’s palace is another rental, offering a single bed suspended from the ceiling by two metal chains. This macabre cross between a hammock and a torture chamber can be yours, friends, for £760 a month, parking permit extra.

All these dispatches from bedsitland tell us two things. First, the private rental market is red-hot – otherwise, landlords wouldn’t be trying to monetise every patch. And second, the private rental market is badly broken.

Welcome to the new age of landlordism, in which the property-owner has all the power and the renter hardly any choice. This year’s English Housing Survey revealed that the number of private tenants had outstripped those in social housing for the first time in its history.

The disparity between those tenures is like the gulf between day and night, between a home and a rabbit hutch. Council tenants get security of tenure and controlled rents; shorthold tenants pay up to four times as much and under most contracts are only ever two months’ notice from getting turfed out of their homes. Yet the impossibility of first-time buying, and the scarcity of public housing, means the private rental market has taken off. The 2001 census showed 1.9m households renting privately in England and Wales – now there are 4m in England alone.

Report after report shows that homes in the private rental sector are far worse than either council housing or those under owner-occupation. One in three are officially classed as non-decent, while one in five are dangerous enough to present a category one hazard – that is, a severe threat to the health or safety of anyone who lives there. All those tenants’ tales you’ve heard or read about permanently broken boilers or mould carpeting the walls aren’t just anecdotes; they cohere into a statistical truth. One of the richest countries in history is fostering 21st-century slums.

It’s in these conditions that millions of people will live for good. Rental is no longer a stepping stone for students and young professionals; instead, it’s fast becoming a terminus. Well over a million families with children now rent. Just as lack of choice has triggered the rise of private renting, so it will keep a growing number of households stewing there. Polls suggest that around 80% of Britons would rather own a home than rent; the lack of new homes suggests that many under-35s without rich parents will be renting for decades to come.

Let me make the obvious disclaimer: not all landlords are on the take, nor are all tenants angels mindful of fixtures and fittings, and keeping the music down. Not that it matters, because a market characterised by this much demand doesn’t really reward good landlords or penalise bad ones. Because the laws give the landlord the power. Because anyone can set up as a letting agent, without qualifications or licensing – and to be one is to own a printing press of made-up fees. Because even if tenants complain, they could face a retaliatory eviction. Because unless a council is tipped off, they’ve probably been too badly hit by cuts to find a scam (Marom had already been banned by Barnet from letting out his second-floor room; but it still took nearly 18 months for officers to catch him at it).

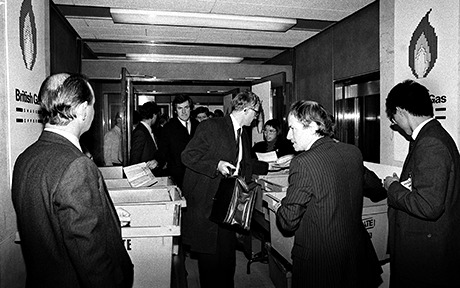

It’s easy to look at this market, with its surveys indicating that 92% of landlords rent out property on the side, and conclude that the entire thing is an epic, ugly accident. Not so: this is Westminster’s creation. Since Margaret Thatcher – at least – successive governments have promised a property-owning democracy, all the while laying the ground for a new landlordism. Thatcher did the most, privatising council homes through right-to-buy, then bringing in the Housing Act 1988 – the big bang for the private rental sector, shredding the last vestiges of rent controls and most protections for tenants. John Major presided over the assured shorthold tenancy and the buy-to-let mortgage. Tony Blair and Gordon Brown refused to countenance the building of new public housing. David Cameron’s contribution has been the Localism Act, which requires councils to put homeless people in the private rental sector: £11bn for build-to-rent, and more right-to-buy.

Whatever the rhetoric, home ownership in England is back down to where it was in 1987. One in three former council homes are now held by private landlords. Tory, Labour and Lib Dems have all taken turns in creating a regime that – as James Meek notes in Private Island, his excellent new book on Britain’s privatisations – “puts more money into the hands of a small number of the very wealthiest people”. To underline the point: this is our money, including the £20bn we pay every year in housing benefit that swiftly goes into landlords’ hands.

That’s the backdrop against which you should judge the current promises made by all the parties to bring in a few extra protections for tenants. None talk of licensing landlords – despite the calls from town halls – let alone guaranteeing more public housing. To do so would be to attack a sector the political classes have cultivated for three decades, and has grown too powerful to hack back – a sector that includes much of the Commons: one in four Tory MPs are landlords, as are one in eight Labour MPs. As for the new housing minister, Conservative Brandon Lewis, would it really surprise you to learn that the parliamentary register has him down as a private landlord?